This interview is a sponsored marketing material in partnership with PERE News originally

published here Data Centers Report | PERE

Principal Asset Management’s Matt Hackman and Sebastian Dooley see data centres emerge as in-demand asset as a matter of function and investment

What role is the emergence of AI playing in driving demand for data centres?

Cloud computing and now the meteoric rise of artificial intelligence are driving data centre returns to new heights, outpacing supply and leading the sector to become one of the most in-demand asset classes, say Matt Hackman, portfolio manager, and Sebastian Dooley, senior fund manager with Principal Asset Management. Just a decade ago, data centres were widely considered little more than an emerging infrastructure play, but have now transformed into a core sector of the commercial

real estate market. Matt Hackman: In the US, we have seen a multitude of headlines announcing bigger and bigger AI training model deployments. Hyperscale companies continue increasing their capex targets, showing commitment to AI growth. High-intensity AI training workloads require dense server deployments with liquid-cooled and hybrid designs, enabling effective heat exchange and operational efficiency. AI inference is equally crucial. While AI training can occur in more remote locations with access to cheap electricity, inference typically requires lower latency and proximity to the population base of end users. Most cloudbased facilities already occupy these locations, increasing demand in major markets nationwide.

Sebastian Dooley: Most of the world’s largest data centres are located in the U.S., given population and demand drivers, although there are major hubs globally. From a European perspective, we are seeing the large-scale generative AI model training deployment lag behind that in the U.S., and there is scepticism if it will reach the same relative scale. Inference, however, should reach the same relative scale across Europe, and we expect to see that demand continue to come through.

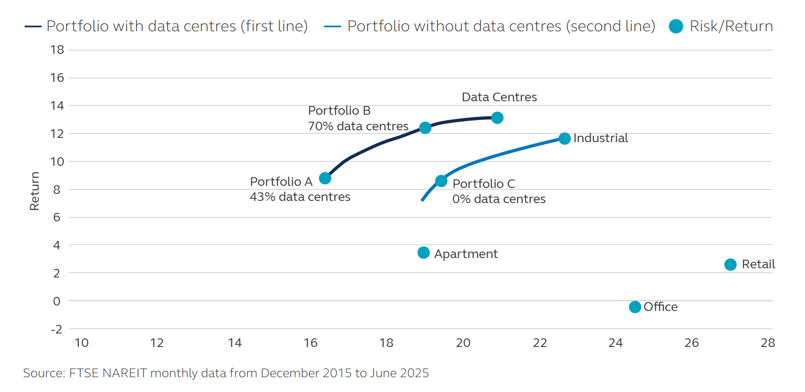

EXHIBIT 1: Optimal REIT portfolios with data centres generate higher returns for the same level of risk (%)

Beyond AI, what other structural or cyclical forces are shaping demand for data centre assets? What does effective execution of a data centre investment strategy look like in today’s market?

SD: The majority of demand for data centres has been through cloud usage and connectivity usage. These have been demand drivers for the last decade or so and have much more mature business models compared with the AI use cases. As we see the general adoption of generative AI pick up and inference become more mainstream, this is pushing for additional demand in cloud – and connectivity – focused assets. In so-called availability zones, or geographical areas where hyperscalers set up their cloud-focused data centres, we are seeing hyperscalers increasingly design and fit out buildings to be able to do both cloud and AI inference. This is pushing demand in these locations and, therefore, pushing rents.

What does effective execution of a data centre investment strategy look like in today’s market?

MH: Data centres are complex developments that require significant experience and relationships for an effective execution. When targeting an opportunity, market selection and timing of power availability are paramount. Without correct site selection, the investment opportunity may be destined for failure. Power demands have shifted significantly as increased utility power has put a strain on many providers nationwide. These utilities are now focused on additional generation, transmission, substations and distribution. Strong relationships with utility providers are now crucial to development. The same applies to equipment vendors and general contractors experienced in data centre construction, and relationships with tenants remain critical. Delivering on time and on budget drives repeat leasing opportunities. Examples include flexible enterprise solutions, high-interconnection opportunities, pulling stranded power into existing data centres to increase capacity and building hyperscale campuses. These diverse partnerships enable investments across all data centre types.

Which geographic markets are the most significant for data centres?

MH: Ten years ago, Northern Virginia and Silicon Valley here in the US dominated data centre growth, but as power challenges intensify in primary markets, absorption continues shifting to regions with fewer land and power constraints. While these markets continue to grow, development has expanded to Atlanta, Chicago, Dallas and Phoenix, and now further to emerging tier-two markets like Austin, Texas; Columbus, Ohio; and Reno, Nevada. Lead times for generators, switchgear and transformers can exceed two years. Without pre-established vendor relationships and contracts in place prior to construction, project timelines face significant delays. Another critical factor in successful delivery is having the right general contractor in place. These are very specialized builds that require a significant level of expertise.

