This article first appeared in The Edge Malaysia Weekly on November 24, 2025 – November 30, 2025

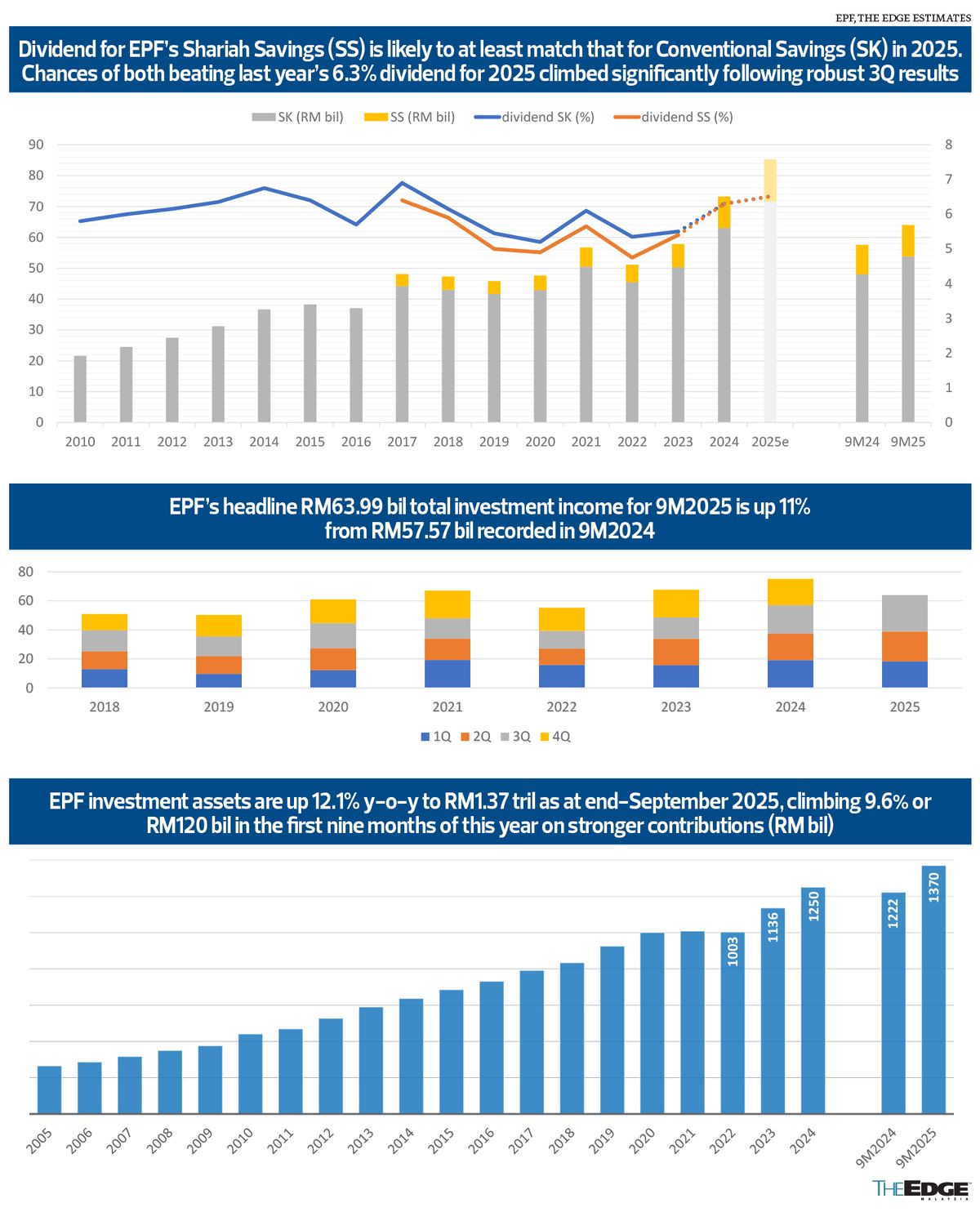

THE over 16.5 million members of the Employees Provident Fund (EPF) can look forward to a dividend of at least 6% for 2025, with prospects of it beating last year’s 6.3% payout brightening after the fund reported possibly its strongest ever quarterly income in the third quarter ended Sept 30, 2025 (3Q2025).

