Report Overview

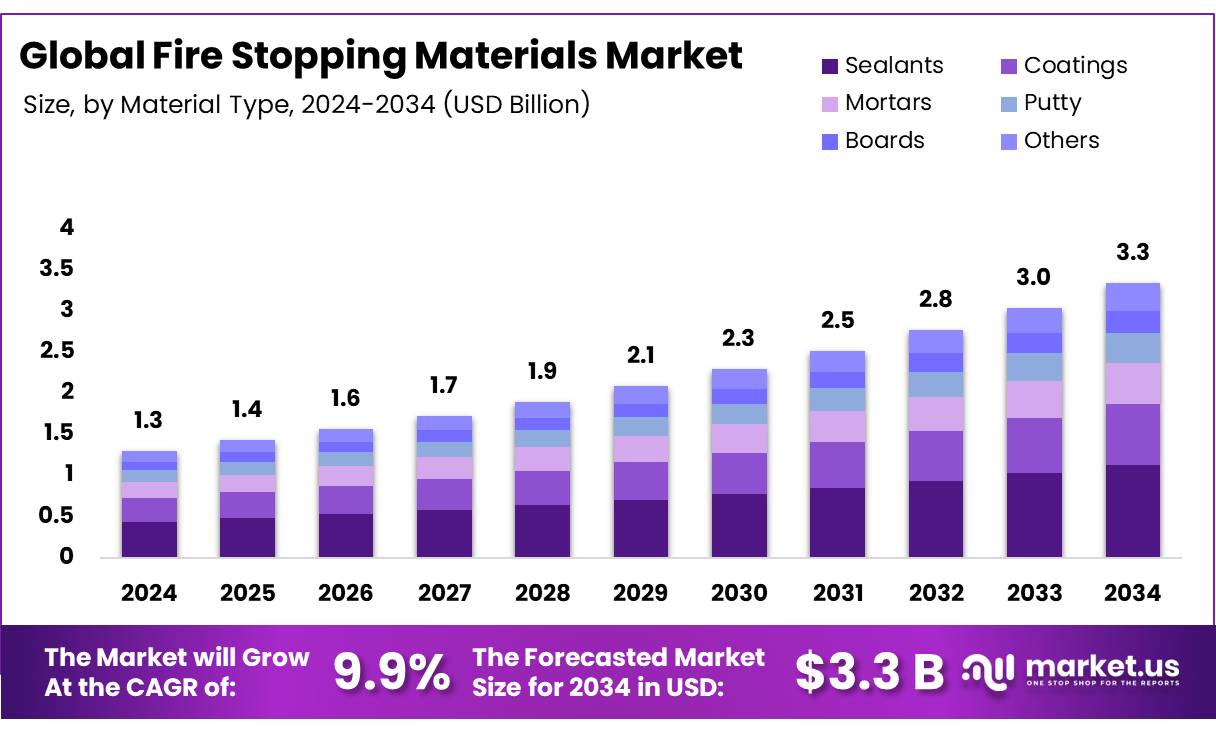

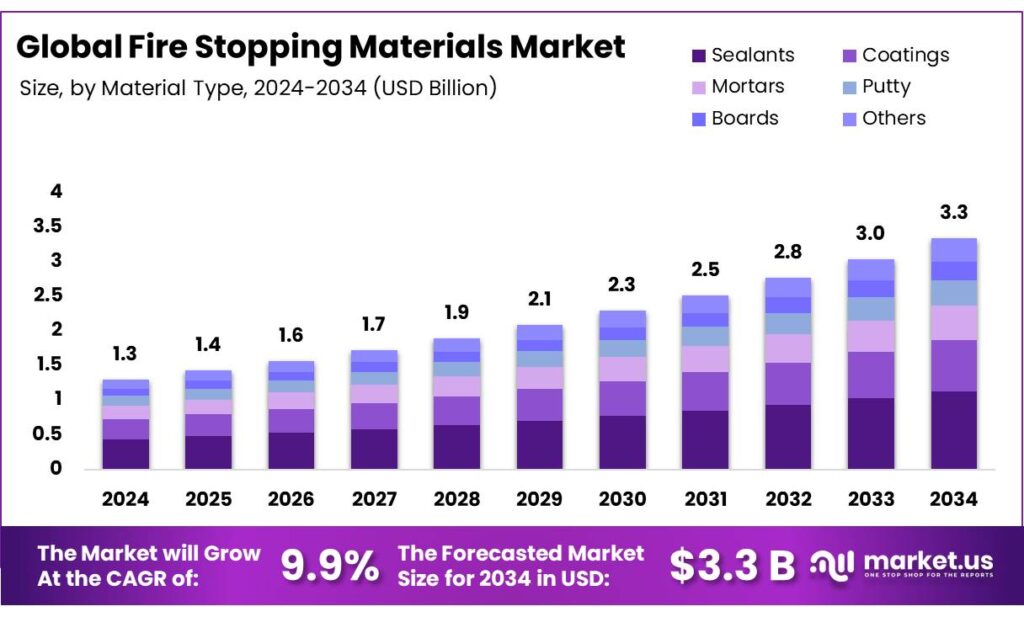

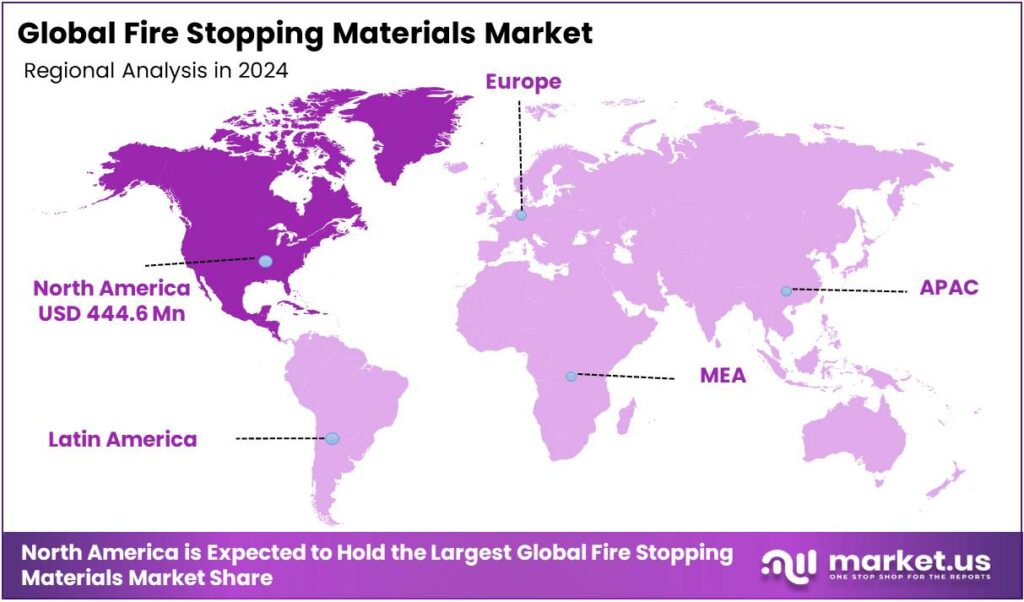

The Global Fire stopping materials Market size is expected to be worth around USD 3.3 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 9.9% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 34.2% share, holding USD 0.44 Billion in revenue.

Fire-stopping materials are products used to seal gaps and penetrations in fire-rated walls and floors, preventing the spread of fire and smoke. These materials fill the spaces that exist where services like pipes, cables, and ducts pass through fire-rated assemblies. The materials include specialized sealants, mortar, intumescent products, mineral wool, and firestop pillows or collars. They are crucial for maintaining the fire resistance of a building’s compartmentation and preserving structural integrity during a fire.

