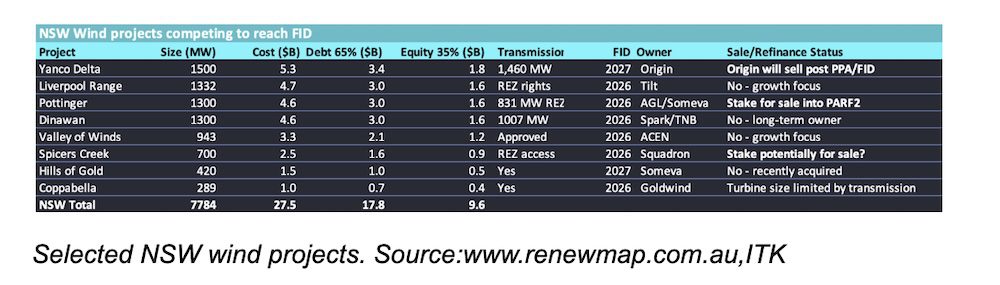

2026 is a critical year for New South Wales as it seeks up to $27 billion in financing across multiple wind projects to enable coal plant closures and meet decarbonisation targets.

Success hinges on overcoming three interconnected challenges: securing power purchase agreements (PPAs) (where Snowy’s entry as a major buyer could be transformative), finding equity partners despite the off-balance sheet model being fundamentally flawed for electricity generation, and navigating physical delivery constraints.

While projects in the South West renewable energy zone (REZ) may be technically superior to those in the Central West Orana REZ, due to better wind resources and flat terrain, the race for capital, PPAs, and legal approvals means only a handful of the dozen-plus projects will likely reach FID in 2026.

The Capacity Investment Scheme’s (CIS) failure to create demand pull – unlike the old Renewable Energy Target (RET) – means developer determination and execution are the key drivers. In truth, it will be another six months before we will get much clarity.

$27 billion for wind financing in NSW

It’s lucky for NSW that the Queensland government has told the renewable industry to p*** off. Because there is a significant funding requirement in NSW. I estimate at least $8 billion of equity is required over the next 12-18 months, and maybe $15 billion of debt. More if all projects for ahead.

Equally, what happens in South Australia won’t move the overall dial that much.

Victoria is having a mid transition crisis about offshore wind, with a likely result that the focus will shift to some extent back on shore. But new onshore projects in Victoria don’t seem ready for 2026 or even 2027. Some more solar and batteries, sure. So replacing Yallourn remains an issue for Victoria, and time presses on.

That brings us back to NSW. Steadiness in NSW policy means that issues like REZ coordination, the cost and building of competitive transmission, the work on getting regional communities to lead rather than be led, has progressed.

No doubt more mistakes will be made, but in my opinion there is now consensus on the problem and how to address it. In short the ducks are starting to line up.

It’s too late, now, to make Project EnergyConnect a 500 KV line, it’s still not too late to make VNI West a bigger line, but in any event the 2 gigawatts (GW) of new transmission to the south and the 5 GW and more available from the Orana renewable energy zone (REZ) provide enough opportunity to developers for the next 12 to 18 months.

The challenge is finance.

– Origin Energy is a seller of its project. I’m not really a fan of the Origin model, to date. However, if Yanco Delta goes well it may be that the transaction could be seen as the first in a series with two projects in New England to follow.

– Someva Renewables has no balance sheet and either will raise capital or see its interest diluted over time. If it raises capital and AGL puts its interest in Pottinger into an off balance sheet fund, the financing seems complex and there will be control provision issues.

– Because of the Twiggy Forrest divorce issues I expect Squadron Energy to pause development, so in my current rankings, the least likely project to go ahead is Spicers Creek.

– Goldwind sells the projects it develops.

– AGL Energy has more or less announced that its interest in Pottinger will be sold into PARF2 [the Powering Australia Renewables Fund]. It’s kind of interesting given both the Someva financing requirement and AGL’s background with Tilt. Could Someva even end up as PARF2 itself? Seems unlikely but in some ways it’s the natural place to put the Pottinger money.

