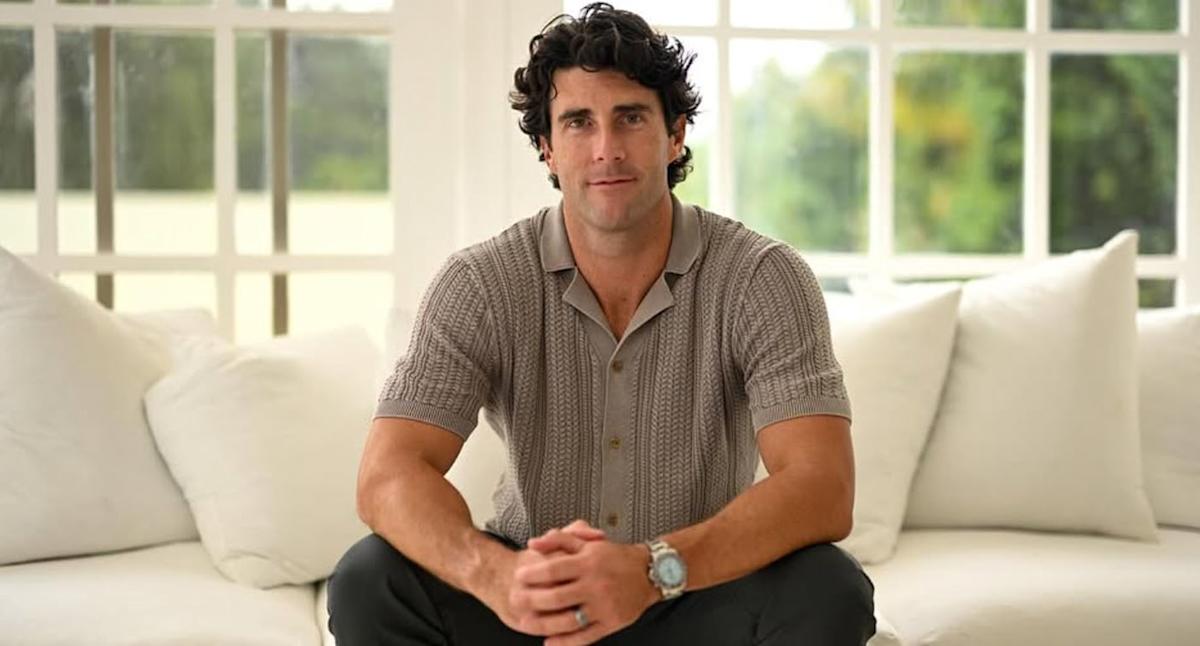

Rich-lister Scott O’Neill shares his learnings after witnessing one of the most ‘powerful wealth creation shifts in Australia’. · Scott O’Neill

Over the past decade, I’ve had a front-row seat to one of the most powerful wealth creation shifts in Australia. I’ve worked with thousands of everyday Australians; engineers, teachers, small business owners, and professionals, helping them rethink property investment.

Together, we’ve facilitated more than $6 billion in acquisitions. And while the deals ranged from suburban warehouses to medical centres and retail complexes, the investors who thrived all shared a common set of behaviours.

Their mindset, not luck, was the differentiator.

I learnt this the hard way myself.

RELATED

Before launching Rethink Investing, I was a residential investor, sinking money into prestige apartments that looked great on paper but bled me dry every month.

It wasn’t until I bought my first commercial property, a small industrial unit, that I experienced true positive cash flow.

That moment not only changed my financial trajectory but also inspired me to show other Australians there was a smarter way.

Here are the five game-changing behaviours I’ve seen across our most successful clients.

For anyone aspiring to build lasting wealth through property, these lessons form a blueprint worth following.

The best investors I’ve worked with treat property as a business.

They understand tenants pay the bills, and in commercial property, tenants cover outgoings like rates, insurance, and maintenance.

Unlike residential landlords who often watch their cash flow evaporate, these investors focus on yield-first strategies.

Importantly, they don’t ignore capital growth.

They just refuse to sacrifice cash flow to chase it.

Timing separates the winners.

When we present a property with rock-solid financials and strong tenant covenants, my most successful clients move decisively, often within 24–48 hours.

The speed isn’t reckless.

They’ve already done their homework on market fundamentals, so by the time the right deal surfaces, they can strike quickly while still running thorough due diligence.

Scott has managed to grow his property portfolio to allow him to live off passive income. (Source: Supplied) · Supplied

While some investors obsess over prestige postcodes, the ones who win big are the ones who know the numbers.

They buy industrial sheds, suburban medical centres, and retail strips that generate positive cash flow from day one.

To them, wealth is built through cash flow compounding over time not through negative gearing and hope.

Success in this space isn’t just about the properties you buy, it’s about the people you connect with.

My top clients actively network, refer other quality investors, and sometimes joint venture on bigger projects.

This collaboration opens doors to off-market opportunities that never hit public listings.

In short: they grow alongside their peers, not in isolation.

Residential investors often treat property like the stock market, betting on price swings.

By contrast, commercial investors think long-term.

With professional tenants, longer leases, and built-in rent increases, they’re essentially buying predictable income streams that hedge against inflation and economic uncertainty.

It’s not a gamble, it’s wealth insurance.

Looking back at $6 billion worth of transactions, one truth stands out: success is predictable when you follow the right behaviours.

Think like a business owner, act decisively, value cash flow over status, invest in relationships, and treat property as a tool for wealth preservation.

I started out making the same mistakes as many investors; chasing the wrong assets, moving too slowly, and prioritising appearances over results.

What changed everything was adopting the very behaviours I now see in my clients.

If there’s one thing $6 billion of transactions has taught me, it’s this: anyone can succeed if they approach investing with the right mindset.

Scott O’Neill is a prominent Australian property investor featured in AFR’s Young Rich List three years in a row. He is an entrepreneur and Founder & CEO of Rethink Group a premium property investment group, host of the top commercial property podcast “Rethink Investing’s Inside Commercial Property’’, co-author of “Rethink Property Investing’’ Australia’s number one commercial property investing book.

The information provided on this website is general in nature only and does not constitute financial advice. Before acting on any information, you should consider your personal objectives, financial situation or needs.