Jump to Winners | Jump to Methodology

Doing it their way

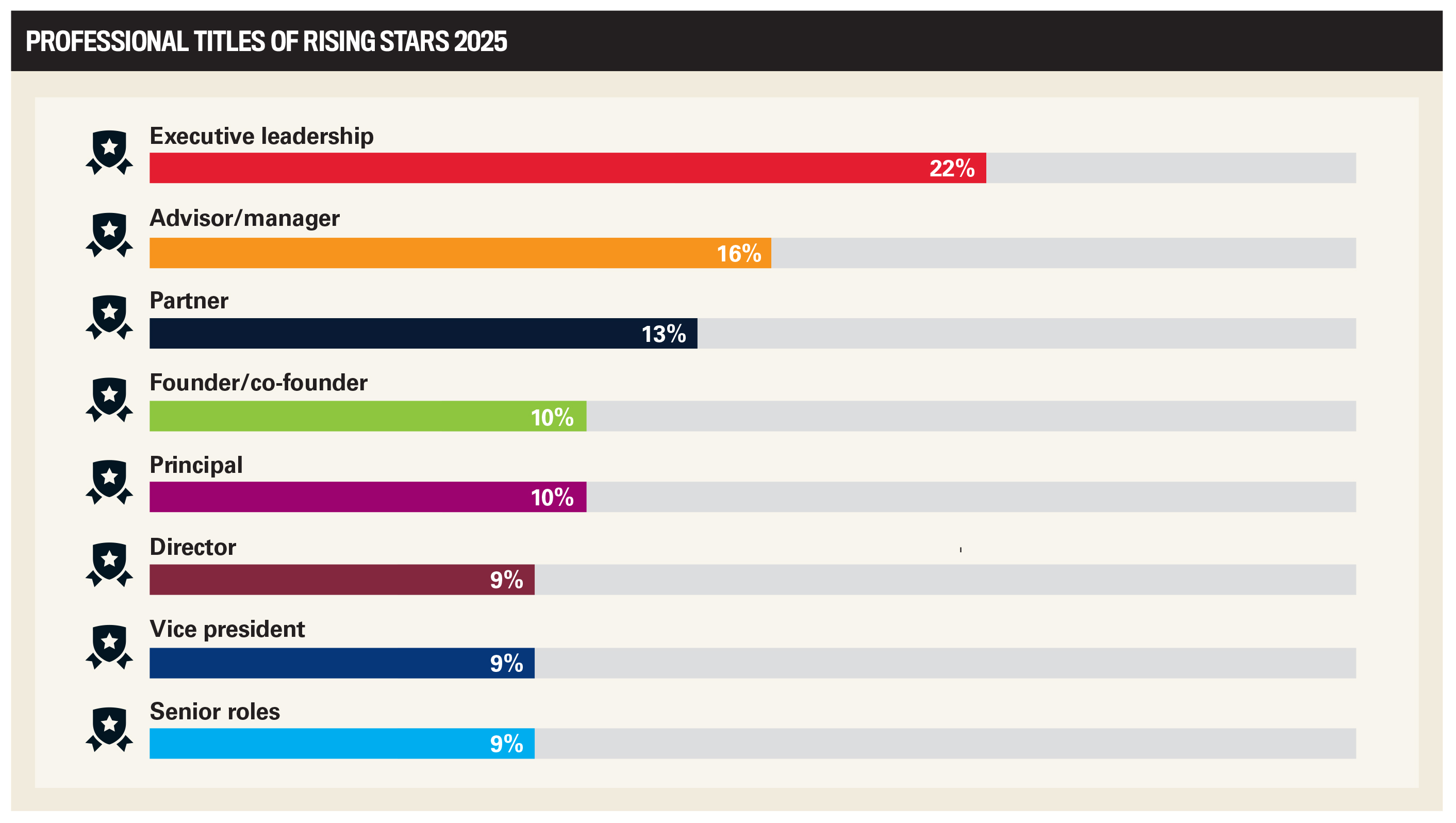

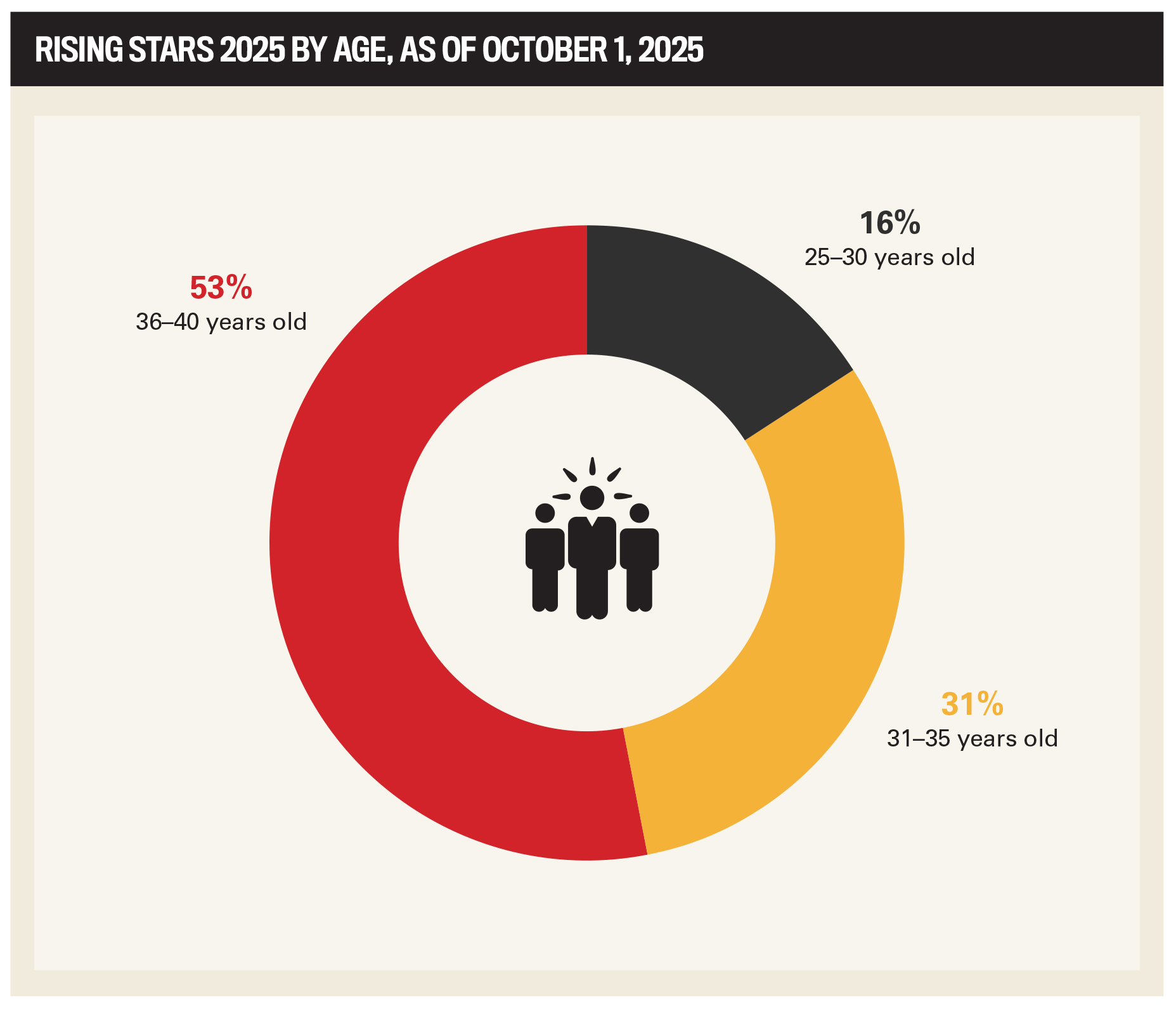

Youthful exuberance, along with a desire to chart their own course and practice in their own image, are the key enablers that InvestmentNews’ Rising Stars of 2025, all under the age of 40, have used to make their mark.

This extends across the winning group:

One tells clients to “take money out of their account and spend it” and, as a result, pay him less.

Another feels that the traditional golden rule of treating people the way you would want to be treated is outdated. Instead, she follows the “platinum rule” of treating people the way they want to be treated.

