Report Overview

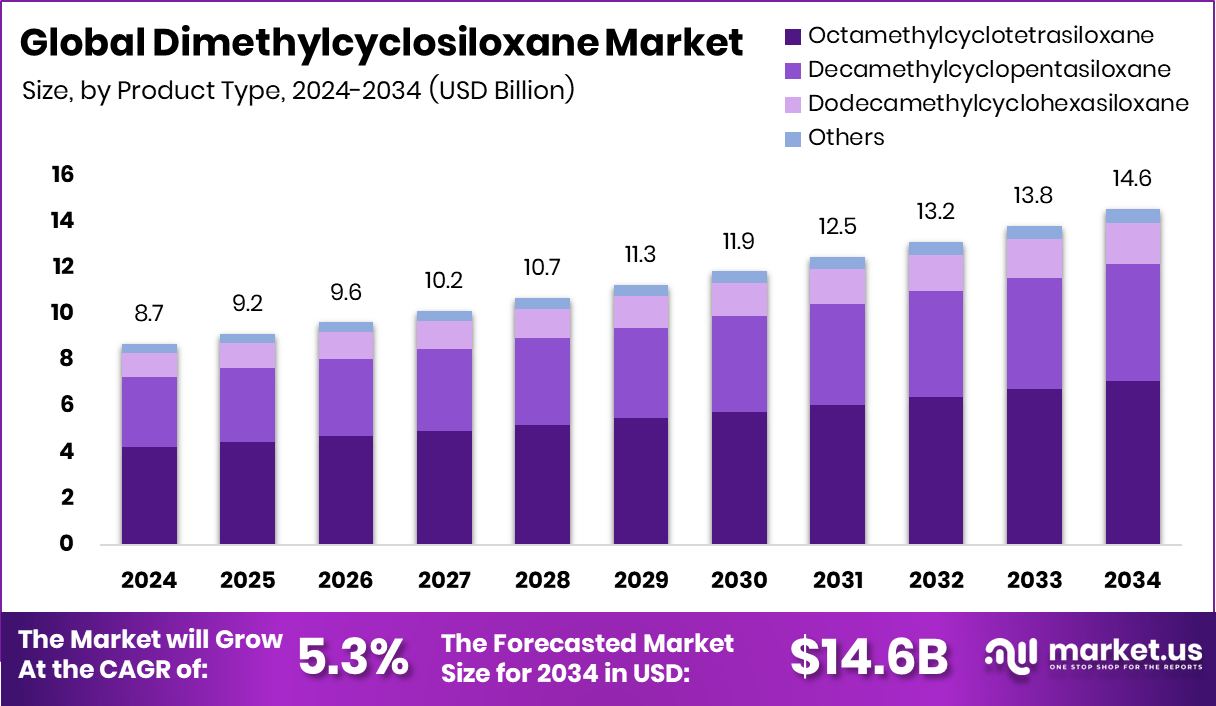

The Global Dimethylcyclosiloxane Market is expected to be worth around USD 14.6 billion by 2034, up from USD 8.7 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034. Rapid growth in silicone-based manufacturing across the Asia-Pacific, 32.8% continues to boost regional consumption.

The Dimethylcyclosiloxane market revolves around the supply and trade of this intermediate chemical and its derivatives, driven by its demand in downstream silicone, personal care, electronics, and industrial sectors. In commercial usage, DMC is a feedstock for producing higher polymers and functional silicones. The market sees pricing pressure from the costs of raw silicon derivatives, regulatory changes around volatile cyclic siloxanes, and the balance between supply from major silicones producers and global demand.

One crucial growth driver is the expanding use of silicones in emerging applications like wearable electronics, advanced adhesives, and high-performance coatings, where the flexibility, thermal stability, and inertness of siloxane chains are valuable. Also, increased adoption in sectors like automotive, medical devices, and green construction supports baseline demand for silicone intermediates. Moreover, supportive policies toward low-carbon materials encourage innovation in more efficient or cleaner production routes.

The demand for dimethylcyclosiloxane is closely tied to the health of its downstream industries. When the silicone, cosmetics, electronics, and automotive sectors expand, uptake of DMC rises. Conversely, slowdowns in construction or consumer goods can dampen purchases. As global industrialization and urbanization persist (especially in Asia), demand remains steady. However, regulatory scrutiny over cyclic siloxanes (for environmental or health concerns) can influence demand or push manufacturers toward safer alternatives, shaping demand trends.

