Quantum dot materials and technologies Market Size and Forecast 2025 to 2034

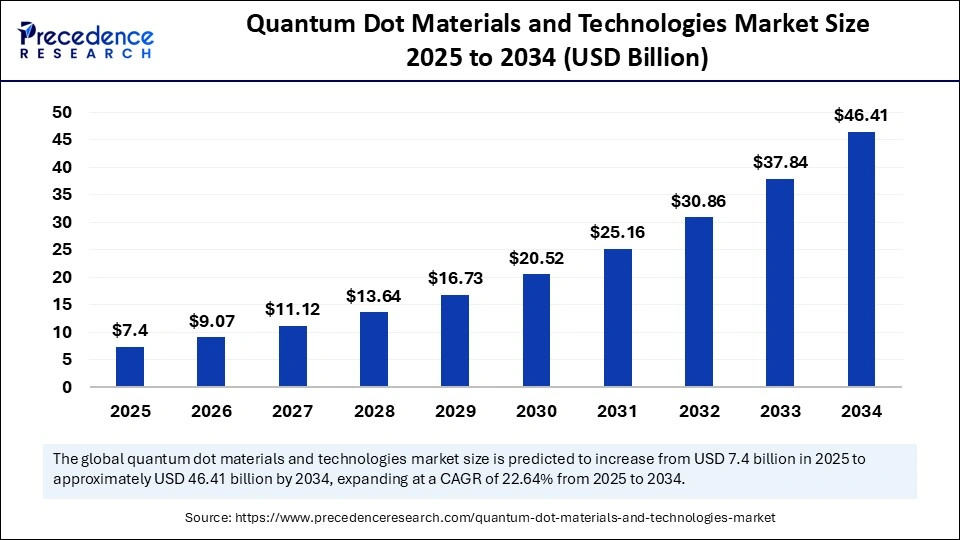

The global quantum dot materials and technologies market size was calculated at USD 6.03 billion in 2024 and is predicted to increase from USD 7.40 billion in 2025 to approximately USD 46.41 billion by 2034, expanding at a CAGR of22.64x% from 2025 to 2034. The growing technological innovation in the production of quantum dots due to their unparalleled benefits, growing demand for high-definition displays for electronics devices and governments huge spending to develop quantum technologies to apply it in the leading sector are fostering the market’s growth globally.

Quantum dot materials and technologies Market Key Takeaways

In terms of revenue, the global quantum dot materials and technologies market was valued at USD 6.03 billion in 2024.

It is projected to reach USD 46.41 billion by 2034.

The market is expected to grow at a CAGR of 22.64% from 2025 to 2034.

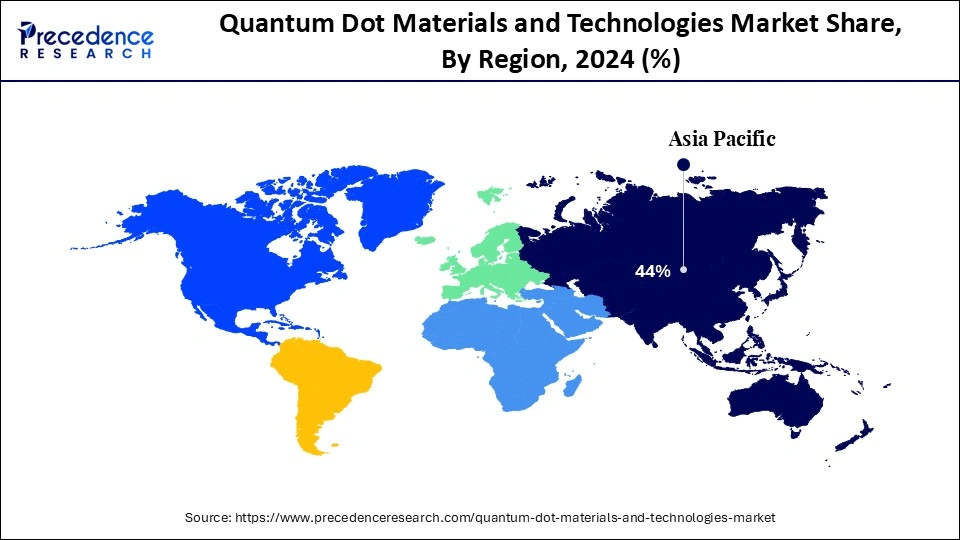

Asia pacific dominated the quantum dot materials and technologies market with the largest market share of 44% in 2024.