According to a study in 2025, the United States faces the most structural fires per capita annually, 110.91, compared to the fewest fires in Canada, which faces around 38.18 structural fires per capita. The United Kingdom, New Zealand, and Australia are in the top five countries that face the most structural fires with 91.59, 67.7, and 46.61 fires per capita, respectively.

According to the United States National Fire Protection Association (NFPA), in 2023, a total of 3,800 individuals died due to fire/smoke inhalation. Out of these, 3,010 were due to structure fire, and 680 were due to motor vehicle fire, which equated to one fire-related death every 2 hours and 17 minutes in the United States.

To avoid casualties, in case of fire, several governments impose stringent laws, which are a major driver of the fire-stopping materials market. For instance, the International Building Code (IBC) provides comprehensive standards for fire safety by establishing requirements for both passive and active fire protection systems in buildings. Similarly, the UK has its own set of standards for fire safety, British Standards (BS). BS 476 provides the fire tests on building materials and structures. BS 9999 provides the code of practice for fire safety in the design, management, and use of buildings.

The construction industry needs to build 13,000 buildings each day, globally, between 2025 and 2050, to support an expected population of 7 billion people living in cities.

As urbanization increases, the demand for modern housing increases, which increases the demand for fire-stopping materials. As the demand for these materials increases, several companies invest in R&D to develop innovative solutions. The fire-stopping materials market faces challenges from a lack of awareness among consumers and improper installations due to a lack of skilled labor.

Key Takeaways

The global fire-stopping materials market was valued at USD 1.3 billion in 2024.

The global fire-stopping materials market is projected to grow at a CAGR of 9.9% and is estimated to reach USD 3.3 billion by 2034.

Based on the types of materials used for stopping the fire, sealants dominated the market, with around 33.8% of the total global market.

Among the applications of the fire-stopping materials, the electrical application is the most dominant in the market, with 45.6% of the market share.

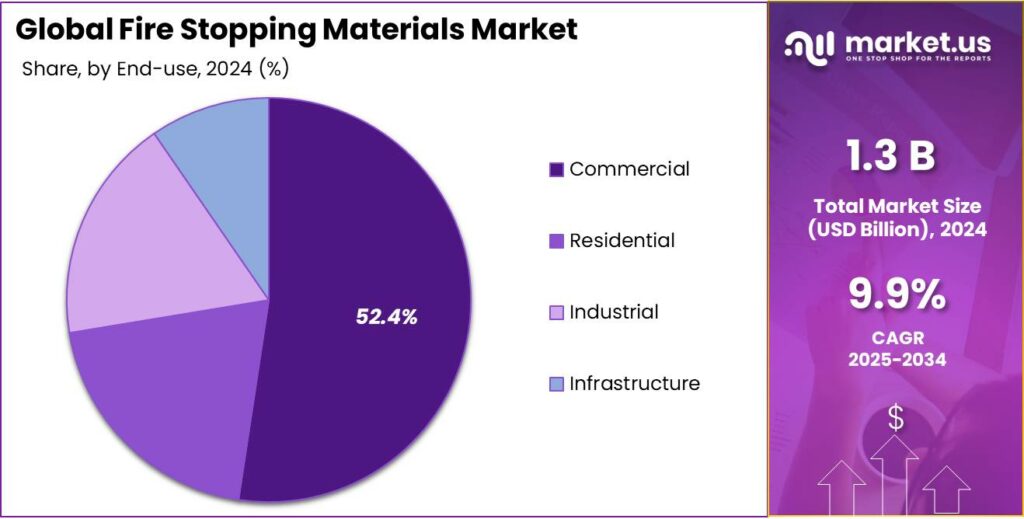

On the basis of end-uses of fire-stopping materials, the materials are mainly used in commercial buildings, approximately 52.4%.

North America was at the forefront of the fire-stopping materials market, accounting for around 34.2% of the total global consumption.

