New Zealand’s economy grew 1.1% in the September 2025 quarter, according to Statistics NZ.

This big rise follows a revised drop of 1.0% in the June quarter (0.9% first reported).

The 1.1% September rise even outstripped the gains forecast by the market.

The big banks had forecasts in the 0.8% to 1.0% range, while the Reserve Bank (RBNZ) had forecast just 0.4%, but this was in its November Monetary Policy Statement (MPS) ahead of the release of more timely information suggesting a higher figure than that. RBNZ’s frequently updating economic modelling ‘Nowcast’ forecast was forecasting a rise of just under 0.9% for the September quarter.

‘Elephant in the room’

Commenting on the quarterly 1.1% rise in GDP, ASB economist Wes Tanuvasa and chief economist Nick Tuffley said “the elephant in the room” is the tightening of financial market conditions, (accompanied by rising mortgage and deposit rates), seen since the RBNZ’s November Official Cash Rate (OCR) review.

“Swap yields have advanced sizeably, and financial markets are now pricing in [OCR] hikes by around September 2026, deviating from the RBNZ’s November guidance of early 2027 policy normalisation,” the economists said.

“While we acknowledge that today’s strong GDP may spook markets further, we must stress how noisy GDP data are, and that GDP is only one of a myriad of inputs that influence the interest rate outlook.

“GDP alone is unlikely to be the silver bullet to bring hikes forward – although markets seem to have already moved. This looks to be an example of how important clear central bank communication is. A lack of clarity constrains the passthrough of intended monetary policy. Therefore, we are not surprised by Governor [Anna] Breman’s recent comments earlier in the week, which have attempted to calm markets down. We await Q4 CPI inflation in January 2026 for signs that hikes could be brought forward,” Tanuvasa and Tuffley said.

What about revisions to previous GDP figures?

Back to the GDP figures themselves – there has been much interest in what revisions there would be of previous quarters – and it’s fair to say the revisions that have materialised will raise eyebrows – particularly that the second quarter ‘June swoon’ has been revised down to being even a bigger drop than it was. Also surprising is that the March quarter has been revised up from a 0.9% rise as previously announced to a now 1.1% rise. More on this further down the article.

What about the detail of the latest figures?

“GDP rose in three of the last four quarters, but fell 0.5% over the year ended September 2025 compared with the year ended September 2024,” Stats NZ economic growth spokesperson Jason Attewell said.

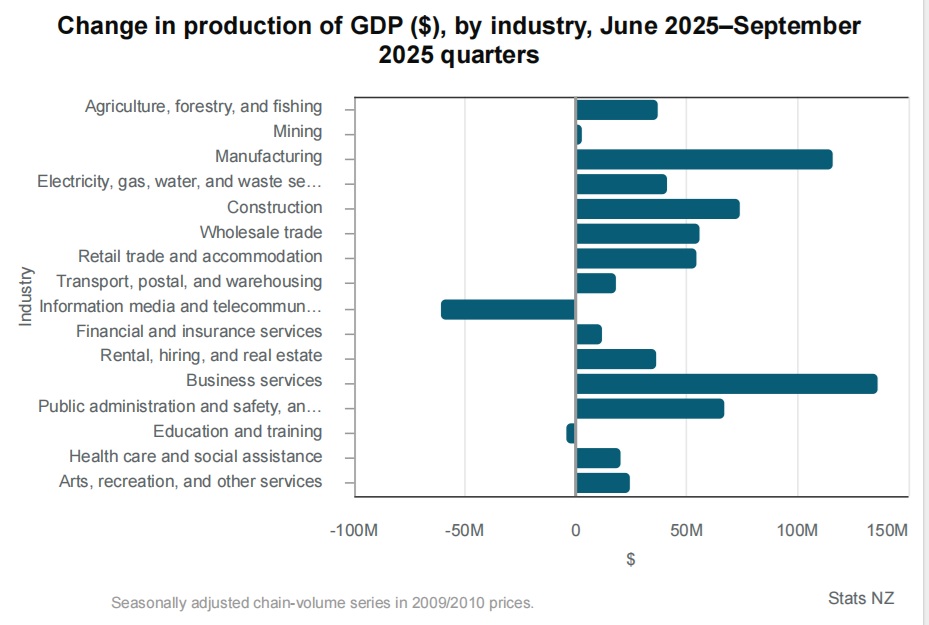

“The 1.1% rise in economic activity in the September 2025 quarter was broad-based, with increases in 14 out of 16 industries. This is in contrast to the June 2025 quarter, when GDP decreased in 10 industries.”

Stats NZ said business services were the largest contributor to the overall increase in GDP, up 1.6% in the quarter. This was driven by a 2.1% rise in professional, scientific, and technical services, such as computer system design and related services.

Manufacturing was up 2.2% in the September 2025 quarter, driven by food, beverage, and tobacco manufacturing.

“The 2.2% increase in manufacturing this quarter follows a 3.9% fall in the June 2025 quarter, when it was the main driver of the 1.0% decrease in GDP,” Attewell said.

Information media and telecommunications was the largest downward contributor to GDP in the latest quarter, down 2.1%.

Per capita and expenditure rises

GDP per capita rose 0.9% during the September 2025 quarter, Stats NZ says.

The expenditure measure of GDP rose 1.3% during the September 2025 quarter, following a 0.8% fall in the June 2025 quarter.

Exports were up 3.3%, with increases in travel services, dairy, and other services, including insurance.

Gross fixed capital formation, up 3.2%, also contributed to the rise in expenditure GDP.

“Businesses invested more in physical fixed assets in the September quarter. There were increases in transport equipment and plant, machinery, and equipment, supported by imports of related capital goods and motor vehicles,” Attewell said.

Household consumption expenditure rose 0.1% this quarter. Expenditure on durables rose 2.0%, while expenditure on services fell 0.1% and non-durables fell 0.2%.

The increased spending on durables was driven by rises in audio-visual equipment (such as televisions, computers, and mobile phones) and motor vehicles.

More on those revisions…

The September quarter is one that does usually have a lot of revisions anyway because it is the time of year in which annual national accounts data is incorporated. In laypersons terms this means better and more accurate information becomes available, so, previous figures may well be changed, but they should be more accurate. It means we now get the definitive view, which could be quite a bit different to what we were earlier told.

The author’s very early reading of both the September quarter figures and the revisions is that they will not end the debate about how our economy has actually been performing. It’s fair to say there was some expectation the ‘June swoon’ would likely just about disappear after revisions – while its actually increased. Likewise there was some belief the March quarter bounce as originally announced would likely be watered down – but it’s been increased too.

If we recall, the official figures for the June quarter showed GDP falling 0.9%. When released in September those figures prompted a strong public reaction and a fair bit of ‘woe is us’ sentiment. But in its latest Official Cash Rate (OCR) review in late November, the Reserve Bank (RBNZ) politely dismissed those figures, saying there were “a lot of one off factors and statistical quirks”. Westpac senior economist Michael Gordon had earlier offered a compelling explanation. The upshot is that nobody really believed our economy shrank 0.9% in that quarter.

Well, now we are being told the economy actually shrank 1.0% in the June quarter. So, as said up top, the debate will go on.