Data Center Accelerator Market Size and Forecast 2025 to 2034

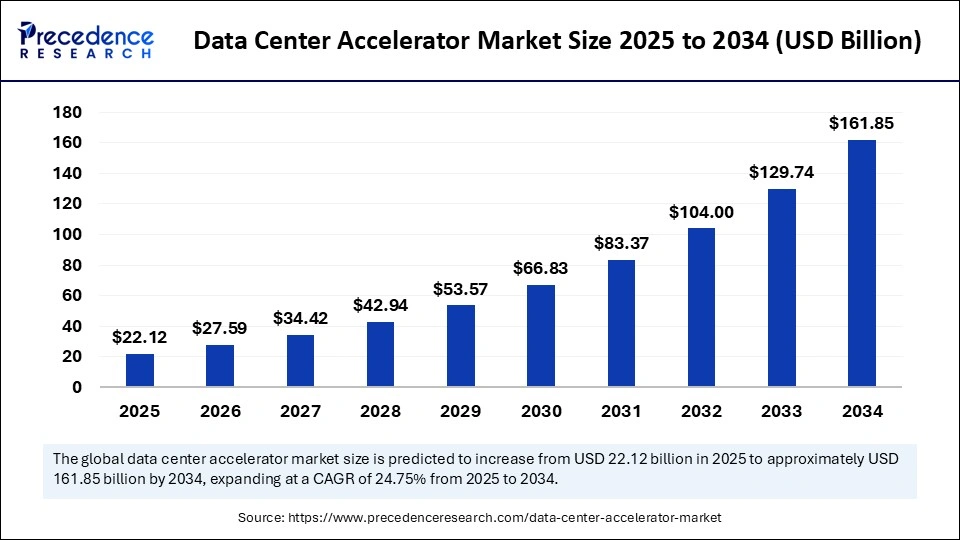

The global data center accelerator market size was calculated at USD 17.73 billion in 2024 and is predicted to increase from USD 22.12 billion in 2025 to approximately USD 161.85 billion by 2034, expanding at a CAGR of 24.75% from 2025 to 2034. The increased demand for cloud-based services is fueling the adoption of data center accelerators, driving the global market. The market is further experiencing rapid growth due to the increased need for fast and efficient data processing.

Data Center Accelerator Market Key Takeaways

In terms of revenue, the global data center accelerator market was valued at USD 17.73 billion in 2024.

It is projected to reach USD 161.85 billion by 2034.

The market is expected to grow at a CAGR of 24.75% from 2025 to 2034

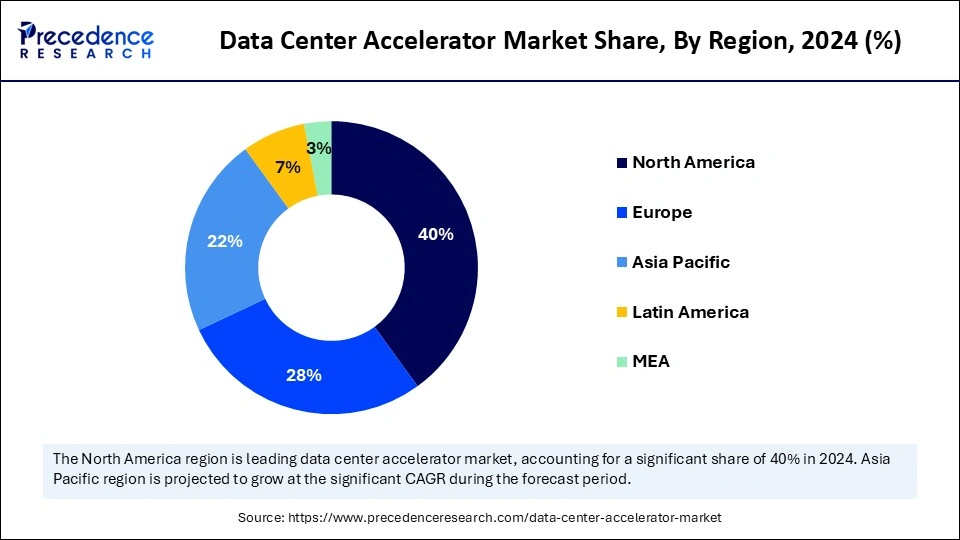

North America dominated the global data center accelerator market with the largest share of 40% in 2024.

Asia Pacific is expected to grow at a significant CAGR from 20245 to 2034.

By type, the graphics processing units (GPUs) segment contributed the largest market share of 45% in 2024.

