Omnicom’s $13.5 billion acquisition of Interpublic Group creates the world’s largest advertising and marketing holding company by revenue and billings. B&T breaks down the state of play in Australia and what a combined group could look like.

Omnicom’s acquisition of rival Interpublic Group marries two Madison Avenue giants with some of the most storied advertising agencies going.

Nonetheless, research shows that most M&As—around three-quarters, according to a Fortune study—end up in failure, and almost all create chaos and change for at least one of the parties.

Omnicom’s acquisition of IPG allows it to scale its data and tech, while delivering greater scale and operational efficiencies.

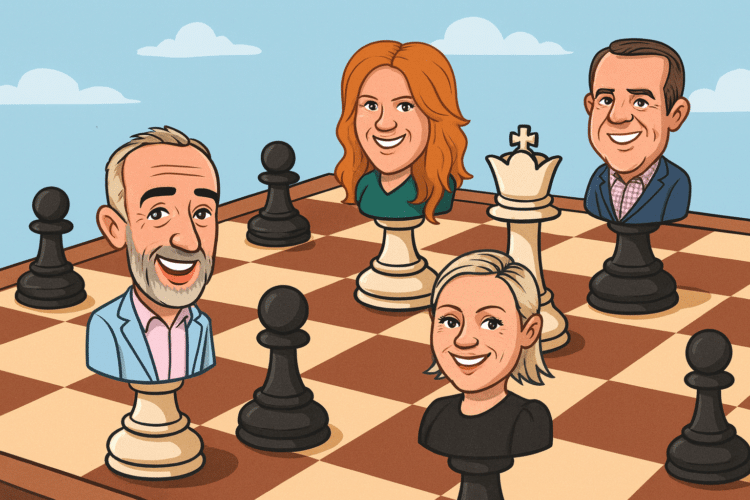

Globally, Omnicom 2.0 will be led by John Wren, who remains CEO and chair, while Phil Angelastro stays on as EVP and CFO, and former IPG CEO Philippe Krakowsky and Daryl Simm will serve as co-presidents and COOs.

There have been plenty of rumours circulating about what the merger means for agencies. B&T has previously reported that the DDB brand could be retired, while other rumours indicate that FCB and MullenLowe could join forces, potentially leaving the group with BBDO Worldwide, McCann Worldwide, TBWA+DDB, FCB+MullenLowe, as its creative brands.

The media side is less clear. B&T understands that OMD and PHD are safe. Initiative and UM could also stand alone, but one of these may absorb Hearts & Science.

The final make up will likely stem from Madison Avenue, and Oceania has already been flagged as one of the pilot markets.

Nonetheless, there will be repercussions Down Under, with an announcement expected this week.

Here is what we know about the agencies and key figures involved.

Omnicom Oceania

Omnicom Oceania is led by Nick Garrett, the former Clemenger BBDO leader and global CMO of Deloitte Digital.

TBWA’s Lisa Brown has been appointed to lead production and Daniel Klug has been appointed director of new media.

Last week, Garrett said that he was in the “uncomfortable position” to merge 127 brands, products, services and capabilities that sit under the agency brands into 30.

Garrett pointed out that his biggest task will be uniting the different Omnicom and IPG agencies under a single culture.

“You can have the most unbelievable architecture. You can hire the best technology systems integration with people, and we all know it’s bullshit. Culture eats strategy for breakfast. If you don’t get the people, it doesn’t count for shit,” he said.

Omnicom Media Group

Here’s where it gets interesting. In Australia, Omnicom Media Group is currently led by chief executive Kristiaan Kroon and new COO Mark Jarrett. Tony Harradine is CEO of Omnicom APAC.

At present, IPG Mediabrands is led by industry veteran Mark Coad, who forged a successful leadership career at Omnicom through OMD and PHD before joining Mediabrands. The roles of Coad, and APAC boss Leigh Terry, are unlikely to continue. We shall soon learn if Omnicom finds alternative roles that are appealing to the pair.

Creative agencies

Clemenger BBDO (full service)

Leader: Lee Legett

Headcount: 350

Offices: Sydney, Melbourne, Brisbane

Major clients: Samsung, Mazda, Asahi

Outlook: Clemenger BBDO only recently united Clems, CHEP Network and Traffik into a single agency. Although they recently lost strategy chief Simon Wassef to M+C Saatchi, the agency is likely to be safe.

