Liverpool Football Club have dozens of investors through Fenway Sports Group, but it’s John Henry who has long been the all-seeing eye at Anfield.

The Illinois-born investor, 75, is worth a reported £4.5bn. Being in the same room as him practically improves your credit rating. And a huge chunk of his wealth is tied up in Liverpool.

But the empire overseen by John Henry is vast, spanning multiple continents and sports. Increasingly, FSG want to get involved in the very infrastructure of sport, not just team ownership.

Company or teamIndustry/leagueLiverpool F.CPremier LeagueBoston Red SoxMajor League BaseballPittsburgh PenguinsNational Hocket LeagueRFK RacingNASCAR Cup SeriesPGA TourUS professional golfGOALFitness and training appHana KumaNaomi Osaka’s Media companySpringHillLeBron James’ entertainment firmBoston Common GolfTGL Golf LeagueFenway Sports ManagementSports marketing and consultingFenway Music CompanyMusic and live eventsTeams and businesses owned by FSG

Having a Premier League club, or ‘franchise’ as the parlance goes in the US, in your portfolio is perhaps the ultimate status symbol in Henry’s industry. His interests in Major League Baseball and the National Hockey League might be more profitable as it stands, but there are very few investments one can make that deliver the same level of prestige and global influence as owning Liverpool.

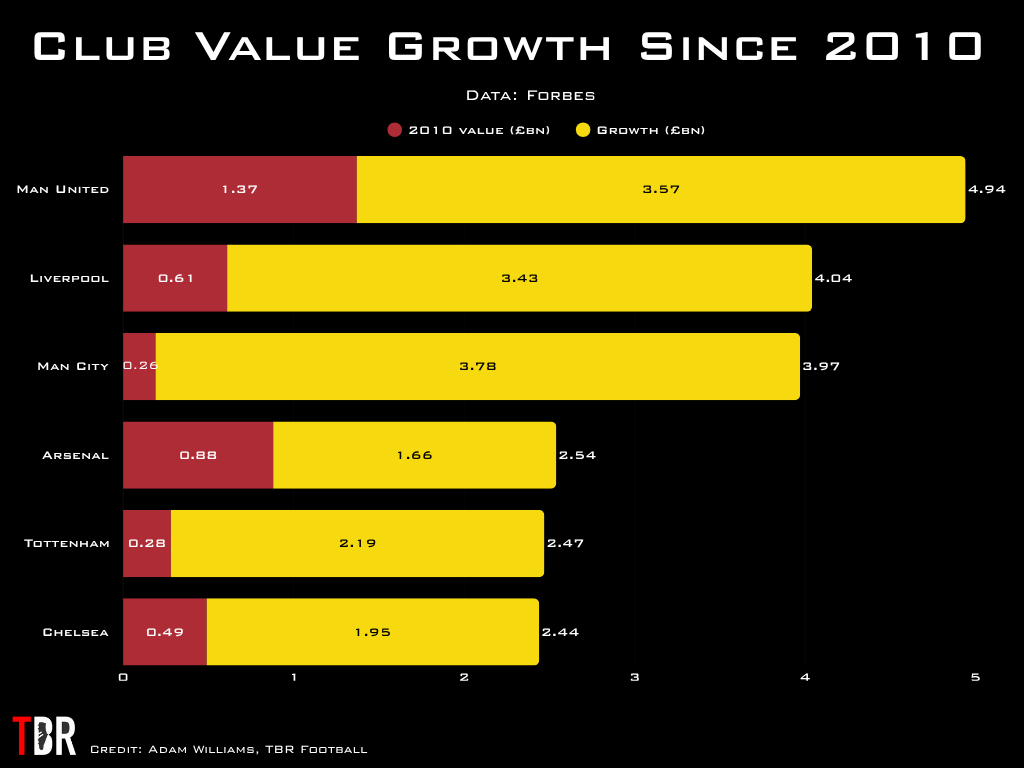

When you own a six-time European champion with a self-professed 1 billion followers worldwide, there are very few rooms you can’t get into, even fewer potential business partners who won’t pick up the phone. And while FSG are yet to realise the value of their £300m investment in 2010, the mother of all paydays one day awaits. By most estimations, Liverpool are now worth somewhere between £4-5bn.

