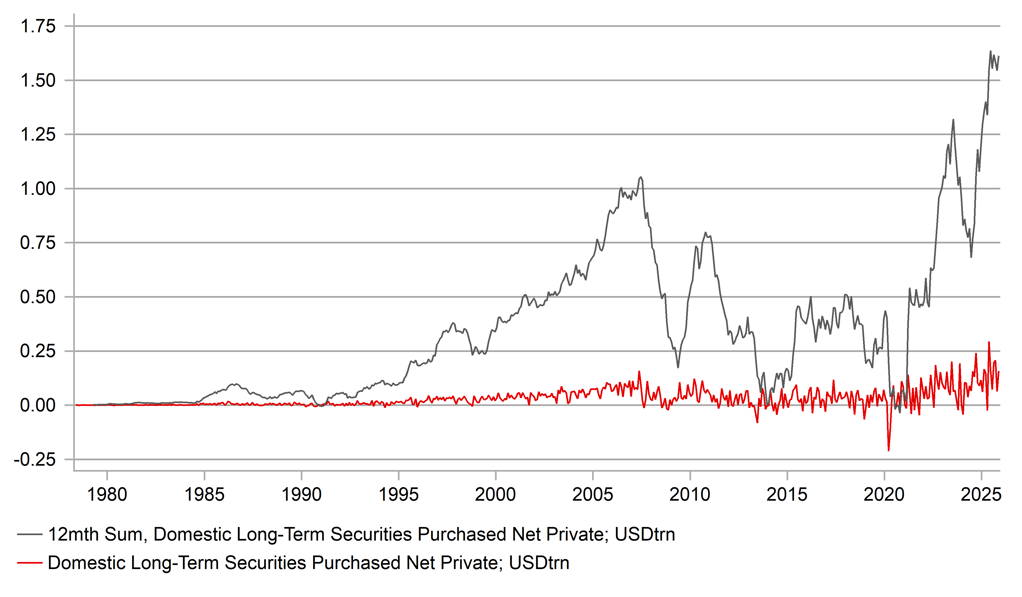

So, the US strong dollar policy remains intact! US Treasury Secretary Scott Bessent said so yesterday in a CNBC interview. The US “always has a strong dollar policy” Bessent stated but that’s because they aim to set sound economic policies and “if we have sound policies, the money will flow in”. But that logic is simply not right. A quick look at flows as reported from the US Treasury department shows the US drew USD 1,569bn of foreign capital into bonds and equities in the 12mths to November with US investor buying of foreign assets totalling around USD 300bn for a net inflow of over USD 1.2trn. It’s no coincidence that the total securities net inflow closely matches the overall trade deficit. We know that in 2025 the US dollar fell by close to 10% so there is not necessarily a link between the cross-border capital flows and the performance of the dollar.

Short-term bank lending flows, foreign investor hedging behaviour and speculative flows can play a key role in US dollar performance and when confidence is undermined, those flows can certainly fuel notable dollar depreciation. Given past capital inflows now means foreign investors own over USD 35trn of US securities, shifts in sentiment that fuels increased hedging can be meaningful. So Bessent’s explanation of why the US “always” has a strong dollar policy basically means it is meaningless.

Trump’s remarks about dollar weakness being “great” will likely resonate with investors given last year’s performance and given one of his key economic advisors, Steve Miran, (whose time on the Board of Governors will come to an end this week) firmly believes that reducing the huge trade imbalance in the US involves US dollar depreciation.

It’s not a surprise Bessent confirmed the US did not intervene in USD/JPY last week, but the Fed did reportedly check rates that had the intended impact of sharply weakening the dollar versus the yen. Coupled with Steve Miran being at the heart of Trump’s economic policymaking team and Trump’s view that the weakening dollar is “great”, it’s very unlikely that Bessent’s comments yesterday will have any lasting impact on lifting the US dollar. Multi-national corporations and investors are likely to continue reducing exposures to the dollar through increased hedge-related US dollar selling.

FOREIGN INVESTOR INFLOWS TO US BONDS AND EQUITIES HIT A RECORD IN 2025 AS THE DOLLAR FELL BY CLOSE TO 10%

Source: Bloomberg & MUFG Research