Banana Bread Market Size

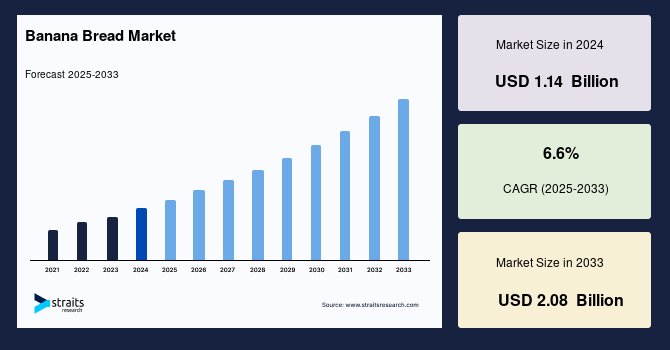

The global banana bread market size was valued at USD 1.14 billion in 2024 and is projected to grow from USD 1.23 billion in 2025 to USD 2.08 billion by 2033, exhibiting a CAGR of 6.6% during the forecast period (2025–2033).

The global banana bread market is consistently growing, propelled by increasing consumer demand for convenient, nutritious, and flavorful baked goods. Banana bread, celebrated for its moist texture and sweet flavour, has transitioned from a homemade classic to a commercial bakery staple. Traditionally made with ripe bananas, flour, eggs, and leavening agents, it now comes in various forms: gluten-free, vegan, low-sugar, and protein-enriched, catering to evolving dietary trends. The booming café culture and on-the-go breakfast habits have also fueled demand for packaged banana bread in supermarkets and coffee chains. Combined with the influence of social media trends and digital baking content, banana bread has reemerged as a versatile, cross-generational favourite in the global bakery sector.

Banana Bread Market Trend

Functional snacking sparks cross-category expansion in banana bread products

The banana bread market is transforming significantly as health-conscious consumers increasingly seek functional, allergen-friendly, and convenient alternatives to traditional baked goods. This evolving preference pushes manufacturers to reimagine banana bread formats, blending nostalgic flavour with nutrient-dense, clean-label ingredients.

For instance, in February 2025, Michigan-based better-for-you brand Cooper Street introduced a banana bread–flavoured granola bake featuring real bananas, quinoa, chia seeds, and flax. Free from artificial additives and common allergens such as dairy, nuts, and soy, the product debuted on QVC and quickly expanded to Cooper Street’s e-commerce platform in March, followed by a broader launch on Amazon in April.

As consumer expectations shift toward snacks that deliver indulgence and functionality, cross-category innovations like these set a new standard in the banana bread space.

Banana Bread Market Growth Factor

Health-forward formulations

The growing consumer shift toward bakery products that combine indulgence with functional nutrition drives market growth. As awareness of digestive health and clean-label eating rises, brands are innovating banana bread formulations to cater to wellness-driven lifestyles.

For instance, in November 2024, wellness-focused Belly Brand Foods launched its Collagen Banana Bread baking mix, specifically designed to offer indulgent taste and targeted health benefits. The mix is crafted with just six gut-friendly ingredients: real bananas, organic coconut flour, organic coconut sugar, cinnamon, sea salt, and grass-fed bovine collagen peptides.

As more consumers seek bakery products that align with dietary sensitivities and wellness goals, demand is rising for ingredient-conscious, health-boosting alternatives that don’t sacrifice flavour or texture. Brands, particularly in the better-for-you segment, are introducing banana breads that double as functional snacks, driving strong retail interest across online and speciality grocery channels.

Market Restraint

Short shelf life and ingredient sensitivities

Despite its popularity as a comfort food and wellness snack, banana bread remains highly perishable due to its moist texture and natural sugar content, making it vulnerable to mould and rapid degradation under standard retail conditions. Unlike packaged snacks with extended shelf lives, banana bread, especially those with clean-label, preservative-free claims, requires careful cold chain logistics or frequent replenishment. This complicates distribution for retailers and limits its accessibility in mainstream convenience and vending channels.

In addition, including allergens such as eggs, dairy, or nuts in traditional recipes presents challenges in appealing to the growing base of consumers with dietary restrictions. This fragility in product formulation and storage stability puts pressure on brands to continuously reformulate, adopt modified atmosphere packaging (MAP), or limit geographic rollout.

Market Opportunity

High protein baking mixes tap demand for post-workout and wellness snacks

The development of high-protein baking products that cater to wellness-oriented and fitness-driven consumers provides an opportunity. As demand surges for clean-label snacks that offer functional benefits, such as muscle recovery, satiety, and sustained energy, banana bread is being reimagined to meet these nutritional expectations.

For instance, in April 2025, Hello launched its Protein Banana Bread Mix, delivering 15 grams of protein per slice using a blend of gluten-free flours and premium whey protein isolate. With a price point around CAD 19.95, the product directly appeals to health-conscious consumers looking for convenient, macro-balanced baking solutions without artificial additives.

This shift toward protein-enriched products reflects a wider industry trend, where traditional indulgent items like banana bread are being adapted for post-workout snacks, meal replacements, and clean snacking occasions. Introducing high-protein banana bread offerings is a strategic avenue for category expansion, especially within health retailers, online wellness platforms, and boutique grocery channels.

![]()

If you have a specific query, feel free to ask our experts.

Regional Analysis

North America leads the global banana bread market, supported by a strong cultural association with baked goods across all meal occasions. This region’s consumers embrace classic and modern formats, ranging from homemade-style loaves to high-protein, snackable bars. Banana bread is widely available in supermarkets, cafés, fitness centres, and even school cafeterias, reflecting its broad appeal across age groups. The market here is also influenced by growing nutritional awareness, which has pushed brands to develop options that are low in sugar, high in fibre, and free from common allergens. Additionally, the rise of online grocery platforms has expanded access to premium and speciality banana bread products across suburban and rural areas.

The United States remains the leading market for banana bread, driven by a strong culture of home baking, evolving consumer preferences for clean-label bakery products, and the widespread popularity of banana-based snacks. Retail chains such as Trader Joe’s and Whole Foods have introduced gluten-free, low-sugar, and plant-based banana bread SKUs in response to shifting dietary patterns. Moreover, cafés and bakery chains across urban hubs are seeing increased foot traffic from consumers seeking artisanal banana bread with gourmet inclusions like walnuts, dark chocolate, and flaxseed. The growing influence of online baking communities and recipe-sharing platforms amplifies DIY consumption.

Canada’s banana bread market is expanding steadily, bolstered by increased consumption of baked goods in retail and foodservice channels. With the rise of plant-based diets, Canadian bakeries offer dairy-free and vegan banana bread made with oat milk and natural sweeteners like maple syrup. Additionally, retailers cater to allergy-sensitive consumers by offering nut-free and gluten-free variants. The market also benefits from seasonal product innovations, such as pumpkin-spiced banana bread in fall and tropical banana-pineapple blends in summer.

Asia-Pacific Banana Bread Market Trend

The Asia-Pacific region is seeing rapid growth in banana bread adoption, driven by increasing urbanisation, changing dietary habits, and exposure to Western-style bakery trends. Banana bread is emerging as a modern, health-conscious choice for young consumers and professionals. Its naturally sweet taste and soft, moist texture make it an appealing alternative to sugary snacks or dense breads. Regional variations, such as incorporating coconut, almond flour, or local spices, help tailor the product to local palates. The rise of boutique bakeries and health cafés in urban hubs further supports its expanding presence in this evolving market. Packaged banana bread is also gaining traction in convenience stores and food delivery platforms, meeting the demand for portable breakfast and snack options.

China is witnessing a significant uptick in banana bread consumption, particularly among younger urban consumers embracing Western-style bakery products. The trend is fueled by growing demand for healthier snacks that bridge traditional and Western flavours. Local manufacturers are infusing banana bread with regional ingredients such as red bean paste, black sesame, and green tea to appeal to domestic palates. Furthermore, e-commerce platforms like JD.com and Tmall are seeing strong growth in ready-to-eat banana bread sales, often marketed as nutritious breakfast or afternoon snacks.

India’s banana bread market is evolving rapidly as health-conscious consumers shift away from high-sugar traditional sweets to more natural baked alternatives. The surge of boutique bakeries and cloud kitchens across metro cities like Bengaluru, Delhi, and Mumbai has made artisanal banana bread a staple on brunch and café menus. Banana bread made with jaggery, whole wheat, and millets is gaining traction, especially among middle-income households. Additionally, supermarkets are expanding shelf space for pre-packaged banana bread, particularly in premium and organic food aisles, signalling rising mainstream adoption.

Europe Banana Bread Market Trend

In Europe, banana bread has become familiar in cafés, organic bakeries, and weekend markets. The region’s consumers strongly prefer authenticity and natural ingredients, often favouring banana bread with additions like walnuts, seeds, or dried fruit. The broader shift toward artisan and plant-based baked goods continues to shape product innovation. The popularity of vegan and gluten-free lifestyles has encouraged widespread experimentation with alternative baking methods, making banana bread an adaptable product for diverse dietary needs and culinary trends across the continent. Clean-label and minimally processed formulations are especially valued, as health-conscious consumers prioritise transparency in sourcing and production.

Germany presents a mature yet innovation-driven banana bread market, supported by growing demand for natural, preservative-free baked goods. Artisanal bakeries focus on minimal-ingredient recipes, while commercial producers emphasise organic and climate-neutral certifications. German consumers increasingly prefer spelt flour and sugar-free formulations, which align with national dietary preferences for low-GI and allergen-free foods. Moreover, banana bread is being adopted into breakfast offerings across hotel chains and workplace cafeterias, reflecting its positioning as a nutritious, energy-dense snack.

France is experiencing renewed interest in banana bread as part of a broader shift toward globalised bakery offerings and hybrid patisserie trends. While traditional baked goods like croissants and brioches still dominate, banana bread has carved a niche in gourmet cafés and speciality bakeries across Paris, Lyon, and Bordeaux. Vegan and gluten-free banana bread varieties have gained prominence in health food stores and bio supermarkets like Naturalia and Biocoop. France’s focus on artisanal quality is reflected in the growing number of banana bread offerings featuring Madagascan vanilla, hand-cracked walnuts, and unrefined sugars.

Need a Custom Report?

We can customize every report – free of charge – including purchasing stand-alone sections or country-level reports

Product Type Insights

Gluten-free banana bread has emerged as the most dynamic product category in recent years, particularly among consumers with dietary restrictions or health-focused lifestyles. Gluten-free variants utilise alternatives such as almond flour, oat flour, or rice flour to ensure compatibility with gluten-sensitive diets. These breads often incorporate natural sweeteners like honey or coconut sugar to cater to clean-label preferences. Demand for gluten-free baked goods has surged in the U.S. and Canada, bolstered by a broader shift toward digestive wellness and plant-based eating. Manufacturers are responding with innovative blends that retain traditional banana bread’s moist, rich texture while eliminating common allergens.

Ingredient Insights

Organic Ingredients represent a fast-growing segment in the banana bread market as consumers seek healthier and more sustainable options. Organic bananas, cage-free eggs, and unrefined oils like coconut or avocado oil are increasingly used to enhance product purity and reduce chemical exposure. The appeal lies in the perception of better taste, environmental consciousness, and non-GMO sourcing. Europe, particularly Germany and France, has shown a robust appetite for organic baked goods, driven by strict regulatory standards and rising demand from eco-aware households. This segment also benefits from increased shelf presence in organic sections of supermarkets and health stores.

Distribution Channel Insights

Online Retail has become a significant distribution avenue for banana bread, especially post-2020, as direct-to-consumer (DTC) food delivery models gained traction. E-commerce platforms and branded websites now offer fresh, made-to-order banana bread with customizable options, such as add-ins (nuts, chocolate chips, protein). This channel also supports subscription services, gift packaging, and doorstep delivery with freshness guarantees. Moreover, online reviews and influencer marketing are accelerating product discovery and conversions, especially among millennial and Gen Z shoppers. Brands also experimented with compostable packaging and cold-chain logistics to maintain freshness during transit.

End-User Insights

Cafés and Coffee Chains form the leading commercial end-user segment for banana bread, leveraging it as a versatile, low-prep bakery item that pairs well with beverages and appeals across age groups. Popular for its moist texture and ability to remain shelf-stable for extended periods, banana bread fits seamlessly into breakfast and snack menus. Many chains use banana bread as a base for upselling, adding whipped butter, nut spreads, or toasting options to enhance perceived value. Chains like Starbucks and Tim Hortons have long featured banana bread in their bakery assortments. Furthermore, grab-and-go counters in urban cafés are increasingly stocking banana bread in pre-sliced packaging for added convenience.

Market Size By Product Type

Classic Banana Bread Loaves

Gluten-Free Banana Bread

Vegan Banana Bread

High-Protein/Functional Banana Bread

Banana Muffins and Mini Loaves

Banana Bread Baking Mixes

Company Market Share

The banana bread market is moderately fragmented, with several health-centric and heritage baking brands gaining prominence in retail and e-commerce. Their growing influence is rooted in brand legacy, health-focused innovation, and direct-to-consumer (DTC) engagement.

GoNanas, LLC: GoNanas, founded in 2017 in Chicago by Annie Slabotsky and Morgan Lerner, is a women-owned brand specialising in gluten-free, vegan, and nut-free banana bread mixes made from clean, plant-based ingredients. Available on their website, Amazon, and major retailers like Target and Whole Foods, they’re known for innovative monthly flavour drops and a strong digital presence.

List of key players in Banana Bread Market

General Mills, Inc. (Betty Crocker, Pillsbury)

King Arthur Baking Company, Inc.

Simple Mills, Inc.

GoNanas, LLC

Grupo Bimbo, S.A.B. de C.V. (Dempster’s, Stonemill)

Bimbo Bakeries USA (Sara Lee, Entenmann’s)

Flowers Foods, Inc. (Nature’s Own, Dave’s Killer Bread)

McKee Foods Corporation (Little Debbie)

The Banana Bread Co.

Banana Manna, LLC

Dank Banana Bread

Krusteaz (Continental Mills, Inc.)

Bob’s Red Mill Natural Foods, Inc.

Miss Jones Baking Co.

Abe’s Vegan Muffins

Recent Developments

January 2025– Flowers Foods, Wonder Bread and Nature’s Own parent company, announced the acquisition of Simple Mills, a premium better-for-you snack and baking mix company, for $795 million. This strategic move aims to strengthen Flowers Foods’ position in the health-driven bakery category. Simple Mills, known for its clean-label products including gluten-free banana bread mixes, has strong shelf placement in over 30,000 stores.

April 2025– Hawai‘i’s Department of Education piloted ʻulu (breadfruit) banana bread across 90 schools. Developed by Kaiser High School’s Food Services Manager Christian Lee Tomita and baker Edison Ching, the recipe used 240 pounds of ʻulu flour sourced from the Hawaiʻi ʻUlu Cooperative and served more than 11,000 students.

Banana Bread Market Segmentations

By Product Type (2021-2033)

Classic Banana Bread Loaves

Gluten-Free Banana Bread

Vegan Banana Bread

High-Protein/Functional Banana Bread

Banana Muffins and Mini Loaves

Banana Bread Baking Mixes

By Ingredient (2021-2033)

Wheat-Based (All-Purpose or Whole Wheat Flour)

Almond and Nut-Based Flours

Gluten-Free Grains (Rice, Oats, Sorghum)

Plant-Based Sweeteners (e.g., Coconut Sugar, Dates)

Inclusions (Nuts, Chocolate Chips, Seeds)

Functional Additives (Protein Isolates, Fiber Enrichments)

By Distribution Channel (2021-2033)

Supermarkets and Hypermarkets

Speciality and Health Food Stores

Online Retailers (DTC and E-Commerce Platforms)

Cafés and Artisan Bakeries

Foodservice and Institutional Catering

Convenience Stores

By End-User (2021-2033)

Health-Conscious Consumers

Vegan and Gluten-Free Product Consumers

Households and Individual Buyers

Cafés, Coffee Shops and Quick-Service Restaurants

Schools, Colleges, and Institutional Buyers

Fitness and Meal Prep Service Providers

By Region (2021-2033)

North America

Europe

APAC

Middle East and Africa

LATAM

Frequently Asked Questions (FAQs)

The global banana bread market size was worth USD 1.14 billion in 2024.

Top industry players are General Mills, Inc. (Betty Crocker, Pillsbury), King Arthur Baking Company, Inc., Simple Mills, Inc., GoNanas, LLC, Grupo Bimbo, S.A.B. de C.V. (Dempster’s, Stonemill), Bimbo Bakeries USA (Sara Lee, Entenmann’s), Flowers Foods, Inc. (Nature’s Own, Dave’s Killer Bread), McKee Foods Corporation (Little Debbie), The Banana Bread Co., Banana Manna, LLC

North America has the highest growth in the global market.

The global market growth rate growing at a 6.6% from 2025 to 2033.

High protein baking mixes tap demand for post-workout and wellness snacks opportunity for the market.