By type, the field programmable gate arrays (FPGAs) segment is expected to grow at a notable CAGR at a CAGR between 2025 and 2034.

By application, the artificial intelligence (AI) & machine learning (ML) segment captured the biggest market share of 35% in 2024.

By application, the high-performance computing (HPC) segment will grow at a CAGR between 2025 and 2034.

By data center type, the hyperscale data centers segment held the maximum market share of 70% in 2024.

By data center type, the colocation data centers segment will grow at a CAGR between 2025 and 2034.

By deployment mode, the cloud-based segment generated the major market share of 55% in 2024.

By deployment mode, the on-premises segment will grow at a CAGR between 2025 and 2034.

Market Overview

The global data center accelerator market reflects the increased demand for artificial intelligence (AI), machine learning (ML), high-performance computing (HPC), and edge computing. Modern and specialized accelerators like graphic processing units (GPUs), field programmable gate arrays (FPGAs), and application-specific integrated circuits (ASICs) are leading the market, driven by the increased need for specialized accelerators to handle large amounts of data and complex workloads. Applications like AI, ML, deep learning, high-performance computing, and data analytics highly utilize these accelerators for more scalability, flexibility, and are highly powerful for handling real-time analytics.

The expanding hyperscale data centers and adoption of cloud services are driving the adoption of specialized accelerators. The hyperscale data centers and cloud service providers are investing heavily in infrastructure developments and accelerators to meet with growing need for computational AI-driven applications.

In June 2025, Dell’Oro Group’s recently published report highlighted that worldwide data center capex has surged by 53% year-over-year in the first quarter of 2025. The growth is propelled by hyperscale cloud service providers that ramp investments in AI infrastructure, especially from servers [powered deployments by NVIDIA’s Blackwell GPU and custom accelerators. (Source: https://www.delloro.com)

U.S. Data Center Accelerator Market Size and Growth 2025 to 2034

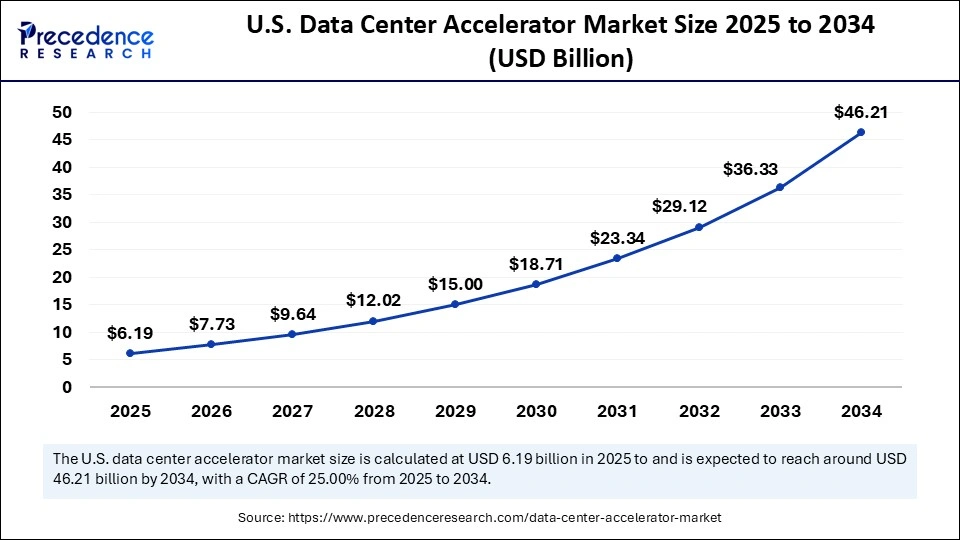

The U.S. data center accelerator market size was exhibited at USD 4.96 billion in 2024 and is projected to be worth around USD 46.21 billion by 2034, growing at a CAGR of 25.00% from 2025 to 2034.

North America Data Center Accelerator Market

North America dominates the global data center accelerator market, driven by the regional strong hyperscale data center infrastructure and growing emphasis on energy efficiency. North America has experienced significant growth in 5G and edge computing adoption, driving the need for specialized accelerators for processing data closer to the sources for real-time and quick analytics. The region’s strong focus on technological advancements and presence of key market players like Intel Corporation, Advanced Micro Devices, Inc., and NVIDIA Corporation are fueling market reach.

