White Chocolate Market Overview

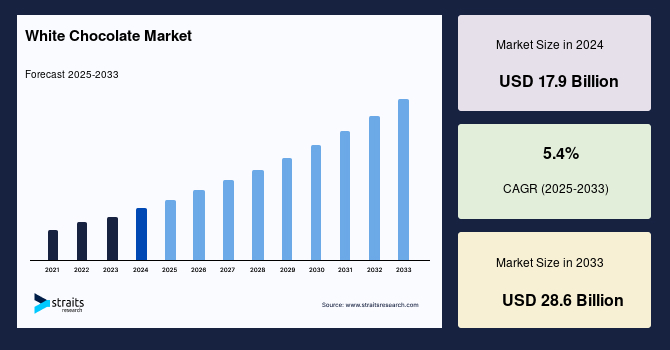

The white chocolate market size was valued at USD 17.9 billion in 2024 and is projected to grow from USD 18.7 billion in 2025 to USD 28.6 billion by 2033, registering a CAGR of 5.4% during the forecast period (2025–2033). The growth of the market is attributed to consumer nostalgia and flavour demand driving white chocolate.

Key Market Insights

The North America region dominated the global white chocolate market with the largest revenue share of 37.8% in 2024.

Based on product type, the white chocolate bars segment represents the most dominant product type, driven by their widespread appeal as ready-to-eat indulgences.

Based on application, the confectionery manufacturing segment stands out as the leading application segment.

Based on distribution channel, the offline retail segment remains the dominant distribution channel in the global market.

Based on end-user, the individual consumer segment form is the largest end-user segment for white chocolate products.

Market Size & Forecast

2024 Market Size: USD 17.9 Billion

2033 Projected Market Size: USD 28.6 Billion

CAGR (2025–2033): 5.4%

North America: Largest market in 2024

Asia-Pacific: Fastest-growing region

The global white chocolate market is witnessing steady growth, fueled by evolving consumer preferences, expanding premium confectionery segments, and rising demand for speciality chocolate across diverse culinary and retail applications. White chocolate is known for its creamy texture and pale ivory hue; its sweet, mellow flavour distinguishes it from dark and milk chocolate, making it a popular choice in dessert formulations, bakery inclusions, and seasonal confections. A rising appetite for indulgent yet premium products, clean-label ingredients, and artisanal chocolate innovations drives the global market. Meanwhile, the cultural significance of chocolate gifting, especially during holidays and celebrations, continues to support sustained market interest.

White Chocolate Market Trend

Seasonal innovation and premium flavours elevate white chocolate appeal

The white chocolate market is evolving rapidly as brands increasingly turn to seasonal themes and premium flavour development to meet shifting consumer preferences. This reflects a growing appetite for limited-edition, indulgent treats that offer novelty, nostalgia, and an elevated chocolate experience.

For example, in February 2025, Lindt introduced a limited-edition LINDOR Carrot Cake Truffle as part of its seasonal Easter collection in the United States. This exclusive product, available only at Target, features Lindt’s signature smooth white chocolate shell filled with a spiced carrot cake-inspired centre, blending warm notes of cinnamon and nutmeg.

This type of seasonal flavour innovation is gaining momentum across the white chocolate category, as brands tap into festive occasions and limited-time offerings to build excitement and drive short-term sales.

White Chocolate Market Driver

Consumer nostalgia and flavour demand drive white chocolate

The growing consumer appetite for nostalgic products and familiar flavours, particularly among younger demographics, drives market growth. White chocolate, once seen as a secondary option to milk or dark varieties, is regaining its spotlight as brands revisit legacy products and respond to renewed consumer interest in creamy, indulgent textures.

For example, in May 2025, Mars Wrigley officially announced the return of Maltesers White Chocolate, a product that had been absent from shelves for over a decade. The product became available on June 16 in multiple pack sizes, including singles, pouches, and share bags.

The comeback of such legacy products not only satisfies an existing demand but also repositions white chocolate as a modern indulgence, contributing to renewed growth momentum within the global confectionery market.

Market Restraint

Heat sensitivity and storage challenges undermine product viability

A key restraint in the white chocolate market is its high sensitivity to heat and moisture, which significantly affects shelf stability, transport, and storage conditions, especially in warmer climates. Unlike dark or milk chocolate, white chocolate lacks cocoa solids and contains a higher proportion of milk fats and sugar, making it prone to fat bloom, discolouration, and texture degradation under temperature fluctuations.