And another believes sensing emotion is what makes them a leading advisor.

Also part of the mix is the march of robo-advisors, with their market size anticipated to grow from $9.5 billion in 2024 to $72 billion by 2032. This data, according to Polaris Market Research, predicts a CAGR of 28.8 percent. And coupled with the much-discussed succession crisis resulting from most advisors in the US being over 50 years old, this showcases the prime opportunity that the best young advisors are taking advantage of.

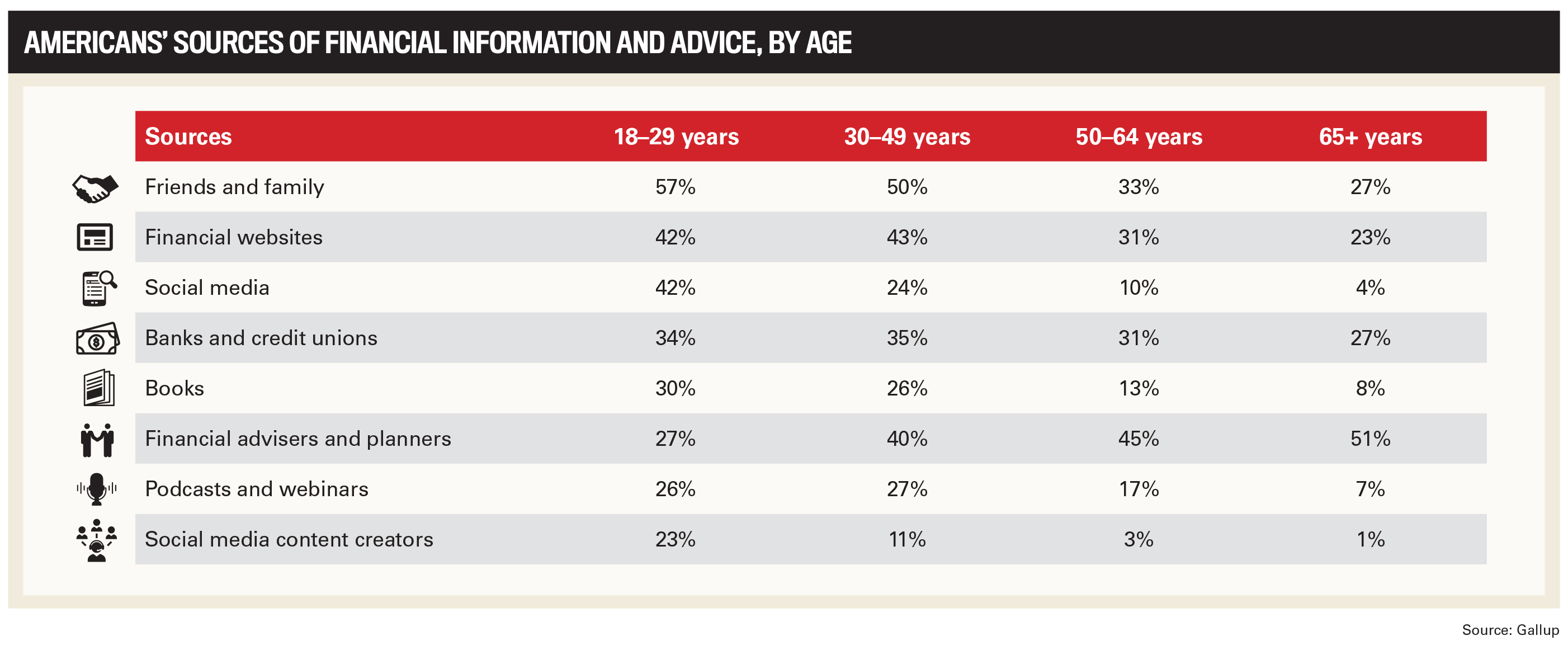

By developing outstanding interpersonal skills, they are connecting and building the trust that clients want. There’s no doubt that all generations seek financial advice, but there are differences in the mediums depending on demographics. For example, a Gallup poll shows the younger demographic gravitating toward influencers on social media and financial websites, who offer non-personalized, and often non-professional, advice.

