Categorised: Channels, The Stream, Top Story | Tags: benchmark, execution cost, FIX, FX, market impact, month-end, Siren FX, WM

Posted by Colin Lambert. Last updated: October 9, 2025

Market impact metrics were back closer to the average for 2025 at the September quarter-end, with currencies behaving largely as expected by analysts, who predicted relatively light dollar selling.

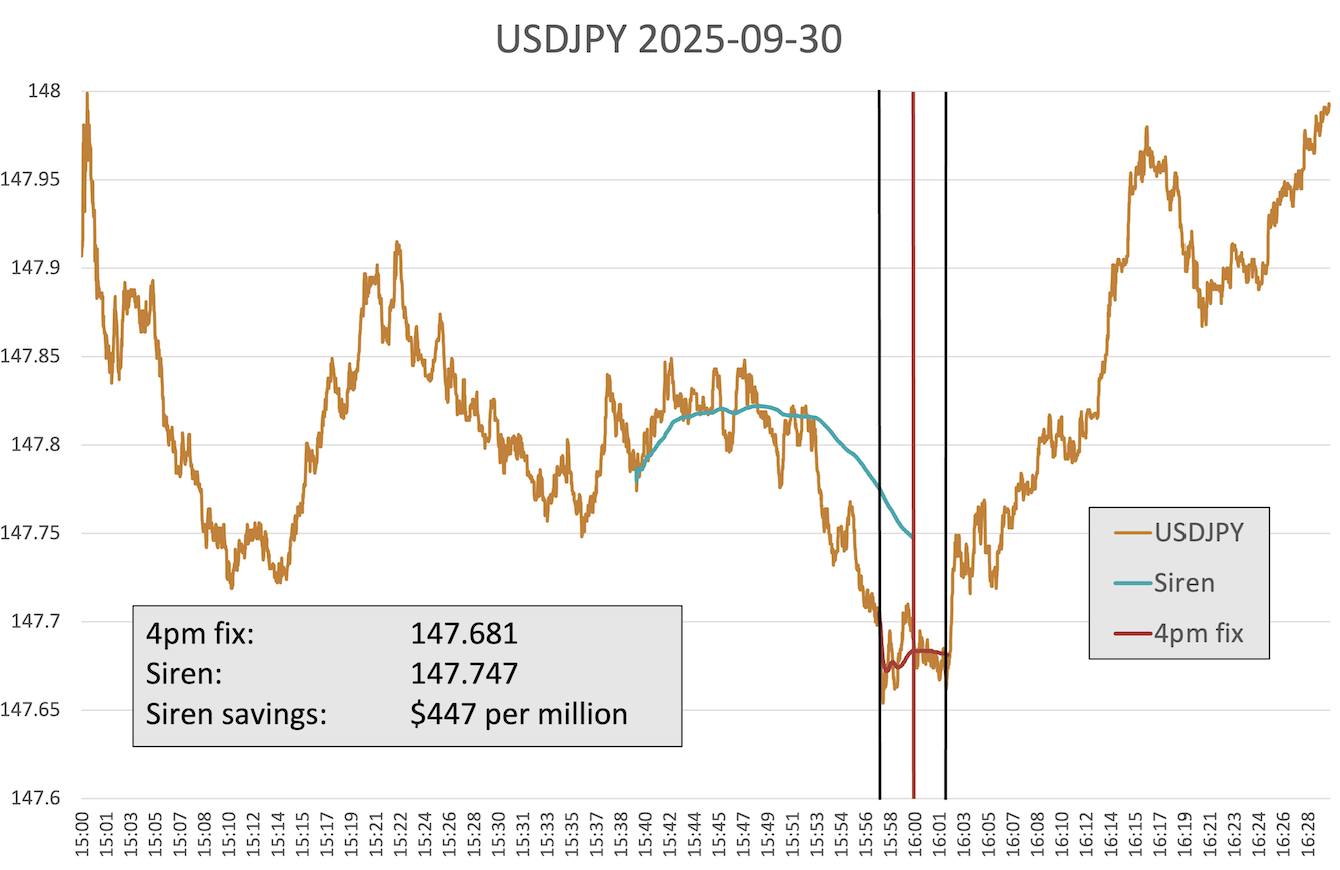

This translated into a series of lower-than-average savings from using the longer 20-minute Siren FX methodology compared to the five-minute WM version. That said, only NZD/USD, at $86 per million was a new low for the year, it was the lowest since July 2024. Only USD/JPY and USD/CHF were above the 2024 average saving, with EUR/USD at just $17 per million – the second lowest in the last 10 months.

Dealing sources say that the dollar selling – that as noted was expected to be light – did indeed turn out to be so, but that did not stop some speculative activity ahead of the WM window, although this too was lighter than recent months. One source suggests that the higher level of uncertainty in markets is dampening speculative appetite for trading the Fix.

To provide more context, the table below also presents projected dollars per million savings across a portfolio of different pairs using a correlation with the Fix calculation, depending upon how much flow was in the direction of the market, or “with the wind”. The rates used for the WM column are calculated using Siren’s proxy five-minute window, which utilises data from New Change FX, however The Full FX endeavours to check that they are a reasonable reflection of those published by the WM.

CCY Pair

WMR 4pm Fix*

Siren Fix

100%**

80%

70%

60%

EUR/USD

1.17496

1.17494

$17

$10

$7

$3

USD/JPY

147.681

147.747

$447

$268

$179

$89

GBP/USD

1.34619

1.34607

$89

$53

$36

$18

AUD/USD

0.66267

0.66263

$60

$36

$24

$12

USD/CAD

1.39136

1.39107

$208

$125

$83

$42

NZD/USD

0.58066

0.58061

$86

$52

$34

$17

USD/CHF

0.79568

0.79533

$440

$264

$176

$88

USD/NOK

9.97750

9.97284

$467

$280

$187

$93

USD/SEK

9.40478

9.40307

$182

$109

$73

$36

Average

$222

$133

$89

$44

*According to Siren FX calculation using New Change FX data

** Savings are in dollars per million by percentage of correlation to the Fix flow. Blue cells signify a projected saving using Siren, Red cells a saving using WMR

Although dollar selling was expected to be light, USD/JPY exhibited classic signs of hedging ahead of the Fix, with the pair drifting lower in the run up to the WM window, trading relatively flatly during the calculation period, before reverting post-Fix. This suggests that a great proportion of the WM flow was hedged before the window even opened, which should be of some concern to asset owners and fiduciaries.

Source: Siren FX

That said, again, flows appear to have been light, and the hedging ahead of the Fix largely appears to have taken place in the five-10 minutes ahead of the WM window opening. It was also the third highest potential saving from the Siren window this year.

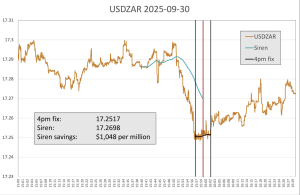

Every month, The Full FX is selecting an emerging market currency pair at random, and before the data is available, to broaden the analysis – this month the selected pair is USD/ZAR. Data is again provided by Siren FX according to the same guidelines in place for the regularly reported currency pairs.

Source: Siren FX

Price action in USD/ZAR was remarkably similar to that in USD/JPY, with the dollar sold off in the five-10 minutes ahead of the WM window opening. Again, actual activity in the window appeared muted, before there was a bounce coming out, and a retracement close to levels seen before the pre-hedging started.

At $1,048 per million, the saving in USD/ZAR was almost right on the 53-month average for the EM pairs selected, it was also the second highest potential saving this year.