North America is expected to witness the fastest CAGR during the foreseeable period.

By material type, the cadmium free quantum dots segment held the biggest market share of 32% in 2024.

By material type, the perovskite quantum dots segment is expected to witness the fastest CAGR during the foreseeable period.

By device/application, the displays-Tvs segment captured the highest market share of 40% in 2024.

By device/application, the biomedical applications segment is expected to witness the fastest CAGR during the foreseeable period.

By manufacturing, the colloidal synthesis segment contributed the maximum market share of 36% in 2024.

By manufacturing, the self-assembly segment is expected to witness the fastest CAGR during the foreseeable period.

By end-use industry, the consumer electronics segment held the largest market share of 45% in 2024.

By end-use industry, the healthcare & life sciences segment is expected to witness the fastest CAGR during the foreseeable period.

By distribution channel, the direct sales segment generated the major market share of 42% in 2024.

By distribution channel, the online platforms segment is expected to witness the fastest CAGR during the foreseeable period.

How is AI transforming the quantum dot materials and technologies market?

The arrival of artificial intelligence has significantly impacting growth of quantum dot materials and technologies development by optimizing synthesis, increasing strength of devices in terms of its performance, prediction of material properties and offering autonomous discovery. These all factors can be achieved by employing AI models like machine learning and reinforcement learning algorithms that analyzes huge datasets to design various quantum dots with different sizes and properties that can be applicable to diverse domain effectively.

AI can be leveraged for material design and discovery, synthesis and manufacturing for efficiency in quantum dots and technologies. Reinforcement learning can intelligently regulate and optimize parameters of synthesis process to further support increased efficiency, color purity and consistency in quantum dots production. AI can further assist in the applications of quantum dots in various fields, especially in fields like biomedical imaging and drug discovery methods.

Asia Pacific Quantum dot materials and technologies Market Size and Growth 2025 to 2034

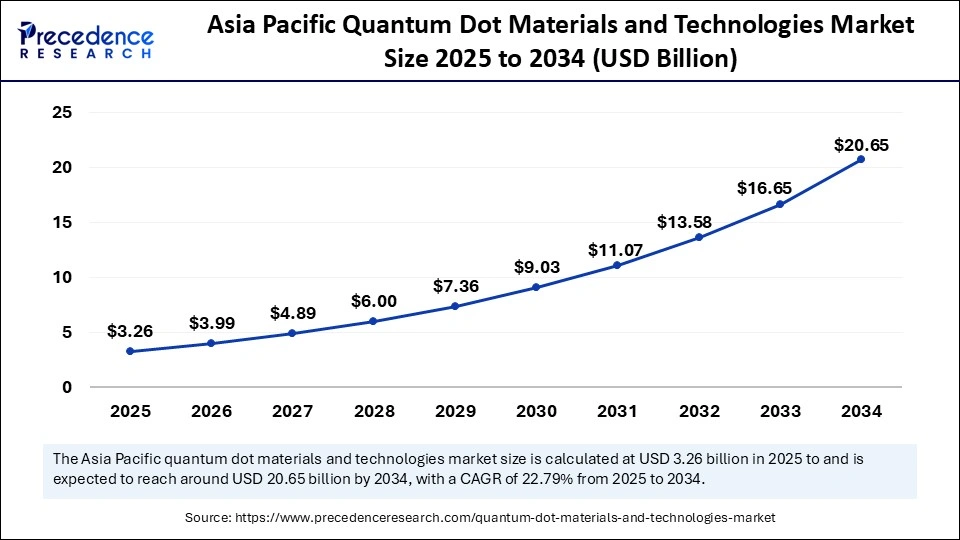

The Asia Pacific quantum dot materials and technologies market size is evaluated at USD 3.26 billion in 2025 and is projected to be worth around USD 20.65 billion by 2034, growing at a CAGR of 22.79% from 2025 to 2034.

