2h agoTue 25 Nov 2025 at 2:16amMarket snapshotASX 200: -0.12% to 8,514 pointsAustralian dollar: flat at 64.64 US centsS&P 500: +1.6% to 6,705 pointsNasdaq: +2.7% to 22,872 pointsFTSE: -0.1% to 9,534 pointsEuroStoxx 600: +0.1% to 562 pointsSpot gold: -0.06% at $US4,136/ounceBrent crude: -0.24% to $US63.22/barrelIron ore: +0.2% to $US104.85/tonneBitcoin: -1.07% at $US87,874

Prices current at around 1:10pm AEDT

Live updates on the major ASX indices:

2m agoTue 25 Nov 2025 at 4:17amAUSTRAC considering regulatory action against Bendigo Bank

AUSTRAC, the anti-money laundering regulator, says it’s engaging with Bendigo Bank regarding its anti-money laundering disclosures.

The bank reported suspicious activities at one of its branches to AUSTRAC, then engaged Deloitte to conduct an investigation into its risk management.

The bank reported the findings today, which found ‘deficiencies’ in the banks approach to money laundering and terrorism financing risk.

“AUSTRAC has been engaging with Bendigo Bank in relation to the matter, and is considering what, if any, regulatory action is appropriate,” the regulator told the ABC in a statement.

Shares in Bendigo & Adelaide Bank are down almost 7%.

25m agoTue 25 Nov 2025 at 3:55amSuperannuation giant Cbus ordered to pay penalty for breaking law over death and disability insurance claims handling

Superannuation giant Cbus has been ordered to pay a $23.5 million fine after admitting it breached the law over major delays in its handling of insurance claims.

The super fund will also pay $32 million in compensation to 7,402 people, in response to its problems with claims handling.

It brings to a close a major case that has been part of the regulator’s push to see the super sector improve its member communication and customer service standards.

Cbus, which is chaired by former Labor treasurer Wayne Swan, holds more than $100 billion in members’ funds. Mr Swan was previously hauled before a Senate committee and apologised for the fund’s “far from perfect” behaviour.

As Nassim Khadem reports, in the Federal Court on Tuesday, Justice David O’Callaghan approved the fine and the compensation both parties had agreed to:

46m agoTue 25 Nov 2025 at 3:33am

Jakarta overtakes Tokyo as world’s largest city according to UN

Indonesia’s capital Jakarta is the world’s largest urban centre with a population of almost 42 million, according to new research by the United Nations.

Australia’s entire population is 27.8 million.

51m agoTue 25 Nov 2025 at 3:29am

Still fixing exploitation in visa system

Matt Thistlethwaite, assistant minister for immigration, has spoken at the Australian National University (ANU) in Canberra today.

He spoke about the moves the Albanese government has taken to try to fix the many problems in our migration system.

He says the government is still working through the recommendations from the Nixon Review, which investigated the prevalence of exploitation in Australia’s visa system.

He says the Review found that a number of facilitators, including scam operators and a small, organised group of Registered Migration Agents were abusing the Australian visa system.

“This was creating real victims — people being trafficked and exploited for profit,” he said.

“We must rid our immigration sector of those scam providers who participate in criminal activity and wreak misery on vulnerable people.

“A major multi-agency effort is currently underway to crack down on scam migration agents who have ripped off vulnerable visa applicants of more than $1.4 million.

“There are teams right now focusing on scam agents who are providing people with unlawful protection visa advice, charging exorbitant fees and encouraging applicants to make false claims for bridging visas with work rights.

He also notes that Net Overseas Migration has fallen by 40 per cent since its peak in 2023, as the flow of migrants into and out of Australia slowly returns to more normal levels.

1h agoTue 25 Nov 2025 at 2:26amInsurance Catastrophe declared for south-east Queensland hailstorms

1h agoTue 25 Nov 2025 at 2:26amInsurance Catastrophe declared for south-east Queensland hailstorms

The Insurance Council of Australia (ICA) has today declared an Insurance Catastrophe for the strong winds and damaging hail that impacted south-east Queensland between Sunday, November 23 to Monday, November 24.

It says insurers have already received more than 16,000 claims across more than 140 postcodes for this event — to be known as CAT 255.

The ICA’s Catastrophe declaration will escalate and prioritise the insurance industry’s response for affected policyholders.

Under the Catastrophe declaration:

Claims from affected policyholders will be given priority by insurers. Claims will be triaged to direct urgent assistance to the worst-impacted property owners. ICA representatives will be mobilised to work with local agencies and services and affected policyholders. Insurers will mobilise disaster response specialists to assist affected customers with claims and assessments. An industry taskforce is established to identify and address issues arising from this catastrophe.

