2h agoMon 15 Dec 2025 at 8:39pmMarket snapshotASX 200 futures: -0.1% to 8,626 points Australian dollar: -0.2% to 66.38 US centsWall Street: S&P500 -0.1%, Dow -0.1%, Nasdaq -0.4%Europe: Dax +0.2%, FTSE +1.1%, Eurostoxx +0.6%Spot gold: flat at $US4,302/ounceBrent crude: -1.2% to $US 60.37/barrelIron ore: +0.1% to $US102.10/tonneBitcoin: -2.9% at $US85,903

Prices current around 7:40am AEDT

25m agoMon 15 Dec 2025 at 10:25pmRussian court rules in favour of Rusal in $2 billion lawsuit against Rio Tinto

In an entirely unsurprising development, a Russian court has ruled in favour of the Russian aluminium giant Rusal in its 104.75-billion-rouble ($2 billion) lawsuit against Rio Tinto.

The ruling intensifies a legal battle over a joint alumina refinery in Queensland, Australia, that Rio took sole control of after Australia imposed sanctions on Russia over its war in Ukraine.

The lawsuit was heard in closed session, and its details have not been disclosed. Rusal declined to comment.

Rio Tinto said in a statement provided to Reuters that the Russian claim brought by Rusal sought to re-litigate matters already decided by a competent court in Australia, linked to Rusal’s stake in Queensland Alumina and Australian sanctions.

“In Russia, as did in Australia, Rusal claims it is entitled to damages for what the Australian Court (and Court of Appeal) held was a lawful application of Australian sanctions,” Rio Tinto said.

“We reject the Russian-based legal proceedings as an abuse of process,” the company said in the statement. “We will continue to defend our position in respect of Rusal’s claim and take any steps necessary to protect our rights and assets,” it said.

Rusal filed the lawsuit after it lost a case in Australia in 2024 to restore its rights to a 20% stake in the alumina plant QAL.

Australia responded to the 2022 launch of Russia’s military campaign in Ukraine with sweeping sanctions, including a ban on exports of the aluminium raw material to Russia.

Shortly after the ban was imposed in March 2022, Rio took sole control of QAL, sidelining Rusal and cutting its access to the refinery’s output. Rio owns 80% of the refinery.

Rio has no assets in Russia, but among the defendants in Rusal’s lawsuit were Rio subsidiaries that own 66% of the Oyu Tolgoi copper-gold deposit in Mongolia, a country Moscow calls “friendly” and which has not imposed sanctions on Russia.

Australia’s alumina export ban and the suspension of operations at a refinery in Ukraine prompted Rusal to seek additional supplies from China and other countries to feed its Siberian aluminium smelters in 2022.

With Reuters

41m agoMon 15 Dec 2025 at 10:09pmNasdaq plans round-the-clock trading

Great news for fans of the blog, the Nasdaq exchange is gearing up for round-the-clock trading, which will boost not only trading opportunities, but also the number of posts we can bang out.

Reuters is reporting that Nasdaq is planning to submit paperwork with the US Securities and Exchange Commission to rollout vastly extended hours for trading of stocks, as it looks to capitalise on a global demand for US equities.

Nasdaq exchange is a tech-stock-focused exchange and home to the likes of Nvidia, Apple and Amazon.

Nasdaq plans to expand trading hours of stocks and exchange-traded products from 16 hours to 23 hours, five days a week.

Currently, Nasdaq operates three daily sessions during weekdays: the pre-market session from 4am to 9:30am (Eastern US time), the regular market session from 9:30am to 4pm, and the post-market session from 4pm to 8pm.

When Nasdaq moves to 23/5, it plans to operate two trading sessions, with the day session starting at 4am and ending at 8pm, followed by a one-hour break for maintenance, testing, and clearing of trades.

The night session will kick off at 9pm and end at 4am the following calendar day.

The US stock market represents almost two-thirds of the market value of listed companies globally, while total foreign holdings of US equities reached $US17 trillion last year, according to data compiled by Nasdaq.