Material Type Analysis

Sealants Dominate the Fire Stopping Materials Market.

The fire-stopping materials market is segmented based on material types as sealants, coatings, mortars, putty, boards, and others. The sealants dominate the market, comprising around 33.8% of the market share, primarily due to their versatility, ease of application, and effectiveness across a wide range of construction scenarios. Unlike boards or mortars, which are more rigid and labor-intensive to install, sealants can be quickly applied to irregular gaps, joints, and penetrations in walls and floors, making them ideal for complex modern building designs.

They are particularly effective in sealing around pipes, cables, and ducts, common weak points in fire-rated assemblies. Additionally, many firestop sealants offer intumescent properties, meaning they expand under heat to block fire and smoke. Their flexibility, compatibility with different materials, and ability to accommodate movement in building structures make them a preferred choice for contractors and builders.

Application Analysis

Electrical Applications Lead the Fire Stopping Materials Market.

On the basis of applications of fire-stopping materials, the market is segmented into electrical, mechanical, plumbing, and others. Approximately 45.6% of the revenue in the fire-stopping materials market is generated from electrical applications, such as electrical penetrations, like cable trays, conduits, and wiring bundles, which create numerous small, irregular openings that can easily become pathways for fire and smoke.

These penetrations are common in nearly every building and often run between multiple fire-rated compartments. Unlike plumbing or mechanical systems, which typically have fewer and larger penetrations that are easier to seal with rigid materials, electrical systems are more complex and subject to frequent changes or upgrades. Firestop sealants, putties, and pillows are ideal for these dynamic conditions, offering flexibility, reusability, and the ability to conform to irregular shapes. This makes them essential for maintaining the integrity of fire-rated assemblies in electrical installations.

End-Use Analysis

The Commercial End-Uses Held a Dominant Position in the Fire Stopping Materials Market.

Based on the end-uses of the fire-stopping materials, the market is divided into commercial, residential, industrial, and infrastructure. In 2024, the commercial end-uses held a dominant market position, capturing more than a 52.4% market share. Fire-stopping materials are mostly used in commercial buildings, as these structures typically have stricter fire safety regulations and more complex layouts with numerous fire-rated compartments and penetrations.

Commercial buildings, such as offices, hotels, hospitals, and shopping centers, often require extensive fire compartmentalization to protect occupants and assets, creating many points where cables, pipes, and ducts pass through walls and floors. Residential buildings generally have simpler designs and fewer fire-rated barriers, reducing the need for extensive fire stopping. Industrial facilities focus more on specialized fire protection systems, such as sprinklers and fire suppression, for hazardous materials. Infrastructure projects like bridges or tunnels may use different fire safety approaches. Therefore, the complexity and regulatory demands of commercial spaces drive the higher use of fire-stopping materials there.

Key Market Segments

By Material Type

Sealants

Coatings

Mortars

Putty

Boards

Others

By Application

Electrical

Mechanical

Plumbing

Others

By End-Uses

Residential

Single Family

Multi Family

Commercial

Office Buildings

Retail Spaces

Hospitality

Healthcare

Educational Institutions

Others

Industrial

Manufacturing

Warehouse and Distribution

Flex Space

Infrastructure

Airports

Rail & Metro Stations

Others

Drivers

Stringent Fire Safety Regulations Drive the Fire Stopping Materials Market.

Stringent fire safety regulations have become a major driving force behind the growth and innovation in the fire-stopping materials market. Governments and regulatory bodies across the globe are increasingly enforcing strict building codes and safety standards to minimize the risks associated with fire hazards. For instance, the National Fire Protection Association (NFPA) in the United States and the Building Regulations in the UK mandate the use of passive fire protection systems, including fire-stopping materials, in commercial and residential buildings.

These materials, such as sealants, wraps, collars, and fire-resistant boards, are designed to prevent the spread of flames, smoke, and toxic gases through openings in walls, floors, and service penetrations.