Integrated Financial Trust’s August 2025 report suggests young advisors must adapt to changing expectations from clients, who are looking to receive counsel on issues beyond investment, such as budgeting, credit building, and student loan management.

Despite the rise in automation and social media content, the best young advisors have built books of business, client bases, and even their own firms by understanding and relating to their clients’ personal circumstances.

This is emphasized by Kali Roberge, COO of wealth management at Beyond Your Hammock, a firm that specializes in helping high-achieving professionals in their 30s and 40s.

“It’s very common for young advisors to be very empathetic and interested in people, and that is such a strength. This should be a relationship business, not a transactional one. Advisors who are eager to expand their emotional intelligence and understand things like behavioral finance and the ‘why’ behind the decisions people make will be more and more valuable, especially as AI platforms do take over some of the more rote or technical work.”

And she adds, “I don’t think anything can replace a person-to-person connection, and the younger advisors I’ve gotten to know seem very interested in genuinely helping others and providing guidance and support to real people that they can relate to and empathize with.”

The Rising Stars of 2025 are the most exceptional young talent in wealth management and all have a clear passion for the industry. These winners have earned their accolades, as the CFP Board of Standards confirmed that 2024 welcomed 6,541 new CFP® professionals, 57 percent of whom were under 35.

It’s certainly a competitive landscape on several fronts.

Roberge underlines how the leading young advisors gain insight into the inner workings of their firms so they can add value in creative and innovative ways.

She says, “Someone who has a ‘no job is beneath me’ attitude, and who is willing to try on many hats, even if they’re not committing to wearing that hat forever, stands out among a sea of young advisors who only want to jump into client meetings and have no curiosity about the million other things that go on within a business in this industry.”

By analyzing the 2025 winners’ careers, IN presents the leading challenges they’ve had to face in the past two years and overcome to stand out against their peers.

1. Navigating market volatility and economic uncertainty

Advisors have had to guide clients through extreme market fluctuations, inflation, rising interest rates, and geopolitical events. This has required not only technical expertise but also emotional intelligence to maintain client confidence and help them stay focused on long-term goals despite anxiety and uncertainty.

2. Growing new business beyond referrals and building awareness

Many advisors report that most of their growth has come from referrals, but expanding beyond this – especially in a crowded, competitive market – remains a significant challenge. Building broader awareness, differentiating their value proposition, and forming relationships earlier in clients’ financial journeys are key hurdles.

3. Attracting, retaining, and developing top talent

Finding and keeping exceptional team members who fit the firm’s culture and standards is difficult. This includes developing robust recruitment processes, revamping compensation structures, and fostering a collaborative, team-oriented environment rather than relying on individual books of business.

4. Adapting to rapid technological and regulatory change

Advisors are challenged by the need to implement new software, adapt to evolving compliance requirements, and leverage digital tools without sacrificing the personal touch. Balancing innovation with regulatory obligations, and ensuring that technology enhances rather than replaces relationships, is a persistent issue.

5. Explosive growth with operational excellence and leadership development

Rapid firm growth brings complexity: scaling processes, maintaining high service standards, and empowering others through delegation and leadership development. Advisors must shift from being hands-on “doers” to strategic leaders, building repeatable systems and strong teams while not losing the firm’s core identity or burning out.

America’s Best Wealth Managers & Advisors Under 40

Courtney Shrewsberry – Coastal 360 (Steward Partners)

Vice president and wealth manager

Age: 38

Location: Naples, FL

Rising Star Courtney Shrewsberry already has 16 years of experience under her belt, having jumped into the industry as an intern. A proactive attitude set the stage for Shrewsberry’s rise.

“Anything you gave me, I would do. I didn’t ever shy away from any extra work,” she says.

She also credits her success to being able to forge connections with clients, part of her reasons for following the “platinum rule” of treating people the way they want to be treated.

“Emotional intelligence is so important because we do spend so much time with [clients]. You need to be able to sit back and listen and really hear what they’re saying because we are their biggest confidants, and they’re telling us some things that are really difficult.”

