Tallow Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

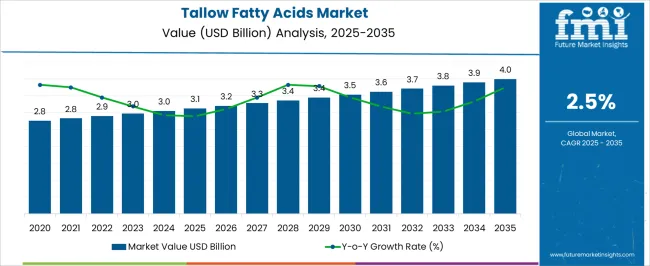

The tallow fatty acids market is projected to grow from USD 3.1 billion in 2025 to USD 4.0 billion by 2035, reflecting a CAGR of 2.5%. This growth represents an absolute dollar opportunity of USD 0.9 billion over the decade. Beginning at USD 2.8 billion in the earlier years, the market experiences steady expansion, reaching USD 3.5 billion by 2030. For companies in the oleochemical, soap, and personal care industries, this trajectory indicates reliable revenue potential.

The absolute dollar opportunity from 2025 to 2035 emphasizes predictable annual gains, with the market rising from USD 3.1 billion to USD 4.0 billion. Incremental growth moves from USD 3.2 billion in 2026 to USD 3.9 billion in 2034, culminating at USD 4.0 billion in 2035.

This steady expansion allows companies to plan production, partnerships, and marketing strategies effectively. Capturing market share during this period ensures meaningful revenue gains while minimizing investment risk. Companies entering or scaling operations in alignment with these trends can maximize returns and secure a strong foothold in the tallow fatty acids market.

Quick Stats for Tallow Fatty Acids Market

Tallow Fatty Acids Market Value (2025): USD 3.1 billion

Tallow Fatty Acids Market Forecast Value (2035): USD 4.0 billion

Tallow Fatty Acids Market Forecast CAGR: 2.5%

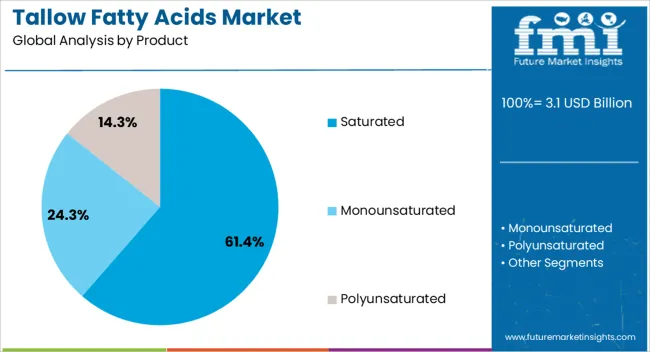

Leading Segment in Tallow Fatty Acids Market in 2025: Saturated (61.4%)

Key Growth Regions in Tallow Fatty Acids Market: North America, Asia-Pacific, Europe

Top Key Players in Tallow Fatty Acids Market: BASF SE, AkzoNobel, Twin Rivers Technologies, VVF L.LC., Godrej Industries, Vantage Oleochemicals, Inc., FerroMac International, LG Household and Healthcare, Limited, Emery Oleochemicals, Chemol Company Inc., Colgate Palmolive, Baerlocher GmbH, Chemithon Enterprises, Acme-Hardesty Co., H Foster & Co. Ltd.

Tallow Fatty Acids Market Key Takeaways

Metric

Value

Tallow Fatty Acids Market Estimated Value in (2025 E)

USD 3.1 billion

Tallow Fatty Acids Market Forecast Value in (2035 F)

USD 4.0 billion

Forecast CAGR (2025 to 2035)

2.5%

A breakpoint analysis of the painting tool market highlights periods of steady and moderately accelerated growth. From 2025 to 2028, the market grows from USD 11.8 billion to USD 12.8 billion, with annual increments of around USD 0.5 billion. This early-stage period represents a stable phase where companies can establish operations, optimize supply chains, and evaluate demand trends. Recognizing this initial breakpoint allows businesses to allocate resources efficiently, test marketing and distribution strategies, and build market presence. Early engagement during this period provides a foundation for capturing higher-value opportunities as the market continues to expand steadily in subsequent years.

The next breakpoint occurs between 2030 and 2035, as the market expands from USD 14.6 billion to USD 18.1 billion, reflecting larger annual increments averaging USD 0.7–0.9 billion. This stage represents accelerated growth and meaningful absolute dollar opportunity, making strategic positioning essential for maximizing market share. Companies entering or scaling operations during this phase can capture significant revenue gains while strengthening competitive positioning.

