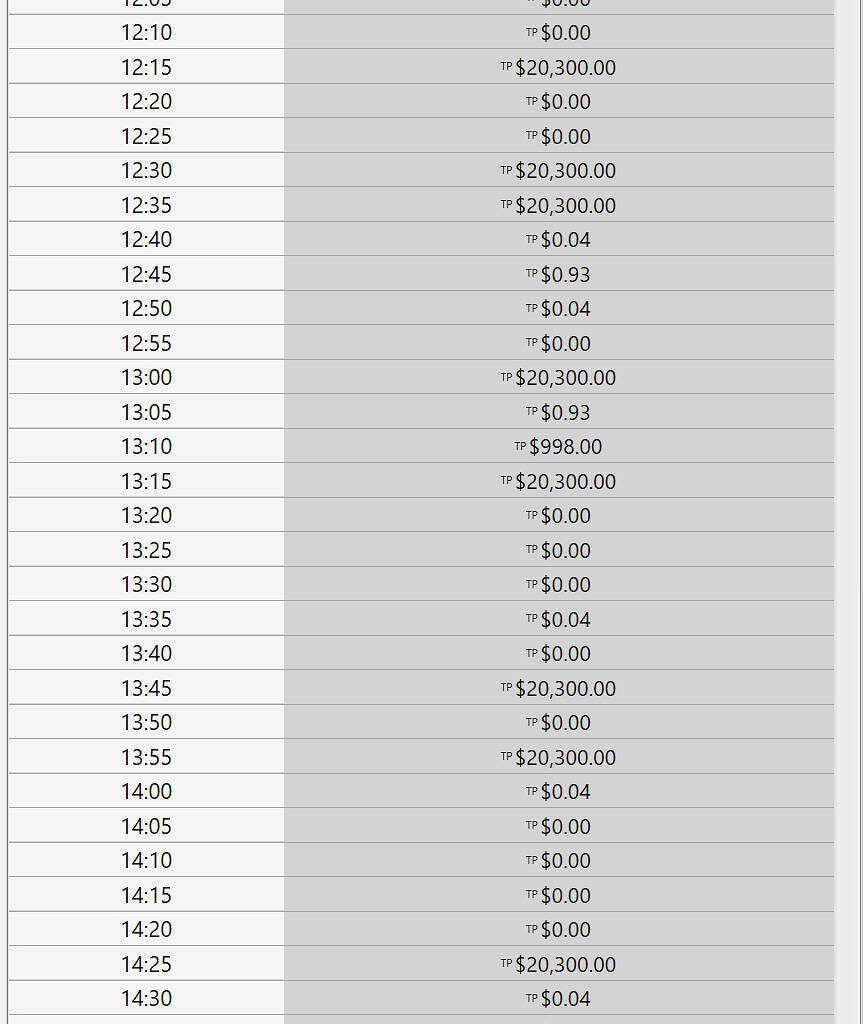

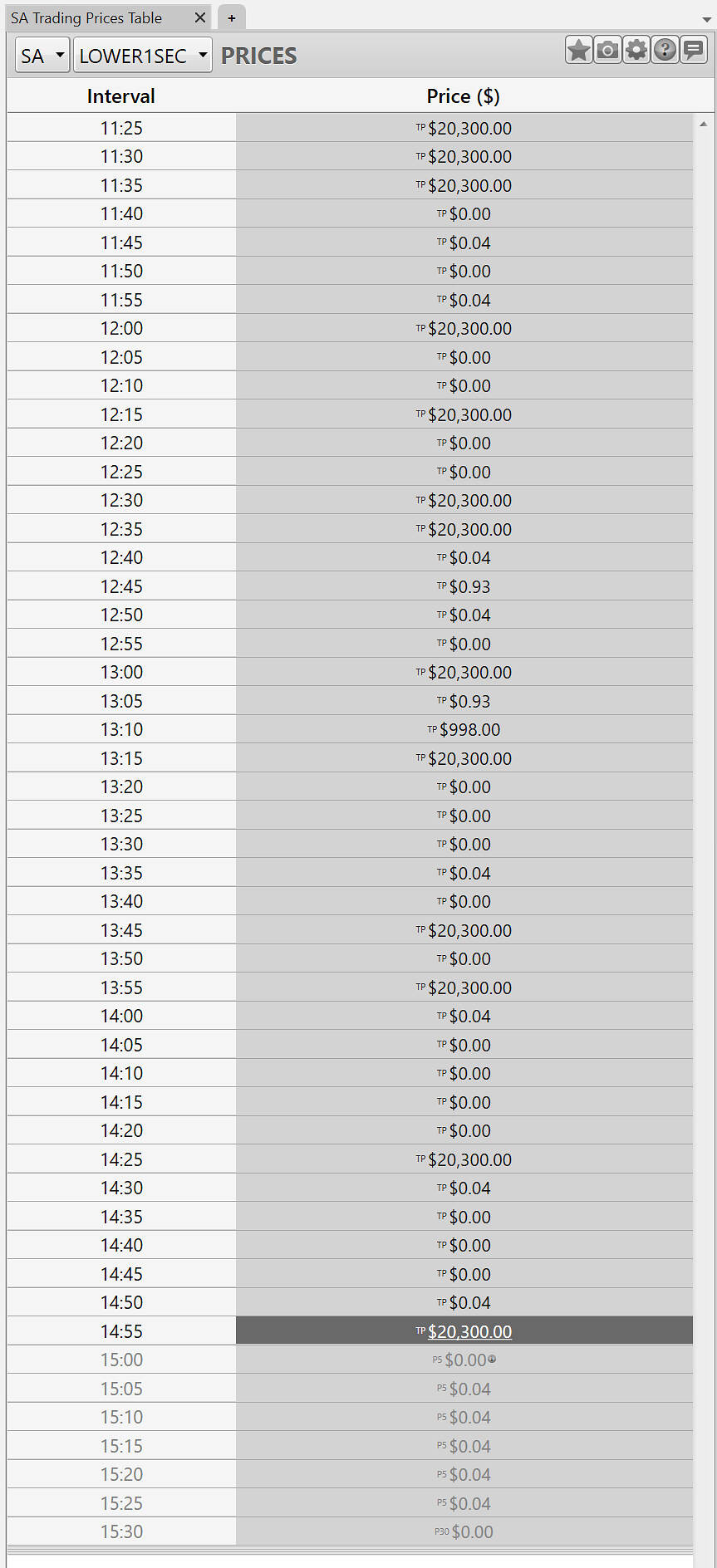

We got one of our first glimpses of the new market price cap in action today, with prices for the ‘Lower 1 Second’ contingency FCAS commodity in South Australia flickering between the FCAS price floor ($0/Mwh) and the market price cap ($20,300/MWh).

This volatility kicked off shortly after 11:00am (NEM time) this morning. This screenshot below was taken at 2:55pm NEM time this afternoon, and shows the price outcomes for the ‘Lower 1 Second’ commodity throughout today, and also shows the P5 price forecast for the next six intervals.

