It is no secret that chip stock Intel (INTC) does indeed have “holes to fill on the desktop front,” as expressed by Corporate Vice President for Investor Relations John Pitzer. But Intel also has a plan to get some of those holes filled, and hopefully, with processors that sell briskly and teach the competition that Intel is not out of the fight for good. Investors are at least somewhat optimistic, as shares ticked up fractionally in Wednesday afternoon’s trading.

Elevate Your Investing Strategy: Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The good news is that 2026 will bring the Arrow Lake refresh line of chips. That will help kick things off, Pitzer noted, and soon bring out the Nova Lake launch in late 2026 into 2027. So what should we expect out of this lineup? Early word says that some improvements to binning and clock speed should help produce better boost clock speeds, if only for some processors. The K-series and KF-series processors are particularly in line for such improvements.

Though some will go with the maxim “better late than never” on such an approach, there are others who believe that this schedule might be too little, too late for Intel. The Arrow Lake processors will be around two years old when the midpoint of 2026 rolls around. Competitors are starting to release their own roadmaps, and in turn, all delays inherently hurt Intel here.

“I Don’t Want Us to Get Ahead of Ourselves”

That was when Jim Cramer of CNBC fame stepped in to offer up a word about Intel, and the word appeared to be “caution.” Intel has seen some gains recently, and that may be getting people interested. But Cramer stepped in and called for cooler heads to prevail, saying Intel has “…just jumped so much that I don’t want us to get ahead of ourselves.”

With Intel filing a prospectus with the United States Department of Commerce for potential resale of warrants, as well as 673,839,150 shares of common stock, there might be an avalanche of new stock coming out. We know that Intel has been courting its large-scale stock buyers already, even offering discounts to those willing to buy in big. So here, Cramer may actually have the right of it.

Is Intel a Buy, Hold or Sell?

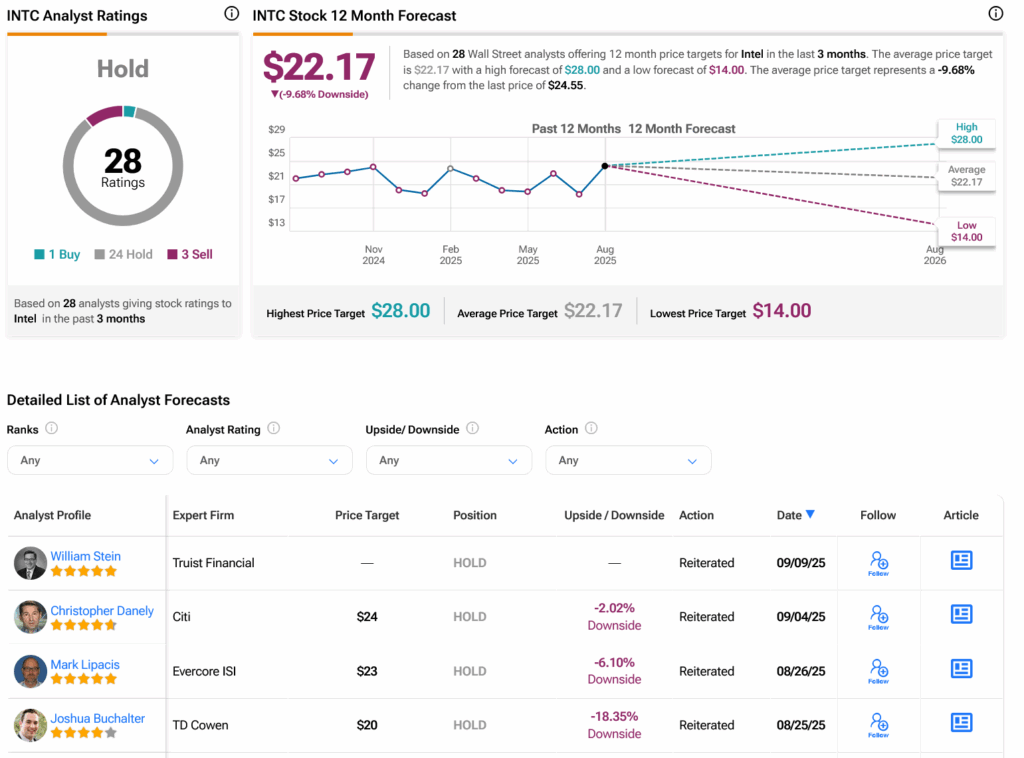

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on one Buy, 24 Holds and three Sells assigned in the past three months, as indicated by the graphic below. After a 24.44% rally in its share price over the past year, the average INTC price target of $22.17 per share implies 9.68% downside risk.