Shrewsberry’s responsibilities are split across:

client relationship management – serving as the primary point of contact for clients

financial planning – developing and implementing a client’s financial plan

investment management – constructing and managing the investment portfolio

Shrewsberry’s start and spells as a client associate have instilled in her a strong client-centric focus, which is reflected in the firm’s 95 percent client retention rate. She meets with clients quarterly and maintains additional touchpoints throughout the year, regardless of what’s happening in the market. She believes in positioning clients correctly in asset allocation, always considering risk mitigation.

“There is such a sense of fulfillment from helping someone, we want to teach our clients about the markets and how to navigate their emotions during the ups and downs”

Courtney ShrewsberryCoastal 360 (Steward Partners)

“Anyone can make money in an up market, but how do we really protect you on the downside? That’s always been our philosophy. So, there isn’t always a lot of pivoting for our portfolios because we’ve always put that thought into it,” she says.

Shrewsberry works alongside her mentor and now-partner, Alicia Fuller, and has soaked up a lot of knowledge. In turn, clients gain long-term peace of mind knowing the advisor who is planning to assume the senior role in future.

Steward Partners has fostered a collegial environment, and Shrewsberry finds herself at a unique juncture.

“I can offer some advice and guidance, which is nice,” she explains. “Then, there’s still things I run into in my career that it’s also nice to get feedback or ideas from other peers.”

This speaks to Shrewsberry’s desire to keep pushing boundaries, and she vows “to never stop learning”.

President and managing partner

Age: 34

Location: Saline, MI

There’s no greater validation in the industry than going from $160 million to $1.8 billion AUM in eight years, and that’s what this Rising Star has overseen at Arcadia Capital. Muthusamy credits it to a fundamental bedrock.

“The equation was fairly straightforward – let’s get bigger assets and work with those clients and give them top level service, and then they will send referrals and we will organically grow,” he says.

As part of his day-to-day, Muthusamy guides clients through complex planning, investment, and legacy decisions. Internally, he oversees the operations of his 16-person team, fostering a collaborative, service-oriented culture that empowers each advisor and team member. This is powered by Muthusamy’s hunger, which stems from growing up as the son of immigrants.

“Dad went to work from morning to evening, and when he got home, my mom went to work. Seeing that, a work ethic was woven into me,” he explains. “And now, when people ask me, ‘What are your hours?’ I say, ‘I don’t have hours; I’m always working.’”

A skill that Muthusamy stresses is listening, which is what he looks for in advisors who want to join the team. He says, “It’s really hard to find top-tier and high-quality people, but when we do, we want to do everything we can to recruit them.”

To ensure a good fit on both sides, Muthusamy has developed an interview process that includes a DISC assessment, quantitative evaluations, interviews, and case studies. While not flawless, the process identifies candidates who would thrive in Arcadia’s collaborative and high-performance culture.

“The best investment you can make in yourself is your team”

Gautam MuthusamyArcadia Capital

There is also a serious focus on developing staff as Arcadia pays for employees to undertake their CFP and other courses.

Muthusamy acknowledges that AI and tech have handed certain tools to clients in terms of the information they can access, but he stresses that, first and foremost, clients still seek an advisor they can trust and bond with. This is a strength of Arcadia’s, evidenced by the steep rise in AUM despite not undertaking any major marketing.

“We are more inclined to not lose clients’ money first and grow it second. I know some other firms have that reversed, but it works well for us.”

To ensure service levels continue to improve, Muthusamy is open to embracing tech, such as platforms that cut down the administrative side of estate planning.

“If the technology can take the tedious part and the not overly complex, and make that solvable very quickly, then that makes more time for the advisor to spend on the relationship and the actual problem at hand,” he says.

Keen to continue developing, Muthusamy invests in himself and has been consulting with executive coach Soojin Kwon for several years. She looks at both his professional and personal lives.

He says, “It’s about understanding how they might work together, and the most recent example is becoming a father. My son just turned two, and I understand there’s going to be some nights that I’m at the office late. Are there ways to maybe balance things by utilizing the team?”

Over the last year and due to economic uncertainty, Arcadia’s clients have experienced a range of emotions, from positive to negative. But the team has led them through it all, under the guidance of Muthusamy, who chairs the firm’s investment policy committee.