It says insurers are also monitoring and prioritising claims across the Northern Territory and Western Australia as a result of Tropical Cyclone Fina.

2h agoTue 25 Nov 2025 at 2:09amAustralia vehicle sales to rebound in 2026 with SUVs and EVs leading

BMI has published its outlook for Australian vehicle sales.

It forecasts vehicle sales in Australia will recover by 1.4% to 1.19 million units in 2026, underpinned by lower inflation and interest rates, improved consumer and business sentiment, and supportive fiscal policy.

In the graphic below, see how the blue line picks up in 2026:

It says in 2025, once the final numbers come in, vehicle sales in Australia are expected to contract by 2.4% y-o-y following underwhelming growth in 2024.

But in 2026, it expects growth across the commercial vehicle (CV) segment — led by light commercial vehicles (LCVs) — and the passenger vehicle (PV) segment.

BMI also expects the electrification of the Australian fleet to continue in 2026 despite the withdrawal of some state-level subsidies as the New Vehicle Efficiency Standard (NVES) is implemented and a flurry of electric sport utility vehicles (SUVs) enter the market.

2h agoTue 25 Nov 2025 at 1:27am

Cautious optimism over lithium price rally

Vivek Dhar, CBA’s mining and energy commodities analyst, has circulated this chart on lithium prices.

Mr Dhar says recent “demand tailwinds” have exceeded expectations and it’s seen lithium prices increase faster than predicted recently.

He says further modest price gains can be sustained too, although he remains cautious about that, given the latent supply that’s sitting on the sidelines globally, which is ready to come online if lithium prices rebound.

What’s happening in lithium markets these days?

“The more recent rally in lithium prices since October has been driven by lithium demand hopes — especially in battery storage in the power sector,” he says.

“The International Energy Agency (IEA) estimates that global lithium demand will expand by 14-21% CAGR (Compounded Annual Growth Rate) from 2024 to 2030 depending on the climate scenario.

“The lower growth projection is tied to the IEA’s Stated Policies Scenario (i.e. +2.4°C increase in global temperatures relative to the pre-industrial age), while the higher growth scenario is linked to the IEA’s Net Zero Emissions scenario (i.e. +1.5°C).

“Grid battery storage only accounts for ~9% of lithium demand, well below the ~53% share of lithium demand held by electric vehicles.

“Lithium chemical producer, Ganfeng Lithium, gave further fuel to the rally earlier this month after the company’s chairman predicted a ~30% increase in lithium carbonate demand in 2026, which would effectively bring the lithium carbonate market into balance and give lithium prices room to rise.

“But the chairman speculated that if lithium carbonate demand does lift above 30%, it is possible lithium carbonate prices may potentially exceed RMB200,000/t —up 122% from spot levels.

3h agoTue 25 Nov 2025 at 12:58am

ABS releases 2026 Census topics

The Bureau of Statistics has released the final topics that will be included in the 2026 Census.

The Census will be held on 11 August 2026.

The ABS says following a comprehensive review, the Census will now include new questions on sexual orientation and gender for individuals aged 16 years and over.

It says those additional topics “will provide valuable data to complement existing Census information and support more inclusive policy development and service delivery for Australians.”

Those questions will be in addition to the Census’s usual questions on housing, health, income, population, transport, disability and carers, Aboriginal and Torres Strait Islander peoples, and many others.