Premier League club value growth graphic

Premier League club value growth graphic

Credit: Adam Williams/TBR Football/GRV Media

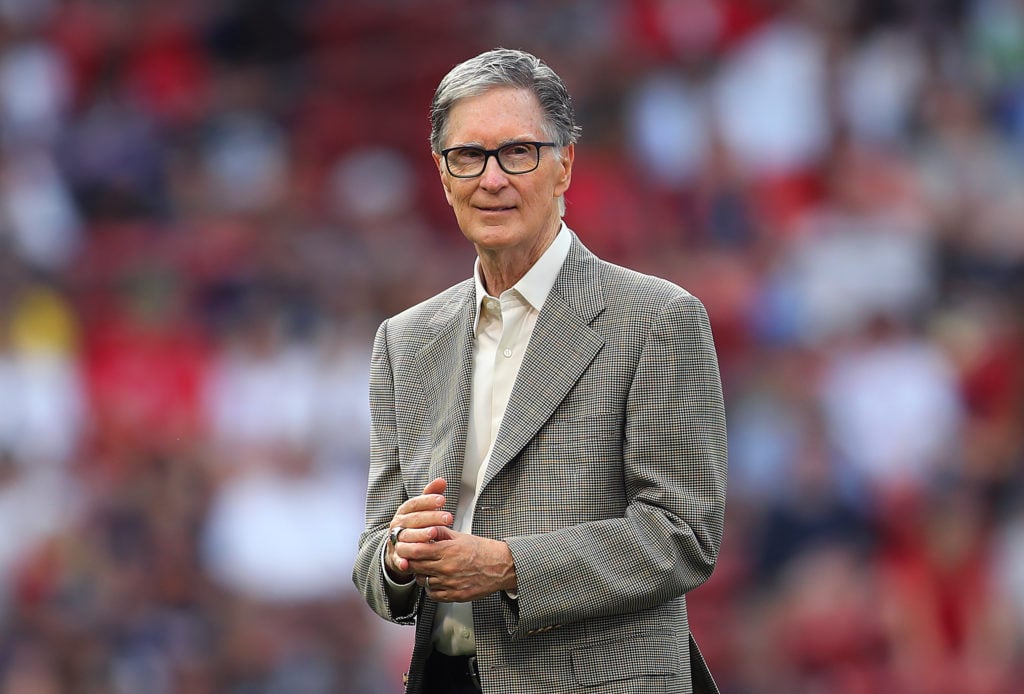

However, after presiding over a second Premier League title triumph in their time on Merseyside and now a historic transfer window that could see them break the British transfer record twice in one summer, FSG aren’t upping sticks any time soon. Indeed, CEO Billy Hogan, speaking during Liverpool’s pre-season tour of Asia, has insisted that “there is absolute commitment from the ownership.”