He has made a point of including more experienced advisors, some of whom have slowed down from their younger days but have learned valuable lessons.

Muthusamy adds, “As the younger generation of advisors, we get the benefit of their experience by having them on the committee, and then we have the time to field the phone calls and work with the clients. Two minds are better than one.”

His vision is to continue building Arcadia on the foundation of two principles:

delivering an unmatched client experience

fostering a culture where team members feel valued, empowered, and inspired

Muthusamy also serves on the Raymond James National Technology Council, giving advice on how to improve platforms and tools for both advisors and clients, along with collaborating with emerging fintech companies to help design technology that better serves advisors and elevates the client experience, and as a result, pushes the profession forward.

Financial advisor

Age: 32

Location: Cambridge, MN

Over the past year, Rebecca Trethewey has expanded her services to include comprehensive financial planning, coordination of employee benefits, and specialized retirement planning for educators and public employees. This has enabled her to currently manage over $90 million in assets for nearly 500 different households.

Trethewey’s success has been driven by a proactive approach to identifying and addressing clients’ unique financial needs.

“I’ve always been very empathetic and good at sensing the emotions of people around me. I think that has given me strength as an advisor because I can anticipate the needs of my clients on a different emotional level,” she says.

By integrating personalized strategies and leveraging her expertise in 403(b), 401(k), and Roth investments, she has helped clients navigate complex financial landscapes.

With this economic backdrop, Trethewey says it’s essential to create an individualized plan.

“In times like these, maybe we’re redirecting our plan a little bit. Maybe we’re not saving as aggressively or we’re creating a different spending strategy if they’re already in retirement,” she says. “It’s so situational to that individual person or that household.”

She also feels part of being a top advisor is acting as a “relationship coach” as she makes a point of never turning things into a “steamrolling sales kind of relationship”.

Trethewey’s career began at entry-level and, from there, she hit her stride and now holds designations including Certified Plan Fiduciary Advisor® (CPFA®) and Certified Retirement Education Specialist (CRES).

“I’m one of those people who never say no to things, and I want to constantly be growing and moving. I added my licenses, various designations, started taking on clients, and [my career has] morphed into what it is today.”

Operating in an atypical environment also suits Trethewey’s style, with EFS Advisors having a more relaxed atmosphere and employees who share experiences and provide mentorship. She says, “I’m fortunate to be around such great people.”

“I’m very passionate about coaching, I would love to mentor another young female advisor and keep building this trajectory of having more females in

this space”

Rebecca TretheweyEFS Advisors

Part of this teaching has given her the skill to set expectations. While high-net-worth individuals have an easier path, that is not always the case.

“I have clients on the other end where, for whatever reason, they’re just not there and they probably won’t ever get there,” she explains. “I’m never going to say that they’re all going to be super successful because I’m this, like, second coming.”

To demonstrate this, Trethewey relies on the analogy of the three little pigs building a house and the need for a strong foundation in order to install a roof.

She adds, “You’re starting with budgeting and early savings, and then depending on the situation, we’re working toward that end goal or what’s attainable.”

Eager to share her insights, outside of her core role, Trethewey hosts an annual event and covers all the expenses for local women in the community and clients to be educated on various topics.

She says, “This year, I’m partnering with a local nonprofit, which is a caregiving consultant group, to talk about how you recognize when you’re the caregiver and how you use the services to be the most efficient caregiver, while also taking care of the other person without getting burnout.”

In addition, she is a board member of the North 65 Area Chamber of Commerce in Isanti, MN, contributing to local business growth and networking opportunities, and is also part of the National Tax-Deferred Savings Association, which aims to enhance the financial confidence of one million women over the next five years.

“I’ve hosted a couple of their events called Rai$e Her, and I’m going to continue these over the next five years,” she explains. All of these efforts are about trying to share insight that isn’t always taught formally.

Trethewey adds, “If you’re able to articulate your knowledge without being overpowering or condescending, that will bring you so far in life, and I hope it continues for me.”

Founder and wealth advisor

Age: 34

Location: Grass Valley, CA

Most up-and-coming advisors would be satisfied with an AUM of $125 million and a contented client base, but Mijares felt he could do more. The entrepreneur left Edward Jones after almost a decade to build his own firm, which boasts $260 million AUM.