The U.S. Data Center Growth and Infrastructure Investments: To Boost Access to Accelerators

The U.S. is a major player in the regional market, contributing to growth due to countries’ rapidly expanding hyperscale data centers and the existence of key market players. The rapid growth of developments of AI data centers and demand for specialized chips like Intel Gaudi contribute to this growth. The strict regulatory environment for expanding the AI industry, especially state regulations aligned with the National Environmental Policy Act, the Endangered Species Act, and the Clean Water Act, is supporting infrastructure growth. Moreover, the reviews for investigations and consent decrees by the Federal Trade Commission from the previous administration ensured investments and support in AI data centers.

According to the McKinsey & Company report released in August 2025, several global companies are surging their investments to around $7 trillion in data center infrastructure by 2030, with investment of more than $4 trillion for computing hardware. In the U.S., the spending is expected to increase by over 40%. (Source: https://www.mckinsey.com)

Asia Pacific Data Center Accelerator Market

Asia Pacific is the fastest-growing region in the global market, growth driven by the region’s rapid digitalization, increasing adoption of cloud computing, emphasis on integration of AI and IoT technologies, and government support. Asia has witnessed rapid market expansion with the adoption of AI, cloud services, and capital investments in data center infrastructure. Governments and leading technology companies are accelerating AI, aligning policies and innovations to meet growing cloud computing and large-scale models demands, leading to heavy investments in data center infrastructure. Countries like Malaysia, Thailand, and Japan are expanding their data center capabilities to boost the regional market.

In August 2025, Cushman & Wakefield releases its Asia Pacific Data Center H1 2025 update, highlighting operational capacity across the region standing at 12,634 MW. The sector development pipeline expanded by 2,282 MW in the first half of 2025 and brought the total to 16,620 MW, including 3,281 MW under construction, and the addition of 13,339 MW of planned capacity. According to this report, Thailand and Malaysia contributed new planned capacity for 64%, including Thailand’s record of 193% increase in planned capacity and Malaysia’s 70% rise. (Source: https://datacenternews.asia)

China’s Market Trends

China is leading the regional data center accelerator market due to the rapid expansion of cloud computing services in the country. The robust emphasis on technological advancements, digitalization, and capital investments by the government and key players is fueling this growth. The development and adoption of FPGA (field programmable gate arrays) is high in China.

India: An Emerging Market Player

India is an emerging player in the regional market, contributing to growth due to increasing investments in cloud computing and AI, driving the need for data center accelerators in the country. Rapid digital transformation, investments in cutting-edge technologies, a large consumer base of advanced technologies, and the presence of leading technology giants are contributing to this growth. Additionally, the growing internet and 5G penetration, and government initiatives like IndiaAI mission are leveraging market expansion.

What are the Key Trends of the Data Center Accelerator Market?

Increased Data Volume: Increasing data volume generated by IoT devices, social media, online transactions, photography, and video streaming is a driving need for efficient data processing solutions, contributing to the adoption of specialized data center accelerators in data centers.

The Need for Fast and Efficient Data Processing: The need for fast and efficient data processing has increased due to demand for low-latency and high-throughput data processing in modern applications, driving demand for data center accelerators.

Increased Adoption of Cloud-based Services: The adoption of cloud-based services has increased, driving the necessity for specialized data center accelerators.

Demand for Specialized Hardware: The demand for specialized hardware like GPUs, TPUs, and ASICs has increased for handling complex workloads in data centers, contributing to the market growth.

Trend Toward Hybrid Architectures: The ongoing trend of combining various accelerator types like GPUs, TPUs, FPGAs, and ASICs in a single system for creating hybrid architectures is driving market growth for managing a wide range of workloads with high effectiveness.

Market Scope

Report Coverage

Details

Market Size by 2034

USD 161.85 Billion

Market Size in 2025

USD 22.12 Billion

Market Size in 2024

USD 17.73 Billion

Market Growth Rate from 2025 to 2034

CAGR of 24.75%

Dominating Region

North America

Fastest Growing Region

Asia Pacific

Base Year

2024

Forecast Period

2025 to 2034

Segments Covered

Type, Application, Data Center Type, Deployment Mode, and Region

Regions Covered

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

Market Dynamics

Drivers

The Increased Demand for Enhanced Energy Efficiency

The increased demand for improved energy efficiency is a significant driver of the global market. Government worldwide and key companies are investing heavily in the adoption of specialized data centre accelerators like GPUs, FPGAs, and ASICS for handling specialized intensive computational tasks with more efficiency. This accelerator helps to manage tasks by reducing energy consumption and offering great alternatives to traditional CPUs. For enabling faster processing of large data sets and quick insights and decision-making capabilities while reducing energy consumption, these specialised accelerators have a significant impact. Additionally, the growing concerns over sustainable data centers are further making these accelerators essential in data centers.

