37m agoTue 23 Dec 2025 at 2:04amMarket snapshotASX 200: +0.9% to 8,780 points

Australian dollar: +0.1% to 66.62 US centsWall Street: Dow Jones (+0.5%), S&P 500 (+0.6%), Nasdaq (+0.5%) Europe: DAX (+0.02%), FTSE (-0.3%), Stoxx 600 (-0.1%)Spot gold: +0.8% to $US4,481/ounceOil (Brent crude): -0.1% to $US61.97/barrelIron ore: -0.1% to $US104.90/tonneBitcoin: -0.1% at $US88,418

Prices current around 1pm AEDT.

11m agoTue 23 Dec 2025 at 2:30am

RBA cautious about new CPI toy

If memory serves, RBA governor Michele Bullock said “yay!” at a press conference in anticipation of the new, more detailed, ABC Monthly CPI report.

While it has arrived, and the RBA is clearly reading it, the board indicated in its December meeting minutes that it is going to continue treating the information in the report with a degree of caution.

“Members noted that it would take time to understand the properties of the new monthly CPI data.

“Furthermore, as the November Statement had set out, monthly data are inherently more volatile than quarterly data, and the difficulty of seasonally adjusting some components at a monthly frequency (owing to their short history) would make the trimmed mean and other measures of the underlying monthly inflation rate less reliable for a period.

“As a result, the staff would continue to rely primarily on the quarterly CPI – which has a much longer history and well-understood properties – for a while to assess the underlying momentum in inflation.

“Members noted that inflation data for the December quarter would be available prior to the February meeting.”

My guess is that both hotter-than-expected monthly and quarterly inflation data will secure a February interest rate hike, but if either data set contradicts the other, there may be a pause for more thought.

48m agoTue 23 Dec 2025 at 1:53am

Market uncertainty

It was not just JGBs pricing lower yesterday or recovering today. There was a sell off across Europe bonds as well.

What do you think about the arbitrary zeroing of most US CPI categories last week for October and November, as well as the market’s bizarre reaction to buy into that in the last three or so days?

– Andrew

Hi again,

Confused about the bond market, I recently called a senior bond trader to seek his insights.

He picked up the phone and told me he couldn’t really talk.

“Why”, I said, expecting him to say he was in the middle of a crucial trade.

“I’m at the pub”, he replied.

50m agoTue 23 Dec 2025 at 1:51am

Comments welcome

Hey DT, that was a nice try to correct you on the gold price. Noone quotes prices in AUD in the first instance. Weird.

– Andrew

G’day Andrew,

We just love people havin’ a crack 😉

Hope you have a nice Christmas.

DT

52m agoTue 23 Dec 2025 at 1:49am

RBA rate hike not a done deal

It’s important to note that while the December RBA minutes pave the way for a potential 2026 rate hike, or two, it’s not a fait accompli.

Here’s an excerpt from the document that helps illustrate that point:

“… members judged that it was too early to determine whether inflation would be more persistent than they had assumed in November, given the uncertainties about the reliability of the signal from the new data series at present.”

“If financial conditions were still slightly restrictive, and evidence emerged that a material part of the apparent renewed pick-up in inflationary pressures reflected volatile or temporary factors, then holding the cash rate at its current level for some time may be sufficient to keep the economy close to balance.”

1h agoTue 23 Dec 2025 at 1:35amRBA eyes interest rate hike: minutes show

The minutes of the Reserve Bank’s December Monetary Policy Board meeting are a challenging read.

It’s not because the document is too long or complicated, rather it’s clear the RBA itself is uncertain whether the recent pick-up in inflation will be sustained.

If the answer to that is “yes”, interest rates will rise in 2026, but if it’s “no”, the cash rate will remain unchanged.

Here’s the relevant excerpt from the minutes:

“Members expressed their concerns about the recent trend in inflation, the risk it could be more persistent than currently assessed and the potential for that persistence, if it crystallised, to contribute to an environment in which price increases are more readily accepted and households’ purchasing power comes under further pressure.”

“They noted that the November forecast already projected underlying inflation to remain above the midpoint of the target range until 2027, albeit on the assumption that the cash rate followed the November market path, which envisaged further easing in monetary policy.

“Members noted that the economy appeared to be operating with a degree of excess demand and it was not clear whether financial conditions were sufficiently restrictive to bring aggregate demand and supply back to balance.

“Members discussed the circumstances in which, should these trends persist, an increase in the cash rate might need to be considered at some point in the coming year.”

1h agoTue 23 Dec 2025 at 1:17am

Crypto market ‘dazed’: analyst

The crypto sector remains in a daze following its October meltdown, writes one analyst.

“After being one of the best-performing assets during the first nine months of 2025 – with Bitcoin up over 35% at its October peak of $126,272 – it is now down 5.25% year-to-date (YTD) at its current price of $88,480,” IG’s Tony Sycamore wrote in a note.

“Ethereum has suffered a similar fall from grace.