With Reuters

50m agoMon 15 Dec 2025 at 10:00pm

ICYMI: Kohler’s finance wrap

What better way to prep for another busy day on the markets than review yesterday’s events with Alan Kohler’s 7pm finance wrap. Here you go:

Loading…1h agoMon 15 Dec 2025 at 9:33pmWall Street closes lower dragged down by tech sector

Wall Street has just closed, and preliminary figures show all the key indices finished in the red, with tech stocks being the biggest drag again.

According to preliminary data, the S&P 500 lost 9.95 points, or 0.15%, to end at 6,816.34 points, while the tech-centric Nasdaq Composite lost 135.14 points, or 0.58%, to 23,060.03.

The blue-chip Dow Jones Industrial Average fell 41.43 points, or 0.09%, to 48,416.62.

The S&P 500 and the Nasdaq had logged their steepest daily declines in more than three weeks on Friday amid concerns about inflation and debt-fuelled AI investments.

With Reuters

1h agoMon 15 Dec 2025 at 9:19pm

China’s two speed economy — exports accelerate, domestic demand slows

Time for a deeper dive into the Chinese economic data we blogged about yesterday afternoon. This time, from Société Générale’s highly respected China team, headed by Wei Yao.

Distilled down, China’s economy is very much a two-speed affair.

The export sector is cruising; the domestic economy is grinding gears between neutral and reverse with a burnt-out clutch.

“The November data reinforces the narrative we have seen throughout the year: resilient exports contrasted with weak domestic demand,” Ms Yao wrote in a note to clients.

“Retail sales decelerated further, reflecting the fading impact of consumption subsidies and the ongoing housing slump. Investment failed to pick up despite additional stimulus — structurally positive but potentially negative in the near term given implications for employment.

“In contrast, exports continued to demonstrate strength, underscoring China’s competitiveness in high value-added sectors.

“Industrial production eased only marginally and remained at a healthy pace. CPI rebounded but was only driven by food prices, while PPI recovery stayed sluggish.

“Looking ahead, unless December delivers a meaningful rebound, annual GDP risks coming in at 4.9% rather than 5.0%, though policymakers could still claim achievement of their “around 5%” GDP target”.

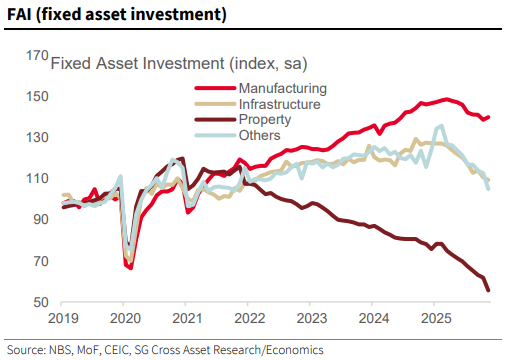

Even within the key data set of Fixed Asset Investment (FAI) – a proxy for spending in construction on factories, public infrastructure and property – there are vastly different speeds, although none with any momentum.

Manufacturing investment seems to have stalled, but that is better than infrastructure investment which has been in reverse all year and property spending which has been going backwards for three years.

Chinese FAI (NBS, MoF, CEIC, SG)

Chinese FAI (NBS, MoF, CEIC, SG)

And within manufacturing FAI everything is slowing — autos, electrical machinery, electronics, pharmaceuticals — and it seems if spending isn’t actually contracting, it soon will be.

Manufacturing FAI by sector (NBS, MoF, CEIC, SG)

Manufacturing FAI by sector (NBS, MoF, CEIC, SG)

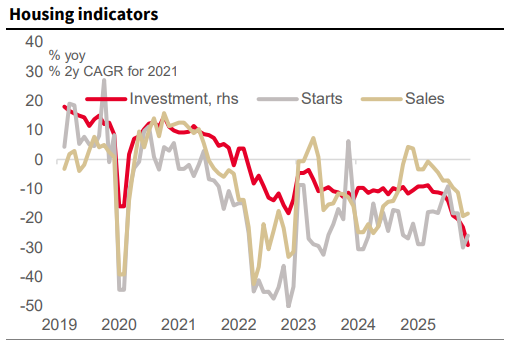

But it’s property where the big problem remains.

