Stock image.

Gold prices soared past $5,500 an ounce late on Wednesday as weakness in the US dollar continued to steer investors towards hard assets, despite the US Federal Reserve leaving interest rates untouched.

Spot gold jumped another 2% to a new record of $5,588.36 an ounce, extending its rally this week to almost 9%. Year to date, the metal has risen by almost 20%, a pace that would easily best last year’s performance (65%).

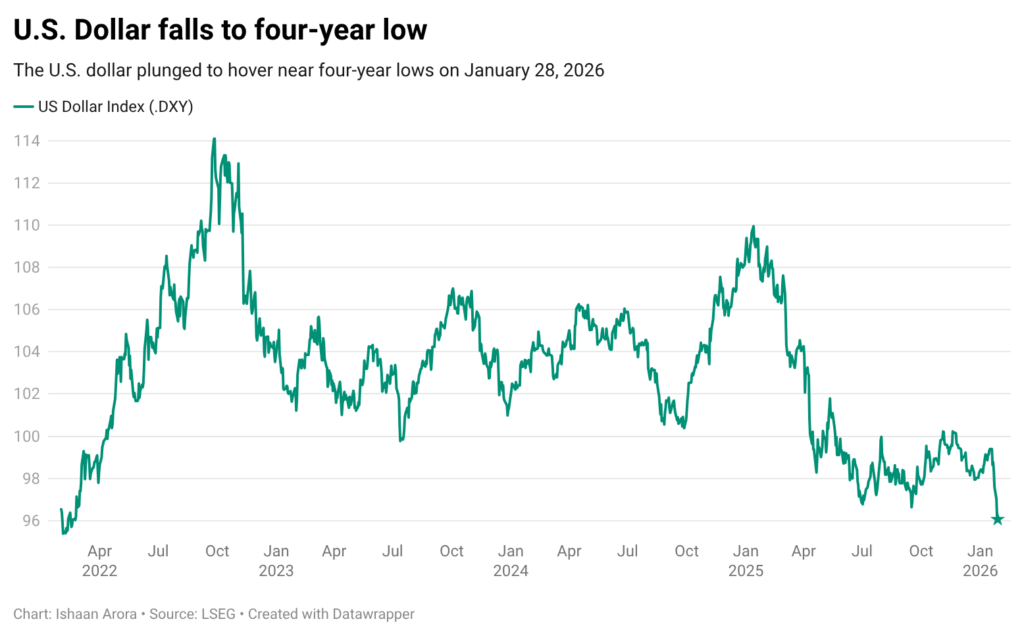

Growing concerns over the value of US dollar, the world’s premier reserve currency, have sparked investment demand for gold as a safer alternative. The latest rally coincides with the dollar’s decline to its weakest level in four years.

Rising geopolitical tensions — such as US President Donald Trump’s threats to annex Greenland and military intervention in Venezuela — have also fueled gold’s rise to unprecedented levels. Earlier this week, bullion smashed through $5,000 an ounce for the first time this week.

Meanwhile, bond traders are ramping up bets on a dovish policy shift at the Federal Reserve, which on Wednesday held interest rates for the first time since last July. However, traders are ramping up bets for a Fed leadership change that would likely lead to monetary easing later this year.

Expectations of a more dovish and less independent Fed, as well as geopolitical risks, “are likely driving more rapid allocations to gold, led by retail investors,” Suki Cooper, global head of commodities research at Standard Chartered Plc, said in a note recently.

Another silver record

Also setting new highs is silver, which has been outperforming gold over the past year and more than doubled its value in 2025.

Spot silver rose as much as 4% to nearly $118 per ounce, taking its start-to-year rally to about 50%.

In light of current volatility in the silver market, CME Group has raised its margins on silver futures from Wednesday’s close, while China’s only pure-play silver fund halted trading earlier in the day.

Despite the monstrous gains, analysts see further upside in the metal, with Citigroup recently forecasting $150 per ounce within three months, citing strong buying momentum in China.

(With files from Bloomberg and Reuters)