– Even in the case of Liverpool Range, the Queensland Investment Corporation (QIC) directly owns about 19% on my calculations, with the Future Fund at 50% and the rest owned by other funds who have provided management mandates to QIC. QIC manages the Future Fund stake operationally. I guess the question is whether QIC is up for the Liverpool Range equity. I estimate its equity requirement at over $300 million in addition to smaller requirements for Waddi Waddi (WA) and Palmer (South Australia)

Historically, projects have been developed in stages. When projects were 400 MW they were developed in 200 MW stages. Now with 1 GW and bigger projects there are still two or three stages, but each stage is bigger.

For financing purposes, each stage can be seen as a separate project, with a separate revenue model (PPA) but the second stage will generally be lower risk for construction. The debt and equity consortia for each stage can be different.

The off-balance-sheet model is inherently flawed for electricity

I’ve had many years of experience analysing stapled trusts particularly for toll roads and airports, but also for electricity and gas networks. The basic idea is that an investment bank identifies assets, and then arranges for a captive or semi captive group of investors to buy them based on the yield the asset offers to the investors.

The assets are held in a trust for cash and tax reasons. This process allowed investment banks to earn a high return via the fees charged. For various reasons stapled securities have fallen out of favour but my point in mentioning it is the experience of looking at the various agendas and incentives of the parties involved.

When it comes to generation assets I believe the most important thing is that in generation there is value in both horizontal and vertical integration. Vertical means having retail and generation, a practice so common we now call them gentailers. But the real point in this note is horizontal.

As soon as a wind asset starts selling its product into the market the operators will want to add value. Value typically means offering a firmer volume, that means adding batteries and generally adding other solar and wind assets. Pretty soon your fund has become an independent power producer (IPP) and, as such, will be competing with its sponsor.

To an extent I think that’s what happened at Tilt. Tilt wanted to add batteries but AGL saw that as competition, and their interests became less aligned.

In short it’s difficult to be a properly passive investor in electricity generation, and you don’t really want your shareholder to be your competitor.

PPAs – NSW will ride on Snowy’s back

In a fortuitous turn of events, the reason the federal government owns Snowy Hydro is finally becoming evident. Just as in Queensland, the government-owned generators can be used to affect policy.

In this way, Tomago’s need has become the opportunity for the government to get back control that had been lost as the CIS replaced the RET.

However if Snowy does write some GWs of new PPAs you can be sure that curtailment will be considered and that the transmission implications for Humelink and eventually VNI West also included.

As has been well documented, the flaw in the CIS is that it does nothing to stimulate demand for renewable generation. The big gentailers could sit on their hands as long as possible.

By contrast the RET’s renewable energy certificates (REC) scheme forced generators to buy renewable energy at least for their retail loads and to some extent for the commercial loads as well.

My own view is that the cheapest power Tomago can access would be unhedged from the NSW pool and using Tomago’s ability to turn down consumption to avoid price spikes.

In that way it can avoid hedging premiums and avoid firming requirements. James Hardie adopted the same approach with pulp. It’s a well established result of portfolio theory that big diversified loads with big diversified supply portfolios have a lower firming cost than a single 1 GW flat load.

Still, in the bigger scheme of things, by handing the Tomago load to Snowy the federal government can accomplish several tasks at once:

(1) Tomago stays open, even if rationally it should close, (2) Snowy gets to be a bigger and more influential player in the market providing industrial as well as household sales and (3) because it has a new load Snowy can write 3-4 GW of renewable energy PPAs.

Having, Snowy actively in the market for significant load will tend to focus the minds of AGL, Origin and Energy Australia.

Additionally, it’s even possible that with new owners, Jeff Dimery might choose to overlook his admiration for Chris Uhlmann’s mad meanderings and Alinta too might choose to compete in the renewable energy market in NSW. Although, personally, I expect Alinta’s initial focus will be Victoria. Nor do I think Alinta will be keen in the way Snowy clearly will be.

