Written by the Market Insights Team

Dovish Fed bets mount after soft data patch

George Vessey – Lead FX & Macro Strategist

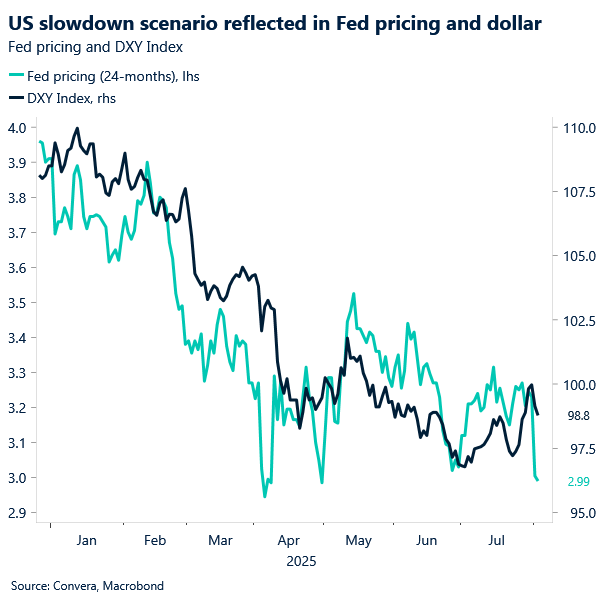

Traders are ramping up bets on Fed rate cuts following Friday’s disappointing jobs report, which weighed on equities and the US dollar and sent bond prices sharply higher. Despite the setback, stocks have consolidated, buoyed by confidence that corporate America might be able to weather tariff headwinds but mainly on hopes the Fed will act to prevent a recession.

San Francisco Fed President Mary Daly added fuel to the dovish narrative, noting that the time for rate cuts is approaching as labour market softness becomes more evident and inflation remains contained despite tariff pressures. Money markets now assign over an 80% probability to a 25bp rate cut next month, with a one-in-three chance of another by year-end.

The broader question for risk assets is whether weak data is seen as bad news (signalling deeper economic trouble) or good news (prompting Fed easing). A mild slowdown could support risk appetite if it leads to more accommodative policy. But a sharp and sustained rise in unemployment would likely sour sentiment, raising concerns over growth and corporate earnings.

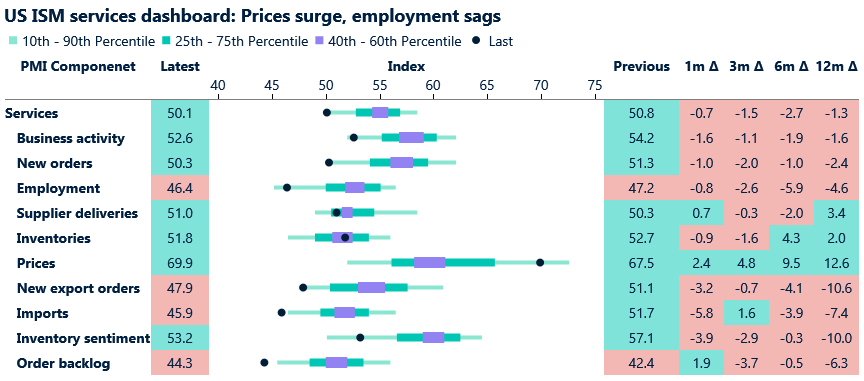

The latest ISM services report captures the Fed’s dilemma: headline activity missed expectations, employment fell to its lowest since March, yet prices paid surged to the highest since October 2022. This stagflationary mix – slowing growth with sticky inflation – is precisely what many economists warned could result from tariff policy. That these dynamics are emerging in the services sector, which is typically less exposed to trade frictions, is particularly notable – and not especially reassuring.

US stocks, yields and the dollar came under selling pressure following this data. In our view, the balance of risks, now, once again points to the downside for the dollar due to Fed easing policy later down the line, the likely negative impact of tariffs on the US economy, and Trump’s continued ‘unorthodox’ policy approach.