These physical vulnerabilities complicate logistics for retailers and distributors, particularly in regions with limited access to cold-chain infrastructure. During peak summer months or international shipping, maintaining product quality becomes increasingly difficult and costly. Even slight exposure to heat can cause oil separation, leading to unappealing visual and textural inconsistencies that deter consumers and result in product returns or markdowns.

Market Opportunity

Plant-based and dairy-free innovations unlock new consumer segments

The development of dairy-free and plant-based formulations that cater to vegan, lactose-intolerant, and health-conscious consumers is gaining popularity. The shifting dietary preferences and rising demand for ethical, allergen-free indulgences are opening new avenues for innovation.

For example, in April 2025, Ombar, a UK-based ethical chocolate brand, launched the Ombar Blonde, a dairy-free white chocolate bar crafted with organic cocoa butter, desiccated coconut, and sustainably sourced Madagascan vanilla. Sweetened with chicory root fibre to reduce sugar content, the bar delivers a creamy texture with subtle caramel and vanilla notes, all while avoiding palm oil, emulsifiers, and artificial additives.

As plant-based diets become mainstream and consumers increasingly seek out transparent ingredient lists, brands that embrace these trends can access a rapidly expanding market segment. With sustainability, clean-label innovation, and inclusive nutrition at the forefront, dairy-free white chocolate presents a promising frontier for long-term category growth.

📊 Preview Report Scope and Structure – Gain immediate visibility into key topics, market segments, and data frameworks covered.

📥 Evaluate Strategic Insights – Access selected charts, statistics, and analyst-driven commentary derived from the final report deliverables.

Regional Analysis

North America continues to lead the global white chocolate market, supported by a deep-rooted confectionery culture and a strong appetite for premium and indulgent treats. The region is characterised by a well-developed retail landscape, with consumers showing a consistent preference for high-quality, innovative chocolate products. White chocolate enjoys broad appeal, especially in seasonal and festive contexts, where demand for novelty and gifting items surges. The growing influence of artisanal makers has also brought white chocolate into focus within gourmet and speciality food circles, encouraging product experimentation across various formats and flavour profiles. There is also increasing interest in dairy-free and plant-based white chocolate options, aligning with evolving dietary preferences across the region.

The United Statescontinues to be a dominant force in the white chocolate market, driven by a diverse consumer base and a deep-rooted culture of confectionery indulgence. Consumers are increasingly exploring premium, artisanal options, with a noticeable preference for clean-label, low-sugar, and ethically sourced white chocolate. Online retail and boutique chocolate shops have further expanded access to niche and small-batch products, reinforcing the trend toward personalisation and premiumization. Home baking trends continue to integrate white chocolate as a staple, from cookies to frostings.

Canada reflects a growing appetite for white chocolate across both mainstream and niche categories, shaped by evolving dietary preferences and lifestyle choices. While traditional white chocolate products still hold appeal, there’s been a visible shift toward allergen-friendly, plant-based, and fair-trade variants. Seasonal events and culinary pairings also play a notable role, with white chocolate being integrated into baking mixes, dessert toppings, and holiday-themed confections. The café scene, especially in metropolitan areas, has embraced white chocolate-infused beverages and desserts, helping to elevate its presence among younger demographics.

Asia-Pacific White Chocolate Market Trends

Asia-Pacific is witnessing dynamic growth in the white chocolate market, propelled by changing consumer lifestyles and a growing appetite for premium indulgences. As urban centres expand and disposable income rises, there is increasing interest in high-end confectionery, with white chocolate emerging as a popular choice among trend-conscious consumers. The region’s diverse culinary landscape is encouraging unique flavour infusions and product variations that resonate with local tastes, making white chocolate a versatile component in both snacks and desserts. Flavour experimentation, such as floral, fruit-based, and tea-infused variants, is common, helping brands connect with adventurous palates.

China’s white chocolate marketis expanding quickly, propelled by urbanisation, rising incomes, and changing taste preferences. White chocolate is gaining ground through innovative flavours and attractive packaging that cater to trend-sensitive consumers. Young professionals and online shoppers are particularly drawn to seasonal and limited-edition products, which blend local ingredients with premium design. Gifting culture plays a significant role, with white chocolate emerging as a popular choice in curated gift sets and holiday promotions. White chocolate is also appearing more frequently in cross-category collaborations, such as in bakery cafés, ice cream brands, and even beverage labels.

