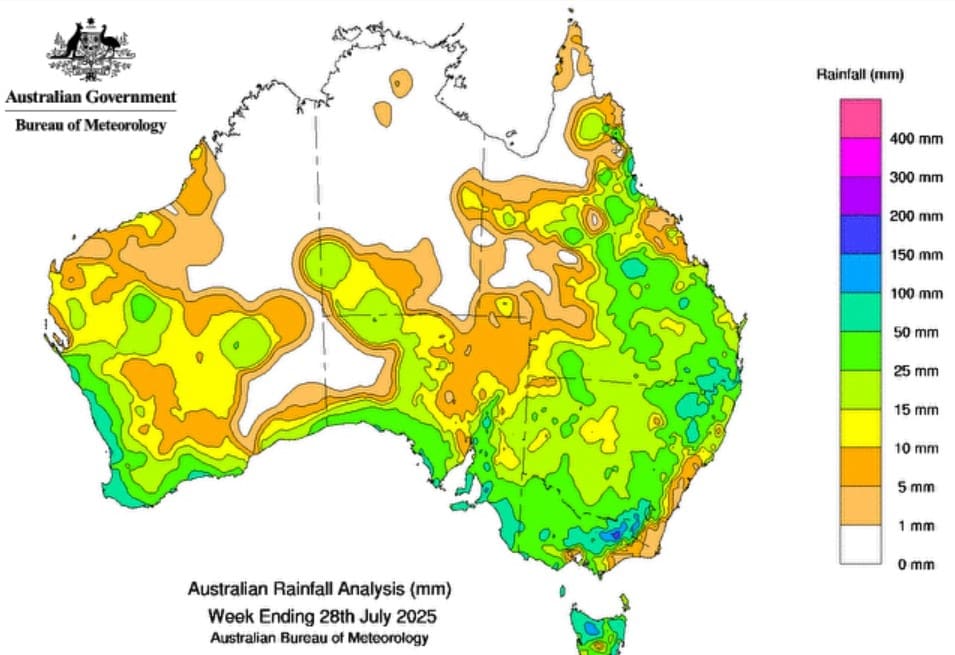

BOM’s seven-day rainfall map for week ending 9am this morning

WIDESPREAD rainfall in eastern and southern parts of NSW, Victoria and Queensland this past week will likely reset markets, with confidence building across the south that they may get a harvest, and the rain in the north coming at just the right time.

Our southern Queensland/northern NSW agents report that the 20mm that’s fallen looks to have had the same impact as three times that amount of rain.

Up north, the rain won’t do much for the western Downs country, but will keep coastal areas fresh.

Saleyard numbers will be restricted this week with numbers across the two sales (Roma and Dalby) in southern QLD likely to fall below 10,000 head, down from 17,000 head in the weeks prior.

In many southern markets, numbers are recording year lows as the rain prompts some confidence that there will be enough sub-soil moisture to promote early Spring pasture growth as soon as temperatures warm up.

Cow prices leading the charge

Cow prices are leading the charge this week, driven by demand for HGP-free beef (on strengthening Chinese demand). In some saleyards markets, cows are selling for more than heavy steers on a liveweight basis, with the best result last week $4.16c/kg lw for heavy cows at Dubbo to average $3.94c/kg.

Internationally, US fed beef prices are backing off seasonally, but imported lean beef prices are holding which has narrowed the margin between the cut-out and manufacturing packs.

Doubts on tariff levels on Brazilian beef into the US may soon encourage US wholesalers to seek increased coverage on imported Australia product given New Zealand supplies have virtually dried up seasonally, as its annual dairy cull cow has finished.

Doubts on tariff levels on Brazilian beef into the US may soon encourage US wholesalers to seek increased coverage on imported Australia product given New Zealand supplies have virtually dried up seasonally, as its annual dairy cull cow has finished.

Some live export boats being planned for slaughter cattle into Vietnam out of Townsville at 320c/kg lw for bullocks and 290c/kg for bulls are being kept honest by buying from southern processors who are looking for HGP-free bullocks buying on a liveweight basis around 350c/kg delivered to North QLD locations like Hughenden.

The Indonesian live export market has gone quiet although there is an order doing the rounds next month for suitable Indonesian feeder cattle ex Cloncurry at 310c/kg lw which puts the Darwin market at 340c/kg delivered.

Otherwise, feeder and slaughter markets are holding in the north with a lift in buying activity in saleyards a sign that available numbers may not have been as robust as they were thought to be a few weeks back. With recent rain events, the season is extending and giving producers more marketing options.

Grain prices

As mentioned previously, international grain prices are cooling as the northern hemisphere winter harvest progresses and as their summer crops are growing well in ideal conditions.

Prices are just hanging on waiting for the rush of Russian new crop wheat sales and for the global corn crop to be made. At this stage, it looks as though global grain supplies for the next year will be comfortable and higher carryout stock levels will continue to exert downward pressure on prices.

Local grain markets were under pressure by the end of last week on widespread rainfall forecasts. Old crop markets shed $3-5/t and new crop markets were down by $5-10/t across all major feeding zones, squeezing out some of the domestic premium. Track markets are some $10-20/t lower than delivered and have been quietly drifting lower in line with international values.

Surge in grain feeding

With the strong meat protein outlook and depressed outlook for grain, there should be another surge in intensive grain feeding in the coming year which will support feeder cattle demand. Competition from southern restockers should keep the lotfeeders honest on heifers. Normally there is an inverse correlation between grain prices and feeder steers.

Large supplies of black feeder cattle sent away for agistment earlier in the year will start to become available from September, and may see some of the large Angus premium built into current feeder markets peel away a little.

With the global manufacturing beef market looking strong, this should underpin strong demand for all types of cattle with anything HGP-free likely to command a premium.

It will be interesting to see how US manufacturing beef markets behave this week as they were mostly in a standoff last week. Exporters are reportedly short on bookings waiting to see if the US imposes an additional 50pc tariff on Brazil which would effectively end Brazilian beef imports into the US.

Any discernible pullback in cattle slaughter should lead to higher prices as processors compete away some of their margin to maintain throughput.

Richard Koch, Elders

Author Richard Koch is Elders’ business intelligence analyst. He discusses local market conditions and trends with senior Elders livestock managers from across Australia each Monday morning.