1h agoWed 10 Sep 2025 at 8:47pmMarket snapsotASX futures: -0.2% at 8,808 points

Australian dollar: +0.5% at 66.15 US cents Wall Street: Dow Jones: +0.4% to 45,490S&P 500: +0.3% to 6,592Nasdaq: +0.03% to 21,886.

Europe: FTSE (-0.2%), DAX (-0.3%), Stoxx 600 (-0.02%)Spot gold: -0.06% to $US3,680/ounce

Oil (Brent crude): +1.78% to $US67.57/barrel Iron ore: -0.3% to $US107.00/tonneBitcoin: +2.22% to $US113,791

Values at approx. 6.46am AEST

15m agoWed 10 Sep 2025 at 10:02pmUS investors react to unexpected fall in inflation data

US producer prices unexpectedly fell in August, suggesting some firms are absorbing import tariffs rather than passing them on to customers.

Wall Street investors reacted to a surprise dip in the Producer Price Index for final demand, which fell 0.1% last month after a 0.7% jump in July.

Economists polled by Reuters had forecast the PPI would advance 0.3% after a previously reported 0.9% surge in July.

The Producer Price Index or PPI is a measure of inflation and gauge of what businesses receive for the goods and services they sell, before prices reach consumers.

A 0.2% drop in services prices accounted for the fall in the PPI, following a 0.7% rebound in July. Services were held down by a 1.7% decline in margins for trade services, reflecting a 3.9% decrease in margins for machinery and vehicle wholesaling.

“Inflation barely has a heartbeat at the producer level which shows the tariff effect is not boosting across-the-board price pressures yet,” said Christopher Rupkey, chief economist at FWDBONDS.

“As time goes on, one has to wonder if there are slow-growth reasons and weak economic demand that is keeping inflation in check.

“There is almost nothing to stop an interest rate cut from coming now.”

However, the lack of heat in producer prices may also point to softer domestic demand against a struggling labour market.

17m agoWed 10 Sep 2025 at 10:00pmHousehold spending ticked higher last month: CBA

The Commonwealth Bank’s latest data shows a sixth-straight month of growth in household spending.

CBA’s Household Spending Insights (HSI) Index rose 0.3% in August.

The bank’s head of Australian economics Belinda Allen says it reinforces her view “that a consumer recovery is underway after a series of false starts last year and early into 2025”.

“The combination of growing incomes, a solid labour market and lower interest rates is helping improve household sentiment as consumers are able to both spend and save again,” Ms Allen said.

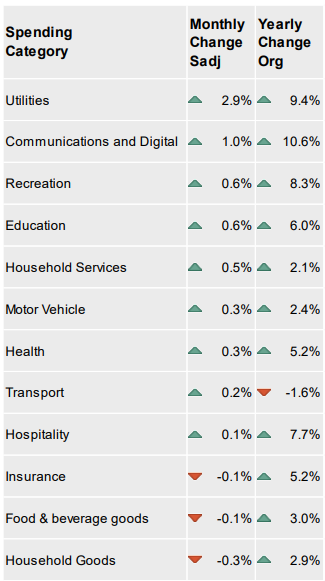

Where consumer spending picked up in August (CommBank)

Where consumer spending picked up in August (CommBank)

On an annual basis, household spending is now up 5%, the report noted.

“Utilities was the top spending category in August, that uptick is largely driven by general volatility in energy bill payments, as well as the timing of energy price rebates,” Ms Allen said.

“More interesting is the strong increase in spending on Communications and Digital, which reflects the longer-running, structural shift in consumers favouring spending on experiences rather than goods.”

It turns out, the wet weather may have had an affect on what people were spending on last month.

“In particular, August’s spending increase is propelled by the surging popularity of online services like gaming and streaming, as well as the impact of weather,” Ms Allen said.

“The wettest August in 27 years in Sydney likely had a hand in higher spending on food delivery services and lower spending in cafes during the month.”

It’s bucketing down here in Sydney this morning, so maybe September will see a similar trend? Although let’s home this is a short-term blip in spring…

Loading34m agoWed 10 Sep 2025 at 9:43pmHome-buying dream pushed further away by RBA rate cuts

While interest rate cuts have been cheered by Australians with a mortgage, they haven’t helped those trying to save for a home.

ABC business reporter Emily Stewart takes a look at why.

Loading…59m agoWed 10 Sep 2025 at 9:18pmOracle soars, US AI stocks rally

The S&P 500 and Nasdaq notched record-high closes on Wednesday, as Oracle surged and cooler-than-expected inflation data supported expectations the US Federal Reserve will cut interest rates next week.

The S&P 500 climbed 0.3% to end the session at 6,532 points, closing with a record high for the second straight day.

The Nasdaq gained 0.03% to 21,886 points for its third consecutive record-high close. The Dow Jones Industrial Average declined 0.5% to 45,490 points.

Oracle soared 36% in its biggest one-day percentage gain since 1992 after the tech company pointed to a demand surge from AI firms for its cloud services.

Its stock market value reached $922 billion, leapfrogging the values of Eli Lilly, JPMorgan Chase and Walmart, and approaching Tesla’s $1.12 trillion market value.

Artificial intelligence-related chip stocks also rallied, with Nvidia up 3.8%, Broadcom jumping 10% and Advanced Micro Devices climbing 2.4%.

Data centre power suppliers also benefited, with Constellation Energy, Vistra and GE Vernova all rising more than 6%.

Apple, viewed by many investors as lagging in the race to dominate AI, declined 3.2%, sliding for a fourth straight session.

A cooler-than-expected producer prices reading provided additional momentum as traders shored up their bets on interest-rate cuts this year.

Traders fully expect the Fed to cut interest rates by at least 25 basis points at its policy meeting next week, with a 10% chance the central bank could cut by 50 basis points, CME’s FedWatch tool showed.

– with Reuters

1h agoWed 10 Sep 2025 at 8:39pm

Good morning

Welcome to the ABC News business blog for Thursday September 11.

The local share market is set to drop when trading resumes at 10am AEST.

Yesterday, the ASX closed 0.3% higher at 8,330, as bank stock gained.

Overnight, it was mixed trading on Wall Street. The benchmark S&P 500 closed at record highs, while the Nasdaq gained about half a dozen points. The Dow Jones Industrial fell by half a per cent.

We’ll bring you more on market movements shortly.

ASX futures: -0.2% at 8,808 points

ASX futures: -0.2% at 8,808 points