Why is the Tallow Fatty Acids Market Growing?

Industry sources and trade publications have noted that tallow-derived fatty acids are valued for their versatility, cost efficiency, and established supply chains, particularly in large-scale production of soaps, detergents, and oleochemicals.

The market benefits from the stable availability of tallow as a byproduct of the meat processing industry, ensuring a reliable feedstock base. Technological improvements in fractionation and purification have enhanced product quality, enabling expanded use in niche applications such as lubricants, rubber processing, and surfactants.

Additionally, market growth is bolstered by cost advantages over certain vegetable oil-derived fatty acids, especially in regions where animal byproducts are widely available. While sustainability concerns and the shift toward plant-based alternatives are shaping future demand patterns, tallow fatty acids continue to hold a competitive position in applications requiring specific physical and chemical properties. The segmental leadership is expected to remain with saturated products and the soaps & detergents sector due to their high-volume consumption and entrenched manufacturing integration.

Segmental Analysis

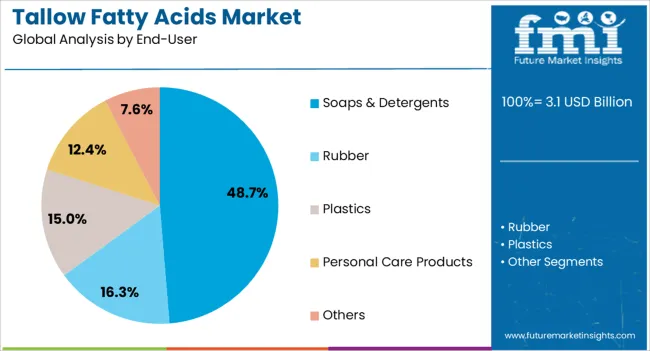

The tallow fatty acids market is segmented by product, end-user, and geographic regions. By product, the tallow fatty acids market is divided into Saturated, Monounsaturated, and Polyunsaturated. In terms of end-user, the tallow fatty acids market is classified into Soaps & Detergents, Rubber, Plastics, Personal Care Products, and Others. Regionally, the tallow fatty acids industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Product Segment: Saturated

The saturated segment is projected to account for 61.40% of the tallow fatty acids market revenue in 2025, maintaining its lead due to its critical role in manufacturing solid and stable end products. Saturated fatty acids derived from tallow offer desirable hardness, opacity, and oxidative stability, which are essential in soap bars, candles, and various industrial formulations.

Producers have favored saturated tallow fatty acids for their consistent performance, long shelf life, and ability to form stable emulsions in diverse applications. The production process benefits from established refining methods that deliver high-purity saturated fractions at competitive costs.

In addition, the segment’s dominance is reinforced by strong demand in regions with significant soap manufacturing industries, where the functional benefits of saturated fatty acids align with product performance requirements. As industrial applications and traditional soap manufacturing continue to sustain demand, the saturated segment is expected to retain its market leadership.

Insights into the End-User Segment: Soaps & Detergents

The soaps & detergents segment is projected to contribute 48.70% of the tallow fatty acids market revenue in 2025, holding its position as the leading end-use sector. This segment’s prominence is supported by the integral role of tallow fatty acids in providing hardness, lather quality, and cleaning efficiency in finished soap and detergent products.

Manufacturers have relied on tallow fatty acids for decades due to their cost-effectiveness and reliable supply, especially in markets where tallow is readily available from the meat processing industry. The segment has also benefited from strong demand in both household and industrial cleaning products, where performance consistency is essential.

Additionally, regional manufacturing hubs with established soap production facilities continue to consume large volumes of tallow fatty acids, ensuring stable demand. While the market is seeing gradual growth in plant-based alternatives, the soaps & detergents segment remains anchored by the functional and economic advantages of tallow fatty acids, sustaining its leadership in overall consumption.

What are the Drivers, Restraints, and Key Trends of the Tallow Fatty Acids Market?

The tallow fatty acids market is expanding due to growing demand in soaps, detergents, lubricants, and personal care products. North America and Europe lead in high-purity, specialty-grade fatty acids for cosmetics and industrial formulations, while Asia-Pacific drives volume demand for soap manufacturing, detergents, and bulk chemical applications. Key manufacturers differentiate through acid value, chain length distribution, and processing efficiency. Market growth is fueled by increasing personal care product consumption, industrial expansion, and rising demand for bio-based chemicals as alternatives to petrochemical-derived fatty acids.