According to data from the U.S. Fire Administration, nearly 1.3 million fires were reported in the U.S. in 2023 alone, resulting in over 13,350 reported civilian injuries and over 3,670 deaths. These alarming figures highlight the critical need for compliant fire protection systems, prompting construction firms and facility managers to prioritize advanced fire-stopping solutions.

Restraints

Lack of Awareness and Improper Installation Might Pose a Challenge for the Fire Stopping Materials Market.

Lack of awareness and improper installation remain significant challenges in the fire-stopping materials market, often undermining the effectiveness of even the most advanced products. Many building owners, contractors, and maintenance personnel are either unaware of the critical role fire-stopping materials play in passive fire protection or lack proper training in their application. Studies by the National Fire Protection Association (NFPA) have shown that improper installation of fire-stopping systems is a common code violation found during building inspections.

For instance, incorrectly sealed pipe penetrations or cable trays can create pathways for fire and smoke to spread rapidly between compartments, defeating the purpose of compartmentalization. In some cases, fire-stopping materials are removed during maintenance work and not replaced, leaving buildings vulnerable. A 2022 audit of fire safety in UK hospitals found several instances where fire stops had been compromised due to poor workmanship or oversight. Addressing this challenge requires better training, certification programs, and stricter enforcement of fire safety standards.

Opportunity

Urbanization and Infrastructure Development Create Opportunities in the Fire Stopping Materials Market.

Rapid urbanization and infrastructure development are creating significant opportunities in the fire-stopping materials market. As cities expand and populations grow, the demand for high-rise buildings, transportation hubs, and industrial facilities is surging. These complex structures require rigorous fire protection systems to ensure occupant safety and structural integrity.

For instance, according to the United Nations, in 2024, the population of around 4.7 billion individuals in the world resided in urban areas. Similarly, according to a study by the Indian Ministry of Statistics and Program Implementation (MoSPI), it is expected that by 2030, more than 40% of India’s population will live in urban areas.

Similarly, about 66.2% of the population in China lived in cities. The country continues to invest heavily in smart cities and mega infrastructure projects such as high-speed rail networks and urban transit systems. In such large-scale developments, fire safety becomes a critical component of building codes and design. Fire-stopping materials are essential in sealing joints, service penetrations, and other vulnerable points to contain fire and smoke during emergencies. With increasing awareness and regulatory scrutiny, the integration of fire-resistant technologies in urban infrastructure presents a growing field of application for these materials.

Trends

The Development of Eco-Friendly Fire Stopping Materials.

The development of eco-friendly fire-stopping materials is an increasingly important trend as the construction industry shifts toward sustainability and green building practices. Traditional fire-stopping materials often contain halogenated compounds and other chemicals that may release toxic fumes when exposed to high heat. In response, manufacturers are focusing on low-VOC (volatile organic compound), non-toxic, and recyclable alternatives that meet both fire safety standards and environmental regulations.

For instance, some intumescent sealants are now being formulated with bio-based ingredients that expand under heat to block fire and smoke while minimizing environmental impact. In addition, the rise of green certification systems such as LEED (Leadership in Energy and Environmental Design) has incentivized the use of environmentally responsible fire protection products. According to the U.S. Green Building Council, in 2022, there were over 100,000 LEED-certified projects worldwide, reflecting a strong demand for sustainable construction materials. This shift is driving innovation in the fire-stopping market, with increased emphasis on performance, safety, and eco-consciousness.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Fire-Stopping Materials market by disrupting the Essential Supply Chains in the Market.

The geopolitical tensions are having a notable impact on the fire-stopping materials market, primarily through disruptions in global supply chains, fluctuations in raw material availability, and shifts in trade policies. Conflicts such as the ongoing Russia-Ukraine war and strained U.S.-China relations have affected the sourcing of critical raw materials like minerals, resins, and fire-resistant additives, many of which are produced or processed in geopolitically sensitive regions.

