Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Everyone’s financial journey is different; Piggyvest gives you the tools to plan, save, and invest, so you can create your own money story. Start now with as low as ₦1,000!

What’s your earliest memory of money?

I started becoming conscious of it around the age of 10 or 11. My dad’s import-export business fell into issues, and my serial entrepreneur mum took over as breadwinner. So, we rarely had enough, and my earliest memories of money were of having to manage it.

How much “managing” did you have to do?

I didn’t get sent out of school for not paying my fees, but I remember having to heavily pad my school list. That way, even when my parents cut down the number of items they could buy, I’d have the basics.

I carried this habit to uni as well. My pocket money stayed at ₦10k/month throughout my time in school. For context, I was in uni between 2014 and 2019.

₦10k was nothing to write home about, so I often had to lie to get extra money. Thankfully, I studied pharmacy, and we always had to buy one textbook or another. So, I could say I needed ₦30k for a ₦10k textbook.

It wasn’t the nicest thing to do, but I had almost no choice. I couldn’t do runs or other bad things to make money. Maybe it was my mother’s prayers.

When was the first time you worked for money?

I had stints renting out my storybooks in primary school for ₦50 – ₦100. I also sold Parago sweets for a bit in secondary school when classmates kept begging me to give them mine. I was like, “Don’t beg me. Just buy it.” So, people bought, and I started buying to resell in school for ₦50 profit.

However, my first proper income was in 300 level. I really loved taking pictures and writing about my everyday life. My inspiration was Linda Ikeji’s story – how she became rich from blogging, and I thought, “Maybe I can start doing this too.”

I had a hand-me-down phone. Those types of phones that your elder sibling finishes using before passing them down to you. I used the phone to take pictures and write stories about my daily activities. At first, I only posted my content on my family’s group chat. However, my brother encouraged me to share it online and on my WhatsApp status as well. So, I did that.

One day, a contact reached out, saying she’d love for me to write for an entertainment blog she was starting. I planned to do it for free because I honestly didn’t feel confident enough in my writing. But she offered a ₦10k/month pay plus data. I was like, “Ah. So I can make money from this?”

Haha. Almost every writer’s rite of passage

Besides writing, I handled the blog’s Instagram page. I just knew Instagram was a place to post pictures, write captions and put hashtags. Social media management was a new terrain, and I really didn’t know what to do. But I’m quite solution-oriented; once you give me something, I must find a way to make it work.

So, I did some research and learnt from online business coaches. I worked with her for six months, then she stopped the blog.

However, I didn’t stay unemployed for long. One of the online business coaches I followed had a thing where she allowed people to pitch their services and share opportunities in her comment section on certain days.

It was from there that I met a client who was looking for someone who could write their Instagram captions. I didn’t even know this was a thing. They paid ₦2500 per caption, and sometimes I’d write two captions a day. I did this for three months, and it further opened my eyes to the fact that there was money to be made in this social media thing. So, I kept pitching people.

I DM’ed small businesses offering to manage their social media pages. Now that I think about it, I was severely undercharging. I’d tell them ₦15k, they’d price me to ₦10k, and I’d collect it. I was stuck at ₦10k for almost two years. I didn’t charge higher out of fear that people would refuse to pay more than that.

Then, in 2018, I made my first “big money”.

Tell me about that

People were always asking me about my hair, so I started a natural hair blog. I thought it’d be a way to make my Linda Ikeji blogger dreams come true.

While I didn’t make money directly from the blog, it helped me get in the eyesight of my next client — a diaspora-based Nigerian who wanted me to write articles for their mental health platform. The articles were SEO-focused; they provided me with keywords, and I wrote based on those. They paid ₦75k per article, and I worked on two articles monthly.

The contract lasted three months, and oh my God, I felt so rich that period. Unfortunately, I mismanaged the money. Suddenly, cooking became irritating. I visited restaurants, bought food for friends, and just flexed all the money. It felt good to have my own money, but I didn’t manage it well.

I didn’t get another gig in uni after this one. I was now in my final year, so I just focused on graduating.

What came next after uni?

An internship was supposed to come next, but while I waited to land a placement, I took on a locum role at a pharmacy. My salary was ₦40k, but I almost never received the full amount because my employer deducted money for various reasons, from punishment for lateness to the cost of expired or lost drugs. I didn’t mind because I lived with my parents and had no expenses.

