Value for money: The Molonglo Valley is leading the field in price growth. Photo: Michelle Kroll.

The median price of a Canberra detached house is back over the million-dollar mark as the residential market continued its rise in August.

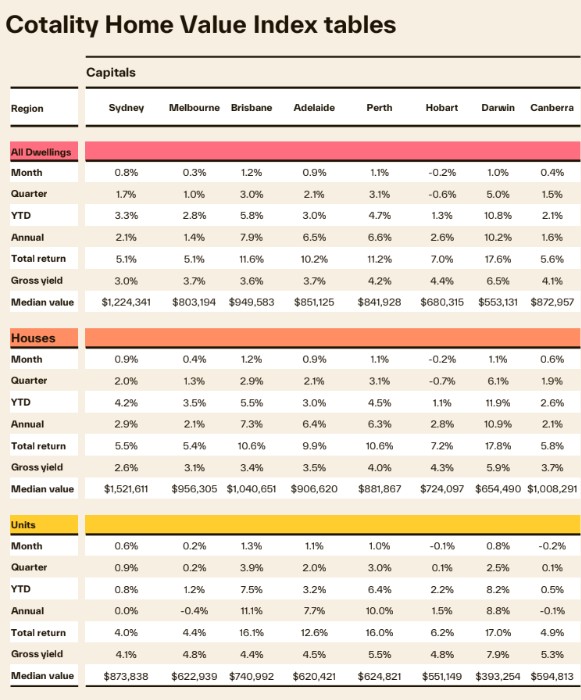

The Cotality Home Value Index showed that prices overall increased 0.4 per cent in August, contributing to a 1.5 per cent rise for the quarter, a 2.1 per cent rise for the year to date, and a 1.6 per cent rise for the last 12 months.

However, the big mover has been in demand for detached houses, which rose 0.6 per cent in August, driving the median price to $1,008,291.

Prices for detached houses have now risen by 2.6 per cent in 2025 and are up 2.1 per cent over the past year.

Prices for units and townhouses actually slipped marginally by -0.2 per cent during August. The sector has remained flat over the past year, but they up in 2025 by 0.5 per cent, with a median of $595,000

The market has been edging upwards since January, encouraged by falling interest rates and the prospect of further cuts, with the overall median now at $873,000.

The bringing forward of the Federal Government’s expanded first-home buyer’s scheme to 1 October is also expected to add impetus to the market as the spring selling season gathers pace and more stock becomes available.

The scheme’s 5 per cent deposit requirement, new property price cap of $1 million, and removal of lender’s mortgage insurance should open up the market to new entrants, particularly those seeking detached houses in outer areas.

The market has been edging upwards since January, encouraged by falling interest rates and the prospect of further cuts. Table: Cotality.

Cotality research director Tim Lawless said first-home buyers generally preferred detached houses, probably as they’re looking to start families, so he expected whatever new stock became available to be absorbed quickly in a sellers’ market.

Mr Lawless said that about 715 houses were listed for sale during August, which is about 22 per cent below the five-year average and 24 per cent lower than a year ago.

“The improvement through spring in the new listings flow will definitely be well received, but it strikes me that it’s coming from a fairly low base, and if buyers become more active, it just means that the stock’s being snapped up more quickly,” he said.

In contrast, in the unit sector, more than 1000 homes were advertised for sale over the same period, about the same as a year ago, and about 12 per cent above the previous five-year average.

Mr Lawless said Canberra’s two-speed market showed the difference supply made to prices.

He said there were still a lot of units and townhouses to be built, whereas house construction had been constrained in the last decade or so.

“I think about three-quarters of new completions have been in the multi-unit sector across the ACT,” he said.

“It’s a good lesson in just how high levels of supply can keep a lid on value growth and support affordability.”

However, for those seeking capital gains in the unit sector, Canberra had not been attractive.

All districts except North Canberra experienced price gains over the past 12 months, with this negative result skewed by the number of units in that area.

Mr Lawless said the trend for North Canberra was positive this year, so he would be surprised if it stayed in the negative for too long.

Molonglo stretched its lead in the annual growth figures to 7.1 per cent, assisted by lower prices, followed by South Canberra (3.7%), Tuggeranong (2.8%), Belconnen (2.4%), Weston Creek (1.1%), Woden (.07%), Gungahlin (0.3%), and North Canberra (-1.4%).

Mr Lawless said that while he expected the market to continue rising, he did not foresee another boom due to fairly tight lending policies and the first-home buyer guarantee price caps keeping a lid on that exuberance.

“What we should be expecting is a moderate, reasonably sustainable level of growth going forward, with the ACT having those high supply levels in the apartment sector, still seeing those two-tier conditions,” he said.

Nationally, Cotality’s Home Value Index rose 0.7 per cent in August, the strongest month-on-month gain since May last year, pushing the annual change higher for the second month in a row, to 4.1 per cent.

Mr Lawless said the growth cycle had been gradually building momentum since the February rate cut, with buyer demand spurred by a lift in borrowing capacity, real wages growth, rising confidence and what is likely to be a growing sense of urgency as advertised stock levels remain tight.

“Once again, we are seeing a clear mismatch between available supply and demonstrated demand, placing upward pressure on housing values,” he said.