Price action in FX markets yesterday certainly looked indicative of a further adjustment in positioning with short positioning lightened further. The FX market is where we saw bigger moves relative to other markets with UST bond yields closing only 1-2bps higher. The S&P 500 closed just 0.3% lower highlighting the lack of fundamental news driving the markets yesterday. We’ve highlighted before the extent of US dollar short positioning amongst leveraged/non-commercial market entities and the lack of fundamental news flow is allowing momentum to take precedence, resulting in a continued lightening of positions. The political uncertainties and data in Europe has reinforced negative yen and euro sentiment. The German Industrial Production data on Wednesday was terrible – the 4.3% MoM drop was much larger than expected with US trade tariffs certainly playing a role in the weakness.

Fed comments yesterday were consistent with current market pricing of a Fed rate cut at the next meeting on 29th October and hence had limited impact on US yields. New York Fed President Williams in a New York Times interview signalled that the vacuum of information on the economy would not deter the FOMC from acting at upcoming meetings and stressed that his focus was on the downside risks to the labour market while the inflation data has revealed less upside pressure from tariffs than earlier assumed. His comments reflect what appears to be the majority view on the FOMC that further cuts are likely over coming meetings. The OIS market remains only about 5bps short of two further 25bp cuts this year.

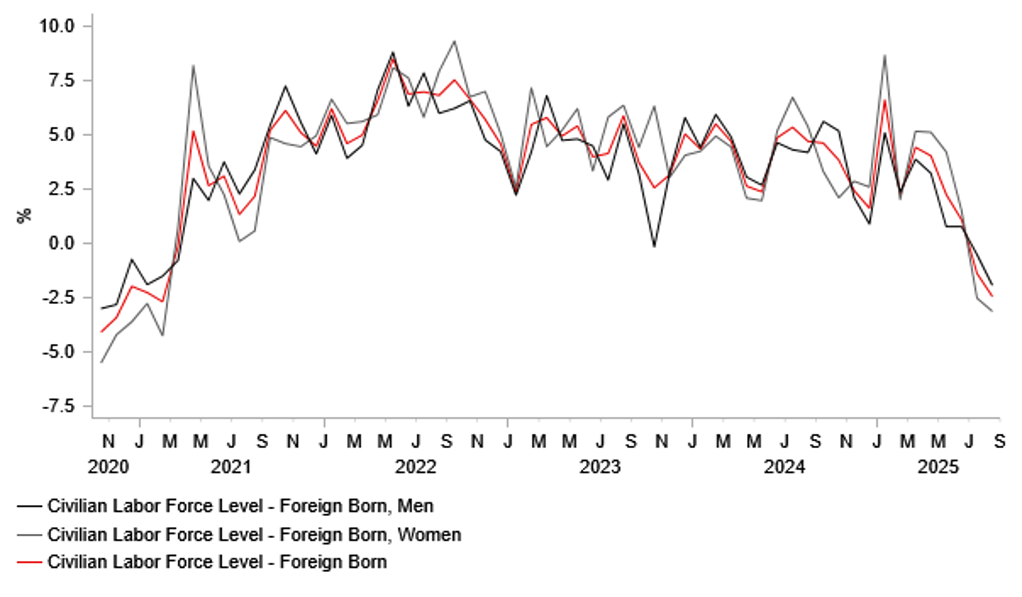

Yesterday, Federal Reserve of Dallas posted a blog outlining analysis conducted in calculating the employment breakeven level – the level of jobs required each month in order to keep the unemployment rate stable. That is an estimate that has gradually been trending down in line with the potential growth rate of the economy and the ageing population. Migration can play a role and given the sudden halt to immigration under President Trump, the Dallas Fed have constructed a new high-frequency estimate of the employment break-even rate and given the immigration decline and other cyclical shifts to labour force participation, this new index reveals the break-even employment rate has dropped from 250k in 2023 to just 30k. This would imply the NFP decline is less a reflection of worsening fundamentals and potential recession and more a healthy correction lower reflecting supply factors. The Pew Research Center has estimated that there has been a decline of 1.4mn immigrants living in the US during the first half of 2025, the first drop since the 1960’s.

The implication of this analysis could be that we need to focus more on the unemployment rate and less on the monthly NFP change and that there is an obvious risk here that the FOMC could over-react and cut too much in anticipation of a slowdown in wage growth that won’t actually materialise. The finding of this analysis is consistent with the fact that this sharp slowdown in payrolls has not coincided with any pick-up in initial claims and that GDP growth remains reasonably solid, helped by the ongoing AI-related investment boom.

LABOUR FORCE GROWTH AMONGST FOREIGN BORN IS LIKELY LOWERING THE EMPLOYMENT BREAKEVEN RATE

Source: Bloomberg, Macrobond & MUFG GMR