Which factors support the growth of Asia pacific quantum dot materials and technologies market?

Asia Pacific held the largest market share of nearly 44% in 2024. The region’s growth can be related to several factors such as leading countries and their participation to develop quantum ecosystem, strong semiconductor background, increasing demand for advanced displays and well-established key players along with government-backed policies and research and development investments for quantum field progression. Leading countries like China, Taiwan, south Korea and Japan are frontiers to adopt quantum technologies in various sector by developing supportive infrastructure and huge investments to produce large scale quantum dots with technological expertise.

In addition to this, the increasing middle-class population which led to growing disposable income in major countries have positively influenced demand for advanced consumer electronics devices like televisions, smartphones, tablets and other premium electronics product having displays. Thus, by looking at the growing demand for such devices, leading brands like Samsung and LG are fiercely integrating quantum dot displays to gain superior color quality and clear visibility. Also, many government policies and subsidies are introduced that support adoption of quantum dot materials, fostering innovation and development of scalable synthesis method for quantum dots.

What are the reasons behind expansion of North America quantum dot materials and technologies market?

North America is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The region is expanding due to significant investment by the government for the development of nanotechnology and quantum sector. Many leading companies are integrating quantum technologies like quantum dot materials by acknowledging the growing demand for innovative display technologies. North America’s market is propelling further due to its promising applications like medical imaging. Virtual/augmented reality, automotive vehicles, defense and telecommunication. Moreover, the increasing rate of collaborative efforts by academic institutes, research organizations and market leaders further helps accelerate markets growth due to the efficient way to adopt quantum dot technologies.

Market Overview

The Quantum Dot (QD) Materials and Technologies Market refer to the ecosystem of materials, devices, and solutions that leverage semiconductor nanocrystals, quantum dots, for applications in display technologies, lighting, solar energy, biomedicine, and quantum computing. Quantum dots exhibit size-dependent optical and electronic properties, enabling enhanced colour purity, tunable emission wavelengths, higher energy efficiency, and improved performance compared to conventional materials. This market encompasses the production of QD materials, integration into devices, equipment for manufacturing, and enabling technologies driving adoption across consumer electronics, healthcare, energy, and research industries.

What are the key trends in the quantum dot materials and technologies market?

Non-toxic materials: An increasing shift towards eco-friendly, non-toxic and cadmium free quantum dots to address concerns regarding toxic emission due to conventional cadmium-based materials and stabilizing high color performance at the same time.

Integration to flexible devices: Another significant trend that quantum dot technology is witnessing includes integration of quantum dots materials into flexible and foldable devices such as smartphones and tablets by leveraging its ability to be compatible for advanced display designs and other gadgets with screens.

High-quality display: The increasing demand for premium and high-performing display showcasing notable market trend and propelling the integration of quantum dots into monitors, television and other electronic equipment to provide highly sharpened contrast, brightness and vibrant colors.

Market Scope

Report Coverage

Details

Market Size by 2034

USD 46.41 Billion

Market Size in 2025

USD 7.40 Billion

Market Size in 2024

USD 6.03 Billion

Market Growth Rate from 2025 to 2034

CAGR of 22.64%

Dominating Region

Asia Pacific

Fastest Growing Region

North America

Base Year

2024

Forecast Period

2025 to 2034

Segments Covered

Material Type, Device/Application, Manufacturing Technique, End-Use Industry, Distribution Channel, and Region

Regions Covered

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

Market Dynamics

Drivers

Rising Demand for High-Resolution Displays

The increasing consumer demand for enhanced visual experiences in televisions, monitors, and smartphones is a major driver for quantum dot technologies. Quantum dots offer superior color accuracy, brightness, and energy efficiency compared to traditional display materials, making them ideal for next-gen QLED TVs and UHD displays. As 4K and 8K resolutions become mainstream, manufacturers are turning to quantum dot materials to differentiate their products and meet evolving consumer expectations.