I worked there for seven months before I got a proper one-year internship at a community pharmacy in 2020. For most people in the pharmacy space, community pharmacies are the last option, but I actually preferred them. I could actually impact people directly. Plus, I didn’t want to work at a hospital because I can’t stand the smell.

Please don’t ask why a pharmacist can’t stand a hospital. I studied the course purely for materialistic reasons. My mum sold me the dream of pharmacists driving cars and having money.

Haha. Real. What was the pay at the internship like?

My salary was ₦75k/month. Sometimes it went up to ₦85k because of my initiative to market drugs and drive sales. I had noticed some products weren’t moving, so I put my digital skills to use.

Our target audience was older people, and since this category uses WhatsApp frequently, I started a broadcast messaging campaign to our customers, highlighting the different products. I also shared health and wellness tips on specific days. It worked. Sales were consistently good while I worked at the pharmacy.

I completed my internship in September 2021, and NYSC was supposed to come next. While I waited for the call-up letter, I started applying to social media management jobs on LinkedIn.

You weren’t planning on practising pharmacy?

I wasn’t. I know most people strive for financial freedom, but location freedom was at the top of my list. I wanted the freedom of working remotely. Also, I’m not sure why, but I just felt cutting off transport costs would equal more money for me.

One of the roles I applied for was a social media associate role at a social enterprise I really admired. They didn’t get back to me for about a month, so I thought I didn’t get it, only for me to receive an interview invitation as I was rounding up NYSC orientation camp.

During the interview, they asked about my salary expectations, and I said ₦250k. My sister had told me to give that figure, and I followed her advice even though I thought it was a lot to ask for.

The interviewer said, “Hmm? What did you say?”

I repeated the amount with confidence, even though I was shaking.

Then she said, “Hmm. Okay.”

Ah. Please tell me you got the job

I honestly thought that was the end. However, to my surprise, I received a congratulatory email to proceed to the next interview stage less than one hour after the call. To cut the long story short, I got the job in December, and they gave me the ₦250k. But that was the gross pay; my net salary came down to around ₦188k after deductions.

I was still excited sha. I had a pension, HMO and all the other corporate things. It was my first big girl job and the first time I had all those benefits, so it was a big deal. On top of all that, it was fully remote.

Love to see it. How did you juggle the job with NYSC?

I was posted to a university for NYSC, and interestingly, they were on strike for almost the entirety of my service year. So, I didn’t work there. I just collected my ₦33k allawee.

I also got another ₦120k/month social media management job during my NYSC year. I had updated my LinkedIn to reflect my new role and was a bit more active on the platform when the client reached out to offer me the gig. I should’ve asked to be paid in dollars, since it was a US-based company, but I didn’t know better. Plus, I didn’t even have the facilities to collect payment in dollars, so there’s that.

So, I had two income sources (plus allawee) during service year, bringing my monthly income to around ₦340k. I was balling.

How long did you manage both jobs?

I stayed at both for a little over a year. I left my 9-5 in early 2023 because it felt like the right time to leave. I was tired of social media management and, to make it worse, I was juggling two demanding SMM jobs. I felt like I was dying inside.

So, I left my regular 9-5 first, and left the other in mid-2023. I transitioned to a media company, where I served as a project manager. The job came with a pay cut to ₦150k/month, and I think emotions played a role in my accepting the offer. My employer was a celebrity I admired and wanted to work with, so I didn’t negotiate.

Also, I took the job to explore something outside social media, but guess what? I ended up doing social media management there, too.

I’m screaming. How come?

I was employed to manage a film project, and after its completion, my employer continued to pay me as usual. I felt guilty about collecting a salary without working. So, when I noticed their social media wasn’t doing so great, I took it upon myself to manage the page.

The page grew in a relatively short time, and my employer decided to start pitching to companies that we could also handle their brand and social media. Of course, this extra work came to my desk because they saw I was doing a good job.

That’s how I became the brand and marketing person managing the portfolios of different brands. At one point, we had five brands on retainer. I did that for a few months before I started to think, “I can actually do this on my own.”

I’d essentially created a new income source for the company, but my pay was nothing compared to how much I was bringing in. So, even though I was scared, I quit my job in September 2024 to start freelancing.

Did you have any immediate plans?