Restraint

High Cost of Accelerators

The high initial investments required for accelerators are a major restraint for the global market. The data center accelerators need premium initial investments, which leads to hindering their adoption in budget-conscious businesses. The developing and underdeveloped countries with infrastructure limitations for data centers are facing barriers to the adoption of experience accelerators. Manufacturers focus on maintaining premium prices with increased demand from AI and HPC applications, which further hampers their accessibility in the global market.

Opportunity

Shift Toward Adoption of Edge Computing

The rapid shift toward the adoption of edge computing is boosting the need for comprehensive and specialized hardware at distributed locations for enabling high-performance data processing for applications and low-latency. Applications like AI, IoT, and automated systems have been highly used in edge computing, driving the need for specialized hardware for quick, accurate, and high-performance data processing. Edge computing is gaining traction for its utilization in real-time data analysis, efficient handling of a broad amount of data streams, and improving data security, which further fuels demand for accelerators to optimize performance. Additionally, the growing trend of edge-as-a-service (EaaS) for accessing processing power, networking, and storage resources at the edge further adds investments in specialized accelerators and infrastructure.

Type Insights

Which Type Leads the Data Center Accelerator Market?

The graphics processing units (GPUs) segment led the market in 2024, due to its increased use in handling massive data sets and complex neural networks. The growing AI-driven innovations are driving the need for graphics processing units (GPUs) accelerators. These accelerators are ideal for AI, machine learning, and high-performance computing (HPC) workloads. The unparalleled processing power of graphics processing units (GPUs) makes them highly preferred in advanced data center infrastructures.

In April 2025, NTT India and Neysa Networks signed a tripartite memorandum of understanding with Telangana’s government for building a data center cluster in Hyderabad. Telangana’s chief minister, Revanth Reddy, has announced providing 400 MW of capacity and 25,000 GPUs in this planned data center cluster. (Source: https://w.media)

The field programmable gate arrays (FPGAs) segment is the second-largest segment, leading the market, due to its superior power efficiency and flexibility for real-time applications. The low latency and power efficiency of field programmable gate arrays (FPGAs) make them ideal for workloads like AI, machine learning, and big data analytics. The field programmable gate arrays (FPGAs) are highly used for reprograming specific tasks, outperforming CPUs in speed and power, and enabling customization. Demand for field programmable gate arrays (FPGAs) is high in cloud services and large-scale data processing applications.

Application Insights

Which Application Dominates the Data Center Accelerator Market?

In 2024, the artificial intelligence (AI) & machine learning (ML) segment dominated the market, due to increased demand for artificial intelligence (AI) & machine learning (ML). This adoption has boosted the need for powerful accelerators for an efficient process of complex computations. The growing adoption of deep learning training solutions is further adding to the adoption of these technologies. Specialized accelerators like GPUs are significant for artificial intelligence (AI) & machine learning (ML), enabling processing capabilities for handling a broad amount of datasets and performing complex computation. The growing capital investments in artificial intelligence (AI) & machine learning (ML) technologies are fostering the segment’s growth.

In May 2025, Microsoft launched its first cloud region, Indonesia Central, featuring its AI Tour in Jakarta. This AI-ready hyperscale infrastructure is designed to bring in-country data residency, low-latency cloud services, and enterprise-grade security to the region. (Source: https://news.microsoft.com)

The high-performance computing (HPC) segment is expected to grow fastest over the forecast period, driven by increased adoption of cloud computing, big data analytics, and IoT technologies. This cutting-edge technology drives the need for efficient and advanced data center infrastructure and accelerators for high computational power and scalability. The growing need for high-performance accelerators like GPUs and FPGAs for managing massive and complex amounts of data and simulations is contributing to this growth. The ability of accelerators to enhance performance and energy efficiency helps the high-performance computing (HPC) segment to scale up with affordability.

Data Center Type Insights

What Made Hyperscale Data Centers Dominate the Data Center Accelerator Market in 2024?

In 2024, the hyperscale data centers segment dominated the data center accelerator market, due to expanding hyperscale data center infrastructure for training and deploying complex AI models. This expansion has boosted demand for specialized hardware like GPUs and TPUs for powerful AI and ML workloads, big data analytics, and cloud services. The ability of this hardware to offer massive computing power, storage, and network capabilities makes it ideal for hyperscale data centers. Hyperscale data sectors are investing heavily in this AI-optimized application driven by the increased need for complex computational task management.

