Updated December 15, 2025 — 3:25pm,first published December 15, 2025 — 3:00pm

Save

You have reached your maximum number of saved items.

Remove items from your saved list to add more.

Save this article for later

Add articles to your saved list and come back to them anytime.

Got it

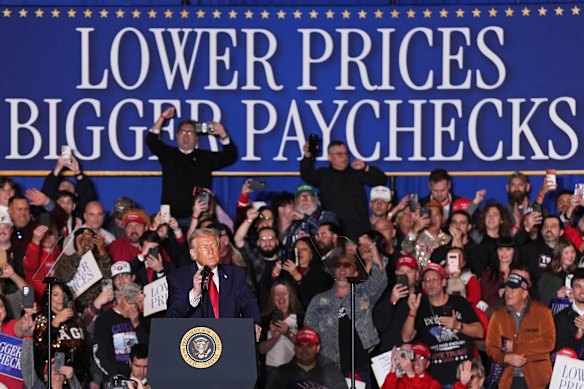

Reserve Bank governor Michele Bullock has warned the next five years could be marked by a slow-moving global economic decay as the unintended consequences of Donald Trump’s policies to make America great translate into higher costs and slower growth.

In an exclusive interview, Bullock said the fallout from the Trump administration’s global tariff campaign would be similar to the trouble afflicting the British economy from Brexit.

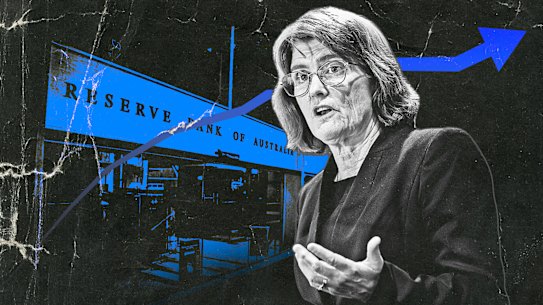

Michele Bullock at her last press conference of 2025 explaining the direction of interest rate movements.Louie Douvis

Michele Bullock at her last press conference of 2025 explaining the direction of interest rate movements.Louie Douvis

As the first RBA governor to give regular press conferences, she has revealed her approach to communicating with the public – by trying to explain difficult economic concepts as if she were talking to her mother.

The bank is this week releasing a report into how it has responded to the 51 recommendations made by an independent review of the Reserve that prompted the institution’s most significant changes since it started targeting a 2-3 per cent inflation rate in the early 1990s.

The changes included the creation of a separate committee to set interest rates, regular press conferences to explain decisions and a shift to less regular meetings over two days.

This has occurred during the largest spike in inflation since the 1980s, international turmoil through wars such as Russia’s invasion of Ukraine and in Gaza, plus economic upheaval driven by the Trump administration’s tariff policies.

Bullock, in an interview with this masthead on Friday, said while the bank’s day-to-day focus was on China and the broader Asian region, the economic issues emanating out of the US were a harbinger of tougher times ahead.

She noted that her deputy, former Bank of England senior official Andrew Hauser, had referenced the turmoil in his home nation caused by its departure from the European Union.

“Andrew often talks about, people said when Brexit was coming it was going to be a disaster. Well, it wasn’t [immediately], it was just a long-term disaster,” she said.

“It didn’t happen like that [Bullock clicks her finger] – it’s just been a slow, slow decay.

“That’s what I think with what’s going on in the world at the moment – nothing’s falling off a cliff. But I think in five years’ time, we’re gonna look back and we’re going to say that was the start of the [decay].”

Bullock said the problems were directly related to explicit policies by nations to cut themselves off from international supply chains.

“[It means] slowing growth in world trade, increasing tensions, increasing sovereignty over things, growth slower than it should be, [slower] productivity,” she said.

“What the US is basically saying, rather than produce things more efficiently somewhere else and bring them in, we’re going to just produce lots of these things ourselves [but] we’re not as efficient as them so it does mean that there’s implications.

“There’s all these sort of unintended consequences. Most people would have realised there would have been these sorts of consequences.

Donald Trump’s economic policies could cause long-term problems for the global economy, according to the head of the Reserve Bank.AP

Donald Trump’s economic policies could cause long-term problems for the global economy, according to the head of the Reserve Bank.AP

“All I’m saying is that it’s just going dampen things down, and things might be a bit more lethargic.”

The Reserve held interest rates steady at 3.6 per cent at its last meeting of the year after delivering three cuts through 2025. Financial markets expect the cash rate to rise to 3.85 per cent by August.

Bullock said during previous rate-cutting periods, commercial banks had not passed on in full reductions in the official cash rate. But the full three-quarter of a percentage point cut in rates had flowed through to borrowers.

“We’ve possibly got slightly easier financial conditions than we might have had in the past,” she said.

Bullock said it appeared consumers were still reticent to spend consistently in a development that had caught the Reserve by surprise.

While spending has lifted for big one-off events such as the recent concerts by AC/DC, Oasis and Lady Gaga, Bullock said people were also “socking” away cash in offset and redraw accounts.

“I do think it’s also true that people can splurge on big events, but I do think they tend to offset that a little bit by saying, ‘I’m doing that, so I’m not going to do that’,” she said.

Some critics argue the bank’s struggle to keep inflation in its target band is due to federal and state government spending. Treasurer Jim Chalmers is expected to confirm a budget deficit this financial year of around $40 billion when he releases his mid-year fiscal update on Wednesday.

Australians may have splurged on a ticket to Taylor Swift, but they know all too well not to keep on spending.Getty Images

Australians may have splurged on a ticket to Taylor Swift, but they know all too well not to keep on spending.Getty Images

Bullock said while governments were conscious of inflation when setting their budgets, they faced numerous demands. The Reserve Bank had to remain focused on just one – keeping inflation under control.

“I don’t think there’s any point in me telling governments what to do with fiscal policy,” she said.

“I don’t want them telling me what to do with monetary policy, so I think I’m just not going to tell them what to do with fiscal policy.”

A key part of the Reserve’s reforms has been regular press conferences. Bullock’s predecessor, Philip Lowe, the first governor to hold press conferences, called them only to explain elements of the bank’s extraordinary quantitative easing policies during the pandemic.

Bullock admits she’s not a natural when it comes to media grilling but believes the conferences had now got into a “nice rhythm”. Some economists, however, are upset about the nature of the questions that the governor says often come from the angle of “the poor old person in the street”.

The governor is unapologetic about her approach, saying her words are aimed at ordinary Australians, including her parents, Nola and Ivan Droop.

“I have tried to explain things in terms that I hope if anyone was listening, I’ve tried to explain it so my mum would understand it,” she said.

“She and dad watch it. They actually watch it – they don’t just listen to it.“

Cut through the noise of federal politics with news, views and expert analysis. Subscribers can sign up to our weekly Inside Politics newsletter.

Save

You have reached your maximum number of saved items.

Remove items from your saved list to add more.

![]() Shane Wright – Shane is a senior economics correspondent for The Age and The Sydney Morning Herald.Connect via Twitter or email.Most Viewed in PoliticsFrom our partners

Shane Wright – Shane is a senior economics correspondent for The Age and The Sydney Morning Herald.Connect via Twitter or email.Most Viewed in PoliticsFrom our partners