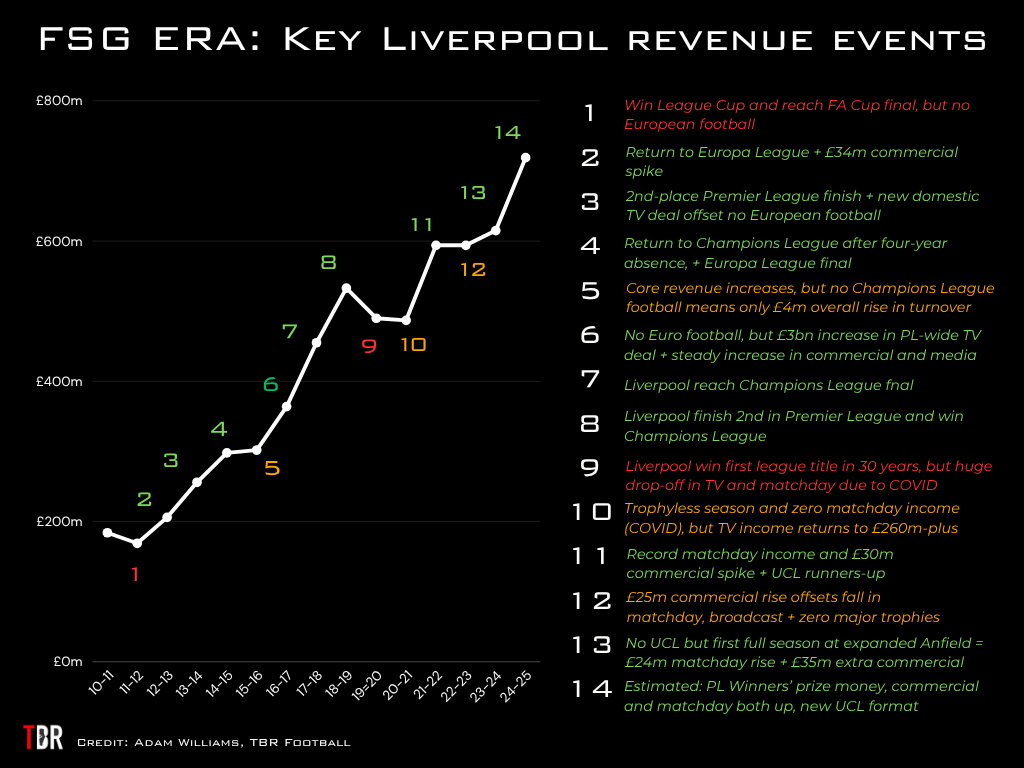

The glory isn’t being confined to the space between the four corner flags, either. Commercially, Liverpool are booming.

In part, it is the outsized growth in sponsorship, retail and matchday income that the Reds are enjoying that has funded the signings of Florian Wirtz, Hugo Ekitike, Jeremie Frimpong, and Milos Kerkez.

Liverpool key revenue events in FSG era

Liverpool key revenue events in FSG era

Credit: Adam Williams/TBR Football/GRV Media

As for a certain much sought after Swede at Newcastle United? Watch this space – there is absolutely no reason why Liverpool couldn’t afford to sign Alexander Isak this summer, even without sales.

Elsewhere on Planet FSG, Henry and his Boston-based colleagues are also said to be eyeing what would be the single biggest windfall of their careers to date.

FSG could make huge profit on NHL investment that dwarfs Liverpool takeover price

As investors, FSG are pretty inscrutable.

No sooner had Henry said they were concentrating on consolidating their portfolio earlier this year, stories about the acceleration of Liverpool’s multi-club model emerged.

As reported by TBR Football, FSG have a Spanish club in the crosshairs. After talks with Malaga and Getafe collapsed, La Liga outfit Levante are understood to be next on the agenda. A takeover in rugby is said to be in the works too.

Photo by John Tlumacki/The Boston Globe via Getty Images

Photo by John Tlumacki/The Boston Globe via Getty Images

But the magnitude of those would-be deals would pale in comparison should FSG decide to sell the Pittsburgh Penguins, the NHL franchise which is probably their most valuable asset after Liverpool and MLB’s Boston Red Sox.

Fenway acquired the franchise for around £650m in 2021. In January of this year, it was revealed that FSG were looking to sell a minority stake in the Pittsburgh Penguins.