Japan’s white chocolate marketstands out for its creativity and visual sophistication. Consumers highly value aesthetics, leading to beautifully crafted white chocolate products that often incorporate local flavours like matcha, yuzu, or sakura. Limited-edition releases tied to cultural events are common, enhancing excitement and consumer engagement. The café and dessert culture in Japan has further elevated white chocolate’s popularity, as it is regularly featured in pastries, parfaits, and fusion treats. Brands often focus on presentation, novelty, and craftsmanship, which aligns well with Japan’s appreciation for premium and artisanal goods.

Europe White Chocolate Market Trends

Europe holds a prominent position in the global white chocolate market, shaped by its longstanding tradition of chocolate making and a discerning consumer base that values craftsmanship and quality. The region is known for its sophisticated taste preferences, where consumers often seek nuanced flavours, premium textures, and ethically sourced ingredients. There is increasing demand for plant-based, allergen-free, and reduced-sugar options, driving diverse product development within the segment. A strong emphasis on artisanal processes and refined presentation also supports a robust market for gourmet and luxury white chocolate products. Food and confectionery exhibitions continue to spotlight white chocolate innovations, encouraging cross-border collaborations and culinary experimentation.

Germany’s chocolate industry is deeply rooted in quality craftsmanship, and this extends into its white chocolate segment. Consumers here exhibit refined tastes, favouring smooth textures, subtle sweetness, and elegant packaging. Premium grocery stores and speciality chocolatiers offer a broad range of white chocolate formats, from classic bars to filled pralines, frequently featuring innovative flavours or origin-based cocoa butter. Culinary professionals also utilise white chocolate in gourmet applications, adding to its niche appeal. White chocolate is also gaining visibility in cooking channels and recipe blogs, inspiring use in savoury-sweet dishes.

In the UK, white chocolate continues to evolve beyond a niche product into a mainstream favourite, especially among younger consumers and gourmet food lovers. The market has seen growing interest in blonde chocolate variations, dairy-free alternatives, and products that balance indulgence with health-conscious formulation. Craft chocolatiers and boutique brands are central to this shift, offering experimental flavours and ethical sourcing stories that resonate with values-driven consumers. Influencer marketing and limited-edition collabs have played a role in boosting its cultural relevance.

Segmentation Analysis

Product Type Insights

White chocolate bars represent the most dominant product type, driven by their widespread appeal as ready-to-eat indulgences and their adaptability across both mainstream and premium categories. These bars range from classic, creamy formulations to more specialised offerings such as no-sugar-added, plant-based, or fortified versions targeting specific dietary preferences. Their compact, portable format makes them ideal for on-the-go snacking, while their versatility allows brands to experiment with fillings, inclusions, and layered textures. White chocolate bars are also a popular format for limited-edition releases during seasonal events such as Valentine’s Day, Easter, and Christmas, enabling manufacturers to refresh portfolios and attract impulse purchases.

Application Insights

Confectionery manufacturing stands out as the leading application segment, with white chocolate being extensively used in the production of truffles, pralines, filled chocolates, and coated confections. Its smooth mouthfeel, sweet profile, and visual appeal make it an ideal base or complement to a wide range of flavour combinations and textural elements. Artisanal and commercial chocolatiers alike value white chocolate for its ease of moulding, enrobing, and layering in multi-component products. Additionally, its neutral colour and sweetness provide a clean canvas for natural food colouring, freeze-dried fruit powders, and decorative toppings, which are especially important in gourmet, festive, and novelty applications.

Distribution Channel Insights

Offline retail remains the dominant distribution channel in the white chocolate market, particularly through supermarkets, hypermarkets, convenience stores, and gourmet food outlets. These physical retail environments play a key role in impulse buying, seasonal promotions, and new product trial, especially when it comes to chocolate, where visual appeal and shelf placement significantly influence purchase decisions. Offline stores provide tactile experiences that digital platforms cannot replicate, such as feeling the product weight, inspecting packaging, or receiving samples. Many premium brands also use dedicated retail counters or curated in-store displays to highlight artisanal credentials and attract premium customers.

