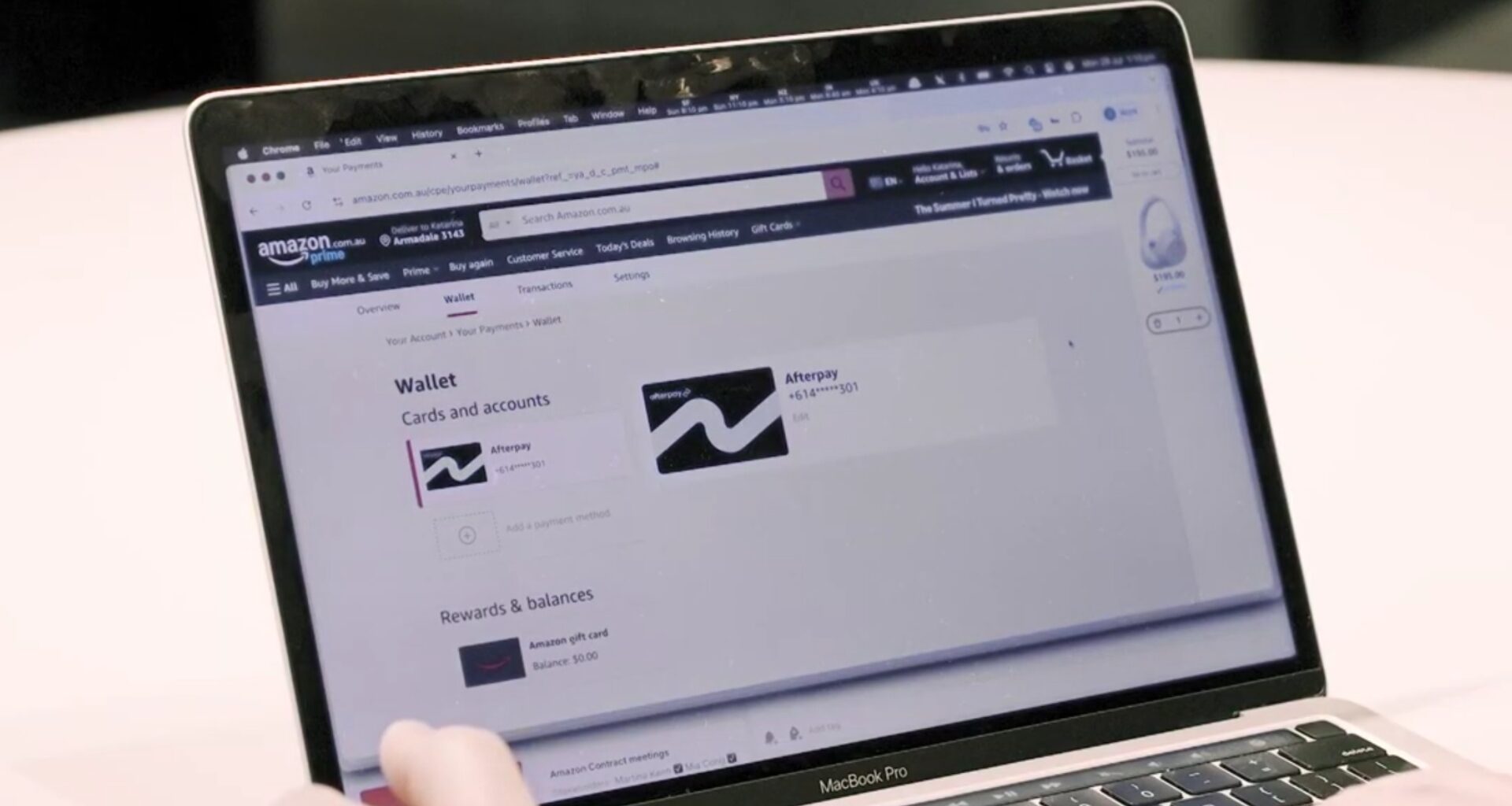

Amazon has added Afterpay as a payment option for Australian shoppers, bringing buy now, pay later to one of the world’s biggest online marketplaces.

Shoppers can use Afterpay as a payment option from Wednesday onwards, at both the Amazon Australia site and its dedicated shopping app.

The pay-in-four system can be used for physical purchases, excluding alcohol, but cannot be used for digital content or subscriptions.

The update comes in time for November’s Black Friday and Cyber Monday sales period — hailed by Amazon as one of its most significant events — and the busy Christmas shopping season.

In a statement, Sujit Misra, Amazon’s payments lead for APAC, said the update will make the shopping experience more flexible.

Smarter business news. Straight to your inbox.

For startup founders, small businesses and leaders. Build sharper instincts and better strategy by learning from Australia’s smartest business minds. Sign up for free.

By continuing, you agree to our Terms & Conditions and Privacy Policy.

Related Article Block Placeholder

Article ID: 321566

Katrina Konstas, EVP, country manager at Afterpay, said the update will help shoppers “access what they want, when they want it”.

The update arrives nearly three months after Afterpay, and other pay-in-four providers, came under Australian consumer credit regulations for the first time.

As a result, Amazon shoppers hoping to sign up for Afterpay will have to provide income and expense data.

Afterpay may also conduct a credit check on new users, with that enquiry becoming visible to other credit providers and lenders in the future.

Backdropped by regulations designed to protect consumers from credit they cannot afford, Konstas claimed Afterpay on Amazon will help shoppers who are “maintaining control of their spending”.

Amazon now joins competitors eBay and Kogan, along with major stores like Kmart, Big W, Harvey Norman, and The Iconic, in offering Afterpay as a payment option.

Australia’s supermarket chains remain one of the last horizons for buy now, pay later expansion.

But in light of new credit regulations, Afterpay co-founder Nick Molnar reportedly sees opportunity in unglamorous grocery spending.