Good morning, investors. While I don’t expect the AI boom to “pop” like past bubbles anytime soon, I do recommend picking up Andrew Ross Sorkin’s new book, 1929, which details the most consequential collapse in Wall Street history.

It’s an excellent read, brimming with lessons for investors today.

Now let’s get to the news.

Volatility has returned to markets but it’s going to take a lot more jitters to derail this bull run.

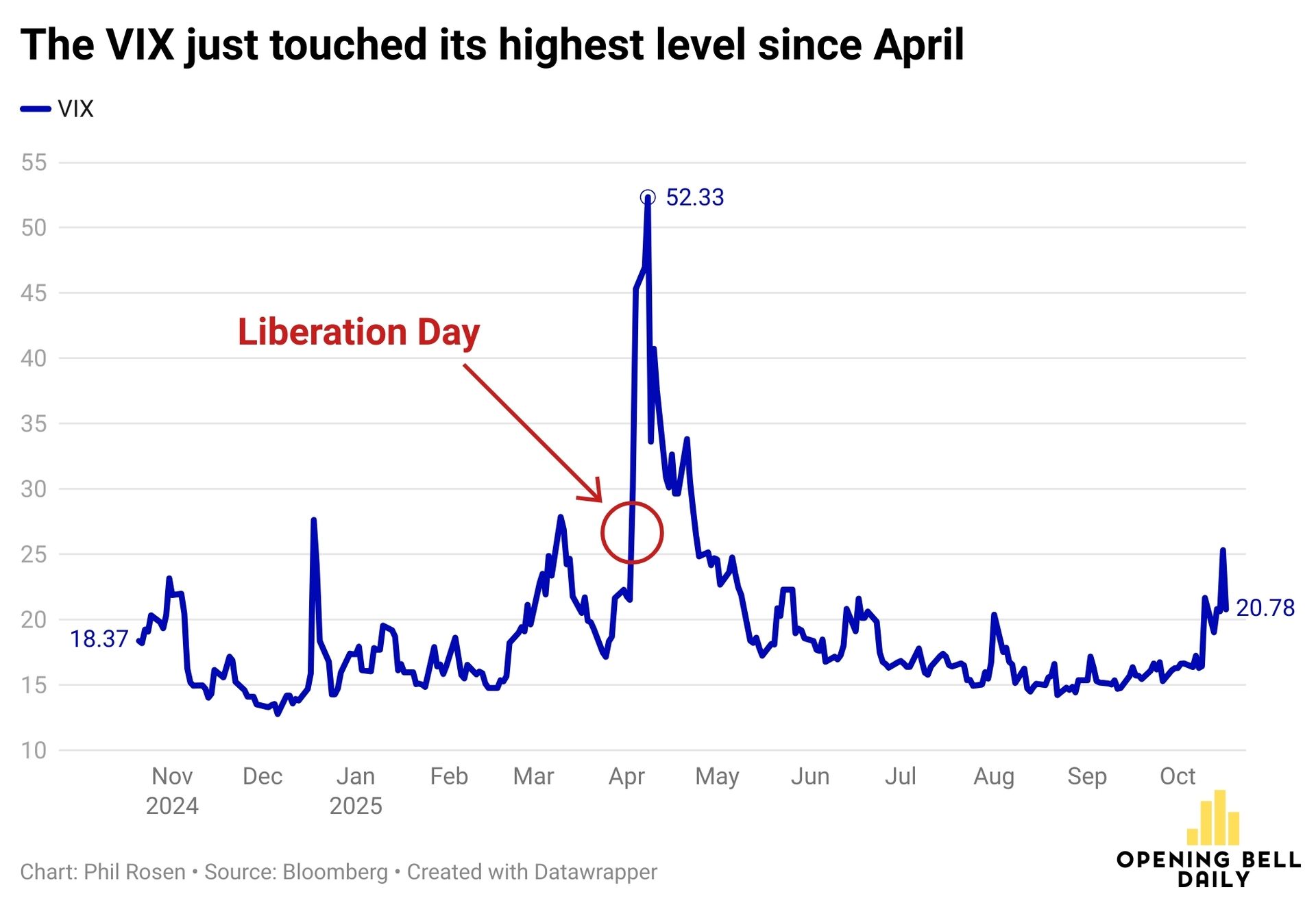

Over the last two trading sessions, regional bank fears tied to Zions Bancorp and Western Alliance pushed the VIX — Wall Street’s fear gauge — as high as 28.99 for the first time since April’s Liberation Day sell-off.