Chain Length and Purity Differences Influence Regional Applications

Tallow fatty acids vary significantly in chain length, saturation, and purity, directly impacting end-use applications. In Europe and North America, manufacturers prioritize long-chain, high-purity fatty acids for cosmetics, pharmaceutical excipients, and high-performance lubricants. These applications require strict control over composition, consistency, and traceability to meet regulatory standards and consumer expectations. Asia-Pacific, however, emphasizes bulk-grade fatty acids for soap, detergent, and industrial chemical production, where cost efficiency often outweighs extreme purity. Differences in chain length and purity affect solubility, chemical reactivity, and processing efficiency, shaping the types of products manufacturers can supply in each region. Suppliers offering fully certified, high-purity products gain access to premium applications, whereas regional producers focus on volume-driven markets. This variation in product specifications between regions influences adoption, pricing, marketing strategies, and the overall positioning of global and regional players.

Industrial Versus Consumer Demand Shapes Regional Market Growth

Regional adoption of tallow fatty acids is highly influenced by end-use industries. Europe and North America prioritize specialty applications, including high-end cosmetics, pharmaceutical intermediates, and precision lubricants. These markets require certified quality, consistent chemical profiles, and traceable sourcing. In contrast, Asia-Pacific consumption is dominated by bulk applications such as soap manufacturing, detergents, and general industrial chemical formulations, with cost competitiveness often prioritized over specialty features. Differences in end-use demand affect production planning, product offerings, and supplier focus. Global manufacturers targeting performance-sensitive markets invest in high-grade, traceable, and customizable fatty acids, while regional producers focus on large-volume, lower-cost products suitable for mass industrial usage. Understanding these contrasts allows companies to align production, optimize inventory, and position themselves strategically across both premium and cost-driven markets.

Production Scale, Raw Material Sourcing, and Compliance Affect Competitiveness

Tallow fatty acid production relies on rendering facilities, availability of animal fats, and efficient processing technology. Europe and North America maintain integrated, high-quality operations with stable supply chains, ensuring consistent performance and adherence to regulatory standards. Asia-Pacific emphasizes large-scale, high-volume production to meet industrial demand, which may introduce variability in product purity and consistency. Differences in feedstock availability, processing capacity, and energy costs affect supply reliability, pricing, and delivery timelines. Regulatory compliance, including traceability, sustainability certifications, and environmental standards, further differentiates suppliers. Companies with well-established raw material sourcing, rigorous quality control, and global certifications secure high-value industrial and specialty contracts, while smaller regional producers compete mainly on price in mass-market applications. These contrasts in production scale, raw material sourcing, and compliance significantly influence competitiveness, market adoption, and long-term growth in the tallow fatty acids market.

Production Scale, Raw Material Sourcing, and Compliance Affect Competitiveness

Tallow fatty acid production relies on rendering facilities, availability of animal fats, and efficient processing technology. Europe and North America maintain integrated, high-quality operations with stable supply chains, ensuring consistent performance and adherence to regulatory standards. Asia-Pacific emphasizes large-scale, high-volume production to meet industrial demand, which may introduce variability in product purity and consistency. Differences in feedstock availability, processing capacity, and energy costs affect supply reliability, pricing, and delivery timelines. Regulatory compliance, including traceability, sustainability certifications, and environmental standards, further differentiates suppliers. Companies with well-established raw material sourcing, rigorous quality control, and global certifications secure high-value industrial and specialty contracts, while smaller regional producers compete mainly on price in mass-market applications. These contrasts in production scale, raw material sourcing, and compliance significantly influence competitiveness, market adoption, and long-term growth in the tallow fatty acids market.

