Weather: No major global weather concerns. The Pro Farmer US crop tour noted some stress in Central Indiana corn, with black tip showing signs of pollination stress, but overall, this is unlikely to dent what remains a large crop.

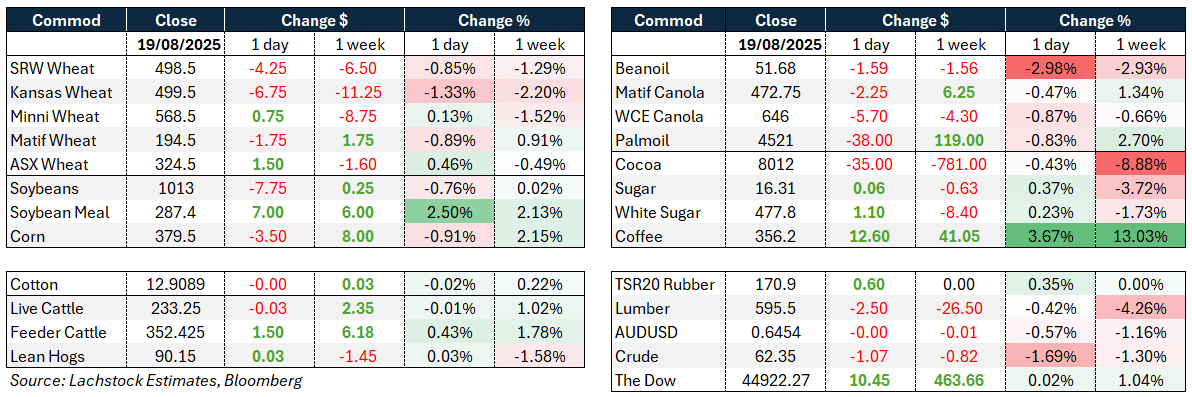

Markets: Wheat kept sliding with demand quiet and ample supply in the system. Canola followed beans lower, weighing on Winnipeg overnight. Corn followed wheat lower on large supply and that the US harvest and delayed Brazilian corn exports could converge in Oct/Nov.

Australian Day Ahead: The AUD fell 0.57 percent overnight, softening the blow from weaker global wheat, meaning bids here should hold steady. Canola could be $1–2 higher on the currency move and slow grower selling with the crop still having plenty of work to do.

Chicago wheat made fresh contract lows as the Pro Farmer Tour found healthy crops across key states. Futures were down 0.8pc while Matif slipped €1.75/t despite a supportive Euro, underscoring the heavy supply tone.

French wheat regained competitiveness into North Africa for the first time in years, but this failed to offset broader bearish sentiment. Exporters note that demand is steady, but global surplus keeps rallies capped.

Weather remains broadly constructive: Argentina’s wheat crop is tracking above average; India’s late monsoon will aid planting. Supply optimism is weighing on price.

Ukraine’s strike on Russia’s Druzhba pipeline briefly raised supply risk, but markets shrugged it off as flows are expected to resume. Heavy Russian exports continue to cap global markets.

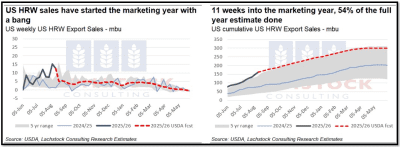

US futures remain under pressure from strong ear counts on the tour, with Ohio pegged at nearly 186 bu/acre. Scouts report “hit and miss” corn, but soybeans consistently strong, reinforcing a bearish grains backdrop.

Sentiment remains weak with flat spreads and no catalyst for a rally. Traders highlight that even FX weakness in the AUD is barely offsetting global price softness for Australian exporters.

Other grains and oilseeds

Corn futures slid 0.8pc to $4.03/bu as healthy yields from Ohio and South Dakota underscored a large US crop. Pockets of Indiana show tip back and weather stress, but replenishing rains have eased concern.

The U.S. harvest and delayed Brazilian corn exports could converge in Oct/Nov, hitting global markets simultaneously. This would pressure feed barley further, especially as China’s sow herd reduction bites.

Soybeans fell 0.7% to $10.34/bu with the tour finding consistently strong pod counts. Processors are slashing bids in the Eastern Midwest, and AgResource warns farmers will sell beans heavily to fund 2026 inputs.

Canola followed beans lower, with Winnipeg under pressure from stronger U.S. yield reports.

Biofuel policy is again in focus: the Philippines paused its biodiesel increase on inflation fears, while Indonesia is pushing for B50 in 2026. Shifts in regional mandates could redirect demand for oilseeds and vegoils.

Macro

The AUD slipped 0.3c to 64.5c as stronger U.S. housing starts and optimism ahead of Jackson Hole boosted the USD. FX remains a key swing factor for local grain pricing.

U.S. equities fell (S&P 500 -0.6%, Nasdaq -1.5%) while European bourses rose modestly. Yields edged lower with the 10y at 4.31%, leaving traders watching closely for Fed policy signals this week.

S&P reaffirmed the U.S. AA+ rating, citing tariff revenues up 75% YoY as a rare fiscal cushion. The move provided reassurance but didn’t shift markets materially.

Energy prices softened with WTI down to $62.5/bbl as geopolitical risks eased, despite ongoing Russia–Ukraine strikes on pipelines and refineries. China has stepped up crude purchases, taking discounted Russian barrels left by India.

Base metals weakened on a stronger USD, though supply-side tightness in copper remains supportive. Beijing’s push to rein in overproduction and negative treatment charges highlight smelter strain.

Broader structural themes linger: BHP forecasts India’s steel output could quadruple to 600mt over coming decades, boosting long-run iron ore demand.

Australia

WA canola bids are holding firm around A$850 with solid buyer appetite, wheat unchanged at $350 and barley steady at $324.

Track markets in Victoria were a touch higher with canola $818, wheat steady $348 and barley $312.

A rainfall event is being built into forecasts for SA, Vic and SNSW mid-to-late next week, with 15–25mm expected across most parts.

Delivered Darling Downs bids are around $328 for Jan+, with barley $316 and sorghum current season $353.

Old crop faba and lupin markets remain quiet in the east as containment feeding demand has dried up, while prices are still too expensive to compete with canola and soybean meal into feed mills.