The colocation data centers segment is the fastest-growing segment in the market, driven by increased infrastructure growth of these centers for handling AI/ML workloads. Colocation data centers have increased demand for flexible, affordable, and scalable accelerators for handling AI and ML workloads. The growing need for specialized accelerators for high-performance computing (HPC) and hybrid cloud deployments contributes to this growth. Additionally, the ability of colocation providers to provide high-power & dense infrastructure and specialized connectivity drives the necessity of modern accelerators like GPUs and TPUs.

Deployment Mode Insights

How Cloud-Based Deployment Dominated the Data Center Accelerator Market in 2024?

The cloud-based segment dominated the data center accelerator market in 2024, due to increased adoption of cloud computing, AI, and big data applications. These application needs a scalable and high-performance infrastructure. Cloud providers utilize accelerators like GPUs, TPUs, ASICs, and FPGAs for processing AI and ML workloads and provide acceleration as a service (AIaaS). The increased adoption of cloud computing has boosted the need for specialized chips and improved cloud data center efficiency and performance, driving the adoption of specialized accelerators.

The on-premises segment is expected to grow fastest over the forecast period, driven by the increased need for high control, security, and customization. Accelerators enhance the security, control, and performance of sensitive workloads, making them ideal for industries with strict regulatory requirements. Industries like finance, healthcare, and government are the major drivers that require for on-premises deployment mode for accelerators. Additionally, organizations with custom AI models and proprietary data drives demand for on-premise solutions for data sovereignty and to reduce latency in high-performance computing applications.

Value Chain Analysis

Raw Material Procurement (Silicon Wafers, Gases)

The raw material procurement of a data center accelerator includes semiconductor manufacturing, packaging, system integration, and data center infrastructure. Materials include silicon, critical materials, and other elements.

Key Players: Nvidia, Intel, Advanced Micro Devices, Achronix Semiconductor, and Alphabet.

Testing and Quality Control

The testing and quality control of data center accelerators revolves around quality manufacturing, method of installation, power distribution, cooling system, environmental controls, and networking infrastructure.

Key Players: Qualitest, Cigniti Technologies, Tech Mahindra, and ITC Infotech.

Distribution to OEMs and Integrators

The data center accelerators rely on a multi-layer ecosystem, which involves their distribution to OEMs and system integrators for implementation in customer-specific environments.

Key Players: Ingram Micro, Avnet, Arrow Electronics, and DigiKey.

Data Center Accelerator Market Companies

NVIDIA Corporation

Intel Corporation

Advanced Micro Devices (AMD)

Alphabet Inc. (Google)

Xilinx Inc. (now part of AMD)

Amazon Web Services (AWS)

IBM Corporation

Huawei Technologies Co., Ltd.

Qualcomm Inc.

Mellanox Technologies

Microsoft Corporation

Cisco Systems, Inc.

Apple Inc.

Baidu Inc.

Oracle Corporation

Graphcore

Samsung Electronics

Marvell Technology Group

Alibaba Cloud

Micron Technology Inc.

Recent Developments

In May 2025, a Total IT Solution Provider for AI, Cloud, Storage, and 5G/Ede, Super Micro Computer, Inc., entered into a strategic partnership with DataVolt under a memorandum of understanding (MOU) for the development of hyperscale AI campuses in Saudi Arabia. This partnership is expected to install Supermicro’s ultra-dense GPU platforms, storage, and rack PnP systems in DataVolt’s renewable and net-zero green AI campuses. (Source: https://ir.supermicro.com)

In April 2025, Tenstorrent launched its Blackhole to support the recently released Zephyr v4.1.0 and the emerging v4.2.0. Blackholes it’s the Tenstorrent’s next-generation standalone AI computer featuring 140 Tensiz++ cores, 16 CPU cores, and high-speed connectivity arrays. Blackhole is designed to provide around 790 TOPS of computer performance with the FP8 data type. (Source: https://www.zephyrproject.org)

Segments Covered in the Report

By Type

Graphics Processing Units (GPUs)

Field Programmable Gate Arrays (FPGAs)

Application-Specific Integrated Circuits (ASICs)

Central Processing Units (CPUs)

Network Processing Units (NPUs)

Tensor Processing Units (TPUs)

By Application

Cloud Computing

Artificial Intelligence (AI) & Machine Learning (ML)

High-Performance Computing (HPC)

Data Analytics

Edge Computing

Virtualization

Content Delivery Network (CDN)

Scientific Computing

By Data Center Type

Hyperscale Data Centers

Enterprise Data Centers

Colocation Data Centers

By Deployment Mode

By Region

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa