Nine has bought out-of-home media company QMS and sold its radio business to billionaire hotel baron Arthur Laundy in sweeping changes announced before the ASX opened this morning.

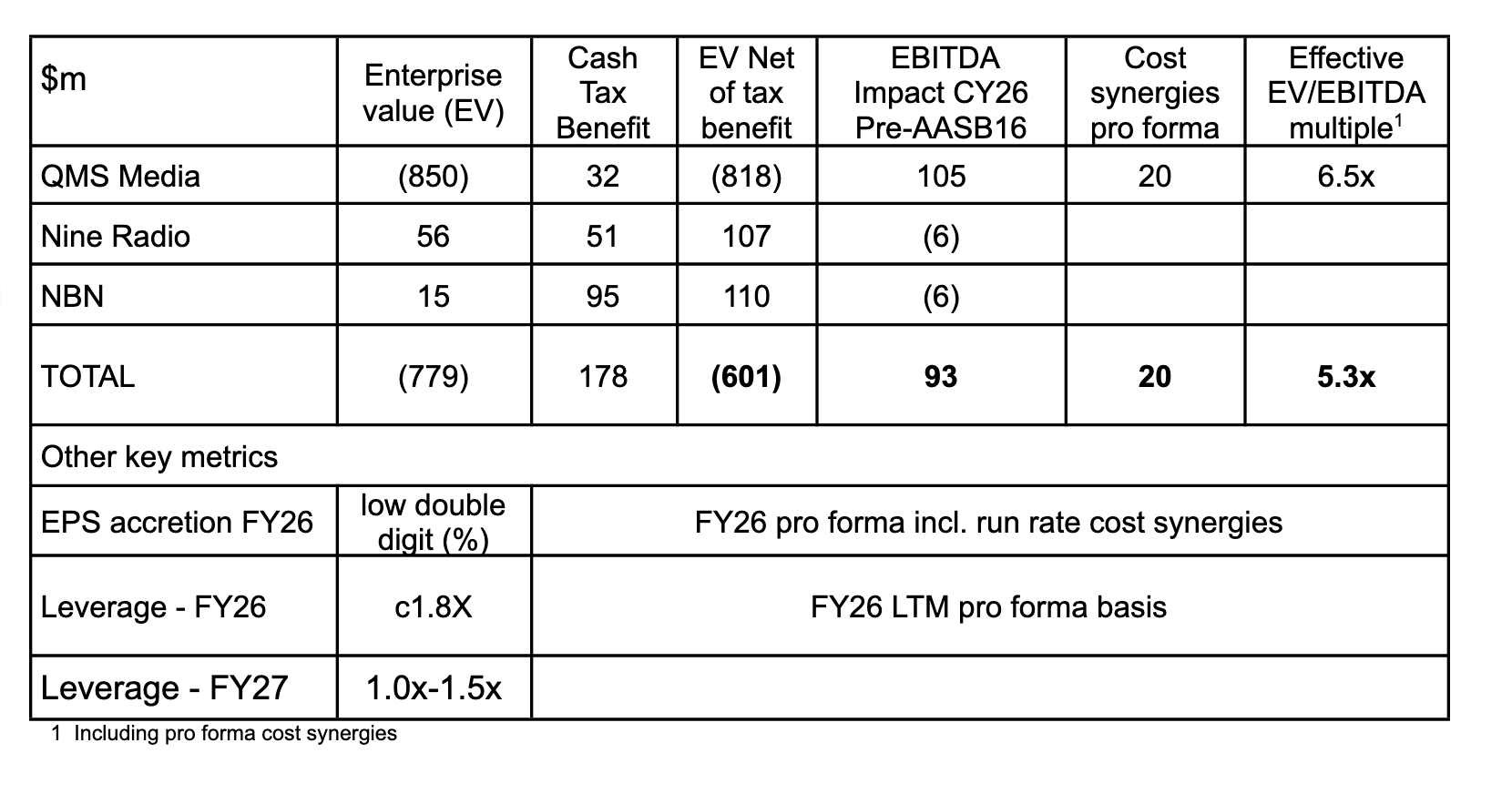

The QMS deal is worth $850m, and the radio sale — for talk back stations 2GB in Sydney, 3AW in Melbourne, 6PR in Perth and 4BC in Brisbane — was for $56 million.

Nine has also converted regional station NBN from a wholly owned business to an affiliate, owned and operated by Nine’s regional partner, Win.

Nine CEO Matt Stanton made the announcements this morning before the market opened.

ADVERTISEMENT

“Today’s announcements mark a critical milestone in our Nine2028 transformation,” Stanton said.