For instance, magnesium hydroxide, a key fire-retardant filler, is heavily produced in China, and export restrictions & trade disputes have delayed shipments and increased costs for manufacturers globally.

Additionally, sanctions on countries like Russia have limited access to certain chemical components used in fire-stopping systems. Furthermore, shipping delays and increased freight costs due to rerouted logistics, particularly in regions like the Red Sea or the South China Sea, have complicated the timely delivery of products. In Europe, heightened security concerns have led to stricter building codes in military and government infrastructure, increasing demand for high-performance fire-stopping solutions but pressuring supply.

According to the United Nations, over 60 countries experienced moderate to severe supply chain disruptions in 2023 due to geopolitical instability. These conditions are pushing manufacturers to localize production and diversify suppliers to mitigate risks and ensure regulatory compliance.

Regional Analysis

North America Held the Largest Share of the Global Fire-Stopping Materials Market.

In 2024, North America dominated the global fire-stopping materials market, holding about 34.2% of the market share. The region holds the largest share of the global fire-stopping materials market, driven by stringent fire safety regulations, a well-established construction sector, and high awareness of passive fire protection measures. Building codes such as the International Building Code (IBC) and standards set by the National Fire Protection Association mandate the use of fire-stopping systems in all commercial, residential, and industrial buildings.

The region’s extensive urban infrastructure, including high-rise buildings, hospitals, data centers, and airports, demands reliable fire containment solutions. For instance, cities such as New York, Los Angeles, and Toronto enforce strict fire compartmentalization standards, requiring fire-stopping materials to seal penetrations through fire-rated walls and floors.

Additionally, North America faces thousands of structural fires each year. In 2023, the U.S. Fire Administration reported property damage caused by fires to be estimated at US$23 billion. Similarly, according to the Canadian Association of Fire Chiefs (CAFC), in 2023, 46% of communities in the country were at risk of downgraded fire protection ratings. These factors, combined with a strong culture of compliance and safety, contribute to North America’s leadership in adopting and advancing fire-stopping technologies.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Russia & CIS

Rest of Europe

APAC

China

Japan

South Korea

India

ASEAN

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

Several players in the fire-stopping materials market maintain a competitive edge through strategic activities, such as product development and expansions. The major market players in the market are BASF SE, 3M Company, Sika AG, Hilti Corporation, RectorSeal, Morgan Advanced Materials, Knauf Insulation, Fosroc, H.B. Fuller Company, Tremco CPG, Etex Group, Specified Technologies, RPM International, Isolatek International, and PPG Industries. These players majorly invest in research and development to develop new and innovative fire-stopping solutions that are unique from the solutions available in the market.

In addition, many players expand their manufacturing facilities to cater to the growing demand for fire-stopping materials. Furthermore, players in the market partner with research companies for R&D and collaborate with builders to provide their materials for construction.

For instance, in September 2025, Promat launched a tested and third-party evaluated solution that sees fire-stopping added to cellular beam openings to maintain a consistent level of fire resistance. It was developed in collaboration with fire-stopping specialist FSi Promat.

The major players in the industry

BASF SE

3M Company

Sika AG

Hilti Corporation

RectorSeal

Morgan Advanced Materials

Knauf Insulation

Fosroc, Inc.

B. Fuller Company

Tremco CPG Inc.

Etex Group

Specified Technologies, Inc.

RPM International Inc.

Isolatek International

PPG Industries, Inc.

Other Key Players

Key Development

In June 2025, ROCKWOOL announced the launch of a global center of excellence for fire-stopping at Hams Hall, near Birmingham, to manufacture a range of fire-stopping products and offer hands-on training to support compliance with UK fire safety regulations.

In November 2022, Hilti launched several innovative firestop solutions, such as acrylic joint spray for curtain wall or edge-of-slab applications where there is exposure to water, and the CFS-SL GA firestop speed sleeve to reduce the quantity of odorous and harmful indoor air contaminants.

Report Scope