Weather: Pakistan’s Punjab has been hit by catastrophic floods, submerging farmland and displacing millions, with major damage to pulse crops including chickpeas and lentils. Domestically, some more rainfall is forecast for WA this week, with nothing too widespread for the rest of the country..

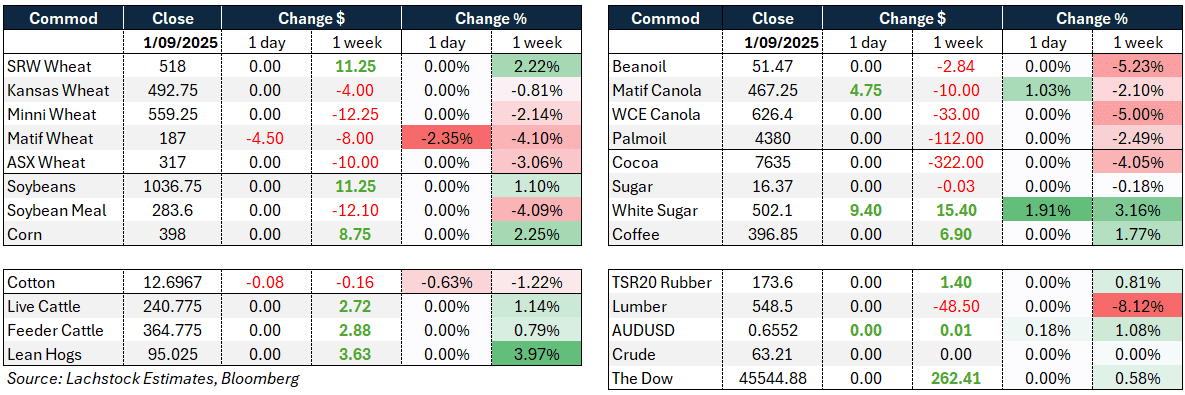

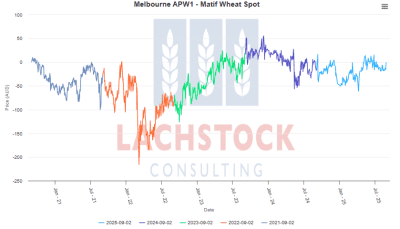

Markets: Labor Day holiday in the US last night. Matif wheat gave back all of Friday’s gains with increased production forecasts for the EU and Russia. Matif canola was stronger but not much else to go from.

Australian Day Ahead: Wheat likely to be back $1–$2 on the back of Matif futures. Yesterday wheat bids were unchanged despite some upside in futures Friday, speaking to the improved crop conditions domestically.

US markets were closed for the Labor Day public holiday.StatsCan forecast Canada’s wheat crop at 35.5 Mt, larger than last year.

EU Commission estimated EU soft wheat production at 128.1 Mt, around 15% above last year.

IKAR lifted its Russian 2025 wheat crop forecast by 500,000t to 86.0 Mt.

SovEcon is calling Russian wheat exports 4 Mt for August, with pace starting to ramp up after a slow start, though plenty of work remains. Russian FOB is pegged around $232/t, with grower selling slowly improving.

Other grains and oilseeds

US markets were closed for Labor Day. Corn futures lifted on Friday with profit taking after the ProFarmer tour pegged yields at 182.7 bpa, 3.2% below USDA’s August estimate, though crop conditions held at 71% G/E, the best since 2016.

StatsCan reported July Canadian canola crush at 968,515t, lifting 2024/25 crush to a record 11.4 Mt vs 11.0 Mt last year, with 12.5 Mt forecast in 2025/26 as new capacity comes online. Exports are projected at 6.4 Mt, with upside to 7.2 Mt if other markets absorb displaced Chinese demand.

Early 2025/26 Canadian farmer deliveries were slower at 342,800t vs a 5-yr avg of 460,900t, reflecting tight on-farm stocks and tariff uncertainty.

Macro

Global markets were steady with the US closed for Labor Day; Euro Stoxx 50 +0.3%, FTSE 100 +0.1%, European bond yields +1–3bp.

Gold and silver rallied on growing expectations of US rate cuts, with gold nearing USD 3,500/oz and silver above USD 40/oz for the first time since 2011.

Focus this week is on the US labour market report, with consensus for +75k jobs and unemployment edging up to 4.3%, ahead of an expected 25bp Fed cut in September.

Uncertainty persists with the ongoing Russia–Ukraine conflict and tariff litigation in the US, adding to global market caution.

Australia

Canola ended the week much the same way it started, with bids down $2–$5 around $820 FIS Albany. Wheat was firm at $348, while barley softened slightly to $314.

Through the east of the country, canola eased $10 to $794 track Geelong, wheat was $340, and barley $305.

In the Griffith market zone, values are back $5–$10 over the past two weeks, with new crop wheat bid at $315 and old crop at $320, as the crop remains in reasonable shape and growers have been more engaged in marketing both seasons.

Feeder cattle grids opened 20c/kg higher this week, with heavy flatback steers quoted 440–460c/kg, Angus types around 530–540c/kg, and British crosses near 480c/kg. The rise has been fuelled by renewed restocker confidence following widespread rain across NSW, Vic, and SA, while southern feedlots continue sourcing cattle further north. Saleyard indicators also moved higher, led by strong gains in Qld and Vic.