TBWA\Australia

Leader: Kimberlee Wells

Headcount: 250 (est)

Offices: Sydney, Melbourne, Adelaide

Major clients: Telstra (through +61), NAB, Apple (Through Media Arts Lab)

Outlook: The Disruption agency has important clients and heritage. At a global level, Wren is understood to be a fan of TBWA and there are no indications the agency is under any threat. But could one of Omnicom’s other agency brands be folded into it? There have been unconfirmed rumours TBWA could absorb DDB if that brand were to go.

DDB

Leaders: Sheryl Marjoran (Sydney), Mike Napolitano (Melbourne)

Headcount: 260 (est)

Offices: Sydney, Melbourne

Major clients: Coles, Dulux, TAC

Outlook: In Australia, DDB recently lost one of its longest client relationships (McDonald’s), while adding another notable account in TAC. There have been reports the DDB will be retired and it has already been phased out in some markets. DDB’s Australian team has produced outstanding work over the years, will this continue under DDB or one of Omnicom’s sister agencies?

Note: 303 MullenLowe is majority-owned by Attivo Group.

Media agencies

OMD

Leader: Sian Whitnall

Headcount: 670+

Offices: Sydney, Melbourne, Canberra, Brisbane

Major Clients: Coles, McDonald’s, Telstra

Outlook: OMD is Omnicom’s flagship media agency with bluechip clients including McDonald’s, Telstra, Qantas, Coles, Apple, Mazda, NSW Government and Victoria Government. It’s business as usual for Australia’s largest media agency.

PHD

Leader: Laura Nice

Headcount: 300+

Offices: Sydney, Melbourne, Brisbane

Major clients: Volkswagen, Bunnings, ANZ

PHD is undergoing its own leadership changes as Mark Jarrett passes the baton onto Laura Nice to step into a group role. Nice inherits an agency that has recovered after a bumpy period with some strong new business wins and momentum. It’s unlikely there will be any changes to PHD globally or in this market.

Hearts & Science

Leader: TBC

Headcount: 130

Offices: Sydney, Melbourne, Brisbane, Perth

Major clients: Diageo, HSBC, Mercedes

Outlook: Long-serving Hearts boss Jane Stanley recently left the business to spend more time with her family in New Zealand. Omnicom will not replace Stanley until after the acquisition wash up and it is unclear whether the agency will continue under Hearts or potentially be combined with another, with UM rumoured as a potential merger partner.

UM

Leader: Anathea Ruys

Headcount: 320

Offices: Sydney, Melbourne, Brisbane & Canberra

Major clients: Australian Federal Government. Kmart Group, Dyson

Outlook: UM has had a rough ride as of late but still counts the Federal Government as a client. It’s hard to envisage Omnicom 2.0 without UM in the mix, but could they be combined with another smaller agency stablemate?

Initiative

Leader: Jo McAllister

Headcount: 274

Offices: Sydney, Melbourne, Perth

Major Clients: Officeworks, WA Government, IAG

Outlook: Globally, Initiative has had a strong year on the new business front and locally McAllister has led a comeback story for the ages after a year in which the agency shed major clients. It’s hard to envisage Omnicom doing too much to change Initiative in the short to medium term.

Mediahub

Leader: Sue Squillace

Headcount: 26

Offices: Sydney, Perth

Major clients: New Balance, Inova Pharmaceuticals, Arla Foods

Outlook: Of all the media agencies between both groups, it’s hard to see Mediahub continuing as a standalone agency brand. The question is where might the Mediahub team go?

Other parts

IPG Mediabrands’ buying division, Magna, could be another part that is likely to be folded into OMG. This would raise questions about the future of experienced chief investment officer Lucy Formosa Morgan and where she fits into the OMG’s buying division.

Interpublic’s Kinesso adds a strong performance and tech business to the Omnicom machine, while Acxiom is a strong data, tech and experience Interpublic brand that will be added. There may be duplication of roles within Omnicom’s current set up and questions about whether those brands continue to operate in market or are folded into the OMG machine.

The respective cultural agencies, Identity Communications (IPG Mediabrands) and OMG Unite, may also join forces.

Join more than 30,000 advertising industry experts

Get all the latest advertising and media news direct to your inbox from B&T.

Subscribe