That jump provided just the fodder bearish forecasters have been looking for to bolster their theories of bubbles and crashes.

Yet the index closed Friday at 20.78, within range of its long-run average.

That only feels high because the VIX has hovered at a tepid 17 through most of the summer.

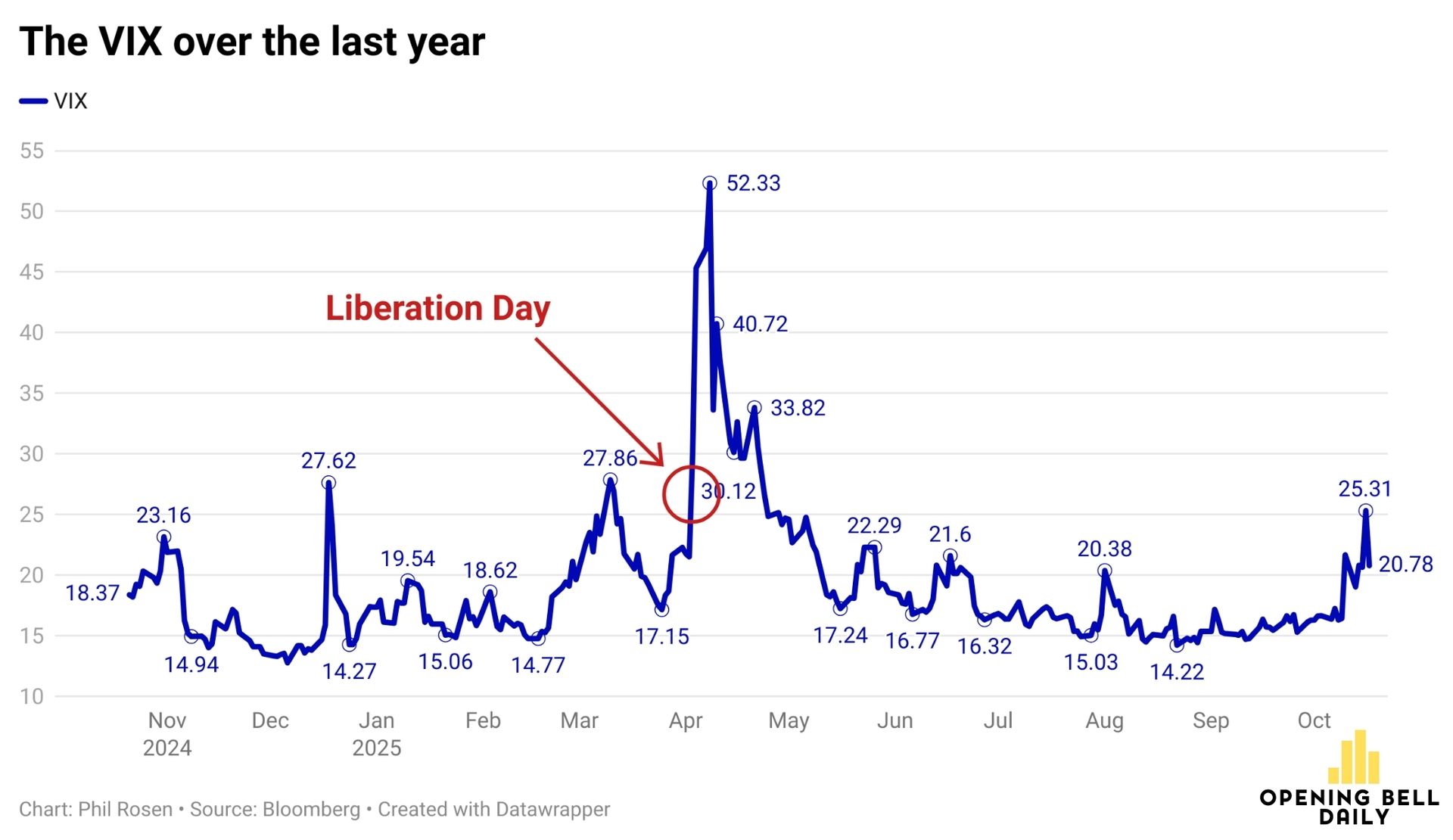

As it turns out, history suggests the momentary surge in volatility offers a point for the optimists.

Since the start of 2024, the S&P 500 has averaged a 2.2% gain the next month whenever the VIX rose above its long-term average of 19.5, according to DataTrek Research.

Stocks have climbed at an 82% win rate with this indicator

It was triggered each of the last two weeks

“The VIX is widely cited and closely watched because most traders know it has a good track record of signaling near term lows,” wrote DataTrek co-founders Nicholas Colas and Jessica Rabe in a recent note to clients.

The recent move, in their view, does not warrant concern about a weakening bull market.

CBOE launched the VIX index in 1990, and it’s closed at 19.5 on average over the last three decades.

In bull markets, volatility is usually below 19.5

In bear markets, it’s usually above 19.5

As the DataTrek team and other market veterans have pointed out, heightened volatility indeed often presents a buy-the-dip opportunity.

Here’s the VIX chart again, highlighting a range of closing levels from the last 12 months.