He says, “I feel like I’m just getting started and I also have the breathing room and a confidence that comes with having the practice we have now.”

Being able to inspire clients was foreshadowed by doing the same among colleagues. When he was launching Zion Capital with his business partner, a few assistants also made the move and were soon joined by additional advisors.

“We had to build the infrastructure because I knew I could get clients,” explains Mijares. “I wanted my clients to have a rich experience. I didn’t want anybody to think that I was leaving for my own good. I wanted them to thoroughly believe I left for the greater good of my clients and to be able to serve them better.”

Part of this process is how Mijares can be more flexible and pivot to alternative investments, which larger and more established firms would be unable to take advantage of so nimbly.

“When you’re an entrepreneur, you get to go whatever direction you want to go. In the fintech world, there are countless different companies out there, which allow you to further serve someone and scale your business.”

One of Mijares’ skills is developing a culture that drives success. Zion Capital is made up of individuals in a similar age group and strongly family oriented. His wife even decorated the office to create an environment that was welcoming for all.

With a client niche of pre-retirees and retirees, Mijares understands the need for income.

“Passive income can be a buzzword online, but there’s really nothing passive about it. It doesn’t just happen n thin air,” he says. “We’re able to use alternative investments like structured products, which means we can actually get a custom agreement.”

He adds, “I believe that if you don’t do structured notes for your clients, you either don’t have access to them or you don’t understand them. But the most no-brainer thing for someone to have in their financial plan is some actual fixed income.”

Enjoying life is the reason why Mijares encourages his clients to spend their money, even though it means he will earn less as their assets decline. This applies even more to his wealthier clients.

“They’ve got the money because they saved and were hard workers, and they never knew how to spend it. This may be controversial, but I really enjoy helping clients spend their money as I think it boosts quality of life,” he says.

“My only goal is to help my clients reach their goals”

Lucas MijaresZion Capital

Despite this, Mijares is focused on revenue, but prioritizes his clients’ well-being.

He adds, “I’m not saying making money is a bad thing as I make a tremendous amount of money. It’s more that when you choose making money over helping a client, you’re officially in the wrong, and I never want to flirt with that line.”

Along with building his firm, Mijares has earned a collection of designations, including being an Accredited Asset Management Specialist, a Chartered Retirement Planning Counselor, and a Certified Kingdom Advisor, on top of his CFP.

The goal was not to impress clients with what he refers to as the “alphabet soup after my name,” but to be informed and plugged in across the board. “For my clients, being able to ask me a question and for me to be able to not look down at my phone or computer to answer is powerful.”

With the influx of AI and tech becoming a bigger part of the industry, Mijares is quick to point out that the human emotion of making good decisions will never be replaced.

“Investment advice and counsel is becoming a lost art,” he says.

However, he believes there is an untapped population who wants help with their finances, and he particularly feels connected to those with a mindset of taking things to the next level.

“I’m a really good fit for people like that because I don’t have a quota. I make more money than I need, and I want to help clients win,” he explains. “If I happen to make more money doing that, then wonderful, but if I can sacrifice my paycheck to make an impact on people’s lives, then that’s great.”

Zion Capital’s culture is built on integrity, alignment, and mission, interlinking with Mijares’ belief that the industry needs more people who live what they preach. To this end, his career goals are clear:

continue scaling Zion Capital into one of the most trusted, values-driven wealth management firms in the country

build a lasting firm culture that reflects faith, character, and excellence

equip the next generation of advisors to serve with conviction and impact

be a thought leader in the industry, not just on financial strategies, but on how to lead with integrity, balance, and purpose

Best Wealth Managers & Advisors Under 40 in the USA | Rising Stars

Adriene McCance

SVP, General Manager of Wealth

Uptiq AI

Alec Rosen

Director of Growth

Connecticut Wealth Management

Alex Farman-Farmaian

Co-founder and Co-CEO

Compound Planning

Alexandra Zendrian

Founder

AtoZ Communications

Alli Jordan

President

LibertyFi

Andree Mohr

President

Integrated Partners

Austin Storck

Financial Advisor

Borza Storck Wealth Management of Raymond James

Brandon Tutak

Senior Principal

Cerity Partners

Brendan Frazier

Chief Behavioral Officer

RFG Advisory

Brian Parke

Principal and Senior Wealth Manager

Connecticut Capital Management Group LLC

Brittany Webb

Senior Associate

Cerity Partners

Carlos Dias Jr.