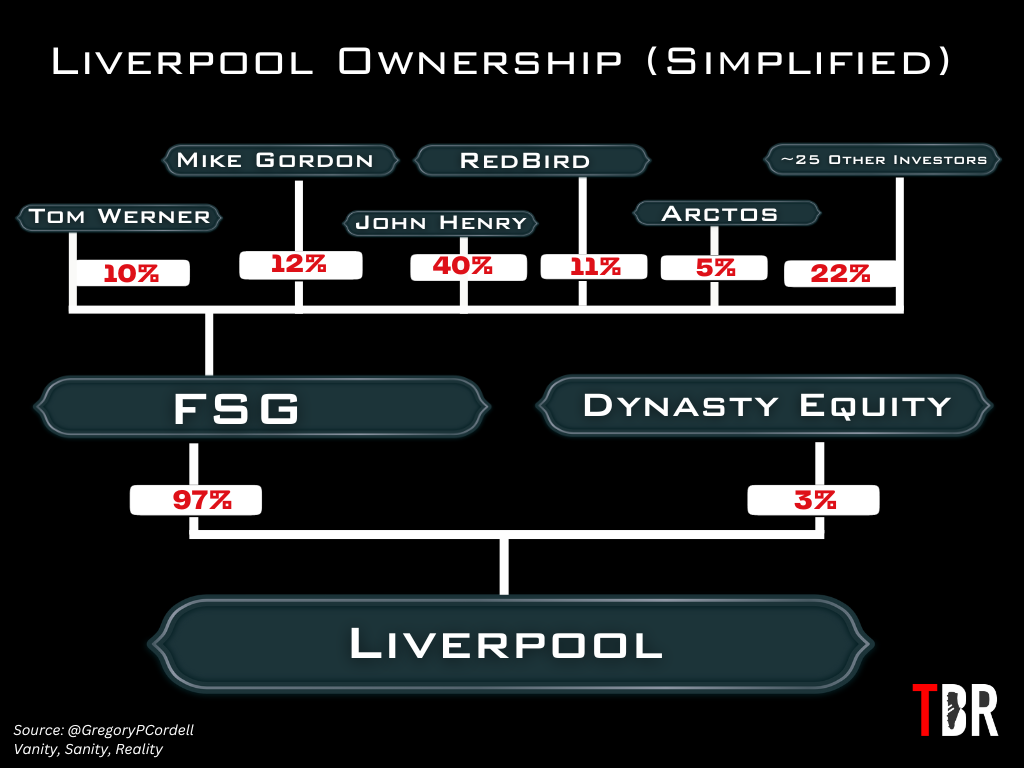

Ostensibly, this would be a similar move as they have performed at Liverpool, where a stake of around three per cent was sold to Dynasty Equity for £127m in September 2023.

Liverpool ownership diagram

Liverpool ownership diagram

Credit: Adam Williams/TBR Football/GRV Media

However, fresh reports now suggest that Mario Lemieux is now attempting to buy the Penguins outright. Incidentally, Lemieux – who in fact played for the Penguins for over 20 years – was the man who sold the franchise to FSG in the first place.

FSG appear to have briefed that the team is not for sale and doubled down on their stance that they are seeking a passive, minority partner. Again, that would mirror their strategy with Dynasty Equity at Anfield.

If their record of capital appreciation at Liverpool is anything to go by, Henry, Tom Werner and Mike Gordon will be confident that they can greatly increase the value of the Penguins if they choose to hold the asset. It is reported that they would only consider a deal for around £970m.

Liverpool making big strides commercially

Arne Slot, his squad and Liverpool’s extended cache of sporting and commercial staff are currently away on a tour of Asia. On Saturday, they were beaten 4-2 by AC Milan in Hong Kong. On Wednesday, they face Yokohama F. Marinos at the Nissan Stadium in Japan.

The aim of these increasingly valuable tours is to both create new fans and nurture the club’s existing overseas following. Liverpool are one of an elite handful of teams whose support is greater outside the UK than it is within it, and getting those fans to engage with the club financially is central to their commercial strategy.

Photo by Carl Recine/Getty Images

Photo by Carl Recine/Getty Images

In that vein, Liverpool have opened a new retail store in Hong Kong and are exploring the possibility of a location in Japan too.

“Liverpool are where they are today by being the smartest man in the room,” says University of Liverpool football finance lecturer Kieran Maguire, speaking exclusively to TBR Football.

“They have observed the success of the likes of Man United in building a brand in markets where there is lots of disposable income. United, for example, have loads of stores in China where there is a lot residual and disposable income. These are the real growth markets.

“You have to know what is popular in those markets – leveraging a social media platform in individual markets, for example. It’s a tried-and-tested approach.“

Maguire also told TBR Football how the

“As far as integrating FSG’s network is concerned, you’re always looking at revenue and cost synergies in business. Utilising the existing FSG network means you don’t have to build that network yourself, so it reduces your cost base. Liverpool are super-smart. You have to appreciate their business acumen.