I honestly didn’t. I had no plan or clients, but I was tired of 9-to-5 and wanted to try freelancing.

Fortunately, I got my first client almost immediately. Someone I’d worked with referred me to an international organisation for a four-month project. The project paid ₦250k/month to lead the marketing for their film project.

While this was happening, I was showing up on social media. I thought it was important for people to know what I did, since referrals have been the primary means of success in my life’s journey. So, I was working on my skills, getting better at LinkedIn and sharing my findings across my channels: WhatsApp status, Instagram and LinkedIn. I even did videos sometimes.

One day, a friend asked, “You do LinkedIn optimisation right? A client needs it for their MBA. What are your rates?” I didn’t have any rates. I was just learning LinkedIn for myself.

I asked someone active on LinkedIn how much he’d likely charge to optimise someone’s profile. He said “₦10k” and it immediately gave me PTSD from my ₦10k days. There was no way I was returning to charging ₦10k for services.

So, what did you do?

Thank God for ChatGPT. I asked it to provide me with three different optimisation packages, with the least expensive package costing ₦100k. It helped with the big, big English, which I carried to Canva and designed into a proper rate card.

The client liked it, even though she priced me too much. She wanted the ₦200k package for ₦100k. We eventually agreed that she’d bring two more clients who would pay ₦100k, too. That’s how I got ₦300k sharp sharp for something I could do within one or two hours.

After that gig, the client referred me to more people, and those ones referred me too. In two weeks, I made ₦1m from LinkedIn optimisation.

This same LinkedIn optimisation?

See, the English in my offerings was plenty. Besides creating profile banners, optimising their headlines and all the other updates, the most expensive package also included ready-made content for one month. They didn’t even have to worry about posting. I created the content and scheduled it. So, there was a lot of value.

The content idea helped me get several returning clients. They were like, “This is great. How much would it cost you to just manage my LinkedIn?” So, I slapped a price on it. Again, my lowest price was ₦100k.

I started the LinkedIn hustle in September 2024, and by December, I had four steady clients. I also got a client who paid me in dollars — $500/month to manage her Instagram and LinkedIn.

In October, my former boss reached out for help managing her personal brand on LinkedIn and Instagram. I knew she had money, so I charged ₦350k. She haggled a bit, and we settled on ₦250k/month to post twice weekly on both platforms.

You were on a roll

I was. However, the goal was to make sure all these clients stayed long-term. They’d all come towards the end of the year, and I didn’t want a three-month arrangement where they’d disappear again. I actually prayed on December 31st for my clients to follow me into the new year.

Fortunately, they did. I’m proud to say I’m even considering registering a company. Between December 2024 and now, I’ve onboarded four more clients, whom I manage their entire personal brand. As a result, my services have expanded beyond LinkedIn. If they want to start a podcast or website, I charge separately to handle the PR, arrange interview rounds, and all that.

Amazing. What’s your income like these days?

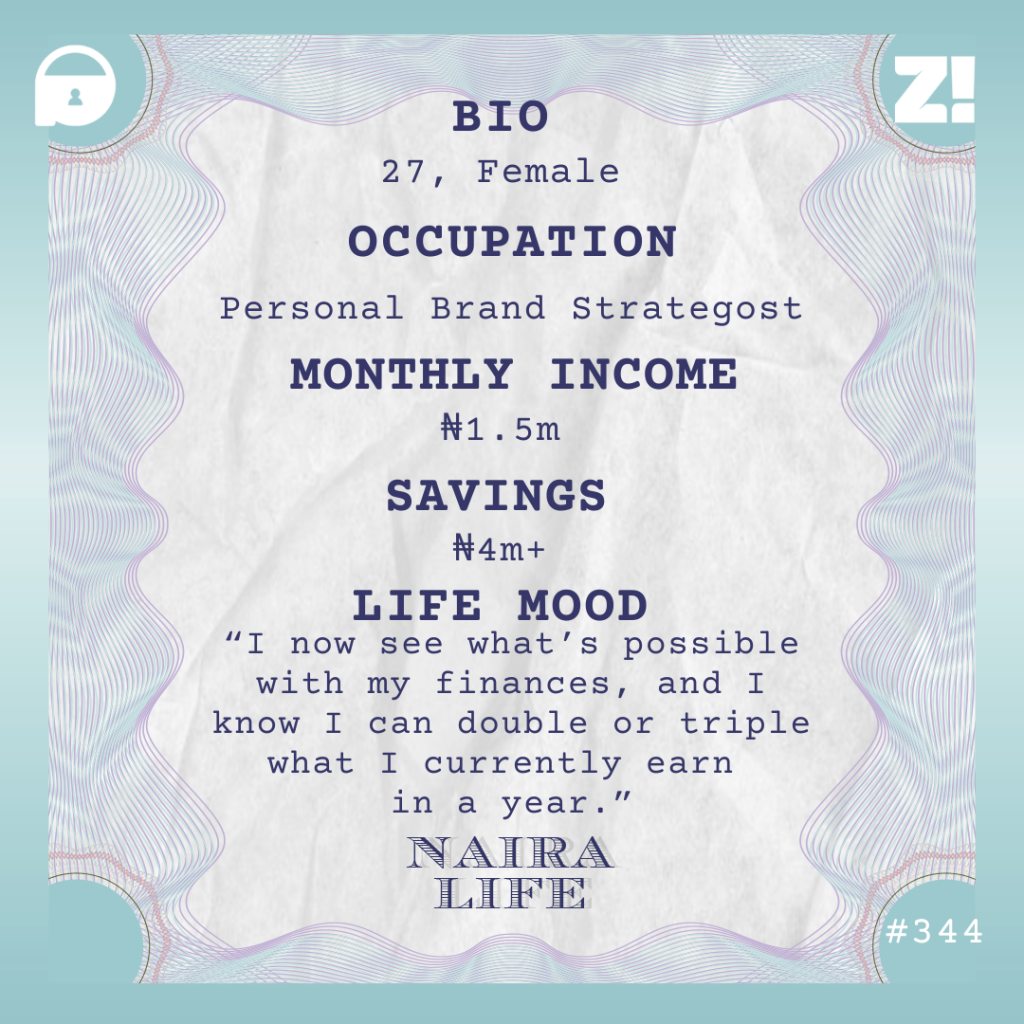

I earn at least ₦1.5 million per month from my naira clients and $600/month from my dollar-paying clients. This is my main job now; I don’t have a 9-to-5 anymore, so you could say I’m a full-time freelancer.

However, I’m looking at turning it into a creative business, specifically a personal branding agency. Personal branding brings me the most money, so I intend to position my agency to handle branding for C-level executives, founders and entrepreneurs with more than 10 years of experience in the industry.

Setting up a proper business will also allow me to hire some help to assist with the work. It’s a lot now, and I need to get assistance, especially because I plan to increase my rates in the new year.

What kind of lifestyle does your income afford you?

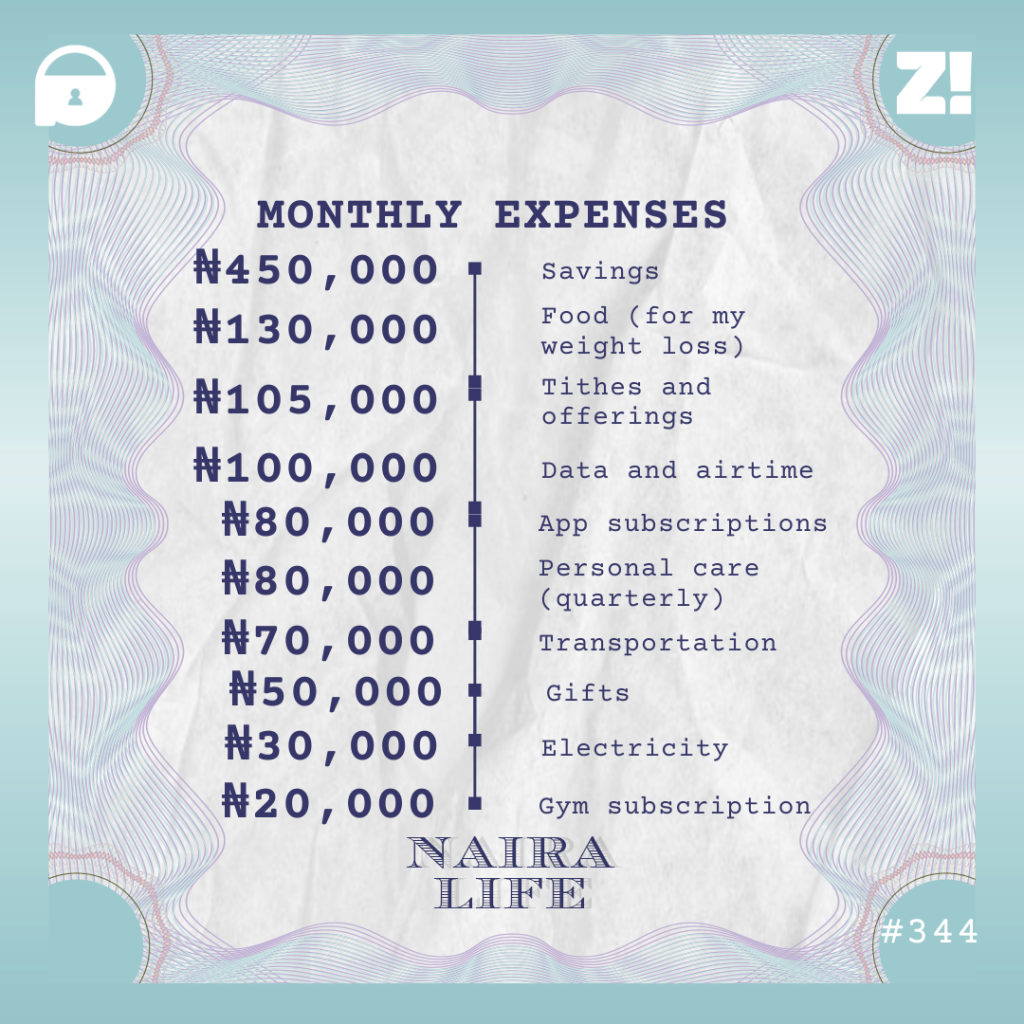

I can afford most of the things I need. Thankfully, I still live with my parents, so I don’t have rent expenses. What typically takes my money are subscriptions (all them Canva, ChatGPT, iCloud and the rest), data, gym subscriptions, cab rides and savings.

Let’s break that down into a typical month

How would you describe your relationship with money?

It’s still an ongoing thing. I grew up with a sense of scarcity, and I’m just now getting used to making money. I’m not proud of it, but I didn’t start saving until late 2024. Because I grew up with scarcity, I thought, “Now that I have money, I need to get everything I want before it goes.” I felt I could always make money since I provided value. So, I spent anyhow. However, I now realise the importance of savings and investments.

Was there any shift that influenced this mindset change?

Yes o. I realised Tinubu was likely to win the 2027 election, and it struck me that I had to prepare. It’s not 2027 yet, and the price of everything is increasing. What happens when he gets four more years? I decided it was time to save some money, so I could sleep better at night.

Right now, I save all my dollar income in an investment app. I use their real estate investment option, and I’ve been doing that for about three months. My investment portfolio is now worth $1800, and I have over ₦4m saved.

You mentioned planning to register a company. Do you have a timeline in mind?

I’ve actually registered it. It cost me ₦47k to register a limited company. I’m trying to get a tax identification number now, and I paid ₦15k for that. I just hired two interns whom I’ll be paying ₦70k each monthly. I want to test our arrangement over the next few months, establish a structure, and pursue more international clients before formally launching my business in January 2026.

Rooting for you. Is there an ideal amount you think you should be earning?

When I made my first ₦1m, I told myself that’s the least amount of money I wanted to make in 2025. Now, I’ve surpassed that, and I know I can double that in 2026. So, $2k/month wouldn’t be bad. That would mean my business is making at least $5k.

Is there anything you want right now but can’t afford?

A car.

I feel like this is everyone’s problem these days, and it’s so crazy how unaffordable a car has become

It’s so crazy. I spend a fortune on cabs, and it’s so stressful. I might need around ₦15m to get a regular small car.

What was the last thing you bought that made you happy?

I didn’t exactly buy this, but I contributed ₦1m to my church building project in April, and it made me so happy. I’d never given that amount before, and I loved that I could do it at once.

How would you rate your financial happiness on a scale of 1-10?

6. I now see what’s possible with my finances, and I know I can double or triple what I currently earn in a year. I’m still a beginner in this money thing, but I’m on the right track. I want to be able to boast of a $20k investment portfolio by 2027.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.