“Property indicators remained weak across the board,” Ms Yao wrote.

“On the supply side, the contraction in property investment deepened from -23% to -29%, reflecting oversupply and limited policy support as the focus shifts toward sustainability.

“On the demand side, residential sales stayed in deep contraction at -18.5%, broadly unchanged from October, as falling price expectations continue to deter buyers.

“Without more forceful policy intervention, house prices are likely to remain on a downward trajectory in 2026, posing a significant risk to household consumption.”

Chinese housing indicators (NBS, MoF, CEIC, SG)1h agoMon 15 Dec 2025 at 8:57pmWall Street slips, ASX set to lose more ground

Chinese housing indicators (NBS, MoF, CEIC, SG)1h agoMon 15 Dec 2025 at 8:57pmWall Street slips, ASX set to lose more ground

Wall Street’s key indices appear to be starting the week in the red following from their sharp retreat on Friday.

At 7:50am AEDT, the S&P 500 and Dow were down 0.1% and the Nasdaq had slipped 0.4%.

European stocks were generally stronger led by the banks.

The Eurostoxx 600 index closed 0.8% higher, while Germany’s Dax gained 0.2% and the FTSE in the UK was up a solid 1.1%.

ASX 200 futures look more aligned with the US, with our market priced to slip 0.1% on opening.

The Australian dollar will start the day a tad lower at 66.38 US cents.

On commodity markets, oil continued its recent trek downhill.

Having fallen 4% last week, the global benchmark Brent crude is down another 1.1%, barely holding above $60.00/barrel.

Gold is 0.2% higher at $US4,300/ounce, while copper resumed its upward trajectory gaining 1.4% to $US11,678/ tonne — just short of its record high hit last week.

Iron ore made a marginal gain holding above $US102.00/tonne.

Iron ore futures were steady amid mixed signals on demand and another batch of weak economic data.

China’s steel mill stockpiles dropped to their lowest level since January 2025.

2h agoMon 15 Dec 2025 at 8:40pm

Good morning

Good morning and welcome to another day on the ABC markets and finance blog.

Stephen Letts from the ABC business team limbering up for a blow-by-blow coverage of the day’s events, where every post is hopefully a winner, but none should be construed as financial advice.

In short, with Wall Street sliding overnight, it looks like the ASX will open marginally lower this morning.

Futures trading is pointing to the ASX 200 dropping around 0.1% on opening.

Looking ahead, the Westpac/Melbourne Institute consumer sentiment survey for December will be released later the morning.

Last reading showed an extraordinary bounce in optimism — it will be interesting to see if that is maintained or whether it was a statistical outlier.

As always, the game’s afoot, so let’s get blogging.

Loading

ASX 200 futures: -0.1% to 8,626 points Australian dollar: -0.2% to 66.38 US centsWall Street: S&P500 -0.1%, Dow -0.1%, Nasdaq -0.4%Europe: Dax +0.2%, FTSE +1.1%, Eurostoxx +0.6%Spot gold: flat at $US4,302/ounceBrent crude: -1.2% to $US 60.37/barrelIron ore: +0.1% to $US102.10/tonneBitcoin: -2.9% at $US85,903

ASX 200 futures: -0.1% to 8,626 points Australian dollar: -0.2% to 66.38 US centsWall Street: S&P500 -0.1%, Dow -0.1%, Nasdaq -0.4%Europe: Dax +0.2%, FTSE +1.1%, Eurostoxx +0.6%Spot gold: flat at $US4,302/ounceBrent crude: -1.2% to $US 60.37/barrelIron ore: +0.1% to $US102.10/tonneBitcoin: -2.9% at $US85,903