We hesitate to say 6.5%, even though our back-of-the-envelope workings show that to be possible — especially for members with Shariah Savings (SS) — if the strong momentum in the second and third quarters of this year continues in the fourth quarter. Here is why.

Total investment income rose 27% year on year (y-o-y) to RM25.07 billion in 3Q2025, bringing income for the first nine months of this year (9M2025) to RM63.99 billion, or 11% above RM57.57 billion in the same period last year.

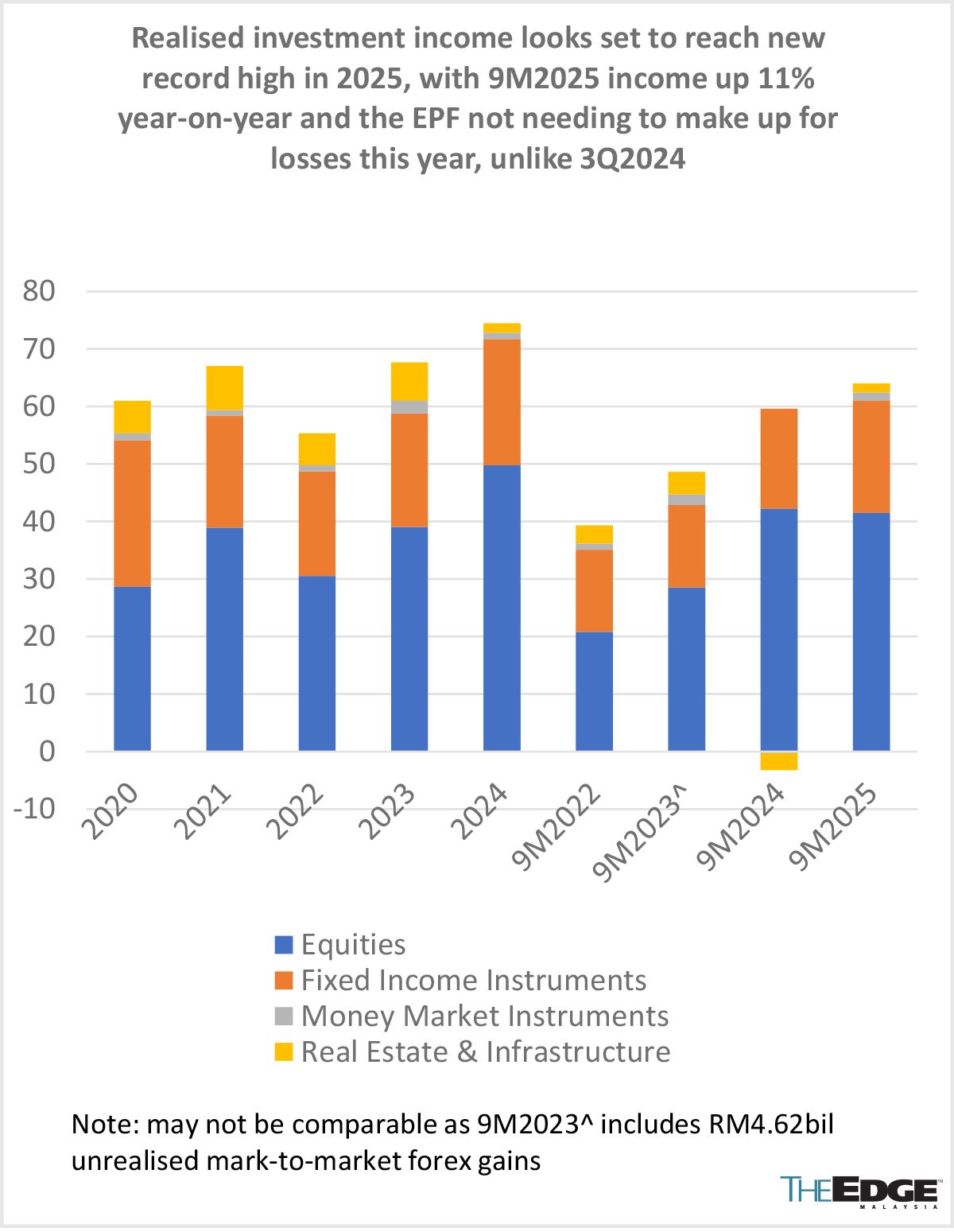

There was no mention of any unrealised mark-to-market gains that cannot be distributed as dividends in EPF’s 3Q2025 release dated Nov 17. There was also no mention of any write-down, which would reduce the pool available for dividend payments. That does not mean there are none so far this year or that there would not be any going into 4Q2025.