So the entry of Snowy is a pencil sharpening event for gentailers.

In any event, my own view is that wind farms in NSW can be built on a merchant basis, just as Golden Plains stage 1 was in Victoria. Eraring has to close, replacement supply is essential. Ergo there will be a market for the wind output. Ergo building the wind will make the coal closures both possible and certain.

Because the new supply has to be built before the old supply can exit there will likely be a period of overlap and this will, or could, lead to low prices for a year or two.

The same thing happened with CSG gas in Queensland where the wells had to be drilled and operated before the LNG plants were finished, leading to gas prices for a year being around $1-$2/GJ

It’s a race of sorts

Physically

No matter what the transmission capacity of a REZ, the real bottleneck is how many turbines can be delivered to site per week. For any given destination things like police escorts (in QLD), equipment and people tend to mean that about 1-2 turbines can be delivered from a port to a destination per week.

At 6 MW per turbine a 1.2 GW project needs 200 turbines, that’s about 2 years of deliveries. If there are two 1000 MW projects being built at the same time, turbine deliveries will take twice as long. So, for instance, if Valley of the Winds and Liverpool Range are being built at the same time that’s about 300 turbines and three years worth of deliveries.

The same will go for two or even three projects in the wouth-west REZ. It’s possible to imagine Delta Yanco, Pottinger and Dinawan all being built at once. Those turbines go a different route to Orana and, assuming enough trucks and rivers, maybe four turbines a week can be delivered across NSW.

PPAs

Snowy may be the new fairy godmother, but there are still only so many PPAs that are easily visible. It’s a race to tie one up.

Capital

There is diversity of ownership, but leaving aside Valley of the Winds and Dinawan most of the projects will be competing for Australian super fund money, one way or another, or new sources of international equity.

Projects and owners

Yanco Delta

This project should hit final investment decision (FID) in late 2026, assuming it gets through the federal EPCB process, which I expect. I don’t like the Origin model, which essentially washes its hands of the project once it’s unsold.

Origin doesn’t have much of a background in wind energy development and so it purchased Yanco Delta. The full $300 million acquisition is now paid, with $175 million having been contingent on transmission rights.

I have assumed that because Origin doesn’t have its own skills it will work with its previous partners. Stockyard Hill was sold to Goldwind and therefore used Goldwind turbines.

Origin is therefore familiar with Goldwind. The gossip is that Bechtel (add 10% to the normal price) will be doing the balance of system. That also makes sense given Origin’s partnership with Bechtel in the APLNG construction process.

The trouble with selling to Goldwind is that Goldwind itself is not generally a long term holder. Goldwind sold its stake in Stockyard Hill to Nebras and Palisade/Aware Super. If the process is successful it may be repeated with Skye Ridge (Walcha 870 MW) and Northern Tablelands (West of Armidale, 650 MW).

Frank Calabria, CEO of Origin, was happy to be on a recent episode of Energy Insiders talking about the project and it’s very live and active. I assume the capital will be there. It may be just like Stockyard Hill, with Goldwind taking it on initially. Stockyard Hill was very slow in commissioning and that will have cost Goldwind money.

Coppabella

I put this smaller project here because it’s a Goldwind project. It could have hit FID any time in the past 12 months but Goldwind hasn’t pressed go. Coppabella has to use 4 MW turbine technology due to transmission issues. But the transmission and the environmental permits are in place. Maybe Goldwind was just too busy with Yanco Delta.

Liverpool Range

This project may hit FID in 2026, but may not. The owner, Tilt Renewables, is racing to get the 288 MW Palmer wind farm to FID in the next week. Liverpool Range is a far bigger deal.

Tilt’s ownership is essentially about 50% Future Fund, which has the money, with the other 50% coming from QIC and QIC clients. QIC’s own fund should end up with about 19% on my estimates.

QIC and its clients will need to find about $0.8 billion in addition to the Waddi Waddi and Palmer equity. Liverpool Range will compete with Valley of the Winds to be the first wind farm in the Orana Zone. Best bet for PPAs in my view, are AGL and Origin. Origin needs more than Delta Yanco to replace Eraring. Obviously neither Delta Yanco or Liverpool Range will be ready if Eraring closes in 2027.

Pottinger

Arguably one of the first projects to get to FID. AGL will offer a PPA for some of the output given its 50% ownership. AGL according to AFR reports is trying to get “PARF2” up. However, it will run into the same issues as PARF 1 (the child competing with the parent) unless there is a change in arrangements.

Snowy could well be a buyer for more of the output. Given the transmission rights and environmental approvals this project could be one of the first to get to FID in NSW. The financing structure is the main issue. Someva has no capital. It could raise capital or sell its stake. AGL could provide an investment (along with others) into Someva. Someva will need about $800 m of equity for its share of Pottinger.

Pottinger could be non recourse asset financed, that is the debt is held against Pottinger only and the equity could also be asset specific, something like a “Pottinger Investment Trust”. The Pottinger PPA, if it was long term and covered 100% of the asset output, would be enough for single asset finance.

AGL used similar structures for its own early wind farm investments. It sold the wind farms for a big development profit. The super funds paid up because AGL offered inflation linked out of the money PPAs to the investors. For all intents and purposes a leveraged lease. AGL booked short term profits and long term problems although the rise in electricity prices has masked the problems.

However, I think it more likely that Someva would like the equity investment into Someva itself and that Someva builds its own portfolio

Perhaps that is part of the reason Someva bought the ready-to-build “Hills of Gold”. However like every other VRE producer it needs a battery or access to the dispatch rights on someone else’s battery to provide dispatchible power. As soon as it has that it’s in competition with AGL and ORG and Snowy.

In short, the financing of Pottinger is the main issue. It’s not clear where AGL will get its $800 million of equity, but it won’t be from AGL’s balance sheet. It’s even less clear, to me, where Someva’s capital is coming from. Still the Pottinger asset is likely to be a good wind farm, good capacity factor, low construction cost, experienced players. Add in Hills of Gold and an AGL and maybe another PPA and you probably have an equity pitch deck.

Dinawan

I have mixed views about Dinawan. On the one hand Spark was the first to recognise the potential of the south-west REZ and Dinawan has transmission. Spark’s parent TNB, the main Malaysian utility, can comfortably finance the $4.5 billion total cost of the 1300 MW project on its own balance sheet. In fact, though, there are 1 GW of transmission rights so the capital call will be smaller.

On the other hand Dinawan doesn’t have a PPA. Again I expect Snowy to be the first port of call. In my opinion it’s taken a long time to get its environmental approvals, and the team have yet to prove themselves as a team although appear well qualified as team members. The project will do well to get to FID in 2026 and I think the PPA is the main issue.

Valley of the Winds

Other than the Class 1 merits appeal, Valley of the Winds the project has the appeal that Acen the Philippines renewable business whose parent is Ayala has a good track record, albeit mostly in solar in Australia. In wind, however, Acen also owns the Robbins Island 900 MW project in Tasmania. I can’t see Acen building both at the same time. And I’m not sure the Acen balance sheet is strong enough for that.

Acen’s share price is down about 40% over the past 12 months but it’s still on a big ebitda multiple. Acen is 59% owned by Ayala, and Ayala’s share price is down 25% in the past 12 months. GIC owns 16% of Acen. Ayala’s market cap is about $US4.5 billion. So Valley of the Winds equity is about 10% of Ayala’s market cap, to put it in perspective.

Add in Robbins Island and never mind Acen, Ayala will be heavily exposed to Australian renewables. I’d not be surprised to see Ayala raise its own equity if it wants to build both projects. Essentially, the Acen free float is quite small, which diminishes the information in the share price signal.