UK macro headwinds put sterling under strain

George Vessey – Lead FX & Macro Strategist

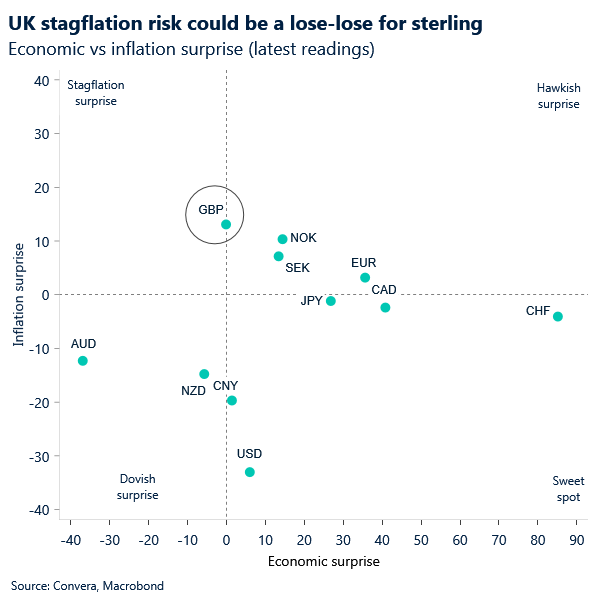

The pound has been trading in a narrow range versus the US dollar this week, unable to convincingly break above or below $1.33. GBP/EUR has also be trading sideways with €1.15 acting as an anchor. The Bank of England’s (BoE) meeting tomorrow could inject some life into sterling, but the domestic backdrop begs the question – will this be a lose-lose situation for GBP?

A 25-basis point cut is almost fully priced in by markets, so attention will be on the vote split, economic projections and forward guidance. If the BoE adopts a more hawkish stance in response to sticky inflation within a stagflationary environment – it could put additional pressure on sterling. Conversely, a shift toward lower interest rates would likely weigh on the pound through the yield channel, as reduced returns make UK assets less attractive to global investors.

Despite the UK composite PMI for July being revised higher yesterday from 51 to 51.2, thanks to a positive revision in the services PMI, the UK economy is facing mounting pressure, with short-term fluctuations and deeper structural issues both contributing to a worsening outlook. The slowdown in UK economic momentum is becoming increasingly evident amid the Citi Economic Surprise Index turning decisively negative, reflecting a string of disappointing data releases.

Any meaningful improvement is unlikely before the autumn Budget, which puts our optimistic projection for sterling – targeting $1.35 to $1.40 later this year – at risk unless the dollar weakens further. That said, we still anticipate a broader decline in the dollar once summer passes, which should give sterling room to recover and move back toward our expected range.

Trade deficit widens again

Kevin Ford – FX & Macro Strategist

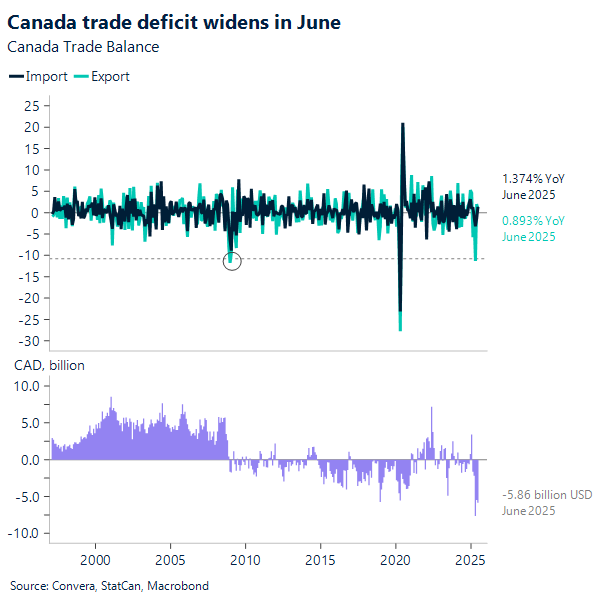

Canada’s merchandise trade deficit expanded to $5.9 billion in June, a notable increase from the $5.5 billion deficit recorded in May. This widening was primarily driven by a 1.4% rise in imports, a figure heavily influenced by a single, high-value shipment for an offshore oil project. Stripping out this extraordinary transaction, total imports would have registered a decline, suggesting that underlying import demand remains soft. The data also showed that approximately 90% of Canadian exports to the U.S. crossed the border duty-free in June, largely thanks to the CUSMA/USMCA trade deal.

