Weather: Underwhelming – rainfall forecasts for Australia are still only providing relief for the southern fringes – Southern NSW a notable omission. Globally, Rostov has had around 10mm since the start of Aug – not enough for new crop establishment.

Markets: So much outside market noise. Troops rolling into Portland, Oregon, UN tensions, Digital ID in the UK – seems everywhere you look. What it means for markets is debatable. It’s interesting that the US data is not nearly as bad as has been predicted, certainly taking the heat off aggressive rate cuts.

Australian Day Ahead: The stand-off continues. With the forecast, it’s hard to see the growers letting much go and it’s equally hard to see the trade paying overs. The old measure of basis to Chicago looks expensive, yet there is an export margin on paper from most ports – a slow start to the week.

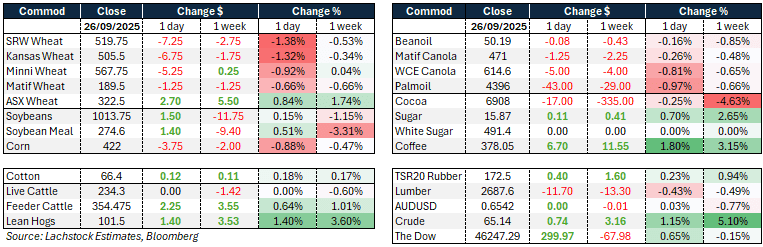

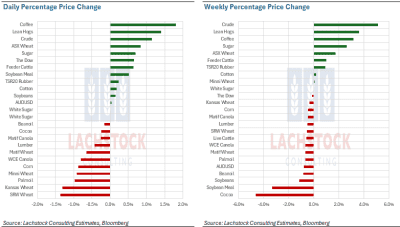

Wheat futures softened across the board with Chicago, Kansas City, and Minneapolis contracts all lower and Paris Matif also slipping. Russian cash values held steady, while spreads and implied volatility in Chicago stayed subdued.

The EU raised its soft wheat production forecast to 132.6 million tonnes (Mt), adding to the sense of ample supply, though Russian planting and quality concerns remain.

Reports suggest US SRW acreage could be down 5–10pc while HRW holds steady, with US wheat stocks expected at 2.043bbu and production at 1.925bbu.

Argentina’s crop outlook improved after timely rainfall in central and northern regions, though excessive moisture in Buenos Aires may delay fieldwork.

In the US, winter wheat harvest is essentially complete, putting additional pressure on prices as new grain flows into elevators.

Despite geopolitical noise around Russian ports and NATO tensions, markets largely ignored the conflict, focusing instead on heavy global supplies from Europe, the Black Sea, Australia, Argentina, and Canada. Russia’s plan to nearly double grain export taxes by 2026 could restrain farmer margins and exports, already slowing by 20pc in September.

Other grains and oilseeds

Corn traded lower into the weekend, with December contracts slipping in narrow ranges.

Harvest is underway with US and Argentine offers into Asia roughly aligned, while Ukraine’s advancing harvest will soon add further supply. US corn stocks are expected at 1.337bbu with last year’s crop pegged at 14.885bbu.

In France, maize harvest progress reached 14pc, slightly ahead of average. US weather brought rain relief to the Delta and Midwest, aiding wheat planting but coming too late for late-season corn.

Farmer selling remains light as growers hold out for higher prices.

Taiwanese buyers signed agreements to secure US corn, reinforcing export demand.

In the US Plains, a record corn crop could weigh on values through harvest, with ADM noting the inflow of new supply as a key pressure point.

The December contract continues to oscillate between 415 and 435, with uncertainty around government reports and a possible shutdown clouding near-term direction.

Soybeans held in a tight range, edging higher in December contracts, though still down about 4pc in September.

The crush margin was steady as meal firmed slightly while oil eased.

The big market feature was Argentina selling about 40 soybean cargoes to China during a temporary tax suspension, displacing US sales in a key seasonal slot and amounting to 2.66Mt for November and December.

This leaves US farmers shut out of China for now, with traders expecting demand may not return until December or January.

Meanwhile, Brazil has begun planting its new crop, and US harvest is advancing with stocks expected at 323mbu and last year’s production at 4.366bbu.

On the product side, analysts project global palm oil and soyoil prices will rise US$100–150/t in early 2026, supported by biodiesel demand in the US, Brazil, and Indonesia.

India is expected to boost soy oil imports by around 9pc next year as cheaper soybean oil undercuts palm. Taiwanese buyers also committed to additional US soybean purchases, helping to underpin demand despite China’s absence.

Macro

Global markets were influenced by monetary and trade policy signals. The US Fed’s 25bp rate cut and guidance of further easing provided a strong tailwind to commodities broadly, particularly metals, though agricultural markets lagged.

US core PCE inflation rose 0.2pc in August (2.9pc y/y), in line with expectations, with services inflation edging higher. Real consumption rose 0.3pc, outpacing forecasts, while incomes grew 0.4pc, but slowing nominal growth and creeping inflation are squeezing household budgets. Consumer sentiment weakened slightly, though inflation expectations eased.

Tariff developments added uncertainty: the EU is preparing duties of 25–50pc on Chinese steel, while Trump announced a 100pc tariff on imported drugs from firms not investing in US plants, sparking industry pushback in Europe.

Argentina’s Treasury intervened in FX markets, soaking up $7b in grain-export dollars to prevent peso appreciation.

Shipping trends show Chinese yards retaining over half of global vessel orders despite US policy moves.

Meanwhile, US hog futures hit contract highs as September inventories fell more than expected, implying tighter protein supplies.

Australia

Through the west of the country canola bids were steady to end the week with new crop bid around A$810, less $110 to GM at $700. Wheat was firmer +$5 to $343 and barley unchanged $307 FIS.

Over in the east canola was bid around $785 track Port Kembla, with wheat $330 and barley $298.

New and old crop Darling Downs feed wheat markets were firmer last week with new crop around $326 for Jan+ and barley around $300.

Some handy falls are forecast for the southern regions of SA and Vic, but that’s where any significant rainfall ends, with warmer temperatures due later in the week set to test crops through parts of SA, Vic, and SNSW with limited soil moisture.

Canola finished the week a little lower across the board, weighed down by global futures and increased grower selling in the east given relative values to cereals and now pulses.