Emily French presents her outlook on world grain and oilseed markets on Wednesday, day one of AGIC 2025’s two-day program. Photo: AGIC 2025

THERE’S no mistaking where Emily French stands on her view of global grain and oilseed markets at present; she’s a bear through and through.

Her take on the markets was delivered to around 600 delegates at the Australian Grains Industry Conference held in Melbourne this week, and is based on weighty crops coming in, or developing, everywhere from Argentina to Russia, lacklustre Chinese demand, and big US stocks.

“The world’s most visual storage tank will be holding more and more and more, and what is that? It’s not bullish,” Ms French said of the US situation.

As the principal of Global Ag Protein, a consultancy she founded in 2009, and wide experience as a trader, broker, and analyst, Ms French said growers everywhere will need “drinks and hugs”.

“The US farmer has been using hope as a hedge strategy: it is not one.”

‘State of red alert’

Ms French is no fan of the Trump Administration, and described its potential trade policies as changing at “any given hour.”

“They’re not trade deals: they’re frameworks.”

“I don’t think anyone in that administration really understands trade.”

The upshot is that US trading partners have no surety about tariff levels, including India, whose exports to the US may be subject to a 25-percent tariff.

“We’re in a state of red alert…and the best thing you can do is look at what you control, and let the rest of it go.”

While US tariff threats are a major source of global market uncertainty, Ms French referred to the US President by the acronym TACO – Trump always chickens out – in light of his ability to reduce or delay threatened tariffs.

Bullish factors lacking

After massive cuts to US Government operations under “TACO”, Ms French described USDA data as “the one great thing the US can still export to the world”, and said its figures paint a picture of the enormity of the global market’s multitude of bearish factors.

With China’s economy contracting, Ms French said a “bitter downside” could be seen in its weakened demand for imported grain generally.