A major opportunity lies in developing greener, more sustainable production pathways with lower emissions and fewer byproducts. For example, Elkem was awarded EUR 1.8 million in EU grant funding to investigate CO₂-free silicon production, which could eventually reduce the carbon footprint of silicone supply chains. The broader climate tech funding environment also supports ventures in advanced materials:

Cottonwood Technology Fund recently announced a €25 M first close of its fourth fund to support hard-tech startups, and Silicon Valley VC fund General Catalyst acquired Venture Highway with plans to deploy $1 billion in India. These capital flows may catalyze innovation in siloxane chemistry, recycling, or alternative monomers, presenting a path for new entrants or incumbents to differentiate their offerings with eco-friendly DMC variants.

Key Takeaways

The Global Dimethylcyclosiloxane Market is expected to be worth around USD 14.6 billion by 2034, up from USD 8.7 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

In 2024, Octamethylcyclotetrasiloxane held a 48.7% share in the dimethylcyclosiloxane market, showcasing dominance.

In 2024, silicone oils captured 44.1% of the Dimethylcyclosiloxane Market, driving substantial consumption.

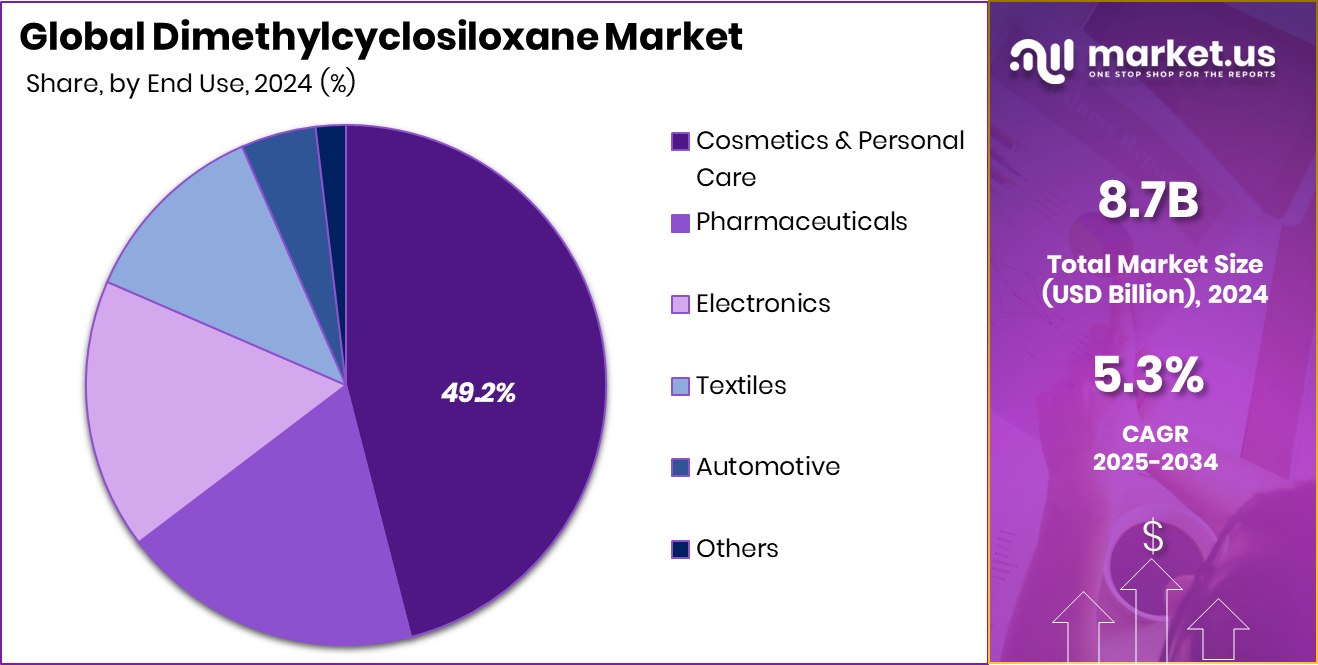

Cosmetics and personal care dominated the dimethylcyclosiloxane market with a 49.2% share in 2024.

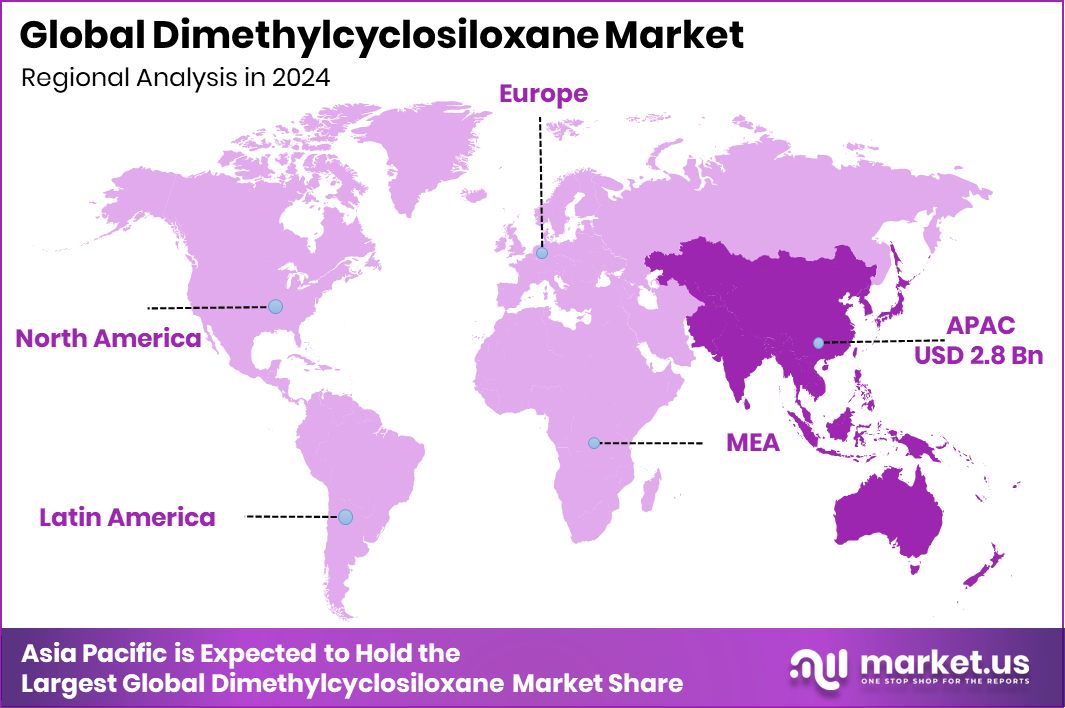

The Asia-Pacific market value reached approximately USD 2.8 billion, showcasing strong industrial demand.

By Product Type Analysis

In 2024, Octamethylcyclotetrasiloxane held a 48.7% share in the Dimethylcyclosiloxane Market.

In 2024, Octamethylcyclotetrasiloxane held a dominant market position in the By Product Type segment of the Dimethylcyclosiloxane Market, with a 48.7% share. This compound serves as a crucial intermediate in the production of silicone fluids, resins, and elastomers, widely used across personal care, electronics, and industrial applications. Its superior stability, low surface tension, and high compatibility with organic compounds have enhanced its demand among end-use industries seeking performance efficiency and material versatility.

The product’s growing adoption in eco-friendly formulations and specialty coatings further supports its market leadership. Additionally, its role as a key raw material in developing low-emission silicone systems positions Octamethylcyclotetrasiloxane as a critical driver of sustainable growth in the Dimethylcyclosiloxane value chain.

By Application Analysis

In 2024, silicone oils accounted for a 44.1% share in the Dimethylcyclosiloxane Market.

In 2024, Silicone Oils held a dominant market position in the By Application segment of the Dimethylcyclosiloxane Market, with a 44.1% share. Silicone oils derived from dimethylcyclosiloxane are widely used for their excellent lubricating, thermal stability, and dielectric properties, making them essential in automotive, electronics, and cosmetic formulations. Their increasing use as defoamers, release agents, and conditioning ingredients in industrial and personal care applications continues to drive demand.

The segment benefits from expanding end-use industries that prioritize high-performance materials with low volatility and environmental safety. Moreover, ongoing innovation in sustainable silicone oil production and enhanced purity grades further support its leading position within the overall Dimethylcyclosiloxane market landscape.

By End Use Analysis

In 2024, Cosmetics and Personal Care captured a 49.2% share in the Dimethylcyclosiloxane Market.

In 2024, Cosmetics and Personal Care held a dominant market position in the By End Use segment of the Dimethylcyclosiloxane Market, with a 49.2% share. The product’s lightweight texture, smooth spreadability, and excellent volatility make it a preferred ingredient in formulations such as skin creams, hair conditioners, serums, and deodorants. Its ability to enhance sensory feel, provide a non-greasy finish, and improve product stability has fueled its strong adoption among cosmetic formulators.

The rising consumer focus on premium and long-lasting personal care products further strengthens this segment’s dominance. Additionally, the growing shift toward high-performance, skin-friendly silicones in beauty and grooming applications continues to position dimethylcyclosiloxane as a key material in modern cosmetic innovation.

Key Market Segments

By Product Type

Octamethylcyclotetrasiloxane

Decamethylcyclopentasiloxane

Dodecamethylcyclohexasiloxane

Others

By Application

Silicone Oils

Silicone Rubbers

Silicone Resins

By End Use

Cosmetics and Personal Care

Pharmaceuticals

Electronics

Textiles

Automotive

Others

Driving Factors

Rising Demand for High-Performance Silicone Materials

One of the major driving factors for the Dimethylcyclosiloxane Market is the growing demand for high-performance silicone materials across diverse industries. Dimethylcyclosiloxane acts as a crucial raw material in producing silicone oils, elastomers, and resins used in personal care, automotive, construction, and electronics applications. Its excellent thermal stability, flexibility, and resistance to moisture and chemicals make it ideal for both industrial and consumer products.

The cosmetics and personal care sector, in particular, continues to expand with rising disposable incomes and a preference for lightweight, smooth-texture formulations. Moreover, strong funding activities like Silicon Valley’s Tribe Capital, planning to raise a $250 million India-dedicated fund, highlight increasing investor confidence in material innovation, potentially boosting silicon-based technology development and market growth globally.

Restraining Factors

Environmental Concerns Over Cyclic Siloxane Emissions

A key restraining factor for the Dimethylcyclosiloxane Market is the growing environmental concern related to emissions of cyclic siloxanes during manufacturing and use. These compounds, including D4 and D5, have been under regulatory scrutiny due to their potential persistence and bioaccumulation in the environment. Several countries are tightening regulations on their allowable concentration in consumer and industrial products. This creates operational challenges for producers, who must invest in cleaner technologies or develop alternative formulations that meet safety standards. A

dditionally, increased compliance costs and complex approval procedures can limit production efficiency and slow market expansion. As environmental standards become stricter worldwide, managing emissions and ensuring sustainable manufacturing practices remain significant hurdles for market participants.

Growth Opportunity

Expanding Use in Sustainable Silicone Manufacturing Processes

A major growth opportunity for the Dimethylcyclosiloxane Market lies in the advancement of sustainable silicone manufacturing technologies. As industries move toward eco-friendly production, there is a rising focus on low-emission and energy-efficient methods of producing siloxane intermediates. Dimethylcyclosiloxane, being a key raw material in silicone-based formulations, benefits from this shift toward cleaner chemistry and circular economy models.

Companies are increasingly exploring renewable feedstocks and closed-loop recycling to reduce waste and improve environmental performance. Furthermore, growing funding in related innovation spaces strengthens this opportunity — for example, construction tech startup LivSYT raised $2.5 million from Silicon Valley Quad and Inventus Cap, signaling investor confidence in sustainable industrial technologies that align with greener and more efficient silicon production pathways.

Latest Trends

Integration of Dimethylcyclosiloxane in Advanced Electronics Manufacturing

One of the latest trends in the Dimethylcyclosiloxane Market is its increasing integration in advanced electronics manufacturing. The compound’s superior thermal stability, electrical insulation, and oxidation resistance make it an essential material for producing silicone-based coatings, adhesives, and encapsulants used in electronic devices. As the demand for 5G technology, smart devices, and high-speed communication systems grows, the use of high-purity siloxanes continues to expand.

Manufacturers are focusing on refining dimethylcyclosiloxane grades to meet the strict quality standards of microelectronics and semiconductor industries. Supporting this trend, Silicon Valley 5G chip startup EdgeQ raised $75 million in funding to boost production, reflecting how advancements in high-tech electronics are driving innovation and material adoption globally.

Regional Analysis

In 2024, Asia-Pacific dominated the Dimethylcyclosiloxane Market with a 32.8% share.

In 2024, Asia-Pacific emerged as the dominant region in the global Dimethylcyclosiloxane Market, capturing a 32.8% share, valued at approximately USD 2.8 billion. The region’s leadership is driven by rapid industrialization, expanding electronics manufacturing, and growing personal care product consumption in countries such as China, Japan, South Korea, and India. Strong demand for silicone-based materials in automotive components, construction sealants, and skincare formulations continues to boost market growth. Government support for advanced materials and favorable manufacturing policies further reinforce the region’s dominance.

North America follows closely, supported by technological innovation and the rising adoption of silicone intermediates in healthcare and industrial applications. Europe maintains a significant share, with a focus on eco-friendly silicone production and compliance with stringent environmental regulations.

Meanwhile, the Middle East & Africa region is gradually advancing due to growing construction and infrastructure investments, while Latin America shows steady progress through increased demand for personal care and industrial silicone applications.

Overall, the regional landscape of the Dimethylcyclosiloxane Market highlights Asia-Pacific’s continued dominance, complemented by steady development across other major global markets driven by evolving industrial and consumer trends.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

Top Key Players in the Market

Hubei Shengbangfan International Trade Co.,Ltd

Zhejiang Sucon Silicone Co.,Ltd.

ALSTONE INDUSTRIES PVT. LTD

Anhui Techchem Industrial Co.,Ltd.

Jiangxi Huahao Chemical Engineering Limit Corporation

Hubei Zhuoxuanyang International

Others

Recent Developments

In January 2025, the U.S. FDA updated an import alert (45-02) that affects products from Anhui (potentially including its chemical lines), which could impact its export or supply chain operations.

Report Scope