“At its current price of $3,005, it is down 9.80% YTD, a stark contrast to being up almost 50% in August.

“The overhang from this correction has left the outlook for Bitcoin and Ethereum uncertain …”

“Our view … is based on our technical view [and] reinforced by the soft price action overnight, as Bitcoin recoiling from the $US90,536 high it hit earlier in the session, despite a supportive backdrop of higher equities, rising gold prices, and a weaker dollar,” he said.

It’s all a bit technical but Sycamore seems to be indicating he believes the crypto market is in a bit of a funk.

It’s one trader’s view. Happy for you to share your thoughts. And a reminder this blog does not offer financial advice.

1h agoTue 23 Dec 2025 at 1:08am

Cash rate not too hot, not too cold: RBA minutes

It’s possible interest rates, where they are, are neither encouraging nor restricting spending in the economy.

The latest RBA minutes hint that interest rates may be what economists call at a “neutral” level.

“Members considered model-based estimates of the neutral cash rate, which reflect data on inflation, the labour market and bond yields,” the minutes noted.

“These implied that the cash rate was now around the average of the central estimate of its neutral level from the full suite of models maintained by RBA staff.”

But, and that’s a big “but”, why argue the point when the minutes then immediately point out that the point about whether the cash rate is neutral or not is rather academic.

“Members acknowledged that model estimates of the neutral cash rate were subject to considerable estimation error and provided no direct guide to monetary policy.”

1h agoTue 23 Dec 2025 at 12:51amWhy did the RBA leave rates on hold in December?

The minutes of December’s Monetary Policy Board meeting have been released.

I’ll do a few posts on it, but I wanted to publish this key line first:

“… while recent data suggested the risks to inflation had tilted to the upside, members felt it would take a little longer to assess the persistence of inflationary pressures,” members noted.

In other words, the RBA remains concerned about rising inflation, but it would hold off increasing interest rates until it eyes the next two CPI reports (both due to be published in January).

1h agoTue 23 Dec 2025 at 12:47am

Fair Work vs CFMEU

The Fair Work Ombudsman has secured a total of $171,500 in penalties in court against the Construction, Forestry and Maritime Employees Union (CFMEU) and four of its current and former officials for unlawful conduct at construction sites in Melbourne.

“The unlawful conduct occurred at various times while the four officials were exercising their right-of-entry rights at a construction site of three apartment buildings in Alphington and a construction site of a multistorey residential apartment building with retail at Croydon,” the Fair Work Ombudsman wrote.

2h agoTue 23 Dec 2025 at 12:35am

My Japanese bond (JGB) obsession continues

JGB prices edged higher in Asia’s morning session on possible dip-buying interest after bond prices fell sharply on Monday.

And the buying continues into the lunchtime session with the risk-free rate now at 2.04%.

The yield on 10-year JGBs closed at 2.080% on Monday, the highest since February 1999.

“With the 10-year JGB yield having reached 2%, whether demand emerges at this major level will be a key area of focus,” SMBC Nikko Securities’ Ataru Okumura says in a recent research report.

“A strategy of buying at current levels could generate a higher return than interest on BOJ current account deposits if yield increases remain constrained to the 2.2% level over the next 12 months,” the senior Japan rates strategist adds.

JGB 40-year yield is down 1 bp at 3.705%.

2h agoTue 23 Dec 2025 at 12:24am

Gold holds onto most gains

Wrong.

Gold hit $6735 on the 16th of October this year.

Yesterday was not “a record high”

– Leigh Jennings

G’day Leigh,

For the purposes of consistency, we quote the price of gold in US dollars.

Overnight, it reached a record high of $US4,475 an ounce.

Gold prices extend gains in evening trade, climbing to an all-time high on safe-haven demand and expectations of further monetary easing in the US.

“Geopolitics remains a factor, too … after the US escalated its tanker standoff with Venezuela, intercepting another vessel off the coast of South America,” Saxo analysts wrote.

Futures in New York rise 1.9% to $US4,470.10 a troy ounce after reaching $4,477.70 earlier in the session and are up nearly 70% so far this year.

Reporting with Reuters

2h agoTue 23 Dec 2025 at 12:11am

Markets relatively sanguine

Hi folks,

Firstly, thanks for joining the ABC biz blog today.

It’s a credit to you.

I’m jumping into the hot seat for the late shift.

Watching equities, bonds, currencies, and anything breaking that might affect your hip pocket.

Any comments or questions are always welcome.

Let’s go.

DT

2h agoTue 23 Dec 2025 at 12:10am

Market dates to keep in mind

The back end of December will work a little differently with markets because it’s almost Christmas!

The ASX will close early at 2:10pm AEDT on Christmas Eve and stay closed on December 25 and December 26.

In the US, Wall Street will close at 1pm on December 24 and remain closed on Christmas Day. Trading will then resume on December 26.

2h agoMon 22 Dec 2025 at 11:55pm

Nvidia aims to begin H200 chip shipments to China by mid-February

Nvidia has told Chinese clients it aims to start shipping its second-most powerful AI chips to China before the Lunar New Year holiday in mid-February.