End-User Insights

Individual consumers form the largest end-user segment for white chocolate products, accounting for consistent demand across age groups, regions, and income levels. Whether purchased as everyday treats, gifts, or seasonal indulgences, white chocolate continues to appeal due to its rich flavour, smooth texture, and association with comfort and celebration. Younger consumers, especially Gen Z and Millennials, are drawn to innovative white chocolate offerings featuring bold flavour pairings, limited-edition collaborations, and ethical sourcing claims. Health-conscious consumers also contribute to segment growth by opting for sugar-free, vegan, or organic variants.

Market Size By Product Type

White Chocolate Bars

White Chocolate Chips and Chunks

White Chocolate-Coated Confectionery

Flavoured or Filled White Chocolates (e.g., Raspberry, Matcha)

Organic and Clean-Label White Chocolate

Company Market Share

The white chocolate market is moderately consolidated, with a handful of global players dominating premium and large-scale production, particularly in North America and Europe. These companies benefit from strong brand equity, global supply chains, and diverse product portfolios that cater to mass-market demand as well as premium niches. Their distribution spans supermarkets, gourmet outlets, and e-commerce platforms, supported by ongoing innovation in low-sugar, plant-based, and ethically sourced white chocolate offerings.

Barry Callebaut, headquartered in Zurich, is a global leader in chocolate and cocoa production, operating in over 40 countries. It owns brands like Callebaut, Cacao Barry, Chocovic, and Carma, serving both industry and artisan professionals. With 60+ production sites and 13,000+ employees, the company is also known for its strong sustainability commitment through its “Forever Chocolate” program.

In February 2024, Barry Callebaut’s Chocovic brand launched Chocovic White in Turkey, unveiled at a distributor meeting in Eskişehir. The range includes two variants, White 34 and White 37, in 10 kg flakes, with White 34 also in a 2.5 kg block. Tailored for pastry professionals, it supports various applications and is produced locally for cost-effective, high-performance use.

Recent Developments

April 2025, Cargill introduced Bright White Chocolate, a premium-grade product designed for foodservice customers such as manufacturers and chefs. This innovation features a brilliant white appearance and an enhanced vanilla flavour profile, addressing growing consumer demand for visually striking and flavorful chocolate.

July 2025- Nestlé launched the Milkybar Buttons Crispy Cookie White Chocolate sharing bag, now available in major UK supermarkets. This new product combines smooth white chocolate with crispy cocoa-flavoured rice inclusions, offering a crunchy and flavorful twist on the classic Milkybar taste.

January 2025- Pepperidge Farm launched its Milano White Chocolate Cookies, marking the brand’s first entry into the white chocolate segment. The cookies feature a smooth white chocolate layer sandwiched between crunchy biscotti, available in flavours such as Strawberry, Lemon, and Coconut.

White Chocolate Market Segmentations

By Product Type (2021-2033)

White Chocolate Bars

White Chocolate Chips and Chunks

White Chocolate-Coated Confectionery

Flavoured or Filled White Chocolates (e.g., Raspberry, Matcha)

Organic and Clean-Label White Chocolate

By Application (2021-2033)

Confectionery Manufacturing

Bakery and Patisserie Products

Dairy Desserts and Ice Cream

Ready-to-Eat Snack Formulations

Beverage Additives (e.g., Mochas, Milkshakes)

Gifting and Seasonal Chocolates

By Distribution Channel (2021-2033)

Supermarkets and Hypermarkets

Speciality Confectionery Stores

Online Retail Platforms

Offline retail

Convenience Stores

Horeca (Hotel/Restaurant/Café Supply Chains)

By End-User (2021-2033)

Individual Consumers

Bakeries and Artisan Confectioners

Food and Beverage Manufacturers

Catering Services and Institutional Buyers

Premium Gift Retailers

By Region (2021-2033)

North America

Europe

APAC

Middle East and Africa

LATAM

Frequently Asked Questions (FAQs)

The global white chocolate market size was worth 17.9 billion in 2024.

Top industry players are Nestlé S.A., Mondelez International, Inc., Barry Callebaut AG, Lindt and Sprüngli AG, The Hershey Company, Ferrero Group, Mars, Incorporated.

North America has the highest growth in the global market.

The global market growth rate growing at a 5.4% from 2025 to 2030.

Plant-based and dairy-free innovations unlock new consumer segments is the opportunity for the market.