Restraint

High Manufacturing Costs and Scalability Issues

Despite their technological promise, quantum dot materials face significant cost barriers in mass production. The synthesis of high-quality quantum dots involves complex procedures and expensive raw materials, making it difficult for small and mid-sized players to enter the market. Additionally, concerns about the environmental impact of heavy metal-based quantum dots (like cadmium) limit widespread adoption due to regulatory hurdles, especially in Europe and North America.

Opportunity

Expansion into Biomedical Imaging and Diagnostics

Quantum dots have unique optical properties, such as tunable emission and high photostability, that make them ideal candidates for biomedical applications, particularly in diagnostics and imaging. Their ability to be engineered at the nanoscale for specific biological targeting opens up opportunities in early cancer detection, real-time imaging, and drug delivery systems. As the healthcare industry continues to embrace precision medicine and advanced diagnostics, quantum dots could play a pivotal role in transforming medical technologies.

Material Type Insights

How do cadmium-free quantum dots mostly prefer in the quantum dot materials and technologies market?

The cadmium free quantum dots segment held the largest market share of nearly 32% in 2024. The segments growth is attributed to the various factors like strong regulatory mandates, growing consumer’s demand for sustainable products along with technological advancements in material science which led to high quality color purity with stabilized quantum dots. Cadmium is a heavy metal and highly toxic in nature that creates disposal issues and health concerns like kidney damage and bone weakness. Thus, cadmium-free quantum dots are highly in demand, fueling the market’s growth globally.

The perovskite quantum dots segment is expected to witness the fastest CAGR during the foreseeable period. These quantum dots have unique characteristic of having convergence of optical and electronic properties making them highly demanding for different high-tech applications. They are highly efficient at transforming electricity into light which leads to brighter and highly vivid displays.

Device/application Insights

How is TV’s display finds extensive application of quantum dots in the quantum dot materials and technologies market?

The displays-TVs segment held the largest market share of nearly 40% in 2024. The quantum dots offer superior color quality and brightness along with energy efficiency which fulfills the growing demand of 4K/8K high-definition and immersive visual experiences. This technology offers a broader spectrum of colors due to emission of pure and precise light wavelength which results in vibrant and living images. Also, leading electronics brands are incorporating quantum LED technology to gain traction in the global market for their premium Television models, expanding the market reach further.

The biomedical applications segment is expected to witness the fastest CAGR during the foreseeable period. Quantum dots can surpass conventional medical imaging by offering bright and stable fluorescence of narrow spectra emission and allowing for more sensitive results. The small size quantum dots offer close interaction with biological things, enhancing sensitivity to detect disease with biomarker detection process.

Manufacturing Insights

Why is colloidal synthesis dominating the quantum dot materials and technologies market?

The colloidal synthesis segment held the largest market share of nearly 36% in 2024. Colloidal synthesis offers production of large quantum dots with an affordable range as compared to other methods. The inherent ability of colloidal synthesis for the huge production of quantum dots at a manufacturing scale further makes it ideal alternative for commercial use. Also, this process offers excellent control over the size distribution of the quantum dots which directly affects the optical and electronic characteristics of the quantum dots.

The self-assembly segment is expected to witness the fastest CAGR during the foreseeable period. The segment growth is attributed to the factors like cost effective nature of self-assembly manufacturing method for quantum dots which further improves stability and mobility of quantum dots. This property is highly beneficial for areas like biosensing, environmental monitoring and optoelectronics, fueling the market growth on a large scale.

End-use Industry Insights

How does consumer electronics find several applications of quantum dot materials and technologies?

The consumer electronics segment held the largest market share of nearly 45% in 2024. Quantum dots offer pure, saturated colors with vibrancy that are ideal for displays of electronic devices like smart TVs, phones leading to more live and immersive viewing experience which is highly appealing for consumers. Also, the growing demand for high-definition content with dynamic range, especially in gaming and entertainment purposes is propelling the segments growth. Hence, leading consumer electronics brands have incorporated quantum dots into their premium products.

