Rigetti Computing, led by CEO Dr. Subodh Kulkarni, has announced the general availability of Cepheus-1-36Q, a 36-qubit multi-chip quantum computer deployed on the Rigetti Quantum Cloud Services (QCS) platform and with future availability on Microsoft Azure. This system demonstrates a two-fold reduction in two-qubit gate error rate compared to the preceding Ankaa-3 system, achieving a median two-qubit gate fidelity of 99%. Cepheus-1-36Q represents the first multi-chip quantum computer to reach this performance level, utilizing a chiplet-based architecture – initially demonstrated in 2021 with interchiplet entanglement – incorporating faster two-qubit gates and an enhanced intermodule coupler design to improve fidelity and coherent error reduction. Rigetti anticipates releasing a 100+ qubit system, also chiplet-based, with a target median two-qubit gate fidelity of 99. 5% before the end of 2025, leveraging superconducting qubits-considered superior to ion traps and pure atoms in scalability and gate speeds by a factor of 1,000-and supported by $571. 6 million in cash, cash equivalents, and available-for-sale investments following a $350 million equity raise in Q2 2025.

Financial Performance

reported total revenues of $1 million for the second quarter ended June 30, 2025, alongside operating expenses of $20. 4 million, resulting in an operating loss of $19 million. The net loss for the quarter reached $39. 7 million, significantly impacted by $22. 8 million in non-cash losses stemming from derivative warrant and earn-out liabilities; these liabilities represent future obligations contingent on performance or equity value, and their non-cash impact highlights the complex financial instruments often employed in high-growth technology ventures.

As of June 30, 2025, the company maintains a robust liquidity position with $571. 6 million in cash, cash equivalents, and available-for-sale investments, providing a substantial buffer for continued research, development, and commercialisation efforts. The company’s financial position was further strengthened by a $350 million equity raise completed during the second quarter, providing capital allocated towards working capital, capital expenditures, and general corporate purposes.

This influx of capital is strategically intended to support the commercial scale-up of Rigetti’s superconducting gate-based quantum computers, reflecting a commitment to translating technological advancements into viable commercial products. Potential future allocations include strategic collaborations, acquisitions, or partnerships, signalling an intention to expand its ecosystem and accelerate innovation within the quantum computing landscape.

Subodh Kulkarni, Rigetti CEO, emphasized the company’s progress in achieving its technology roadmap, particularly the development of Cepheus-1-36Q, a 36-qubit multi-chip quantum computer. Rigetti’s approach to scaling, leveraging a proprietary chiplet architecture, is validated by the successful deployment of Cepheus-1-36Q, which currently boasts the largest number of chiplets integrated into a single quantum computer.

Technology Advancement

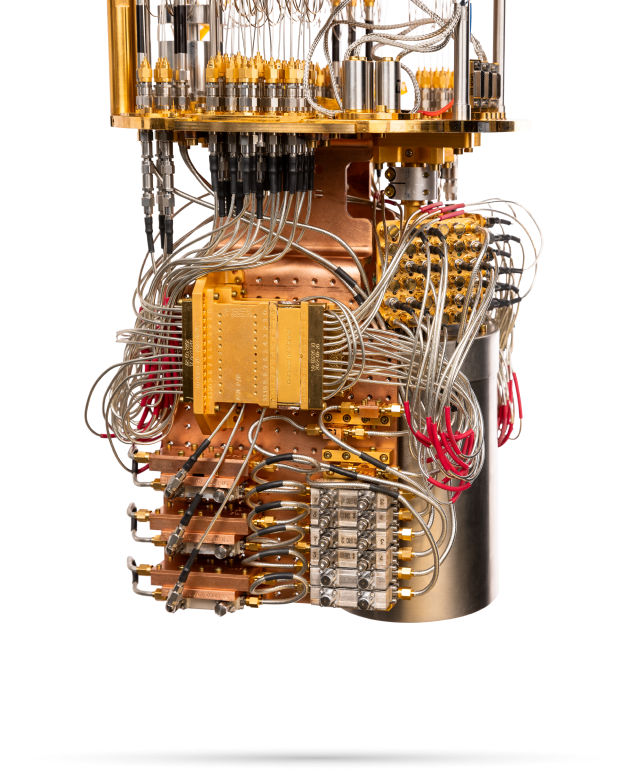

This achievement builds upon Rigetti’s pioneering work, having introduced the world’s first multi-chip quantum processor in 2021, establishing entanglement across interchiplet boundaries and laying the foundation for the more recent Cepheus-1-36Q system. The Cepheus-1-36Q represents a substantial advancement in scalability, currently possessing the largest number of chiplets integrated within a single quantum computer, validating Rigetti’s modular approach to quantum processor design.

