School districts and state agencies face another major hike in their payments to the Oregon Public Employees Retirement System during the two-year budget cycle starting July 1, 2027, according to new projections released last week.

The tab for individual public employers won’t be clear until December, when system actuary Milliman Inc. releases projected pension contribution rates for each of the system’s 900 participating employers for the next biennium. And those rates won’t be set in stone until next year, when the actuary knows how much the system’s investments earned in 2025.

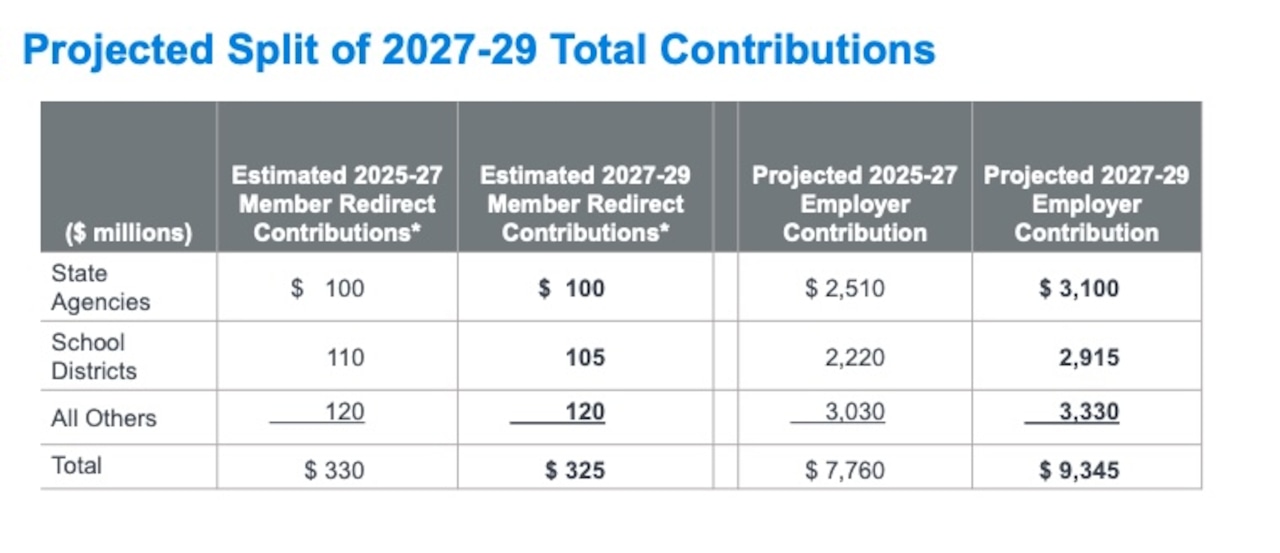

But Milliman’s preliminary estimates reviewed at a PERS Board meeting Friday show a $1.6 billion increase in overall contributions, an eye-popping 20% increase on top of the $7.8 billion that employers will contribute during the current budget cycle.

The projected split of pension contributions to Oregon Pers in 2027.Courtesy Milliman

The projected split of pension contributions to Oregon Pers in 2027.Courtesy Milliman

It’s déjà vu all over again, as employer contributions to the system spiked by $1.8 billion in the current biennium. And once again, the impact of this budget freight train won’t be spread evenly.

Indeed, some public employers face 100%, 200% or even bigger jumps in the contributions they’re making to PERS today, while others will see nominal increases. That’s because the bulk of the projected cost increases — around $1 billion — stem from the expiration of so-called pension side accounts that a subset of public employers previously established with PERS, using borrowed money to place a side bet on the system’s financial performance.

Between 2003 and 2008, nearly 150 government employers around the state made such bets. Schools, cities, counties, community colleges, even the state itself, collectively issued more than $6 billion in pension obligation bonds, then forwarded the proceeds to the Oregon Treasury to invest alongside the pension system’s portfolio of stocks, bonds, real estate, private equity and other assets.