The healthcare & life sciences segment is expected to witness the fastest CAGR during the foreseeable period. Quantum dots possess the ability to keep track with cellular components, find biomarkers and to target particular tissues that are affected without major side effects. This makes them a critical tool to improve patient care with disease management. Quantum dots can further integrate to microsystems for point-of-care testing processes that offer accessible and fast diagnostics for disease detection at an early stage to enhance patient’s outcome for treatment.

Distribution Channel Insights

Why are direct sales preferred in the quantum dot materials and technologies market?

The direct sales segment held the largest market share of nearly 42% in 2024. Direct sales offer manufacturers to provide value-added services like technical support, customization of products as per requirement and services after sales which strengthen relationship and trust between provider and consumer. Direct sales are basically highly beneficial for niche markets such as research institutions and small businesses who need specialized products but have limited access to conventional networks of distribution.

The online platforms segment is expected to witness the fastest CAGR during the foreseeable period. Online platforms provide manufacturers of quantum dots to bypass conventional methods of purchasing raw products by using distribution channels. Online platform offers direct-to-consumers and business-to business sales. Online platforms offer a gateway to a global audience which facilitates specialized and technically advanced markets like quantum dot materials and technologies market.

Value Chain Analysis

This stage involves production of high purity and organic precursors for the synthesis of quantum dots. It needs access to specialized chemicals with advanced manufacturing methods.

Key players- Shoei chemical, Inc., Merck KGaA, Dow chemical company and NNCrystal US corp.

Distribution to OEMs and Integrators

After synthesizing quantum dots, they are incorporated into different applications by OEMs and other specialized integrators. This stage consists of production of QD films, QD inks for various machine’s display.

Key players- Samsung display Co., Ltd, LG display, AUO corporation, Sony, Apple, and BOE technology group Co.,Ltd.

Lifecycle Support and Recycling

This stage involves management of products with quantum dots at their end of life and includes collection, dismantling and safe recovery and disposable to protect environment from toxic elements in it like cadmium.

Key players- Nanoco Group Plc, Samsung display Co and general E-waste recyclers.

Quantum Dot Materials and Technologies Market Companies

Samsung Electronics

LG Display

Nanosys Inc.

Quantum Materials Corp.

Nanoco Group Plc

Ocean NanoTech

Avantama AG

QD Laser, Inc.

QD Vision (acquired by Samsung)

Quantum Solutions LLC

UbiQD Inc.

Ossila Ltd.

Navillum Nanotechnologies

Crystalplex Corporation

Solterra Renewable Technologies

NN-Labs LLC

InVisage Technologies

Evident Technologies

SiliconCore Technology

Helio Display Materials

Recent Developments

In January 2025, LG electronics launched its OLED evo lineup with range of advanced TV offerings like world’s first true wireless OLED evo M5 and OLED evo G5 models with unparalleled clarity and other features. (Source: https://www.lg.com)

In August 2025, researchers from university of Innsbruck have found an innovative method to produce quantum dots that are tiny and light-emitting crystals which creates streams of highly controlled photons without depending on expensive and complex electronics. (Source: https://www.sciencedaily.com)

Segments Covered in the Report

By Material Type

Cadmium-Based Quantum Dots

Cadmium-Free Quantum Dots

Carbon Quantum Dots

Perovskite Quantum Dots

Graphene Quantum Dots

Silicon Quantum Dots

Others

By Device/Application

Displays

TVs

Monitors

Smartphones/Tablets

Laptops

Others

Lighting

General Illumination

Backlighting

Specialty Lighting

Solar Cells & Photovoltaics

QD-Sensitized Solar Cells

Hybrid QD-PV Cells

Others

Biomedical Applications

Imaging & Diagnostics

Drug Delivery

Biosensors

Photodetectors & Lasers

Quantum Computing & Quantum Dots in Optoelectronics

Others

By Manufacturing Technique

Colloidal Synthesis

Vapor Phase Synthesis

Lithography

Self-Assembly

Epitaxial Growth

Others

By End-Use Industry

Consumer Electronics

Healthcare & Life Sciences

Energy & Utilities

Aerospace & Defense

Research & Academia

Others

By Distribution Channel

Direct Sales

Distributors / Resellers

Online Platforms

Others

By Region

North America

Europe

Asia Pacific

South America

Middle East & Africa