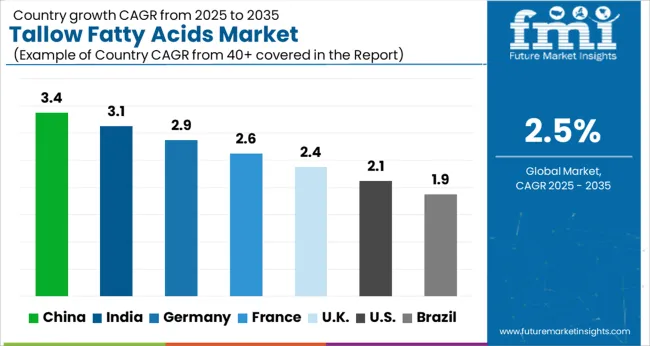

Analysis of Tallow Fatty Acids Market By Key Countries

Country

CAGR

China

3.4%

India

3.1%

Germany

2.9%

France

2.6%

UK

2.4%

USA

2.1%

Brazil

1.9%

The global tallow fatty acids market was projected to grow at a 2.5% CAGR through 2035, driven by demand in soaps, cosmetics, and industrial applications. Among BRICS nations, China recorded 3.4% growth as large-scale production facilities were commissioned and compliance with chemical quality standards was enforced, while India at 3.1% growth saw expansion of manufacturing units to meet rising regional consumption in personal care and industrial products. In the OECD region, Germany at 2.9% maintained substantial output under strict chemical and safety regulations, while the United Kingdom at 2.4% relied on moderate-scale operations for soap and cosmetic applications. The USA, expanding at 2.1%, remained a mature market with steady demand across industrial and personal care segments, supported by adherence to federal and state-level safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Tallow Fatty Acids Market Growth in China

Tallow fatty acids market in China is growing at a CAGR of 3.4%. Between 2020 and 2024, growth was driven by rising demand from soaps, detergents, cosmetics, and personal care industries. Manufacturers focused on producing high purity, cost-effective, and versatile fatty acids for diverse applications. In the forecast period 2025 to 2035, growth is expected to accelerate with adoption in oleochemical derivatives, lubricants, and industrial applications. Increasing domestic production capacity, growth of personal care consumption, and expansion of chemical manufacturing will further support market expansion. China remains a leading market due to industrial scale, supply chain efficiency, and strong end-use demand.

Soaps, detergents, and personal care drove adoption

High purity and versatile products supported growth

Oleochemical and industrial applications enhanced forecast growth

Tallow Fatty Acids Market Expansion in India

Tallow fatty acids market in India is growing at a CAGR of 3.1%. Historical period 2020 to 2024 saw growth supported by increasing demand from personal care, soaps, detergents, and chemical manufacturing sectors. Manufacturers focused on cost-effective, reliable, and high quality fatty acids. In the forecast period 2025 to 2035, market growth is expected to continue with adoption in oleochemicals, lubricants, and industrial products. Rising personal care consumption, growth of chemical industries, and industrial expansion will further drive growth. India is projected to maintain steady growth due to increasing domestic production and rising end-use demand.

Personal care and chemical industries drove adoption

Cost-effective and high quality products supported growth

Oleochemicals and industrial applications enhanced forecast growth

Tallow Fatty Acids Market Trends in Germany

Tallow fatty acids market in Germany is growing at a CAGR of 2.9%. Between 2020 and 2024, growth was supported by demand from soaps, detergents, lubricants, and personal care products. Manufacturers focused on high quality, reliable, and environmentally compliant fatty acids. In the forecast period 2025 to 2035, market growth is expected to continue steadily with adoption in industrial chemicals, oleochemicals, and specialty personal care products. Sustainability standards, industrial modernization, and eco-friendly regulations will further support market expansion. Germany remains a key European market due to strong industrial base and focus on quality and compliance.

Soaps, detergents, and lubricants drove adoption

High quality and environmentally compliant products supported growth

Industrial chemicals and oleochemicals enhanced forecast growth

Tallow Fatty Acids Market Development in the United Kingdom

Tallow fatty acids market in the United Kingdom is growing at a CAGR of 2.4%. During 2020 to 2024, adoption was driven by soaps, detergents, personal care products, and chemical applications. Manufacturers focused on reliable, cost-effective, and safe products. In the forecast period 2025 to 2035, market growth is expected to continue moderately with adoption in industrial chemicals, lubricants, and specialty oleochemical applications. Regulatory compliance, sustainable production, and steady demand from end-use industries will further support market expansion. The United Kingdom market reflects stable growth with emphasis on quality, reliability, and environmental standards.