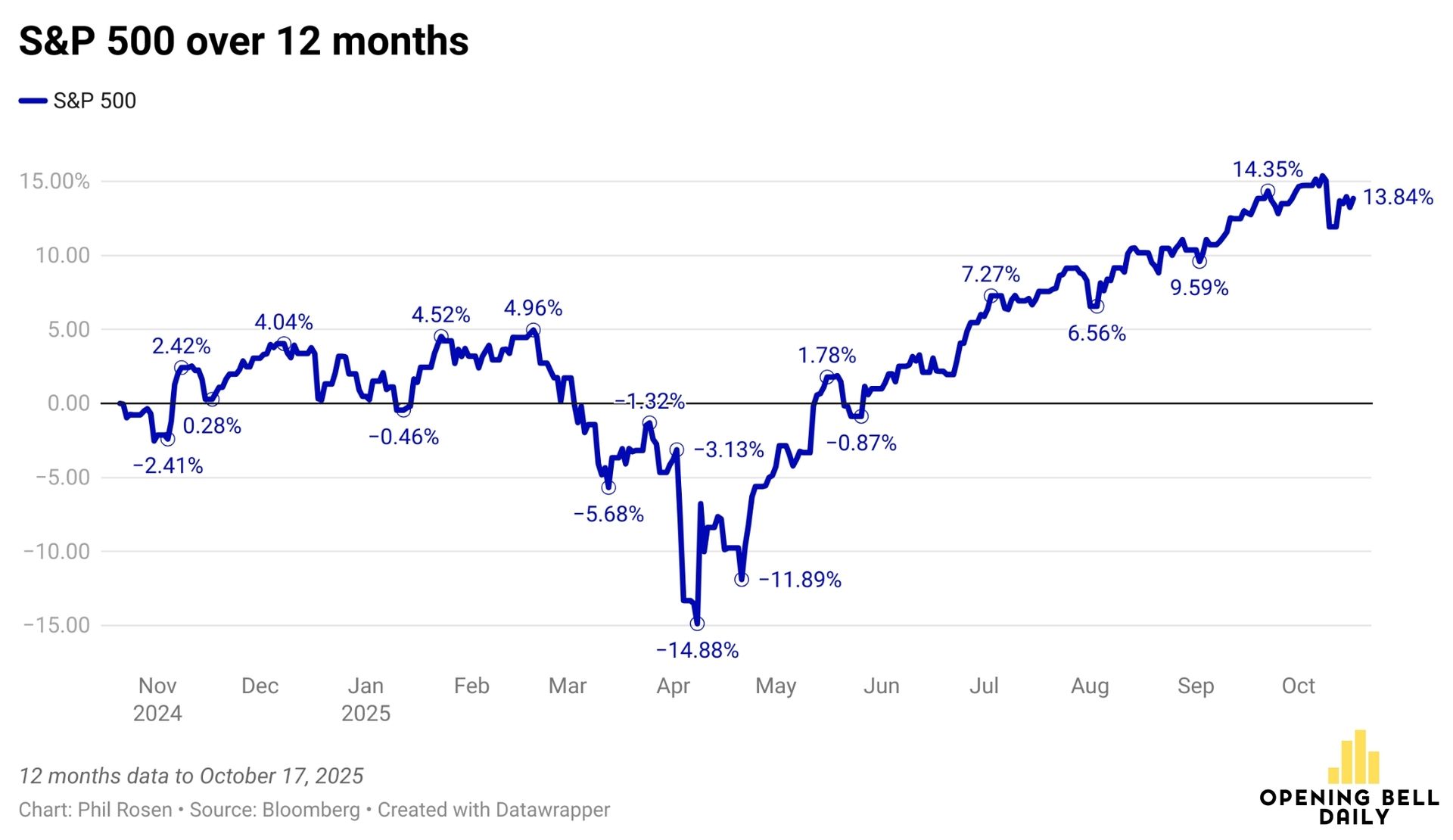

When you compare that to the S&P 500 over the last year, the spikes in volatility indeed have marked local bottoms for stocks.

The above and below charts are nearly inverted mirror images.

None of the above is likely to placate the bears, who will point to heightened volatility as reason to brace for armageddon.

What if buying a home felt as seamless as buying a car? With reAlpha, it can.

Realty, mortgage and title — all in one place, powered by the latest technology.

And when you close with reAlpha, you may qualify for a buyer’s agent commission rebate.

Homebuying is complex. reAlpha helps smooth the journey.

📈 Gold is having its third breakout of the last five decades. The last two times ended with a pullback, but bullish investors who continue to pile into the bullion believe the most cautionary words in finance now apply: “this time is different.” (WSJ)

📊 Brokerages are battling for new active investors. New and old trading platforms are launching powerful tools and AI-powered products to lure highly profitable customers as the share of Americans who buy stocks balloons to record highs. (Barron’s)

🚀 Outperform Wall Street’s leading hedge funds. Our Best Ideas Club has doubled the S&P 500 this year. We send members a new high-conviction stock idea every week — join today.

Netflix, Coca-Cola, Tesla and Intel all report earnings this week (Yahoo Finance)