“These transactions will create a more efficient, higher-growth, and digitally powered Nine Group for our consumers, advertisers, shareholders and people. This positions Nine well for the future, enabling the Group to withstand industry disruption and deliver long-term sustainable value to our shareholders.”

Nine will acquire 100% of the issued capital of QMS (on a cash and debt-free enterprise value basis) for A$850m from Quadrant Private Equity.

QMS is one of the country’s leading digital outdoor media platform, with a number of plum contracts, including the City of Sydney and Auckland Transport.

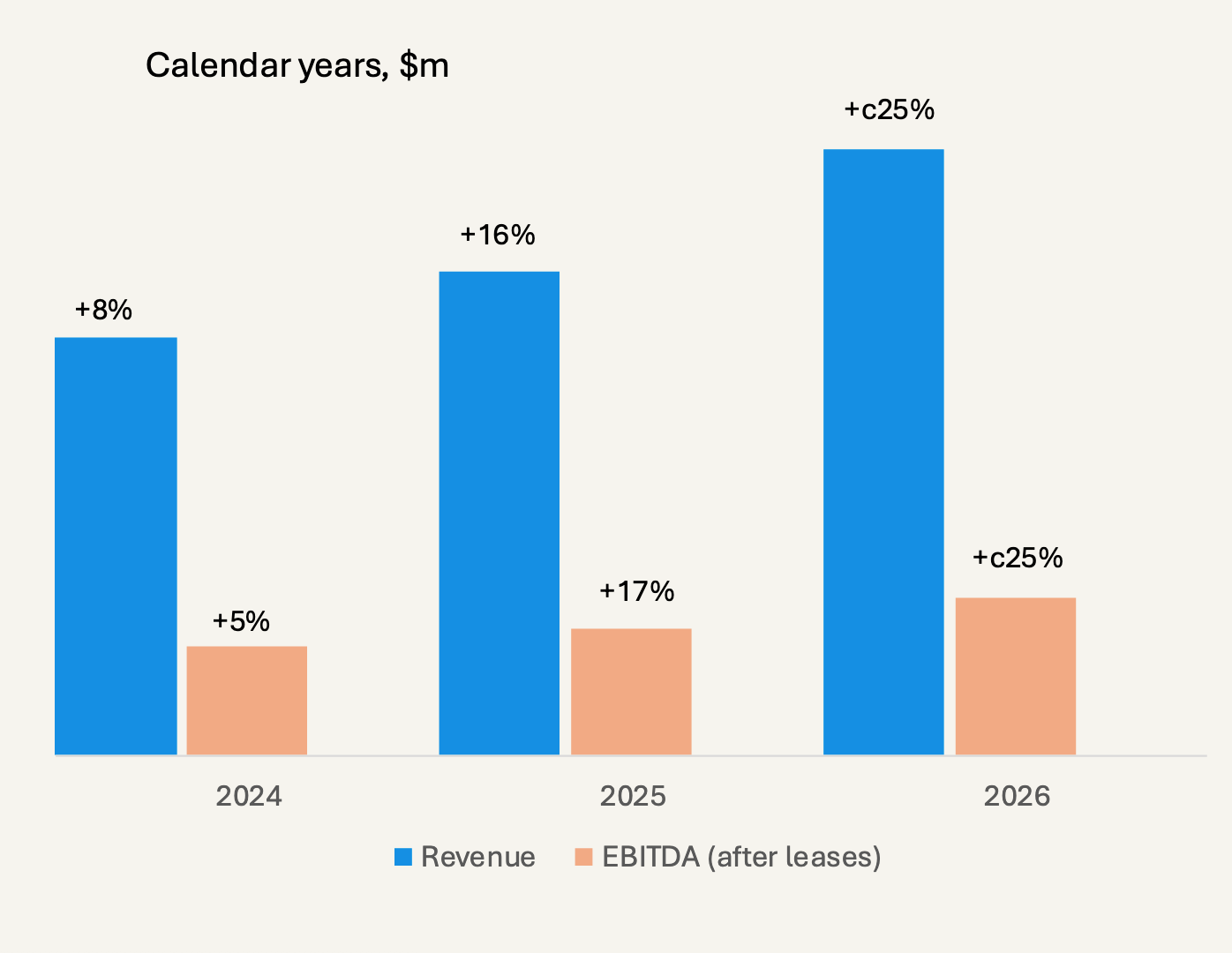

The business is expected to report EBITDA of $105m for calendar year 2026, a double-digit percentage leap from the prior year. The company is ran by John O’Neill, who has been the chief executive officer since January 2018.

The outdoor category has growth from making up just 10% of Australia’s advertising market in 2014, to around 18%. QMS commands 15% of the total outdoor market in Australia.

More than 80% of its current revenue from billings is for contacts that extend through to December 2028.