Citing elevated valuations in global equity markets and mixed signals from global economic indicators that may temper the pace of interest rate cuts by the US Federal Reserve, EPF CEO Ahmad Zulqarnain Onn said the fund is “cautious heading into the fourth quarter” and “is actively managing these risks by accelerating the locking in of profits at a pace that may be hard to match in 4Q”.

Stocks sank around the globe on Nov 21, barely four days after EPF released “encouraging” 3Q2025 numbers. “We are encouraged by the strength of the Malaysian economy, which supports 61% of the EPF portfolio,” its statement read.

Over half of income from abroad

Global investments contributed RM13.33 billion, or 53% of total investment income of RM25.07 billion in 3Q2025. Profit realised from these foreign investments accounted for RM34.25 billion, or 53.5% of total investment income of RM63.99 billion for 9M2025 — while making up 39% of total investment assets of RM1.37 trillion as at end-September.

Equities — which account for 46% of investment assets — contributed RM16.95 billion, or 68% of total investment income in 3Q2025 and just under 65% of total investment income for 9M2025.

The execution of its strategic asset allocation “allowed the EPF to participate in the recovery of equity markets post ‘Liberation Day’”, the fund said, referring to US tariff angst.

Fixed income, which makes up 45% of investment assets for capital preservation, contributed 27% of total investment income for 3Q2025 and 30.4% of total investment income for 9M2025.

EPF’s performance is largely dependent on its performance in the equities and fixed income segment, even though profit from disposals do shore up income for the real estate and infrastructure segment during certain quarters.

Real estate and infrastructure, which make up 7% of assets, only brought in 1% of income in 3Q2025 and 2.5% of investment income in 9M2025. Meanwhile, money market instruments, which account for 2% of investment assets, contributed 5% of 3Q2025 and 2.2% of 9M2025 total investment income.

Growing dividend threshold

Notably, EPF’s total investment assets rose 12.1% y-o-y to RM1.37 trillion as at end-September 2025. That is higher than the 11% growth in total investment income over the same period.

Total investment assets are up about RM120 billion or 9.6% in the first nine months of this year, on the back of stronger statutory plus voluntary contributions — even before mandatory EPF contributions for non-Malaysian citizens kicked in from October this year.

That further raises the amount necessary to deliver every 1% of dividend to EPF members, which has already been above RM10 billion since 2023.

Moreover, the split between members’ savings kept under Conventional Savings (SK) and SS is not immediately known.

At the time of writing, EPF has yet to release its 2024 annual report. Before 2018, EPF used to release its annual report by end-May, according to our internal records in the past two decades. Bank Negara Malaysia also no longer releases monthly data on EPF contributions and withdrawals from early 2020.

According to EPF, voluntary contributions increased 47.5% y-o-y to RM15.3 billion in 9M2025 from RM10.37 billion a year earlier. The number of EPF members contributing more than the statutory contribution rate of 11% rose to 231,034 from 172,829 last year. This made up 2.5% of EPF’s 9.07 million active members, which represented 51.7% of Malaysia’s 17.54 million labour force as at end-September 2025.

If indeed EPF repeats last year’s stellar 6.3% dividend payout in 2025, there would be fewer questions over its performance — as witnessed by the noise in parliament over the headline 13% y-o-y decline in its total investment income in 1Q2025.

If action does speak louder than words, strong dividends should offer some respite to those unnerved by the debate over the timing of the divestment of Malaysia Airports Holdings Bhd shares and calm any unease among members over talks of their old age savings being used for national service under the Ministry of Finance-led GEAR-uP initiative for nation-building.

More importantly, a higher dividend payout would shore up the compounding power of EPF savings — essential for members looking to replenish old-age savings depleted by Covid-19-related withdrawals.

EPF announced its annual dividend in the first week of March in the past four years, but announcements have previously been as early as end-January.

Save by subscribing to us for

your print and/or

digital copy.

P/S: The Edge is also available on

Apple’s App Store and

Android’s Google Play.