Soaps, detergents, and personal care drove adoption

Reliable and cost-effective products supported growth

Industrial and oleochemical applications enhanced forecast growth

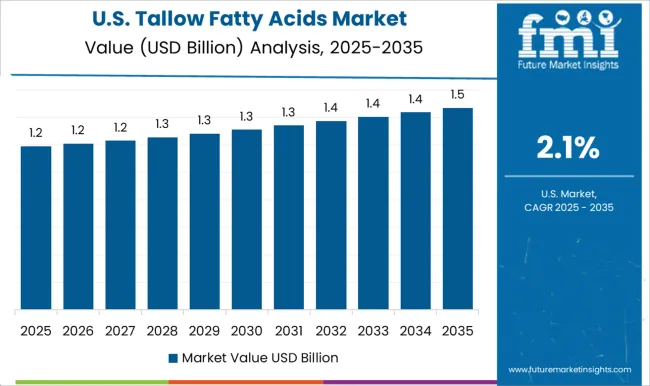

Tallow Fatty Acids Market Insights in the United States

Tallow fatty acids market in the United States is growing at a CAGR of 2.1%. Historical period 2020 to 2024 saw growth driven by demand from personal care, soaps, detergents, and industrial applications. Manufacturers focused on high quality, reliable, and versatile fatty acids. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption in oleochemicals, lubricants, and specialty industrial products. Industrial modernization, regulatory standards, and consumer demand for personal care products will further support market expansion. The United States market demonstrates stable growth with emphasis on reliability, versatility, and compliance with environmental standards.

Personal care and soaps drove adoption

High quality and versatile products supported growth

Oleochemicals and industrial applications enhanced forecast growth

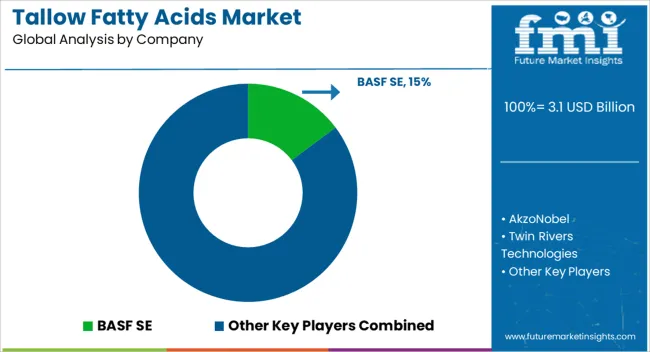

Competitive Landscape of Tallow Fatty Acids Market

The tallow fatty acids market is supplied by BASF SE, AkzoNobel, Twin Rivers Technologies, VVF L.L.C., Godrej Industries, Vantage Oleochemicals, Inc., FerroMac International, LG Household and Healthcare, Limited, Emery Oleochemicals, Chemol Company Inc., Colgate Palmolive, Baerlocher GmbH, Chemithon Enterprises, Acme-Hardesty Co., and H Foster & Co. Ltd. Competition is shaped by product purity, chain length variations, and application versatility. BASF and AkzoNobel brochures emphasize high-purity fatty acids for soaps, detergents, and personal care products with specified melting points, saponification values, and acid numbers.

Twin Rivers and Vantage Oleochemicals highlight tallow-derived fatty acids suitable for lubricants, greases, and industrial chemicals. Godrej Industries and Emery Oleochemicals datasheets provide technical details on free fatty acid content, iodine value, and shelf stability. Observed industry trends include rising demand for biodegradable and multifunctional fatty acids in cosmetic, industrial, and chemical formulations. Market strategies focus on application specialization, scale of production, and regional distribution. BASF SE and AkzoNobel prioritize high-volume industrial supply chains for detergent and cosmetic sectors.

Key Players in the Tallow Fatty Acids Market

BASF SE

AkzoNobel

Twin Rivers Technologies

VVF L.LC.

Godrej Industries

Vantage Oleochemicals, Inc.

FerroMac International

LG Household and Healthcare, Limited

Emery Oleochemicals

Chemol Company Inc.

Colgate Palmolive

Baerlocher GmbH

Chemithon Enterprises

Acme-Hardesty Co.

H Foster & Co. Ltd.

Scope of the Report

Item

Value

Quantitative Units

USD 3.1 Billion

Product

Saturated, Monounsaturated, and Polyunsaturated

End-User

Soaps & Detergents, Rubber, Plastics, Personal Care Products, and Others

Regions Covered

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Country Covered

United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa

Key Companies Profiled

BASF SE, AkzoNobel, Twin Rivers Technologies, VVF L.LC., Godrej Industries, Vantage Oleochemicals, Inc., FerroMac International, LG Household and Healthcare, Limited, Emery Oleochemicals, Chemol Company Inc., Colgate Palmolive, Baerlocher GmbH, Chemithon Enterprises, Acme-Hardesty Co., and H Foster & Co. Ltd.

Additional Attributes

Dollar sales vary by product type, including oleic acid, stearic acid, palmitic acid, and myristic acid; by application, such as soaps & detergents, cosmetics, lubricants, and rubber processing; by end-use industry, spanning personal care, chemicals, and industrial manufacturing; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by rising demand for personal care products, industrial chemicals, and bio-based materials.