Cepheus-1-36Q exhibits a marked improvement in performance over its predecessor, the Ankaa-3 system, achieving a 2x reduction in two-qubit gate error rate and a median two-qubit gate fidelity of 99%. This fidelity level represents a key milestone, establishing Cepheus-1-36Q as the first multi-chip quantum computer in the industry to attain this performance benchmark.

The architecture underpinning Cepheus-1-36Q incorporates several key features designed to enhance performance, including a proprietary chiplet-based architecture facilitating improved control over chip uniformity and fabrication yield, faster two-qubit gates to minimise coherent errors, and an enhanced intermodule coupler design to optimise performance. Rigetti’s commitment to superconducting qubits stems from their superior scalability and gate speeds compared to alternative modalities such as ion traps and neutral atoms – exceeding their performance by a factor of 1,000.

Leveraging established semiconductor technologies, particularly chiplets, allows Rigetti to address the challenges associated with scaling quantum systems while maintaining performance characteristics. The company anticipates releasing a 100+ qubit chiplet-based system before the end of 2025, targeting a median two-qubit gate fidelity of 99. 5%, further solidifying its position at the forefront of quantum hardware development.

Subodh Kulkarni, Rigetti CEO, stated that “quadrupling our chiplet count and significantly decreasing error rates is the clear path towards quantum advantage and fault tolerance. ”

Rigetti Computing’s second quarter 2025 financial results demonstrate a strong financial foundation, bolstered by a recent $350 million equity raise. As of June 30, 2025, the company reported cash, cash equivalents, and available-for-sale investments totalling $571. 6 million, with no reported debt obligations.

The infusion of capital allows Rigetti to pursue a multi-pronged growth strategy, encompassing internal development, potential strategic collaborations, and future acquisitions or partnerships. The company’s financial stability is particularly noteworthy within the capital-intensive quantum computing sector, where sustained investment is crucial for overcoming significant technological hurdles and achieving commercial viability.

Rigetti’s leadership anticipates utilising these funds to accelerate the development of increasingly complex quantum processors, exemplified by the recently released 36-qubit Cepheus-1-36Q system and the planned 100+ qubit system slated for release before the end of 2025. Subodh Kulkarni, Rigetti CEO, highlighted the importance of this financial strength, stating that it provides the necessary resources to “hit our end-of-year technology goals. ”

This confidence is underpinned by the company’s demonstrated ability to achieve key milestones in quantum hardware development, including the successful deployment of the multi-chip Cepheus-1-36Q system on the Rigetti Quantum Cloud Services (QCS) platform and its future availability on Microsoft Azure. The company’s financial position, therefore, is not merely a static metric, but an enabling factor driving innovation and facilitating the progression towards fault-tolerant quantum computing.

Rigetti bolstered by approximately $571 6 million in cash

Rigetti Computing’s financial performance for the second quarter of 2025 reveals a substantial cash reserve of approximately $571. 6 million, comprising cash, cash equivalents, and available-for-sale investments. This financial strength stems from a recently completed $350 million equity raise, providing a robust foundation for continued research, development, and commercialisation efforts within the rapidly evolving quantum computing landscape.

The absence of reported debt further reinforces Rigetti’s advantageous position, allowing for focused investment in core technologies without the constraints of debt servicing obligations. Furthermore, Rigetti retains the flexibility to pursue strategic collaborations, potential acquisitions, or synergistic partnerships that could accelerate its technological roadmap and expand its market reach.

Subodh Kulkarni, CEO of Rigetti, affirmed this strategic outlook, stating, “We continue to achieve our ambitious roadmap goals…and our strong financial position makes us confident in hitting our end-of-year technology goals. ” This confidence is predicated on Rigetti’s proprietary chiplet-based approach to scaling quantum processors, exemplified by the recently launched Cepheus-1-36Q system.

The significance of this financial stability cannot be overstated, particularly within the context of quantum computing’s substantial capital requirements. Developing and manufacturing superconducting qubits, the technology underpinning Rigetti’s processors, necessitates significant investment in specialised equipment, materials, and expertise.

The company’s ability to maintain a healthy cash reserve allows it to navigate the inherent risks associated with cutting-edge technology development and sustain its momentum towards achieving quantum advantage. Rigetti’s commitment to leveraging established semiconductor technologies, such as chiplets, further underscores its pragmatic approach to scaling and improving performance, reducing reliance on entirely novel and potentially costly manufacturing processes.

The company anticipates utilising these funds to refine its chiplet architecture further and achieve its target of 99. 5% median two-qubit gate fidelity for its forthcoming 100+ qubit system.