My guess is Valley of the Winds will be prioritised over Robbins Island, but it too will be chasing a PPA and – again – I expect Snowy to be a potential partner. Assuming Acen and Ayala can find the equity, and a satisfactory result in the Class 1 appeal and potentially a PPA, Valley of the Winds could get to FID by the end of 2026.

Spicers Creek

Spicers creek would be a natural follow-on development for Squadron from Uungula. However Twiggy Forrest’s divorce is likely to make finance and progress quite difficult if not impossible for the time being. It seems to be normal practice that a divorce involving assets of this size is treated much like a business subject to owner probate.

In general, risky new investments are hard to do until things are settled. In my opinion this is going to be a big problem, because having bought CWP and having contracted Bunbaban to RIO, Squadron/Windlab have major financing requirements.

Logically I’d have thought Bungaban with a PPA would be prioritised over Spicers Creek, however the PPA may not be attractive and so the development doesn’t happen. Equally, for my money, Uungula has only been developed slowly. First turbines were only recently delivered to the site. I’ll be surprised if Spicers gets to FID in 2026

Bullawah

Bullawah has 262 MW of transmission rights but has a much larger site. 262 MW is, unfortunately, just a rounding error in the total NSW requirement. Although it’s still $1 billion of capital that has to be found.

Bullawah is owned by BayWa r.e. which, in turn, was owned by BayWa AG (AG). AG is in financial distress and subsequently EIP a $13 billion Swiss Infrastructure Fund moved to 65% of BayWa r.e. The upshot is that EIP will easily be able to fund Bullawah. Bullawah could get to FID in 2026 but it won’t move the dial much.

Class 1 appeals for Valley of Winds and Hills of Gold

Not gunna lie, I used Chat GPT to assist with this section. Hills of Gold and Valley of the Winds both face what’s known as a Class 1 merits appeal in the NSW Land and Environment Court. Should that appeal fail there is very limited scope for further appeal to the NSW Court of Appeal based only on a question of law.

The Class 1 appeal is a De Novo full merits review. The median appeal process lasts about 7 months and there is supposed to be a consultation before court hearing.

Obviously, to me, since both wind farms have an EIS and have been to the Independent Planning Commission and have received favourable outcomes, yet legal action proceeds, then it’s obvious to me that consultation has zero chance of success.

According to ChatGPTs summary, IPC findings are not binding on the Court; the Court starts afresh. But IPC findings are likely to be treated as high quality independent information, that is a quasi judicial evidence based forum.

Because the wind farm has been through the IPC the appellant likely needs something new or stronger than what the IPC has considered. Still in AQC Dartbrook, following a conciliation process, a coal mine the IPC had refused to approve was ultimately approved. So, as usual, in legal matters it pays not to make too many assumptions about how the case will go.

That said, I expect both wind farm approvals to survive their Class 1 appeals, and I expect the decisions by, say, May 31. That’s just a guess though.

I looked at Marshall Baillieu’s notes supplied to the IPC. Baillieu owns Tongy Station which is located in part close to Valley of the Winds. According to Wikipedia, Baillieu lives in Victoria but as the notes state has owned Tongy for over 100 years.

Baillieu states that he was going to rebuild a house burned by fire that would be within 2 km of some turbines. Baillieu presented evidence from his expert that turbine noise levels at his houses (that he doesn’t live at, there are 11 of them he owns) will be higher than as presented in the EIS. He also complains of turbines being close to an airfield and the visual impact.

All of these matters were specifically considered by the IPC and reasons supplied for why for instance the noise measurement method adopted by the proponent in the EIS was appropriate. Unless Baillieu provides new data I cannot easily see the Court reaching a different conclusion to the IPC. But I am no lawyer.

REZs in NSW – Modelling v reality

The draft 2026 ISP REZ appendix says:

– From the start of the study horizon, there would be a rapid increase in VRE projected in the Central-West Orana and Wagga Wagga REZs, with 2,500 MW and 2,100 MW respectively of new VRE capacity by 2028-29. By 2030-31 this has increased to 7,700 MW and 2,500 MW respectively. After this, Wagga Wagga development stops, while Central-West Orana is projected to increase to over 13 GW in the 2040s.

