Chinese tourists visiting Thailand can now enjoy easier payments, thanks to expanded, interoperable quick response (QR) code services enabled by deepening cross-border collaboration between the two countries. The initiative is powered by UnionPay’s global payment capabilities and QR infrastructure from UnionPay International (UPI).

Making cross-border QR payments seamless

UPI, a global leader in payment solutions, has partnered with National ITMX Co Ltd (NITMX), Thailand’s national payment infrastructure operator, to allow UnionPay users to make PromptPay-supported QR payments in Thailand.

The China-Thailand QR code interoperability is based on a Network-to-Network (N2N) model. Under the guidance of the Bank of Thailand (BoT) and with bilateral policy support, UnionPay and Thailand’s local QR code network have implemented cross-border interoperability collaboration on a commercial basis, to support trade, investment and tourism.

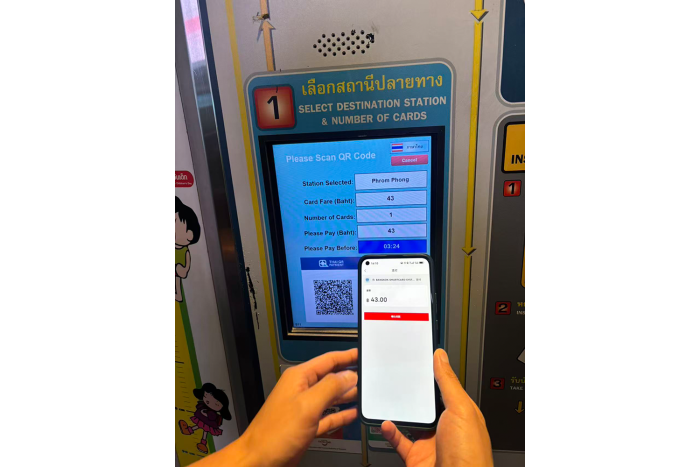

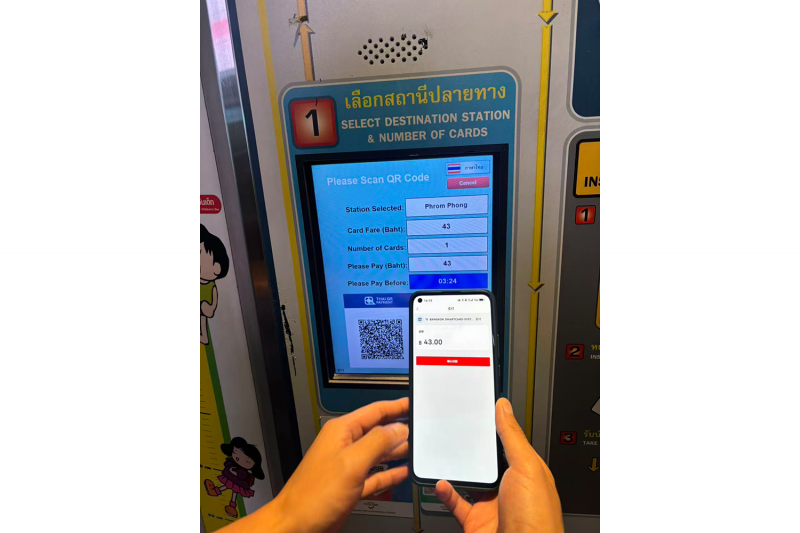

The partnership enables Chinese tourists to scan and pay at Thai merchants, enhancing their digital payment experience while travelling. The service has been available since 30 October this year.

With this collaboration, Chinese visitors can make purchases at participating merchants across Thailand—especially in Bangkok, Phuket and Chiang Mai—by simply scanning merchant’s QR code using their familiar mobile payment apps such as Yun Shan Fu (UnionPay app).

This removes the need for currency exchange and delivers the same fast, secure and convenient experience they enjoy at home. For example, a tourist buying mango sticky rice at a Chiang Mai night market can pay just as they would in China, according to Chinese media reports.

Under the China–Thailand cross-border QR interoperability project, UnionPay has become the first international card scheme to provide PromptPay QR code payment services for visitors from China.

Driving QR interoperability across Asean

As payment digitisation spreads across Southeast Asia, QR code scanning has grown increasingly popular. UPI has become a leading global payment partner in the region, supporting multiple cross-border interoperability initiatives across the Association of Southeast Asian Nations (Asean) over the past two years.

In 2024, UPI and Vietnam’s National Payment Corporation (NAPAS) launched a “model project” for government-to-government cross-border QR payments. UPI also partnered with Laos’ national payment network (LAPNet) to roll out QR interoperability in the same year.

In 2025, UnionPay’s efforts accelerated further. UPI signed agreements with Indonesia’s Payment System Association (ASPI), Ant International, Bank of China (Hong Kong) Jakarta Branch and the country’s four switching networks—Rintis, ALTO, Artajasa and Jalin—streamlining project implementation.

ICBC, together with UPI, NAPAS, and Vietcombank, established the “Quadrilateral Cooperation Agreement on China–Vietnam QR Code Retail Payment Interoperability,” marking a landmark bilateral initiative.

In Thailand, UPI and NITMX are focusing on tourism, enabling cross-border payments for Chinese and Thai travellers. Following the 2024 mutual visa-exemption agreement, two-way tourism has surged. From Jan 1 to Nov 16, Thailand welcomed 28.3 million foreign visitors, with Chinese tourists among the largest groups.

Strengthening connectivity through trusted ties

UnionPay continues to deepen collaboration with the BoT, local payment networks, financial institutions and other partners to advance QR payment interoperability between China and Thailand.

Through comprehensive UnionPay solutions, the company tries to provide integrated connection with Thailand’s payments ecosystem—using digital connectivity to support economic cooperation, smoother capital flows and enhance people-to-people links.

With QR payments now embedded in everyday spending, what crosses the border is not only money, but also trust, convenience and a shared commitment to a more seamless financial future.

In line with UnionPay’s corporate vision of “Trusted Ties, Shared Success,” this collaborative and open “UnionPay model” is emerging as a meaningful catalyst for broader regional financial cooperation.

As more interoperability project take shape, cross-border payments are expected to progress from simple “technical connectivity” to deeper “ecosystem connectivity” —ultimately strengthening genuine people-to-people exchange.

This evolution highlights UnionPay’s contribution to smoother cross-border transactions and a more connected ASEAN.