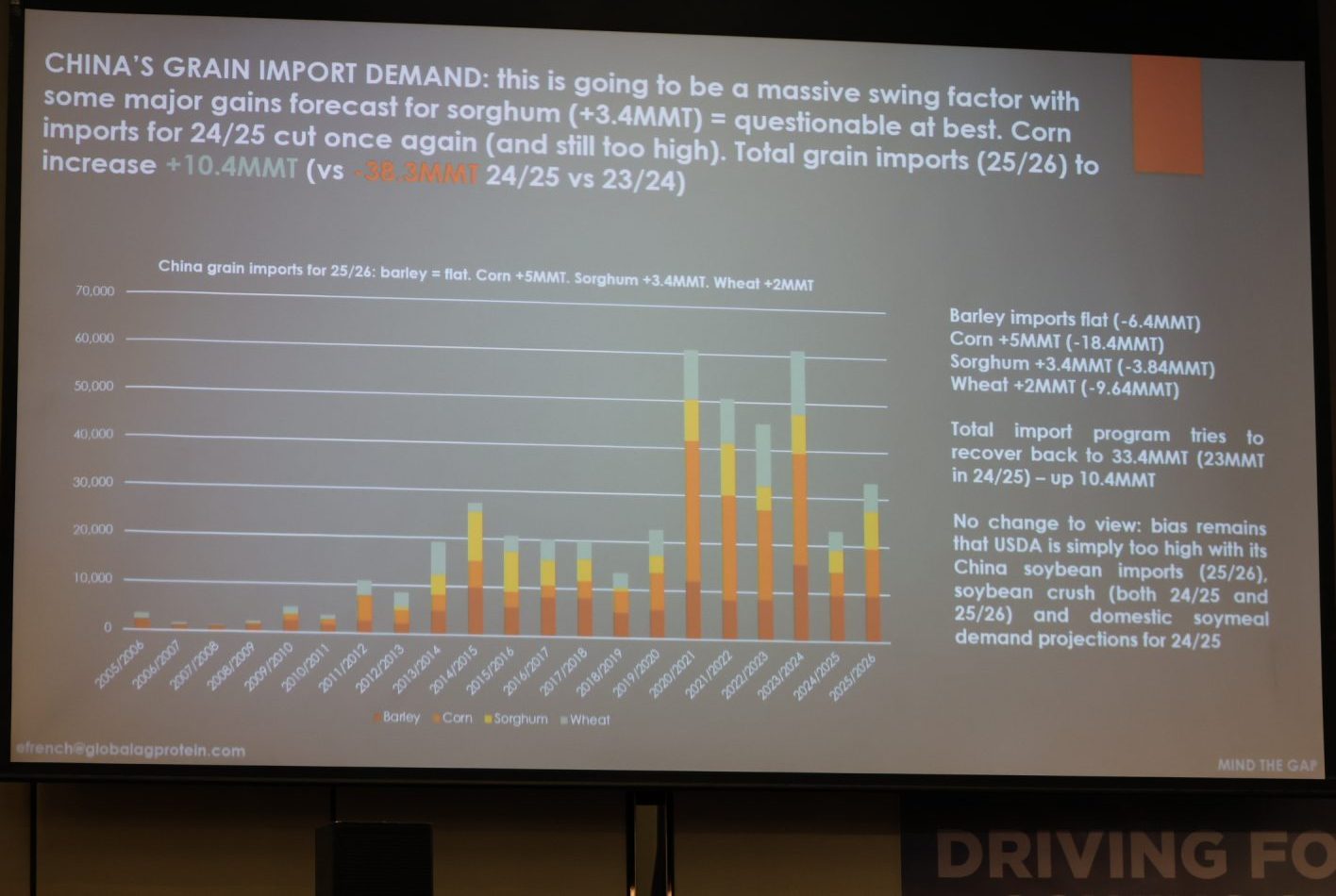

Figure 1: China’s import demand is expected to rebound by 10Mt in 2025-26 to a level well below the previous four years.

While China’s total forecast grain imports for 2025-26 are seen as being up 10Mt from 2024-25, Ms French said they not give the global market “the demand that agriculture needs”.

“Really, what’s happening is China is merely returning to the average.”

China’s stocks, on top of reduced demand from its domestic market on everything bar sorghum, plus decent crops, have tempered its appetite for imported grain.

USDA’s estimate of China’s supply cushion on wheat sits at 303 days: “That’s big”.

“It’s going to be a rough ride, particularly for those people that are on the production side.

“It’s wonderful to be an end-user, finally.”

Aggressive exporting

In her wrap of world currencies, Ms French noted the strength of the Euro, and said the Australian dollar was “kind of grinding higher”.

Flagging is the greenback.

“One thing that the world is not actually trading on is that the US dollar can rally.

“The US has a debt problem; no one wants to fix it, we want to add to it; that’s clear.

“The Euro has clearly broken out versus the US dollar.”

Ms French said currency has becoming “very interesting” for the first time in years.

Big crops, and weak currencies, are both putting expanded volumes into the export market, with Russian farmers also playing their part.

“There’s no carry in the cash market: you have to pay your debt,” she said of Russia’s farmer selling.

“If the ruble continues to weaken, what happens to fob wheat out of Russia? It gets cheaper and cheaper and cheaper; not bullish.”

Likewise, Ms French expects Brazil’s soybean and corn production, and exports, to continue to grow if Brazil’s real keeps within the range of five to six to the US dollar, and she said its neighbour was being even more active on the sell side.

“Argentina is killing it.

“They lowered their export tax…so we should continue to see more corn exported in the weeks and months ahead.”

Argentina is also aggressively exporting its soy complex, with more than 80 cargoes sold to China from current crop.

With the Northern Hemisphere escaping significant production threats or risks, Ms French painted a picture of the world being awash with wheat, corn, and oilseeds.

“The world does not have a supply threat.”

Futures tell a story

With Europe’s new-crop rapeseed, and Australian and Canadian canola all looking comfortable, Ms French said trade negotiations directed at Canadian canola from China, the US, or both could have an impact.

Again, the outlook is overridingly bearish.

“The risk for canola prices will be the funds are already long, and they’ve already been liquidating.”

“What we’ve seen is an ongoing liquidation after it made…a record high about a month ago.”

“I think what you’re starting to see is a retest of the lows.

“Trade is forecast to decline and production will go up; in no way is that bullish.”

While funds are short on just about everything else in the grains and oilseeds space, Ms French said they still have some positions left to unwind on canola and soy oil.

“The only thing they’re long is canola and soy oil; that’s it.”

She said stocks were so high that the trade was not driving the pricing.

“Managed money is in charge.”

USDA has forecast modest year-on-year increases in wheat imports from Indonesia, Iran, Mexico, and Türkiye, and Ms French said that demand will need to be seen soon to stave off a further easing in the wheat market.

India, which has just harvested a record wheat crop, is another one to watch.

“What the hell happens if India steps back into the export market?”

Grain Central: Get our free news straight to your inbox – Click here