Australian shares are poised to open lower. US equities were little changed in afternoon trading with investors looking ahead to a speech by Federal Reserve chairman Jerome Powell later in the week.

On Tuesday’s reporting schedule, among others: CSL, BHP Group, HMC Capital, Woodside Energy and Centuria Capital Group. Follow our reporting season coverage here.

Powell will speak on Friday morning (early Saturday AEST) at the Kansas City Fed’s annual gathering of global central bankers in Jackson Hole, Wyoming.

Powell’s speech is “the most anticipated [one] of his 90 months” as chairman, according to Yardeni Research. “An unwarranted cut of the federal funds rate [next month] could have unintended consequences that include a stock market melt up and a bond market meltdown.”

Yardeni said every meeting seems consequential to investors just before it occurs. “But with stock investors confident of a rate cut, President Donald Trump demanding one, and the economic support for one so far ambivalent at best, the US central bank’s September 2025 decision will be important for sure.”

Market highlights

ASX 200 futures are pointing down 23 points or 0.3 per cent to 8874.

All US prices near 5pm New York time.

AUD -0.2% to US64.93¢Bitcoin -1% to $US116,520On Wall St: Dow -0.08% S&P -0.01% Nasdaq +0.03%VIX -0.1% to 14.99Gold -0.1% to $US3332.72 an ounceBrent oil +1.1% to $US66.54 a barrelIron ore -0.2% to $US101.70 a tonne10-year yield: US 4.33% Australia 4.27%Today’s agenda

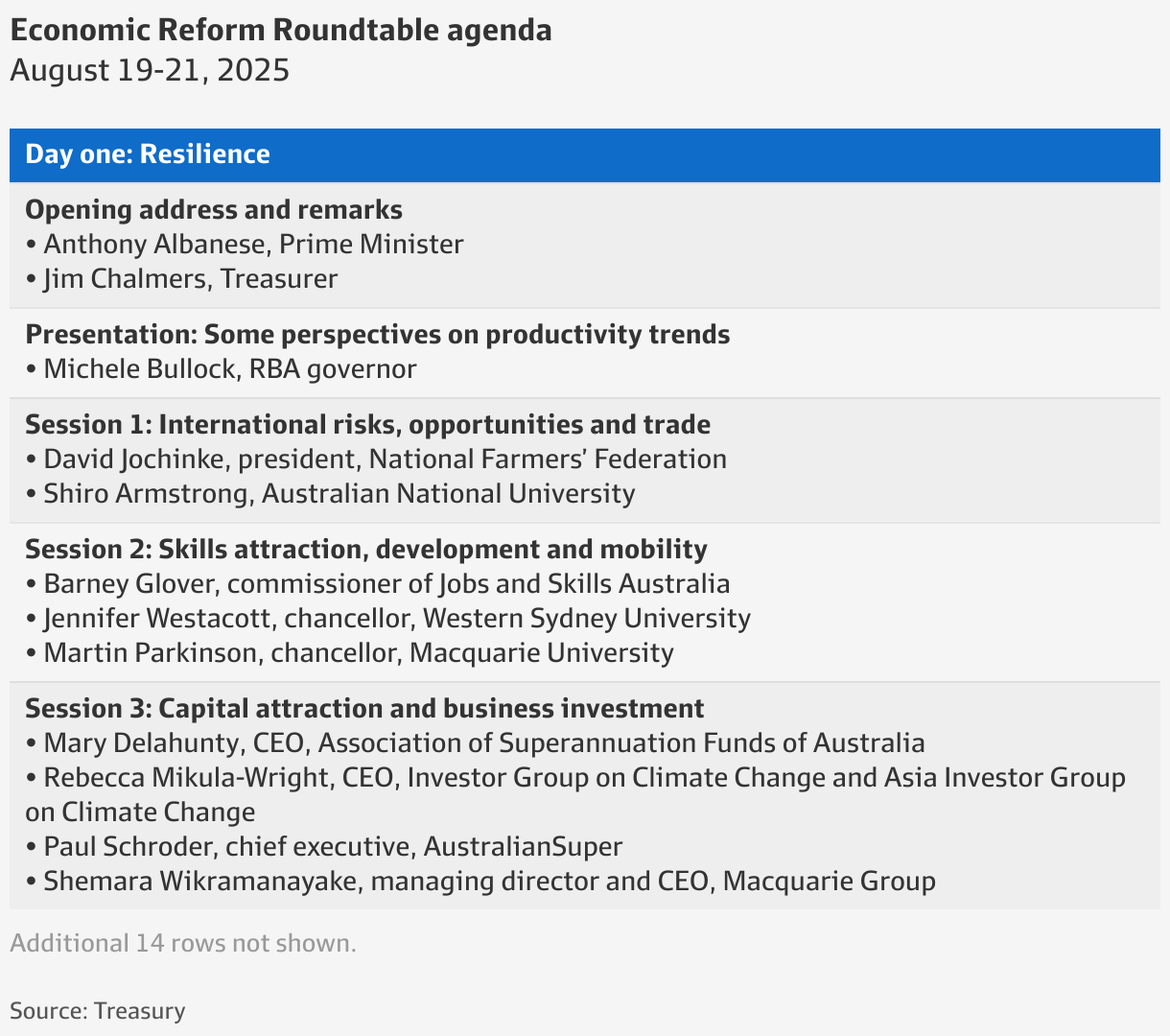

The Economic Reform Roundtable begins on Tuesday with Anthony Albanese, Jim Chalmers and Michele Bullock set to speak.

August consumer confidence data will be released at 10.30am on Tuesday morning. NAB said: “We expect consumer confidence to lift following the RBA’s August interest rate cut and the ongoing rally in equity markets. NAB’s high frequency transactions data suggests the pickup in consumer spending seen in May and June continued into July – July transactions rose 0.7 per cent month-over-month.”

Later, at 10.30pm, the US will release July housing starts and building permits.

Top stories

How $50m windfall in Qantas case changes the game for unions | The unprecedented amount awarded to the Transport Workers Union could be the beginning as new wage theft laws dramatically increase the maximum fines available.

Chanticleer: The market and the maths show Qantas got off lightly | The illegal sacking of more than 1800 workers has cost money, reputations and investor angst. But after its record penalty, does the size of the stick match the carrot?

Tensions between unions and business cast shadow over summit | Productivity Commission chair Danielle Wood joins employers in pushing back at the Victorian government’s proposed work-from-home laws.

Blackbird adds billions to Canva valuation after Figma’s roaring IPO | In a note to investors on Monday, the firm said the huge Wall Street debut meant it had revised the value of its stake in the design software business.

Judge says record $90m Qantas fine is ‘a message to big business’ | Federal Court Justice Michael Lee has imposed the largest fine on a company under the Fair Work Act for illegally sacking more than 1800 workers.