3h agoTue 25 Nov 2025 at 12:35am

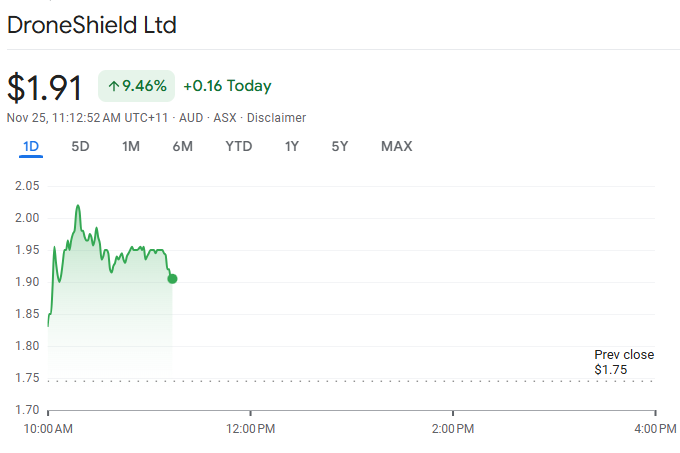

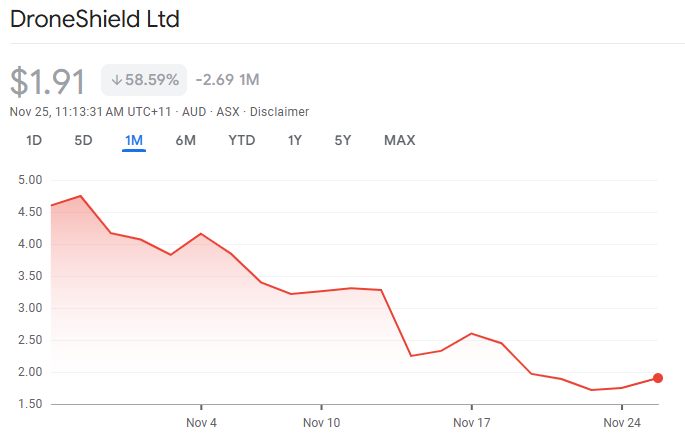

DroneShield share price up today

How are Droneshield going today?

– Leon

Hi Leon, its share price is up significantly today.

But it’s got a lot of work to do to regain the value it’s lost over the past month.

3h agoTue 25 Nov 2025 at 12:22am

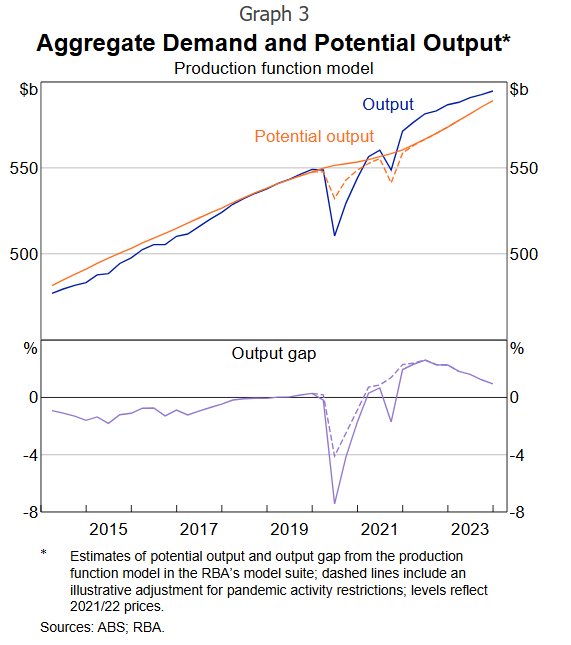

The economy’s speed limit

I’m a bit confused. Luke Yeaman says firstly current “stronger growth “ is a concern for the RBA , then he says “potential growth is lower” which means the RBA would be happier wouldn’t they?

– Phillip

Hi Phillip,

Economists try to keep tabs on what an economy’s “potential growth rate” is at any given moment.

They estimate that potential growth rate by figuring out what they think the economy is capable of producing, at the outer frontier, without producing worrying inflation.

That potential growth rate can rise or fall depending on multiple things.

If workers and businesses suddenly become more productive, an economy’s potential growth rate will increase, but;If the supply of oil shoots significantly higher, and stays higher for a year or more, then lots of capital stock could be rendered uneconomic and suddenly your economy won’t be able to produce as much and its potential growth rate will fall.

So, if Mr Yeaman thinks the potential growth rate is lower, it means the prevailing rate of growth is now relatively stronger.

And in such a situation, that means there’s less room to move if economic growth starts getting stronger still because the rate at which the economy can sustainably grow without pushing inflation higher is already lower than what it was.

This graph from the RBA from a couple of years ago helps to visualise it.

During the inflation surge in 2021 to 2023, they estimated that economic activity (the blue line: output) was stronger that the potential rate of growth (the orange line: potential output), which is what was driving the inflation.

Mr Yeaman is talking about a similar phenomenon today.

When he says we’re already close to our economic speed limit, he’s talking about our economy’s potential output.

This is where that RBA graph comes from:

4h agoTue 25 Nov 2025 at 12:18amBendigo & Adelaide Bank shares drop 7%

Shares in Bendigo & Adelaide Bank are down more than 7% after the bank revealed shortcomings in its anti-money laundering controls.

The bank this morning reported the findings of a Deloitte investigation to the ASX, with the consultancy finding deficiencies in its risk management, after suspicious activities at one of the bank’s branches.

Bendigo hired Deloitte to conduct the investigation after reporting the matter to financial crimes regulator AUSTRAC.