SD: Here in Europe, the FLAP-D markets of Frankfurt, London, Amsterdam, Paris and Dublin are the data centre hubs. Power constraints and se- curing power transmission infrastructure are difficult, which has led to expansion in Madrid, Milan, Zurich and Berlin, among other locations. We are also eeing some Nordic cities, such as Copenhagen and Stockholm, draw increased demand, although construction in these markets is not a given. Madrid is getting tight, and Zurich has natural barriers to entry, given that mountains surround it. There is still some runway in those markets for further growth, though.

Access to power is often cited as the biggest bottleneck in data centre development these days. There are also significant cooling needs. How are managers and developers navigating those challenges?

MH: Access to power gates data centre development. Public utilities are facing amplified demand; hence, increased dialogue with utilities is required. Large deposits are often required to facilitate infrastructure requirements for power delivery. To expedite power, we may provide land to the utility for a sub- station or look to build the substation ourselves. Beyond local utilities, we explore potential on-site generation opportunities for deployment timing and scalability. These options are often driven by tenant timing and redundancy requirements. Near term, natural gas solutions offer viability in locations with access to the expansive network of pipelines in place. Long term, small modular reactors may play a role if regulatory and public perception hurdles can be navigated.

SD: We are increasingly working with partners with a good, granular understanding of the local markets that they are looking to develop in. As execution becomes tougher, whether from production of power or transmission, understanding the requirements and challenges of the local economy and population is key to being able to propose solutions that work with utility companies and local governments to find solutions while enabling data centre development.

Data centre inclusion in a REIT portfolio has historically improved overall returns

Data centres are evolving into highly strategic assets offering attractive return potential

What are the other challenges or risks in executing data centre strategies?

MH: With increasing demand for data centres, the supply chain has struggled to keep up with critical equipment. Lead times for generators, switchgear and transformers can exceed two years. Without pre-established vendor relationships and contracts in place prior to construction, project timelines face significant delays. Another critical factor in successful delivery is having the right general contractor in place. These are very specialized builds that require a significant level of expertise.

How does allocating to data centres affect the overall risk-return profile of an investment portfolio?

SD: In short, data centre inclusion in a REIT portfolio has historically improved overall returns. In the US, we looked at 10 years of data from NCREIF, which shows that portfolios without data centre investment average a 9 percent return, whereas portfolios that do include data centres – assuming the same amount of risk – average a return rate just below 13 percent. Historically, data centres have not been a large investment sector, but demand has increased, with capital raising for data centre investment on the rise.

What trends do you anticipate will most shape the data centre investment landscape over the next three to five years?

MH: I expect average rack densities to continue to rise in new developments, especially those supporting AI, driving the need for advanced cooling solutions to become a central focus. Increasing power demands will make energy procurement, whether through utility partnerships or onsite generation, a critical priority as well. Data centres are evolving into highly strategic assets, offering attractive return potential while serving as essential infrastructure for societal growth and the ongoing digitization of our world. Twenty years ago, facilities supported websites and e-mail; a decade ago, mobile services; today, they power AI, autonomous vehicles and complex intelligence systems. The scale of demand is unprecedented. Approximately 90 percent of all existing data has been created in just the past two years. The amount of data creation is exponential, and with AI, data is creating more data.

SD: We also expect to see the capital markets continue to evolve. General- ly, the data center market has grown to the scale it has in a world of readi- ly available and cheap debt, and most of the equity capital raised has had a cost of capital associated with develop- ment-style risks. Higher interest rates and more stabilized assets have created demand for new sources of capital. Given the long-term, high-credit- quality nature of the income that stabilized data centers have, we expect to see core capital start to move to the sector, which will change the nature of capital markets.

Contact our sales team: Stef Bogaars (bogaars.stef@principal.com) or Britt Laeven (laeven.britt@principal.com)

Important information

Investing involves risk, including possible loss of Principal. Past Performance does not guarantee future return This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections, and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. Commercial Real Estate Development strategies contain a high degree of risk, and all projects contain the risk of an investor losing some, or all of the equity invested. Ground-up commercial real estate development is subject to a host of risks that are beyond the control of Principal Real Estate. Potential investors should be aware of the risks inherent to owning and investing in real estate, including value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk. This material covers general information only and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. This document is intended for sophisticated institutional and professional investors only and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation, or otherwise distributed in whole or in part, by the recipient to any other person or organization.

© 2025 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset Management℠ is a trade name of Principal Global Investors, LLC. Principal Real Estate is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.

MM14682A | 10/2025 | 4876785-102025