1h agoMon 29 Sep 2025 at 9:45pmMarket snapshot

ASX 200 futures: +0.7% to 8.904 points

Australian dollar: Flat at 66.73 US cents

Dow Jones: +0.1% to 46,316 points

S&P 500: +0.3% to 6,661 points

Nasdaq: +0.5% to 22,591 points

FTSE: +0.2% to 9,299 points

EuroStoxx: +0.2% to 555 points

Spot gold: +1.4% to $US3,862/ounce

Brent crude: -3.9% to $US63.18/barrel

Iron ore: -0.1% to $US105.35/tonne

Bitcoin: +3.2% to $US114,257

Prices current around 7:45am AEDT.

Live updates on the major ASX indices:

4m agoMon 29 Sep 2025 at 11:23pm

Why is Optus in hot water? Deaths and Dapto

The leadership (local and Singaporean) of telco Optus are meeting Communications Minister Anika Wells today, in what will be a tough moment for the embattled company.

Loading…

Optus has been in the frame of public outrage after network failures that led to three deaths – when people couldn’t call the emergency ‘000’ line.

Now, Dapto.

Optus is investigating a network outage that led to nine failed triple-0 calls near Wollongong on the NSW south coast. It issued a statement saying the problem stemmed from a mobile phone tower site in Dapto.

The outage affected calls between 3am and 12:20pm on Sunday, including calls to the triple-0 network. One caller required an ambulance but then managed to get through using another phone.

The telco says it has confirmed with police that all callers who tried to contact emergency services are OK. About 4,500 people were affected by the Dapto outage and Optus has apologised to affected customers. Service to the area has now been restored.

The government has asked the Australian Communications Media Authority (ACMA) to investigate. The latest incident comes just 10 days after a disastrous outage that led to hundreds of failed triple-0 calls. The deaths of three people have been linked to that outage and the Australian Communications Media Authority has launched an investigation.

ACMA has also confirmed it will investigate the latest incident, and the probe will be separate to its inquiry into the September 18 outage.

The regulator said it was “alarming” that another outage had occurred so soon after the previous incident.

13m agoMon 29 Sep 2025 at 11:14pm

Why the September slump has only hit the ASX while other global markets gain

What’s going on in the market?

Loading…

Head of client coverage, Pacific, at FTSE Russell, Julia Lee, says the tech rally has carried global markets to gains in the last quarter including September, which is traditionally a challenging time for markets, but the sector is simply too small on the ASX to pull the market into positive territory.

23m agoMon 29 Sep 2025 at 11:04pm

Optus CEO meeting Communications Minister

The tragic consequences of repeated triple-0 outages will be the topic of discussion when Communications Minister Anika Wells meets with Optus boss Stephen Rue and chief executive of the telco’s parent company, Singtel, Yuen Kuan Moon today.

An outage in the emergency network on September 18 has been linked to the deaths of three people.

(When you call the emergency number – 0 0 0 or ‘triple zero’ – you are meant to be placed via any network. Meaning even if you pay Optus for mobile connection, the call can go through Telstra or whichever network is strongest and available where you are. Because it’s an emergency, right? That didn’t happen).

There was also another outage affecting triple-0 calls on Sunday near Wollongong on the NSW south coast, which led to nine failed calls.

Ahead of the meeting, Environment Minister Murray Watt said Wells was prepared to “lay down the law” with Singtel.

“I’m very confident that Anika will really lay down the law the parent company, [Singtel], CEO,” he told Nine.

“She’s obviously already had discussions with Optus themselves, but escalating that now to the parent company demonstrates how seriously we are taking this.”

My colleague David Taylor has a read on how we got to here.

34m agoMon 29 Sep 2025 at 10:53pm

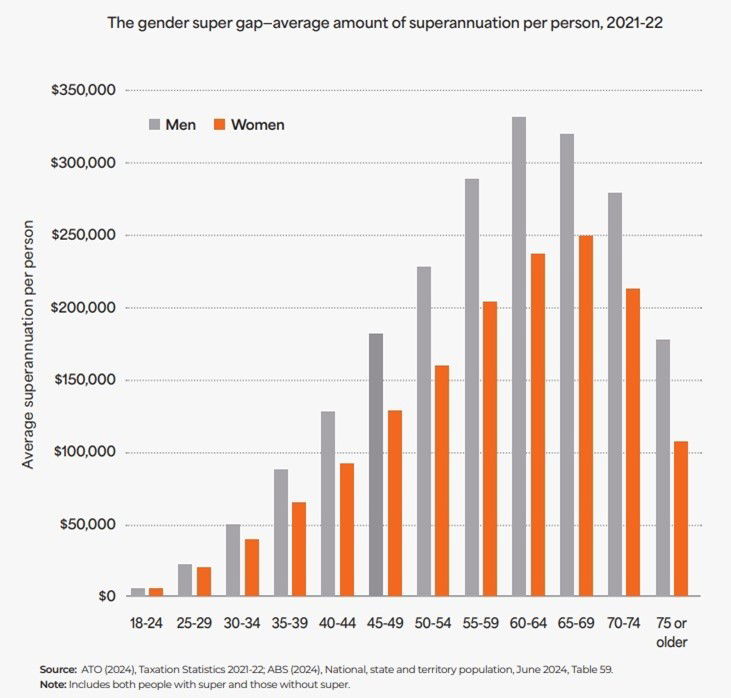

Women have less super at every stage of life

New research points to a looming crisis of older women entering retirement in poverty, unless urgent action is taken.

The report from the Super Members Council (SMC) has found while the so-called “superannuation gender gap” has often been blamed on having children, events later in life also have a disproportionate impact on women.

Women have less superannuation, at every stage of life (SMC)

Women have less superannuation, at every stage of life (SMC)

The report by Impact Economics and Policy was commissioned by SMC.

It found events such as separation, unpaid caregiving for older family members and family violence affected super balances, worsening women’s economic insecurity.

This could potentially result in up to $95,000 less in super for women.

SMC CEO Misha Schubert said the report was a wake-up call for all policymakers with its compelling insights.

“Australia has made important strides in recent years on the gaps in pay, super and workforce participation, but this research shines a spotlight on the need for further bold reforms to ensure our retirement system truly works for women — especially low-income women.

“Without urgent action, generations of Australia’s lowest-paid women risk poverty in retirement.”

Great read from my colleague, business reporter Yiying Li.

45m agoMon 29 Sep 2025 at 10:42pm

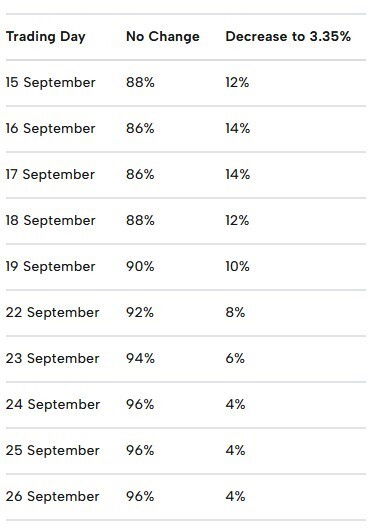

Hold on, wasn’t there a 96% chance of something happening that didn’t?

There is a 96% chance of no rate cut happening today.

However, I do recall in recent months there being a 100% chance of a rate cut happening at one of the meetings and it did not end up occurring. 96% although means highly likely, does not mean certain by any measure

– LK

Good call LK.

Yes, in July the RBA shocked markets by holding rates steady.

Here’s my wonderful colleague Stephanie Chalmers reporting from that surprising day:

“The Reserve Bank has not delivered an interest rate cut in July as had been widely forecast, but has indicated it expects to cut rates further from here.

“The RBA kept the cash rate on hold at 3.85 per cent, in a decision the central bank’s governor described as more about “timing than direction” of rates.

“The decision defied financial market expectations, which had priced in a 96 per cent chance of a 0.25 percentage point cut, and economist forecasts.

“Forecasts had shifted almost unanimously in favour of a cut, after the latest inflation data showed consumer prices rising less than expected in May, while economic growth slowed in the first quarter of the year.”

When the minutes of the RBA meeting came out, two things were revealed.

The first was a split 3-6 vote (Six voting “hold”, three voting “cut”). Unlike normal markets and democracies, we’ll never know who voted which way because the RBA keeps that information secret.

The other element was a plan for “cautious and gradual” rate cuts that clashed with a “surge” in unemployment.

You can read more here:

1h agoMon 29 Sep 2025 at 10:25pm

Compulsive switcher makes fair point about switching

Former finance journalist, Sunrise host and Port Adelaide FC David “Kochie” Koch makes a reasonable point as part of his new role at aggregator Compare the Market.

Sites like that one — and there are plenty of others — generally offer a comparison service that puts options for financial products like loans, mobile phone plans and insurance. They are typically paid a percentage or a fee for products they point people towards, by the originating company.

Anyway, back to the non-individual general financial advice.

“So many home owners are holding out for rate relief but it’s unlikely the Reserve Bank will deliver that (today).

“But that doesn’t mean that a lot of people can’t start saving anyway. The average interest rate for outstanding loans is 5.76%. Right now, there are variable rates from 5.34% – that could be a saving of about $179 a month, surpassing what a typical RBA cut would deliver.

“Plus, there are two-year fixed rates as low as 4.79%. That’s the lowest we’ve seen in years and could be a smart option if you’re looking to start saving now and lock in some certainty for the months ahead.”

The point here is about the “loyalty penalty” customers pay by not shopping — and shifting — their accounts around.

It’s a pain, it can take a while, but it does seem to be worth it.

This is in insurance, phone plans, bills — it is endless.

When it comes to the biggest of debts, people are doing it.

About 65,000 home loans were refinanced by borrowers moving to different lenders in June 2025, a 25% increase on the previous year. Australian Bureau of Statistics (ABS) data shows that around 43,000 loans were refinanced with the same lender, up 30.7% for the year.

That means people calling up and saying: “Hey, why is my rate higher than the one you’re offering newbies who walk in the door?”

It’s a good question. The answer is the loyalty penalty.

And you don’t have to pay it.

1h agoMon 29 Sep 2025 at 10:16pm

Will the RBA cut rates today?

Spoiler alert: almost certainly not.

As at September 26 the ASX 30 Day Interbank Cash Rate FuturesOctober 2025 contract was trading at 96.41.

What that indicats is a less than 4% expectation of an interest rate decrease to 3.35% at the next RBA Board meeting.

What’s more, the most likely thing being no-thing has been getting more likely.

Table of likelihood of interest rate cuts, based on market pricing (ASX)

Table of likelihood of interest rate cuts, based on market pricing (ASX)

We’ll know at 2.30pm eastern time what the go is… but it’s likely to be ‘business as usual’ as the Reserve Bank sits on any move.

1h agoMon 29 Sep 2025 at 10:07pm

Why likely no cut? Ivan has thoughts

CreditorWatch chief economist Ivan Colhoun has summarised the state of play and it’s a great backgrounder on the different elements that go into the decision of the Reserve Bank to lift, hold or cut the official cash rate.

Any change to the rate has significant implications for the cost of money – and has an out-sized impact on the one-in-three Australians who have substantial housing debt (loans) and the further third who rent – because many of those dwellings are subject to mortgages.

“No change in interest rates is the almost universal expectation among market economists and financial markets price very low odds of a follow up interest rate reduction tomorrow (just a 3.5% probability of a cut is priced. Interestingly, market pricing does not factor in another cut until February next year following recent stronger consumer spending and higher monthly inflation data).”

But hold on…. the minutes of the August Board Meeting noted that further easing was likely to be required over the next year and discussed the Board’s strategy in relation to when to deliver that easing.

Here’s Ivan’s assessment of what that meant:

A gradual pace of easing would be appropriate with the labour market still assessed to be a little tight, inflation forecast to be a little above the midpoint of the target band and signs of some recovery in private demand.A faster pace of easing would likely be appropriate if it was revealed that the labour market was already in balance, inflation began to undershoot the target or the balance of risks shifted to the downside.The Board concluded that it could not judge between the two scenarios at this stage and the pace of further easing would be determined by incoming data on a month-by-month basis.

So, what’s happened since?

“The higher monthly CPI casts a lot of doubt on the forecast of inflation being close to target as currently forecast, while there have also been positive signs of stronger consumer spending (though to me it remains unclear how much of that is special factors). While the pace of employment growth appears to have slowed, senior RBA personnel have retained their assessment that the labour market is a little tight in recent public comments.”

Meaning…

“Together this overwhelmingly supports a decision not to further reduce interest rates at this meeting, with the most optimistic assessment I can come up with being that the Board – as in July – opts to wait for more information and reassesses policy at the November meeting. This would be following the release of the full quarterly CPI, which is not expected to make pretty reading based on some of the componentry of the monthly August CPI. This is why the market is less convinced about further easing this year. I’d also add that SEEK job ads and the NAB Business Survey have improved a little in recent months and have a very strong history of correctly predicting the direction of Australian interest rates.”

We’ll find out later today.

1h agoMon 29 Sep 2025 at 9:57pm

Will the RBA cut rates ? ‘About as much chance of Satan needing an overcoat’

ABC Business editor Michael Janda has pulled all the strings together in a summary worth your time.

Turns out today is actually all about next month…

Here’s the top:

Anxiously anticipating the Reserve Bank’s rates decision at 2:30pm eastern time? Don’t waste your energy.

There’s about as much chance of Satan needing an overcoat as there is of the RBA lowering its cash rate today.

Financial markets are pricing in less than an 8 per cent chance of a cut, according to LSEG data, and I think even that’s far too generous.

The thing to watch out for at 2:30pm will be the Monetary Policy Board’s statement explaining its decision to keep the cash rate steady at 3.6 per cent, looking out for any hints about what it will do next month.

The chances of a Melbourne Cup Day rate cut are also likely to be the key focus of questions to RBA governor Michele Bullock at her 3:30pm press conference.

Here’s a link to the full read.

1h agoMon 29 Sep 2025 at 9:46pm

How has the RBA’s cash rate tracked?

The Reserve Bank’s monetary policy board is forecast to keep the official cash rate unchanged at 3.6% later this afternoon.

So how did we get here?

Here’s how the cash rate has tracked over the last few years:

1h agoMon 29 Sep 2025 at 9:41pmGood morning – it’s RBA Day!

Hello, I’m Daniel Ziffer from the ABC business team and I’ll be taking you through the morning on our business, finance and economics blog.

Overnight, Wall Street indices were higher.

The blue-chip Dow Jones of 30 mega-companies like Boeing and Visa was +0.1% to 46,316 points.

The broader S&P 500 that covers 500 of the largest listed companies in the US +0.3% to 6,661 points.

The tech-heavy Nasdaq was +0.5% to 22,591 points.

At 2.30PM AEST we’ll get the announcement on the cash rate from the Reserve Bank’s meeting of the committee that sets it.

The market doesn’t expect a shift, but who knows.

There’s lots to get to, all of it news, analysis and information and none of it financial advice.

Let’s get started!

Loading