Source: ez2view’s Trading Prices widget

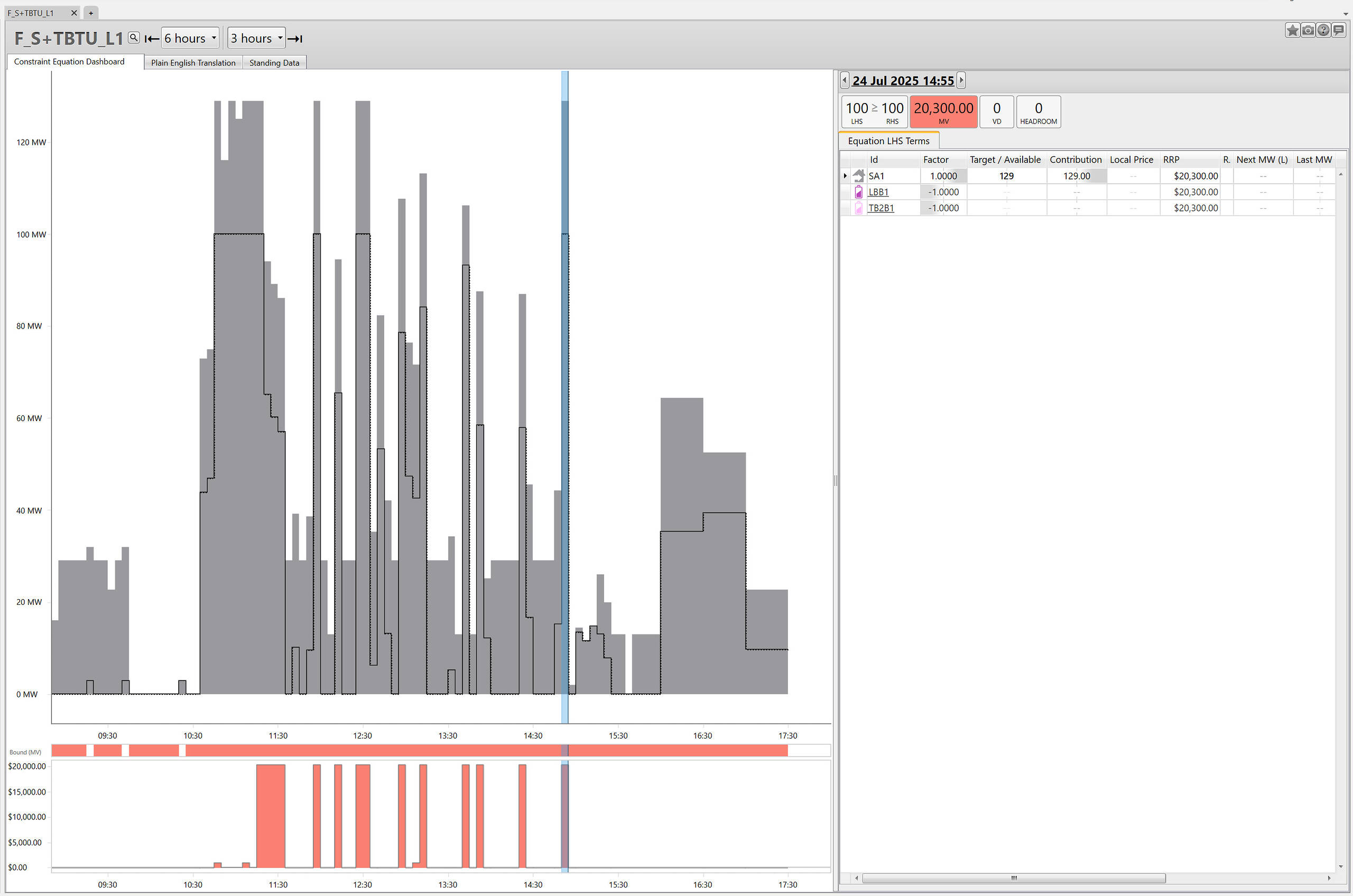

Earlier in the week we noted the invocation of the ‘I-HYSE’ constraint set, due to an outage on the 275kV Heywood-South-East transmission line (forming part of the SA-VIC interconnector), and warned of energy and FCAS price risk due to these limitations on the Heywoood interconnector.

That outage concluded yesterday evening, but I note that the ‘S-TBTU’ constraint set has been invoked since 8am this morning, and is scheduled to conclude at 5:30pm NEM time this afternoon. That constraint set is invoked due to an outage on the 275kV Tailem Bend-Tungkillo line (which also forms part of the SA-VIC interconnector). This set contains several constraint equations that change the FCAS requirements for each contingency commodity — limiting procurement to within SA, or in this case, procurement from parts of the SA region west of the outage) due to risks if the region became islanded.

The screenshot below shows our constraint equation dashboard widget from within ez2view — showing the ‘F_S+TBTU_L1’ equation (within the ‘S-TBTU’ set) binding throughout today. It also shows the P5 and P30 forecasted values for this equation, for the next three hours ahead.

Source: ez2view’s Constraint Equation Dashboard widget