President and CEO

Dias Wealth

CJ Miller

Partner and Executive Financial Planner

Sensible Money

Cody Garrett, CFP®

Owner and Financial Planner

Measure Twice

Corbin Foster

Director, Wealth Advisor

Greenwood Gearhart

Cormac Murphy

Chief Investment Officer/Chief Executive Officer

Adams Wealth Advisors/CacheTech Advisor Solutions

Courtney M. Shrewsberry

Vice President and Wealth Manager

Coastal 360 (Steward Partners)

Dan Bolton

Head of Marketing

Wealth.com

Danny Lohrfink

Co-founder and Chief Product Officer

Wealth.com

Danny McAuliffe

Wealth Advisor

Perigon Wealth Management

Darcy Nelson Smoot

Principal and Certified Investment Officer

Nelson Capital Management

Dinon Hughes

Partner

Nvest Financial

Doug Scott

CEO and Co-founder

Ethic

Elizabeth Lenz

Managing Director

Concurrent Investment Advisors

Eric Ashburn

Partner, Private Wealth Advisor

Argent Bridge Advisors

Frederic Alain Behrens

Partner, International Investment Advisor

Cerity Partners

Greg Giardino

VP, Financial Advisor

Wealth Enhancement

Gregory Fortier

Financial Advisor

Centinel Financial Group

James Comblo

Chief Executive Officer

FSC Wealth Advisors

Jeremy Runnels, CFP®

Partner, Wealth Management

Cerity Partners

Jett Moore, CFP®

Director, Wealth Advisor

Greenwood Gearhart

John Troncoso

Financial Advisor

Jaffe Tilchin Wealth Management

Joy Lere

Co-founder, Licensed Clinical Psychologist

Shaping Wealth

Katie Pickler

Vice President

Pickler Wealth Advisors

Krista Baumgardner

Director, Wealth Management

Choreo

Kyle Blackwell

Financial Advisor

Steward Partners

Lauren Rowland

Principal

RZH Advisors

Madison Blalock, CFP®, CPWA

Director, Wealth Advisor

Greenwood Gearhart

Marcus Welnel

Financial Advisor

SG Long Financial

Michelle Borkowski

Head of Marketing

F2 Strategy

Nicholas Garcia

Principal Wealth Advisor

Compound Planning

Nikhil Kumar

Senior Portfolio Manager

Hartree Partners

Nisiar Smith

President and Financial Advisor

Courtside Wealth Partners

Seungwoo Son

VP of Applied AI

Wealth.com

Slone Alley

Founder and Financial Advisor

Green Hills Advisory LLC

Stephen Hart

Senior Wealth Advisor, Director of Financial Planning

Generational Wealth Advisors

Susy Thomas

Vice President

Grunden Financial Advisory Inc.

Tara Shulman

Principal Wealth Advisor

Compound Planning

Taryn Bertetto

Wealth Manager

Steward Partners Investment Solutions

Travis Jensen

Founder and Advisor

Jensen Complete Wealth

Trisha Qualy

Managing Partner

Affiliated Advisors

Zach McCown

Senior Vice President, Wealth Manager

Steward Partners

Zachary (Zach) Q. Carver, CPA, CFP®

Senior Principal and Tax Advisor

Cerity Partners

Methodology

Starting in May, InvestmentNews invited financial advice and wealth management professionals across the country to nominate their most exceptional young talent for the second annual Rising Stars list.

Nominees had to be aged 40 or under (as of October 1, 2025) and be committed to a career in wealth management, with a clear passion for the industry. Nominees were asked about their current role, key achievements, and career goals, as well as the contributions they’ve made to shaping the industry. Recommendations from managers and senior industry professionals were also taken into account.

The Rising Stars were determined by an independent panel of industry leaders composed of: