Emerging market equities have been outperforming developed markets so far in 2025, supported by a weaker US dollar and investors looking to diversify out of US assets.

However despite the current strength, the recent move looks more like a recovery rally after years of underperformance rather than the start of a bull market, according to Nenad Dinic, EM equity strategist at Julius Baer.

Dinic argued that a sustained bull market would require “material improvements in economic growth and significant upward revisions to earnings estimates” like those seen during the late 1980s to early 1990s, 2001 to 2010, and 2016 to 2018.

Emerging market equities are up 20.9% year-to-date, versus a 13.9% return from the MSCI World index.

In spite of the recent rally, the bank has reiterated its neutral stance on emerging market stocks versus developed markets going into the second half of the year.

Dinic highlighted that tariff uncertainty continues to weigh more heavily on sentiment in emerging markets, which has seen investor outflows from key countries like Brazil and India over the past few weeks.

He said: “Sustaining relative strength will be more difficult going forward without visible improvement in macroeconomic trends or a new round of earnings upgrades.”

“The risk of downward revisions is still present if tariff-related pressures escalate, as consensus EPS revisions stayed flat and currently do not reflect ongoing uncertainties.”

Despite the bank’s neutral stance, Dinic recommends investors focus on Asian markets for EM equity exposure due to the region’s policy support, structural reforms and improving bottom-up fundamentals.

Constructive on China

On a more granular level within Asia, the bank sees strong return potential for Chinese equities towards year end, with an overweight stance.

Richard Tang, China strategist and head of research Hong Kong said his overweight thesis is largely underpinned by strengthening bottom-up fundamentals and a more supportive liquidity backdrop.

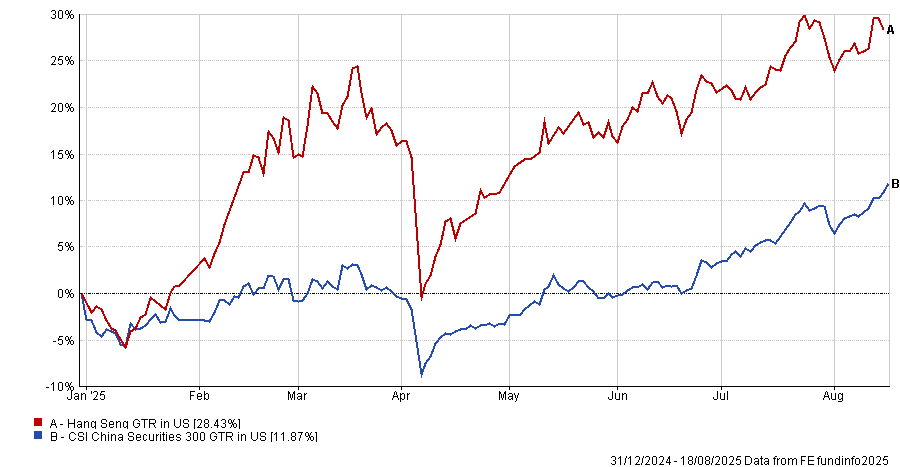

China has been one of the strongest performing Asian markets so far this year, with the Hang Seng Index up 28.4% year-to-date. However the CSI 300 Index has lagged, up just 11.8% over the same period.

While the bank previously had a preference for H shares, it now expects China A shares to catch up in the near term.

“This is due not only to the A–H premium nearing a new low (noticed by most investors), but also to an improving liquidity set-up in the onshore market,” Tang said.

He pointed to a sharp increase in the onshare margin balance since July, which exceeds 2trn Chinese Yuan, as one indicator.

He said: “While the number of new account openings is yet to show a clear pickup, the constant accumulation of excess savings by Chinese households over the past few years provides ample dry powder for the market to rally.”

“Onshore mutual funds have marginally raised their equity positioning, although they remain far from previous highs,” he added.

Within the A-share market, the bank expects outperformance from non-bank financials, hardware technology, defence, and companies set to benefit from the government’s ‘anti-involution’ campaign.