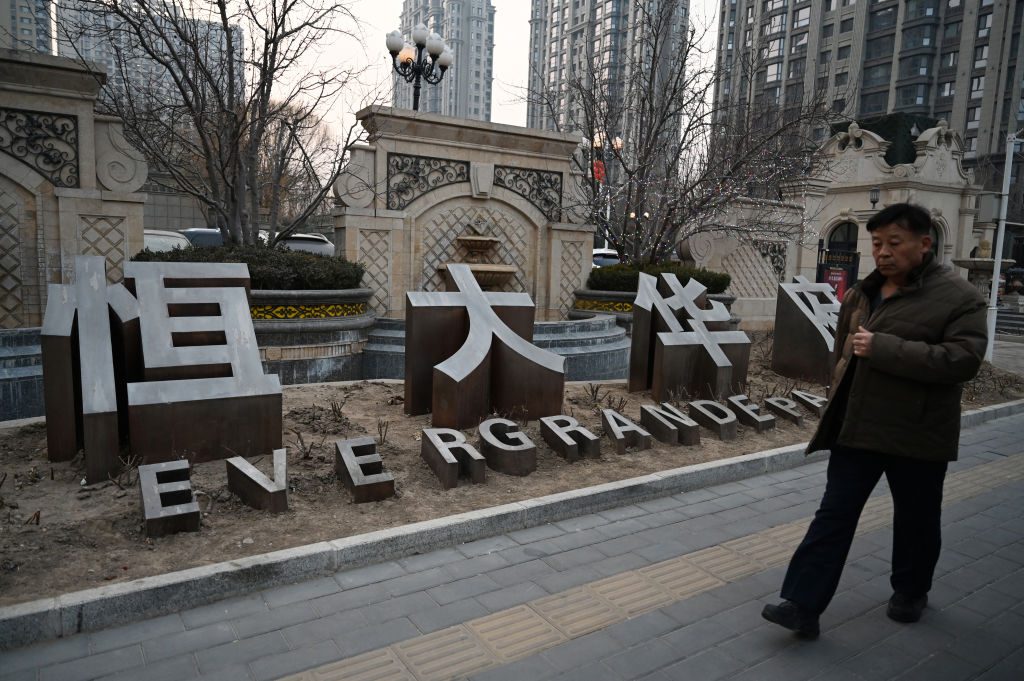

In early 2024, the Evergrande property empire was put into liquidation and Chinese stocks plunged. On Monday, however, when the company was delisted from the Hong Kong stock exchange, the Chinese stock market leapt by 1.5%. Talk about dying with a whimper.

But while the markets shrugging off Evergrande’s final demise was not a surprise — the company’s shares had already lost virtually all their value since their peak — the strong performance of China’s stock market is more puzzling. The economy is still struggling, after all. Yet after 15 years of funk, Chinese stocks are now up over 30% in the last year. Over the last month alone, a time in which the US market seemed to hit a ceiling, the Chinese market is up 7%.

Given that stock markets are meant to be discounting mechanisms, anticipating events before they happen, a continued strong performance could suggest Chinese investors have spotted something. In fact, it’s possible the property slump and stock market boom are connected. Only half of what China’s economy produces each year is consumed, with the rest being saved.

Traditionally, housing has been the most popular vehicle for Chinese households to park their savings, but the property crash has caused a pullback. If ordinary Chinese people are shifting their savings over to the stock market, there may be some legs to the market rally. To the extent such a rally would then begin to restore the finances of Chinese households, it could conceivably create a virtuous spiral in which the country’s consumers start spending more, boosting profits and sustaining the market rally.

It may also be that investors are betting on China winning the AI race against the US. Amid growing doubts about an AI bubble in America, ChatGPT’s recent update was a bit of a dud. What received little notice at the time was that DeepSeek released its latest update simultaneously, with some suggesting it “humiliated” its American rival with its superior performance. As word spreads, it may bolster the faith of those who believe that China will dominate this market. That may help explain why the tech-heavy Hong Kong market is up even more strongly than the Chinese one, having increased at more than twice the rate of the US Nasdaq over the last year.

What’s more, only recently has attention turned to a looming obstacle to the AI industry’s future: energy costs. AI’s vast electricity appetite is beginning to hit the limits of the US’s power supply, and Donald Trump’s broadsides against renewable energy are slowing new installations. Yet China, which is heading in the opposite direction and plunging headlong into the green transition, installed nearly 400 GW of new electrical capacity in 2024, mostly from renewables. The United States trailed behind, installing barely 50 GW of new capacity in that time. If AI’s growth is heading for an energy wall, it will hit that wall first in the US.

Of course, it’s also possible that the market rally is a bubble unsupported by economic fundamentals, and will therefore eventually pop. But the next few weeks will be revealing; and if the rally continues in China, Western investors will have to take seriously the sentiment of their Eastern counterparts.