Weather: Late-season rainfall is aiding US winter wheat planting in the Plains, improving topsoil moisture, though dry conditions persist in parts of the Eastern Corn Belt, stressing corn and soybeans. In Canada, much of the Prairies remain dry apart from showers in southern Manitoba, while Europe’s outlook is mixed, with strong French wheat quality but maize yields cut by summer heat.

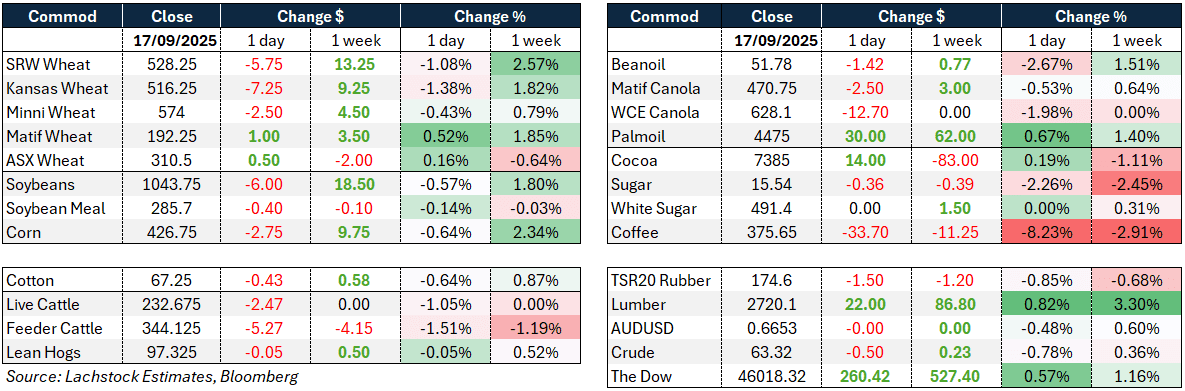

Markets: Wheat, corn and soybeans fell overnight, pressured by a slightly stronger USD and timely rains aiding US winter wheat planting. Canola tracked lower with weaker vegoils and crude, while StatCan’s higher production estimate added extra weight.

Australian Day Ahead: Red across the board overnight, with canola likely to give back yesterday’s GM gains. Wheat and barley expected unchanged to slightly softer, though a firmer AUD should offer some support locally.

US wheat futures eased (WZ -5.75c, KWZ -7.25c, MWZ -2.5c; Dec CBOT wheat -1pc to $5.29/bu) as fund selling weighed despite firm world values, with EU/BSEA demand from MENA keeping export markets supported.

StatsCan raised its Canadian wheat crop estimate to 36.6Mt (Sep WASDE 36.0Mt), with local sources suggesting upside to 38.5Mt; Canadian output continues to pressure global balance sheets.

EU wheat outlook firmed: FranceAgriMer lifted 2025/26 exports outside EU to 7.85Mt (prev. 7.5Mt), with strong quality metrics (protein 11.3pc, 94pc >76kg/hl test weight).

Russia’s seaborne exports slumped 16pc y/y in August (5.3Mt), with traders citing unattractive overseas margins vs domestic sales; officials discussing rail subsidies to accelerate flows.

Winter wheat planting underway in the US Plains, with timely rainfall expected to boost topsoil moisture and establish the new crop.

Managed money positions remain heavily short, with Euronext wheat holding a record 313k short contracts, underscoring vulnerability to short-covering rallies.

Other grains and oilseeds

Corn futures slipped (CZ -2.75c, Dec -0.6pc to $4.27/bu) as resistance capped recent gains; market balancing yield uncertainty (179–186bpa) against heavy supply and undersold farmer positions.

US ethanol production tumbled to 1.055m b/d (vs 1.11m prior week), a larger-than-expected drop; stocks fell to 22.6m bbls, defying expectations for a build.

Brazil ethanol outlook robust: Evolua forecasts output at 42bn litres in 2027/28 (vs 36bn this season), with growth led by corn ethanol (+4bn litres).

Soybeans weakened (SX -6c; Nov -0.6pc to $10.44/bu) with soyoil hit (-2.6pc) on EPA biofuel blending proposal uncertainty; renewable fuel policy still unsettled, weighing on demand confidence.

Canola futures fell as StatCan lifted 2025/26 harvest to 20.03Mt (19.94Mt last month), with analysts flagging potential for 21Mt in December; harvest 33pc complete in Manitoba.

Oilseed complex broadly pressured by weakness in soy complex, EU rapeseed, Malaysian palm, and crude oil, alongside China’s absence as a Canadian canola buyer.

Macro

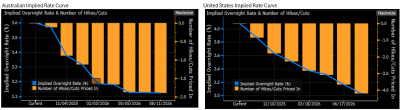

The US Fed cut rates by 25bp to 4.00–4.25pc (one dissent calling for -50bp); Powell described it as a “risk management cut” with no pre-set easing path. UST 10y yields rose ~6bp to 4.09pc, USD firmed, AUD/USD fell to mid-0.66s.

UK inflation remained sticky in August (core CPI +3.6pc y/y, services +4.7pc), seen keeping the BoE on hold at 4.00pc this week.

US housing starts dropped 8.5pc m/m to 1.307m saar (lowest since May), with permits -3.7pc to 1.312m saar (lowest in nearly 5 years).

Commodities mixed: gold spiked post-Fed cut before reversing (-0.8pc to $3,659/oz), WTI crude fell -0.7pc to $64/bbl despite large US stock draw (-9.3mbbl). Copper and zinc softened on rising inventories and strong Chinese output.

Gas markets edged higher on fears of more sanctions on Russia; North Asian LNG prices firmed on India/China buying interest.

Broader equities subdued: S&P500 -0.1pc, Euro Stoxx 50 -0.05pc, FTSE100 +0.1pc; sentiment cautious on central bank outlook and commodity headwinds.

Australia

It was a stronger day in the west yesterday with canola bids adding A$3–$10 around $818, wheat +$3 to $334 and barley firm at $304.

Through the east of the country canola was firmer at $796 track Geelong, wheat was $325 and barley $290.

Track barley markets have lost about $15 since the start of this month, with Victoria moving from $305 to $290.

Delivered Darling Downs wheat markets are bid around $314 for new crop and $322 for current season.

Local production is looking strong currently but there is little moisture under crops through SNSW and parts of SA/Vic. They are starting to draw significant moisture — one good rain away from some big crops, but equally on the flip side they can fall over quickly.