The US is weighing lifting tariffs on some products not produced in the US (WSJ)

The Trump Administration will deliver more student-loan forgiveness (CNBC)

JPMorgan’s Jamie Dimon wants everyone back in office and his new $3 billion Manhattan skyscraper offers a new allure (WSJ)

The Fed can cut rates but that may not save the housing market (Pomp Letter)

This small-cap materials stock could jump 30% as global aircraft production ramps up (Best Ideas Club)

Thieves broke into the Louvre Museum in Paris to steal priceless jewels in a 7-minute heist (WSJ)

🗓October 20, 1987: Fed Chair Alan Greenspan injected markets with emergency liquidity the day after Black Monday. The central bank acted as the lender of last resort and the Dow saw a short-lived rally that morning before resuming its fall after lunch.

📰 I’m Phil Rosen, co-founder of Opening Bell Daily. I’ve published books, lived on three continents, and won awards for my journalism, which has appeared in Business Insider, Fortune, Yahoo Finance, Bloomberg and Inc. Magazine.

I write our flagship newsletter to prepare you for each trading day — unpacking markets, economic data and Wall Street with analysis you won’t find anywhere else.

*reAlpha Disclaimers: Actual savings vary and are not guaranteed. Not available in all states. Terms apply. reAlpha Realty, LLC | reAlpha Mortgage | NMLS #1743790 | Equal Housing Opportunity