– There would be 2,500 MW of VRE capacity installed by 2028-29 in the New England REZ, with installed capacity increasing above 6 GW after 2040.

– Broken Hill sees projected solar capacity from about 2030 before over 1,000 MW of wind is modelled by 2038-39. By 2050, over 2 GW of VRE is projected.

– South West New South Wales shows approximately 1,200 MW of VRE developments from 2029-30, and about 2,100 MW by 2049-50.

But in respect of Wagga Wagga and South West REZ I don’t see how this even vaguely corresponds with reality. In reality, wind projects in SW REZ have over 2000 MW of access rights, environmental approvals and, in my opinion, a couple of projects will hit FID in 2026. By contrast in the Wagga Wagga zone there is nothing close to approval. Perhaps I misunderstand.

I want to thank the good folk at www.renewmap.com.au for their invaluable mapping and database tools. I’ve taken an end-of-year liberty by annotating a screenshot from renewmap of a subsection of the SW REZ.

You can see the allocated transmission right, project energy connect and where VNI West will run. You can see that Dinawan and Yanco Delta might as well be the one project and Bullawah and Pottinger another. If I’d had more time I’d have created a custom layer but a modified screenshot will have to suffice.

SWREZ showing transmission rights. Source:www.renewmap.com.au

Not thinking big enough on transmission

In the US a series of 765 KV lines are being built, essentially duplicating some existing 330 KV lines, more than doubling capacity. In China a series of ultra high voltage DC lines have been built.

Are we trying hard enough on transmission?

As you can see from the map it looks like Yanco and perhaps Dinawan could connect to VNI West and flow to Victoria, freeing up more EnergyConnect capacity to flow North. But that would probably make a transmission engineer laugh. Looking at lines on a map doesn’t make me a power flow person.

Opinion

It seems to me that projects in the South-West REZ, that is Yanco Delta, Dinawan, Pottinger even a cutdown Bullawah are in some ways fundamentally superior to projects in Orana zone.

I believe, but with only limited evidence, the wind resource is better, and the flat ground makes both the transport and the construction costs lower. Transmission will be available earlier in SW REZ but you would also have to think about line congestion and curtailment.

It’s notable that AEMO’s ISP modelling doesn’t select wind projects in the SW REZ, preferring solar projects in the Wagga REZ. Unfortunately, you need to know more than I do to understand why this is the case.

Equally, the NSW government has strongly prioritised the Orana zone and lots and lots of work has been done on grid modelling, community engagement, road transport, worker accommodation. By contrast, in the SW REZ, AEMO and the NSW government are kind of letting business get on with it, helping but not prioritising.

Disadvantages in the SW REZ that I can think of are lack of access to water, quarry materials and accommodation.

I do think the wind resource and the flat ground are key attributes.

In a perfectly competitive, rational world this would mean that SWREZ projects could undercut Orana projects on PPA prices. However things rarely work out the way, I think.

Overall, I’m not sure the CIS is going to have that much impact on which project gets to go ahead in 2026. The CIS will lower the debt cost but I expect lenders to also take comfort from PPA and the “equity quality” of the equity partner in the project.

Equally lenders would far prefer to lend against a portfolio of assets rather than a single one. That would push them to Tilt and Acen , but ultimately it’s another long-term driver of consolidation within the sector.

I personally retain a view that AGL and Origin would do better to keep the assets on balance sheet and have a minority rather than majority partnership. It is a universal rule that the further down the minority food chain the worse off you are.

David Leitch is a regular contributor to Renew Economy and co-host of the weekly Energy Insiders Podcast. He is principal at ITK, specialising in analysis of electricity, gas and decarbonisation drawn from 33 years experience in stockbroking research & analysis for UBS, JPMorgan and predecessor firms.