For the most part, it’s been a big success, with employers earning more money on the side accounts than they’re paying in interest on the underlying debt. Meanwhile, PERS has been tapping those accounts over the last two decades to offset normal pension costs for the jurisdictions who issued them.

Yet 183 of those side accounts belonging to 144 public employers will expire in 2027, according to PERS. The associated pension contribution offsets will go away, too. In some cases, employers that have been seeing their entire pension bill offset by the proceeds of their side account could see their required contributions shoot to 27% to 30% of their payroll costs, sucking millions of dollars out of their budgets.

School districts and community colleges were some of the most aggressive issuers of pension bonds, and face some of the biggest contribution increases when their side accounts expire. The Milliman estimates show K-12 schools shouldering $695 million in new costs.

“It’ll be really scary, something that could be very problematic from an employment standpoint,” said Bryce Bumgardner, business manager for the Rainier School District.

His district issued a $7.3 million pension obligation bond in 2005. By the time its resulting side account expires in 2027, Bumgardner estimates it will have generated more than $2.5 million in pension contribution savings over two decades. And when that day comes, the district faces $1.2 million in new pension costs each year.

That’s the equivalent of 14.5 full-time teacher positions, roughly 25% of its certified teaching staff of 54. If applied to lower paid positions such as instructional assistants, it’s still equivalent to 25% of the district’s 110 total staff members.

“Getting ready for it is the big thing,” Bumgardner said. The district’s goal is to accumulate savings over the next two years to cushion the blow and avoid the most abrupt budgetary impacts. And it is working under the assumption that local solutions will be the only viable option.

The Legislature stepped in earlier this year with $180 million to help school districts cope with pension cost increases in the current biennium. But that money bought rate reductions that will also expire in 2027, an extra cost not included in Milliman’s numbers.

A similar state bailout may not happen again. State agencies face a $590 million increase in their own pension costs, according to Milliman’s estimates. This comes at a time when policy makers are grappling with wider revenue problems due to tax cuts by the Trump Administration, which undermine personal and corporate income tax receipts, as well as deep cuts in federal spending on programs like Medicaid, food stamps and transportation grants.

Carol Samuels, a municipal banker at Piper Sandler & Co., helped many government employers in Oregon issue their pension bonds and is one of their go-to advisors on side account issues. She said that like last year, she is “hearing a lot of anxiety on the part of school districts who have gotten used to having a healthy credit and are now facing the massive budget consequences of that credit going away.”

One silver lining: the debt service on the bonds issued to fund the expiring side accounts will also be going away, lowering pension costs that aren’t reflected in PERS rates.

It’s not clear how much that will help. Samuels said it’s impossible to generalize, as it depends on how much an individual employer originally borrowed, when, and how fast their payroll has grown in the interim. Districts like Rainier also track their debt service and PERS contributions separately, with different funding sources, so there is no direct swap between the two.

“When I tell them their debt service is going away,” she said, “I don’t get a feeling of huge relief.”

This will be the second round of acute side account-related anxiety for many employers. Many saw big increases in their required pension contributions starting in July because the balance of those accounts had declined as they neared expiration and were spent down faster because of payroll growth, reducing the credits they generated.

But Jake Winship, actuarial manager at PERS, says the next round of related rate increases will be broader, affecting some 20% of the system’s employers, and potentially deeper from a budget perspective.

When Milliman releases preliminary contribution rates in December, he said, “it’s going to be a real wake-up call and will be flashing neon lights for us to get out and do the legwork educating employers. I want to have the shock occur in December of 2025, when they still have runway to deal with this, rather than in 2027.”

If you purchase a product or register for an account through a link on our site, we may receive compensation. By using this site, you consent to our User Agreement and agree that your clicks, interactions, and personal information may be collected, recorded, and/or stored by us and social media and other third-party partners in accordance with our Privacy Policy.