Key points

The Raiz Gen Z Savings Report found more than half of the platform’s new sign-ups over the last twelve months were Gen Z customers.Raiz CEO says there’s been a “massive shift” over the past decade in how young people view money.Gen Z seems to be prioritising saving and growing their wealth despite cost of living pressures.

According to the Raiz Savings Report, more than 50% of sign-ups to the micro-investing app over the last twelve months were Gen Z.

The average opening balance among this cohort was also nearly 70% higher in November 2025 compared to January 2024, and Raiz CEO Brendan Malone says there’s been a “massive shift” in the savings mindsets of younger Australians.

“Over the past ten years, you can see this cohort have [said] ‘right, there is an issue [with cost of living and rent], I’m going to take action, I’m going to understand what investing is’,” he told the Savings Tip Jar podcast.

“[They’re] really sitting there saying ‘I know I’ve got rent problems, I know I’ve got to buy a house someday, cost of living prices, and I also want to go on holiday someday, I’ll start saving for it’.”

Save as you spend?

With inflation consistently increasing faster than wages over the past few years, young people are likely finding that cutting back on their spending to put more into investments or deposit products is the only realistic way to grow their wealth.

Mr Malone said one of the benefits of Raiz, along with the other platforms offering this feature – including many banks, is its automated ’round-up’ feature, which sees users able to save/invest as they spend.

This typically sees users automatically investing the difference between the purchase price and the nearest dollar each time they buy something – if you buy avocado toast for $11.25, 75 cents automatically gets deposited in your saving or investment account.

“Our round-up concept [means] where you spend money, you save at the same time,” he said.

Rise of young investors?

Historically, younger people have been less prolific investors.

A 2023 study found just 9% of shareholders in ASX-listed stocks were ‘next generation’ investors, aged between 18-24.

However, that number appears to be increasing, with the same report finding that about 1 in 6 new entrants to the share market during the pandemic were aged under 20.

Micro-investing platforms like Raiz mean the barriers to entry into investing have never been lower – Raiz customers can get started with a minimum deposit of just $5.

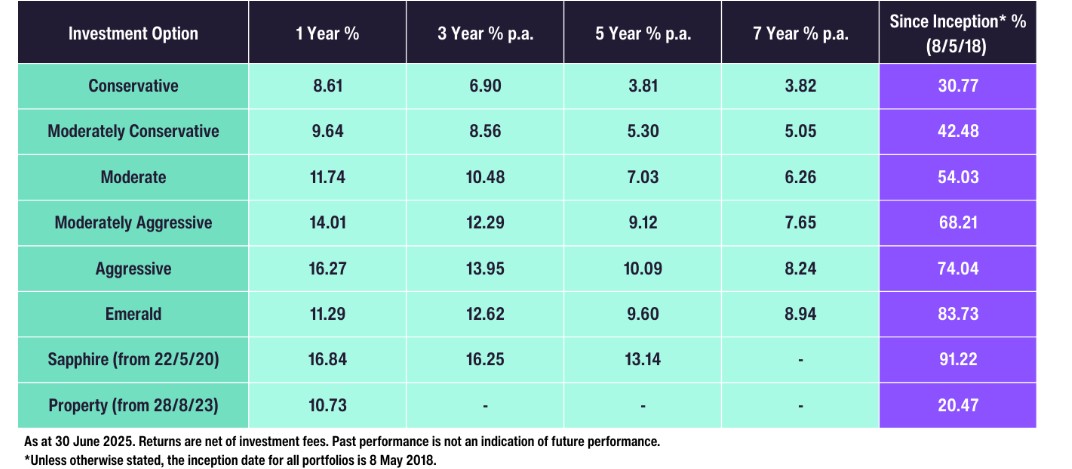

Mr Malone says there are already about 100,000 Gen Z Raiz users with money invested in one of its seven investment portfolio options.

That sees just over 20% of Raiz users aged between 18-29 and, while a smaller portion than the 30-39 and the 40-49 age bracket, the trend suggests it will continue to increase.

Image: Raiz returns to June 2025 for each of its seven investment portfolio options