4h agoMon 24 Nov 2025 at 11:51pm

Market snapshotASX 200: +0.2% to 8,538 pointsAustralian dollar: flat at 64.64 US centsS&P 500: +1.6% to 6,705 pointsNasdaq: +2.7% to 22,872 pointsFTSE: -0.1% to 9,534 pointsEuroStoxx 600: +0.1% to 562 pointsSpot gold: flat at $US4,140/ounceBrent crude: +1.3% to $U63.37/barrelIron ore: +0.1% to $US104.75/tonneBitcoin: -0.5% at $US88,329

Prices current at around 10:50am AEDT

Live updates on the major ASX indices:

4h agoMon 24 Nov 2025 at 11:41pm’This is their day’: Union leader pays tribute to workers

Earlier this morning, the TWU, Minister for Employment and Workplace Relations Amanda Rishworth and delivery drivers fronted a press conference in Canberra.

Secretary of the peak body of Australian unions, Sally McManus, gave a bit of a potted history of the gig economy as she paid tribute to the Transport Workers Union and workers in gaining the new protections.

“Aussie unions have pulled off a world first. This is the first time in the world that gig riders, delivery riders, have got minimum conditions and are now treated and respected as they should be. And Australian unions were never gonna leave behind these workers. “

“We knew when they started joining their union, the TWU, the poverty wages they were on and how much they were being pushed to complete orders.

“Unfortunately, throughout this eight-year fight, we’ve seen some workers be killed because they were pushed so hard by the algorithm to deliver orders quickly in our big cities and forced to drive (in) dangerous conditions. And you know, it’s in their memory too, that these laws are here.”

Sadly, the number of delivery riders killed in recent years is too numerous to list, but the ABC has covered many including, Burak Dogan, Dede Fredy and Xiaojun Chen.

“We would never accept the fact that some workers in our country had less rights than workers did a hundred years ago.

“We worked with the Labor government to get new laws in place that gave them the legal minimums but new laws are one thing, putting them in action is another thing and that’s due to the work of the TWU and the members who have negotiated with these huge multinationals UberEats and DoorDash to put in place minimum standards which are going to lead quite frankly, to very significant pay increases for these workers as well as protection in terms of insurance for them and to make sure that they have basic rights that other workers have to be properly consulted about how their work happens.

The laws also put in protections against summary dismissal. In standard employment, there are protections (as well as the ability for employers to boot staff doing egregious and illegal things). Now, increased job security for workers taking on the internet giants.

“This comes on top of protections for gig workers for being unfairly deactivated, also bringing them in line with other workers who have basic protections from being unfairly dismissed as well.

“So this is a huge … Huge day for Australia actually we should be proud that we’re the first in the world to deliver fairness for these workers and really, this is their day.”

4h agoMon 24 Nov 2025 at 11:29pm

What is petrol costing where you are?

OK, so the national average price of a litre of unleaded petrol is up 1.3 cents to 181.6 cents in the week to Sunday.

But what you really want to know is what it’s like where you live?

And thanks to the dedicated boffins at the Australian Institute of Petroleum, here’s that very data.

What 1 litre of unleaded cost last week, where you are (Australian Institute of Petroleum)5h agoMon 24 Nov 2025 at 11:13pmASX edges up at the open

What 1 litre of unleaded cost last week, where you are (Australian Institute of Petroleum)5h agoMon 24 Nov 2025 at 11:13pmASX edges up at the open

Local trade is underway and the ASX 200 has gained 0.1% so far, so a more modest start than the strong gains seen on Wall Street overnight.

5h agoMon 24 Nov 2025 at 10:46pm

Bendigo Bank discloses anti-money laundering shortcomings

Bendigo Bank has disclosed ‘deficiencies’ in the bank’s approach to financial crimes.

In a statement, it says it engaged an independent consultant in August, after it found suspicious activity at one of its branches.

The investigation found shortcomings in the bank’s approach to the “identification, mitigation and management of money laundering and terrorism financing risk.”

“The Bank accepts that is has more to do and will continue to work on improving its risk frameworks and processes, in order to continue delivering on its purpose,” the statement reads.

Bendigo Bank says it has made investments to improve its approach and make sure it’s fully compliant with its obligations.

5h agoMon 24 Nov 2025 at 10:28pmEconomy ‘about to crash through its speed limit’, rates may rise in 2026, warns CBA

An interesting and, for mortgage borrowers, slightly worrying note from the Commonwealth Bank’s chief economist.

Luke Yeaman was, until quite recently, one of the most senior federal Treasury officials, and he is warning that Australia’s economy is running close to full speed, creating a headache for the Reserve Bank.

