PETALING JAYA: Teens are abusing the ease of e-wallets to charge for lewd content sold on social media, says child activist Firdaus Ashaj.

This, he said, is because there is no strong mechanism to monitor payment transactions made.

Firdaus, who is also a lecturer in management and education, said youth creating and selling sexually-explicit content goes undetected because it is not possible to trace what the payments made are for.

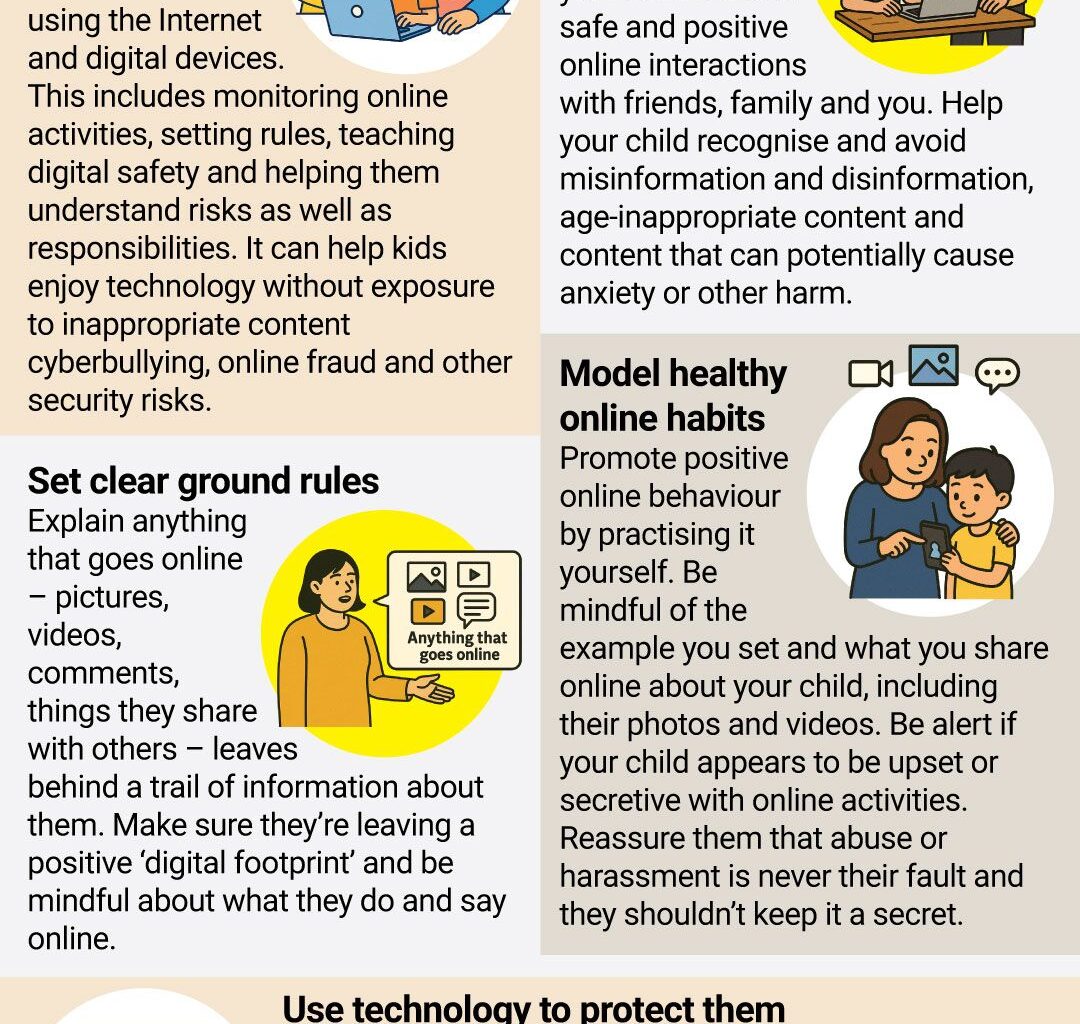

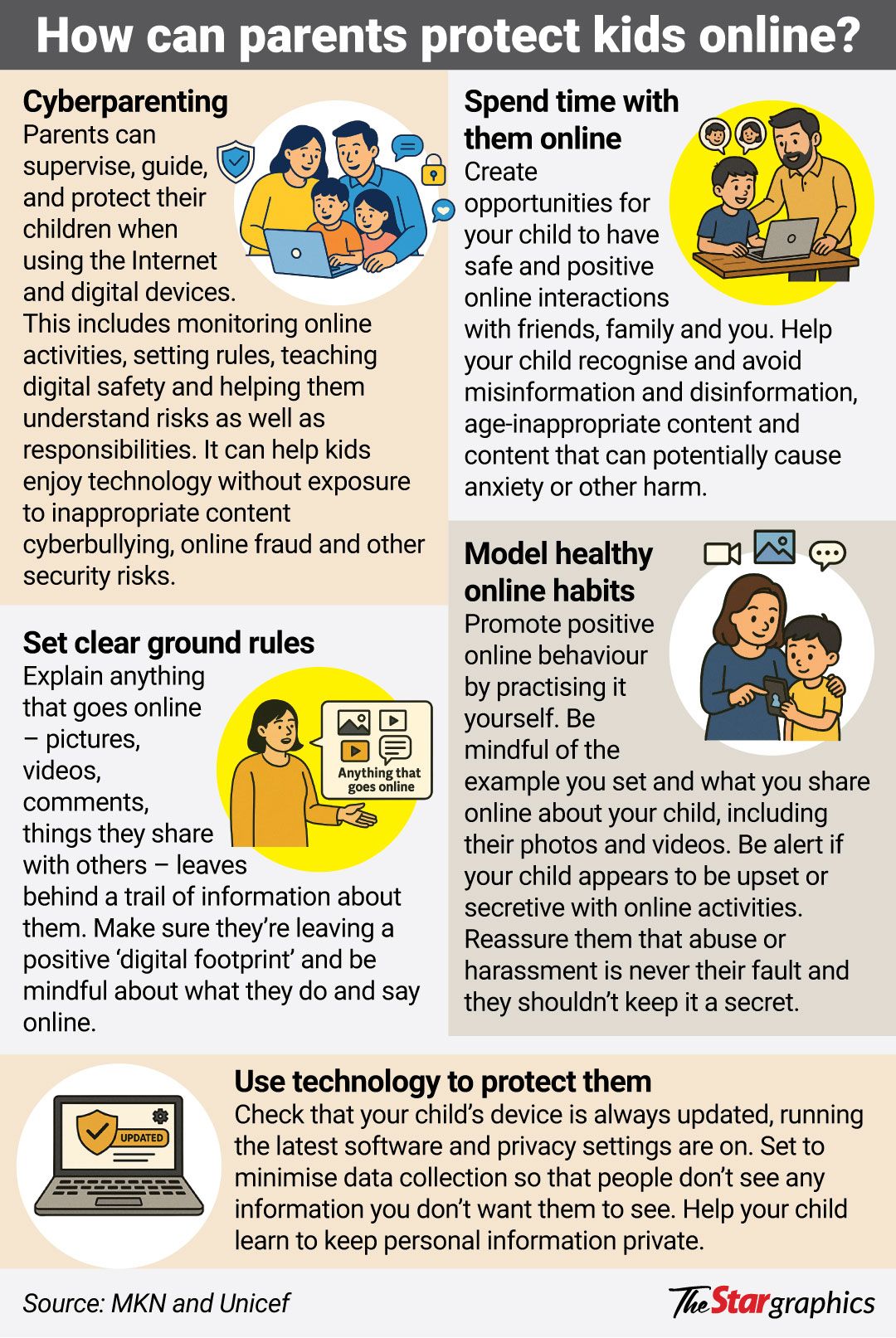

“Parents have no way of monitoring who is paying their child or what the money is for.

“When a child can earn money without their parents’ knowledge, why stop?” he said, while calling for tighter e-wallet regulations.

He suggested that transaction notifications should be sent to parents if a user is underage.

Firdaus said he received several case reports involving minors who received money from adults in exchange for sexually-explicit content.

“The e-wallet registration age is 12 at the moment. This should be raised and parents must be able to see who is sending money to their child and the amount involved,” he said.

Malaysia Cyber Consumer Association (MCCA) president Siraj Jalil said e-wallet providers merely offer a financial service – what’s more important is to find out where children are learning to create such content.

“Youth posting such content has now been normalised. There are thousands of such accounts on the dark web.

“Most teens are posting links to lewd content on the social media platform X (formerly Twitter).

“And unless they go through a traumatic experience or get caught, they will not be deterred from doing it,” he said, adding that there must be more stringent monitoring of digital identities on the Internet as many users are using prepaid and third-party SIMs.

Siraj also called for “cyber immorality” provisions to be included in Syariah law to deter creators and procurers of lewd content online.

TNG Digital, the operator of TNG eWallet, said the company is committed to providing a safe, secure and seamless platform for all its users.

“On Dec 20 last year, we implemented 100% electronic Know-Your-Customer verification for all accounts, ensuring that every user completes identity verification before accessing our services.

“Like all payment methods, whether e-wallet, card or cash, the medium itself is neutral.

“What matters most is responsible use, and users should not contravene the platform terms of use, applicable laws or regulations when using the platform,” it said, while encouraging parents to play an active role in their children’s online and financial activities.

To address the needs of younger users, TNG is exploring various options through direct engagement with parents, children and the youth.

“This consultative approach helps us design solutions that balance safety, usability and trust.

“We will share more details once these solutions are ready for rollout,” it said.

In Malaysia, the minimum age to register for most e-wallets is 12 years old. Some e-wallets, like eMadani, may have a minimum age of 21 for specific government initiatives.