Macquarie Equities strategists have created a FOMO Gold measure, based on the speculative futures, a consensus view on the upside and survey questions on expectations for the gold price. Gold FOMO is now about four times the share market FOMO, according to Macquarie’s reading.

It can’t be valued on a yield basis because it doesn’t produce a dividend or an interest return, and it isn’t used for much other than jewellery. Rather, it is a store of value and something of an insurance policy against uncertainty.

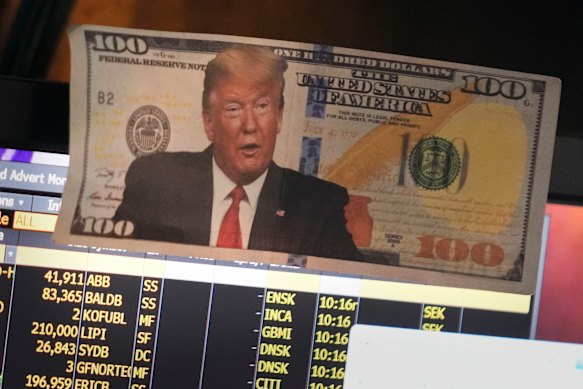

Trump’s policies are putting pressure on the dollar.Credit: AP

The ingredients that go into the uncertainty pot include geopolitical tensions that have abounded this year mainly due to Donald Trump’s trade policies and concerns about the United States’ delicate relationship with China.

Added to this are other Trump-induced fears such as his assault on the independence of key US institutions such as its central bank, the Federal Reserve. The US government shutdown, which is already in its third week, is adding to the general level of uncertainty and further stoking the fire under the gold price.

Gold is also used as a currency hedge, in particular a falling US dollar, and its price generally increases as interest rates fall – which is the direction they are moving in most economies at the moment.

Loading

It isn’t just retail investors riding the gold bandwagon. Its weighting in professional investment portfolios has risen, and central banks have been increasing their gold purchases over recent years.

“The erosion of confidence in sovereign debt is driving investors to gold, as recent fiscal policies characterised by rising deficits and explosive debt trajectories challenge the traditional safe-haven status of government bonds, such as US Treasuries,” says Amundi.

So gold has become, as they call it in markets vernacular, a crowded trade.

As Macquarie notes, “when gold is in a bull market as it is now, gold sentiment will generally remain positive, often for years”.

The structural elements supporting gold look like they are here for a while, but whether it has reached its natural peak is a question investors will need to address.

The people lining up for the bullion bars in Martin Place appear undeterred!

The Market Recap newsletter is a wrap of the day’s trading. Get it each weekday afternoon.