The report also sheds light on the tangible effects of global trade policies on Canadian exports. While total exports grew by 0.9% in June, this was largely due to price increases, particularly in energy products, rather than a robust expansion in export volumes. The data points to a direct link between recent declines in unwrought aluminum and iron and steel exports and the higher tariffs imposed by the United States on these products, underscoring the ongoing pressures faced by key Canadian industries in a challenging geopolitical landscape.

The trade dynamics with Canada’s two largest trading partners also reveal a nuanced picture. Although Canada’s merchandise trade surplus with the United States saw a modest expansion to $3.9 billion, its trade deficit with the rest of the world widened to $9.8 billion. This divergence highlights a significant trend: while the trade relationship with the U.S. showed some resilience, a contraction in exports to other international markets, including the UK and Japan, contributed to the overall deterioration of the country’s trade balance.

The USD/CAD could be consolidating around the 1.38 level, trading within a narrow range between 1.374 and 1.384, near its medium-term moving average. The most important data point for Canada this week, will be the job report, where markets are expecting the economy to have created 10,000 jobs in July and the unemployment rate tick up again to 7%.

Euro in consolidation mode

George Vessey – Lead FX & Macro Strategist

It’s been a quiet start to the week in FX, with euro in consolidation mode in the higher realms of $1.15 versus the US dollar. EUR/USD continues to bump into resistance near its 50-day moving average within a whisker of $1.16, whilst the 100-day moving average down at $1.1384 offered decent support last week.

On the data front, June saw euro area industrial producer prices rise by 0.8% month-on-month, marking a reversal after three straight months of declines and aligning with market expectations. The rebound was largely driven by energy costs, which surged 3.2% following a 2.2% drop in May, highlighting the volatility in input prices.

Meanwhile, geopolitical trade tensions are resurfacing. President Trump has proposed aggressive tariffs on pharmaceutical imports, with rates potentially reaching 250% over the next 18 months. This is particularly significant for Europe, as medical and pharmaceutical goods represent its largest export category to the US—accounting for roughly 20% of total exports in 20242. Despite the scale of the threat, markets showed little immediate reaction, likely due to the EU’s recent decision to suspend retaliatory measures.

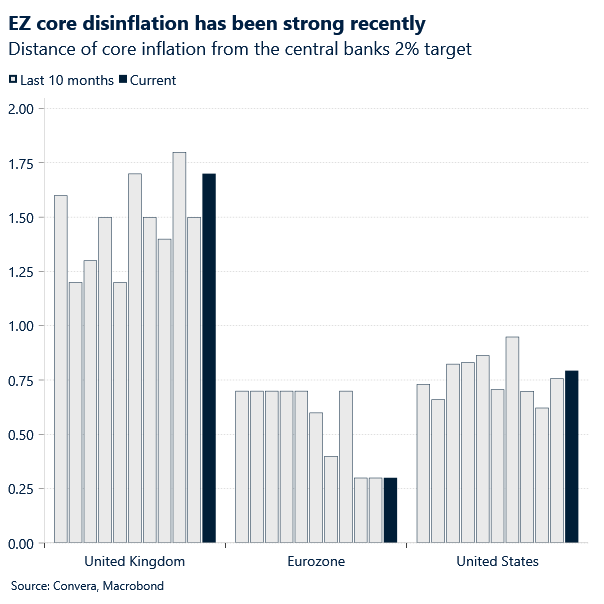

However, the broader macro implications are more nuanced. With the EU stepping back from countermeasures and the US pressing ahead with sector-specific tariffs, the result could be a disinflationary impulse for the euro area. Reduced export demand and redirected global supply chains – especially from China – may exert downward pressure on prices, reinforcing expectations for further ECB easing.