QMS financials

Nine told the market it has “identified clear opportunities for operational efficiency” and expects to deliver $20m of annual

pre-tax cost synergies by 2029. “These synergies will be driven by the consolidation of back-office functions, technology infrastructure, procurement efficiencies and the switching of marketing spend into QMS.”

The wider Nine group “expects to benefit from incremental revenue growth opportunities” relating to the increase in digital inventory, greater localised targeting and broader advertising briefs.

“The acquisition of this high-growth digital outdoor media company, QMS, further diversifies Nine’s revenue streams and adds scale to our advertiser and agency relationships,” Stanton said.

“Together with our existing media assets, the acquisition will allow Nine to offer customers a broader advertising solution and the use of tools such as Nine Ad Manager for more targeted and localised messaging across a wider set of customers. We also see the opportunity to promote and drive subscriptions for our publishing mastheads and Stan through leveraging any excess QMS inventory.

“The QMS network will provide Nine with a branded platform to support key national news and sporting moments and serve as a public service utility for governments at all levels in times of emergency or community need. We are excited about the potential in this space.

“QMS is a highly complementary media platform, offering Nine the opportunity to drive significant value by leveraging our premium content on QMS screens and creating an unparalleled advertising proposition that spans from ‘Sofa to Street’.”

Stanton elaborated on this further during an investor call on Friday morning, shortly after the market opened. He described out-of-home as “more resilient to the impact of global digital platforms”, and said QMS was “highly complementary” to Nine.

Arthur Laundy and the Laundy Family Office emerged on Thursday evening as a surprise front-runner for Nine Radio, after months of rumours suggesting up to a dozen suitors. The hotel baron is one of the country’s richest men, with a reported net value of about $1.75b, and control of over 40 hotels across the country. In 2004, Laundy received an Order of Australia.

Arthur Laundy and the Laundy Family Office emerged on Thursday evening as a surprise front-runner for Nine Radio, after months of rumours suggesting up to a dozen suitors. The hotel baron is one of the country’s richest men, with a reported net value of about $1.75b, and control of over 40 hotels across the country. In 2004, Laundy received an Order of Australia.

Stanton confirmed in September 2025 that he had fielded “a number of unsolicited inquiries about our radio business”.

Singleton was the early front-runner, with a reported bid of between $20-$30m. He previously held a 32.2% stake in Macquarie Media, which he sold to Nine in 2019 for $80m.

Australian Digital Holdings, which James Packer has a financial interest in, reportedly made a bid in November that valued Nine’s radio arm at $42m, while SEN boss Craig Hutchison, and Global Traffic Network, which shares a chair with Nine Entertainment – Peter Tonagh, reportedly teamed up to lob a bid.

Nine said that the Laundy family is “expected to remain a long-term partner of Nine, with plans to utilise 9News journalists on radio, showcase Stan Sport through Laundy venues, provide promotion and ad sales collaboration, as well as increased ad spend by Laundy on Nine properties.”

Arthur Laundy son Craig, said in a statement issued by Nine that the family is “backing management and all employees to work with us over the coming years to grow this business. We want you to help us continue the important role the stations play in the life of every-day Australians.”

He continued: “We see strong similarities between hotels and talk back radio. Patrons in our venues are at the centre of everything we do and we will have that same ethos with our listeners.

“In public bars, we chat with our customers about the issues of the day. A lot of the time, the thoughts in the minds of our customers are shaped by what is said on the radio. Many of our patrons call the open lines and there are no better arbiters of what passes the pub test.”

2025 was a transitional year for Nine’s radio division.

In January, Nine split into three consumer-focused divisions: streaming and broadcast; publishing; and marketplaces. Nine Radio falls under the streaming and broadcasting arm, led by former Foxtel executive Amanda Laing.

Nine’s director of audio sales Ashley Earnshaw announced in May he would be stepping down at the end of June, after making the “tough decision to leave a business that is primed for growth”. He joined Nova as the network’s new group commercial director.

In July, Nine reshaped its sales operation within audio, with Brian Gallagher, former chair of Boomtown and chief sales officer at Southern Cross Austereo, joining as Nine’s commercial director of audio.

Bolster’s head of media Jonathan Mandel (previously head of digital at SCA’s Listnr) joined Nine Audio as national head of digital sales in late September. Rick Lenarcic, former national head of direct sales, moved into head of sales operations.

Amanda Unwin was appointed of as Sydney sales director, longtime SCA executive Christine Lester joined Nine Audio as Melbourne sales director in mid-August, while Michael Graham was added as Brisbane sales director in the same month, coming across from Car Expert, where he held a commercial leadership role.

Noel Quick, former group business director at Nine Perth, transitioned to sales director of Nine Audio at the start of October.