“Stronger growth, a resilient labour market, rising house prices and an inflation surprise in the September quarter have taken rate cuts off the table and raised the risk of hikes in 2026,” he warns.

“Three points are clear:

Potential growth in Australia is now lower; We are starting this cyclical upswing with less excess capacity (or headroom) than is normal; And we are already getting close to our economic speed limit.”

Yeaman says rate hikes over the next year are not CBA’s ‘base case’.

“In our view, slower income growth, mildly restrictive monetary policy and the shift from an easing to a hiking bias on interest rates will take enough heat out of the cycle to prevent a return of broad‑based inflation and rate hikes,” he notes.

But he reiterates the points from a recent speech by RBA deputy governor Andrew Hauser, where the central bank’s second in command warned the economy could head in two directions, one consistent with some more rate cuts, the other with future rate hikes.

“We will continue to run close to the economy’s speed limit, so the RBA Board will constantly be on edge and rate cuts will remain off the agenda,” Yeaman warns.

“If the economy builds more steam than we expect, watch for rate hikes in 2026.”

6h agoMon 24 Nov 2025 at 9:56pm

Cbus death benefit delay judgement due today

You’ll likely recall the furore about the delayed release of superannuation death benefits to relatives from recent years.

Here’s a link to a report from Nassim Khadem, where a woman says superannuation giant Cbus took so long processing her claim that she gave up fighting for life insurance benefits after the death of her former partner.

The penalty decision in regulator ASIC’s case against Cbus for death benefits delays will be handed down at 10:15am AEDT today and we’ll bring you the outcome.

6h agoMon 24 Nov 2025 at 9:45pm

Seeking more in your paypacket? Already happening

Data from market-dominating jobs website SEEK gives us an insight int the employment market.

It’s different to, but a complement, to official ABS stats.

For October, here are their key figures:

Job ads declined 0.4% month-on-month in October, with the annual decline slowing to 2.2%. The industries showing a monthly increase included Manufacturing, Transport & Logistics (1.1%), and Construction (1.0%), with roles in Real Estate & Property jobs (1.4%) the fastest growing month on month.Applications per job ad increased by 1.3% month-on-month, marking over three years of uninterrupted growth.Advertised salary growth rose 0.4% month-on-month in October, inching up since June 2025, and to 3.6% year-on-year.

In a statement, SEEK Senior Economist, Dr Blair Chapman, added some meat to the bones of the data:

“Job ad volumes declined this month, down 0.4% in October.

“Failing demand within the Professional Services and Public sectors drove the overall monthly decline, while Healthcare and Medical, and Retail & Consumer Products roles recorded monthly and annual drops in ad volume.

“There were pockets of growth for the month, which reflect longer term demand within the Construction and Industrial Sectors, particularly in New South Wales, Queensland and South Australia.

“As we move through the final weeks of 2025, where hiring activity tends to slow, candidate activity tends to rise, making it competitive for workers looking to secure a new position ahead of the new year.”

SEEK Advertised Salary Index – October 2025

The site also publishes an index, essentially marking against its older data. Blair Chapman, again:

“Advertised salary growth accelerated slightly to 3.6% year ended, with monthly growth trending up slowly since June.

“The slight acceleration in annual advertised salaries growth, returning to the pace last recorded in May, comes despite the labour market looking a little weaker than it did then, with annual employment growth slower and a higher unemployment rate.

“Advertised salary growth outpaced employee living costs by an even wider margin in the September quarter. While employee living costs remain steady at 2.6% year-on-year, advertised salaries grew faster in September than they did in June.”

ASX 200: -0.12% to 8,514 pointsAustralian dollar: flat at 64.64 US centsS&P 500: +1.6% to 6,705 pointsNasdaq: +2.7% to 22,872 pointsFTSE: -0.1% to 9,534 pointsEuroStoxx 600: +0.1% to 562 pointsSpot gold: -0.06% at $US4,136/ounceBrent crude: -0.24% to $US63.22/barrelIron ore: +0.2% to $US104.85/tonneBitcoin: -1.07% at $US87,874

ASX 200: -0.12% to 8,514 pointsAustralian dollar: flat at 64.64 US centsS&P 500: +1.6% to 6,705 pointsNasdaq: +2.7% to 22,872 pointsFTSE: -0.1% to 9,534 pointsEuroStoxx 600: +0.1% to 562 pointsSpot gold: -0.06% at $US4,136/ounceBrent crude: -0.24% to $US63.22/barrelIron ore: +0.2% to $US104.85/tonneBitcoin: -1.07% at $US87,874