Oil prices are under the pump

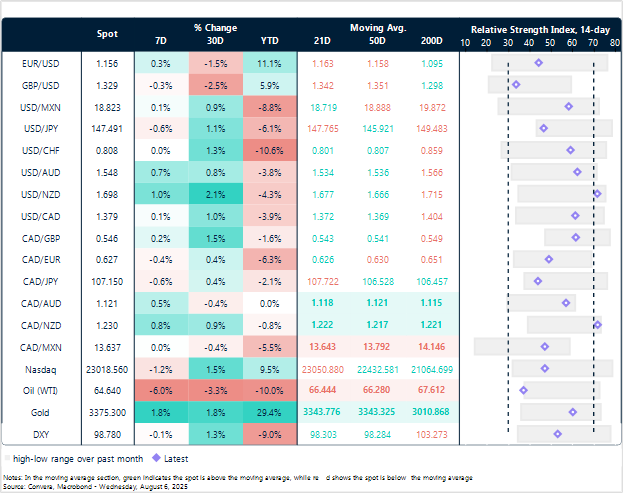

Table: Currency trends, trading ranges and technical indicators

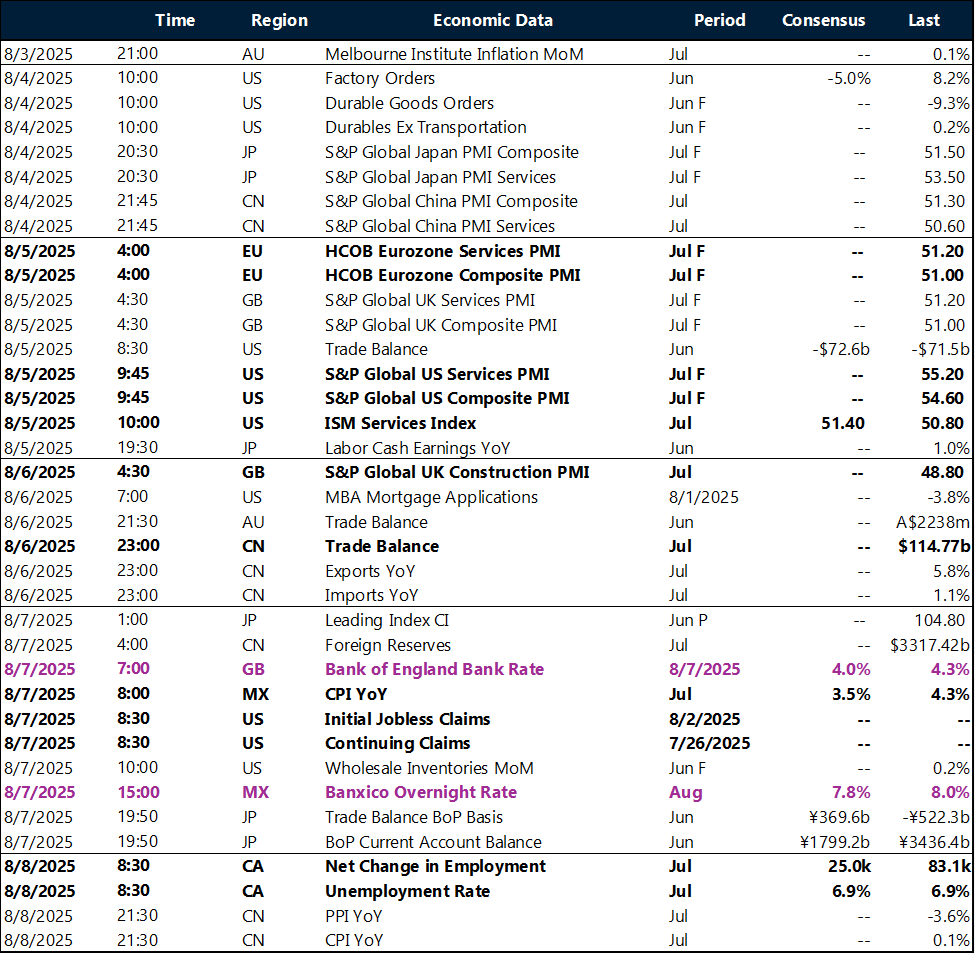

Key global risk events

Calendar: August 4-8

All times are in ET

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.ve a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.