The US chipmaker plans to fulfil initial orders from existing stock, with shipments expected to total 5,000 to 10,000 chip modules – equivalent to about 40,000 to 80,000 H200 AI chips.

Nvidia has also told Chinese clients that it plans to add new production capacity for the chips, with orders for that capacity opening in the second quarter of 2026.

Significant uncertainty remains, as Beijing has yet to approve any H200 purchases, and the timeline could shift depending on government decisions.

– Reporting from Reuters

3h agoMon 22 Dec 2025 at 11:40pmDroneShield extends gains on measures to tackle governance issues

DroneShield has begun the trading day up +4.2%, one of the top movers of the morning.

The technology firm has announced it will undertake immediate action following an independent review of the company’s continuous disclosure and securities trading policies.

This includes establishing a mandatory minimum shareholding policy for all directors and members of senior management and an update of the company’s securities trading policy.

It will also review the director and executive remuneration framework.

These measures come after a sharp sell-off at the end of last month; however, the stock is up 300% across the year to date.

Here is a snapshot of DroneShield and its market movement this year:

DroneShield market movement (Refinitiv)

DroneShield market movement (Refinitiv)

– Reporting with Reuters.

3h agoMon 22 Dec 2025 at 11:19pmUpdate

The ASX 200 has begun the morning trade up +0.3% to 8,728 points.

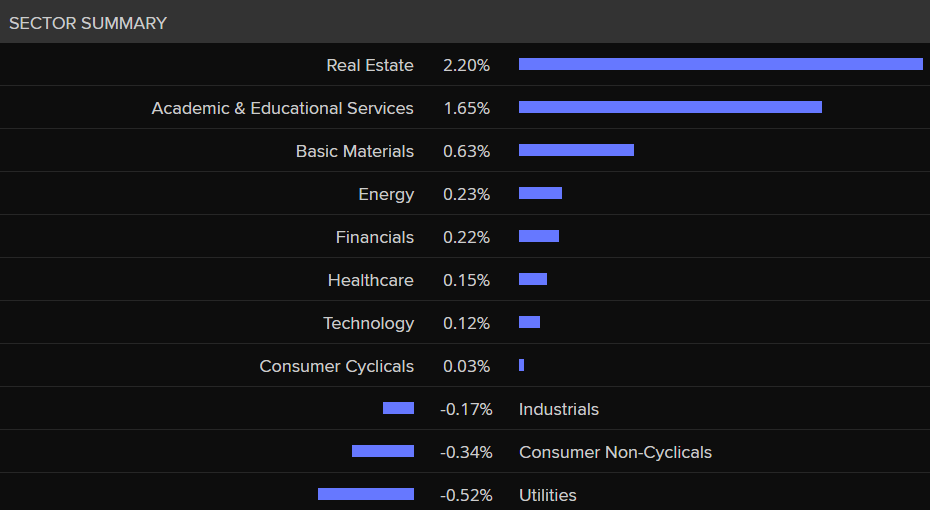

Most of the sectors are up, with Real Estate leading the way (+2.2%).

Here’s a snapshot:

ASX 200 sector summary (Refinitiv)

ASX 200 sector summary (Refinitiv)

When looking at stocks, it’s pretty even, with 95 in the red, 14 unchanged, and 91 gaining.

Goodman Group is up top (+6.4%).

Top movers ASX 200 (Refinitiv)

Top movers ASX 200 (Refinitiv)

While Greatland Resources Ltd is down at the bottom (-2.4%).

Bottom movers ASX 200 (Refinitiv)

Bottom movers ASX 200 (Refinitiv)

The Aussie dollar is pretty flat at $66.58 US cents.

3h agoMon 22 Dec 2025 at 11:10pmMarket snapshotASX 200: +0.3% to 8,728 points

Australian dollar: +0.05% to 66.59 US centsWall Street: Dow Jones (+0.5%), S&P 500 (+0.6%), Nasdaq (+0.5%) Europe: DAX (+0.02%), FTSE (-0.3%), Stoxx 600 (-0.1%)Spot gold: +0.1% to $US4,450/ounceOil (Brent crude): +2.6% to $US62.05/barrelIron ore: +0.2% to $US104.90/tonneBitcoin: +0.4% at $US88,632

Prices current around 10:10am AEDT

3h agoMon 22 Dec 2025 at 11:02pmASX opens in the green

The Australian share market has begun the trading day up +0.3% at 8,732 points.

I’ll bring a detailed snapshot soon, standby!

3h agoMon 22 Dec 2025 at 11:00pmAI and fires

New cameras using AI have been installed in southern NSW forests and are spotting fires before they have a chance to spread.

The state government and private timber companies have invested $9 million to install and operate 36 cameras across parts of southern NSW for the 2025-2026 bushfire season.

You can read the full report from Emily Doak and Rachel Holdsworth below.

ASX 200: +0.9% to 8,780 points

ASX 200: +0.9% to 8,780 points