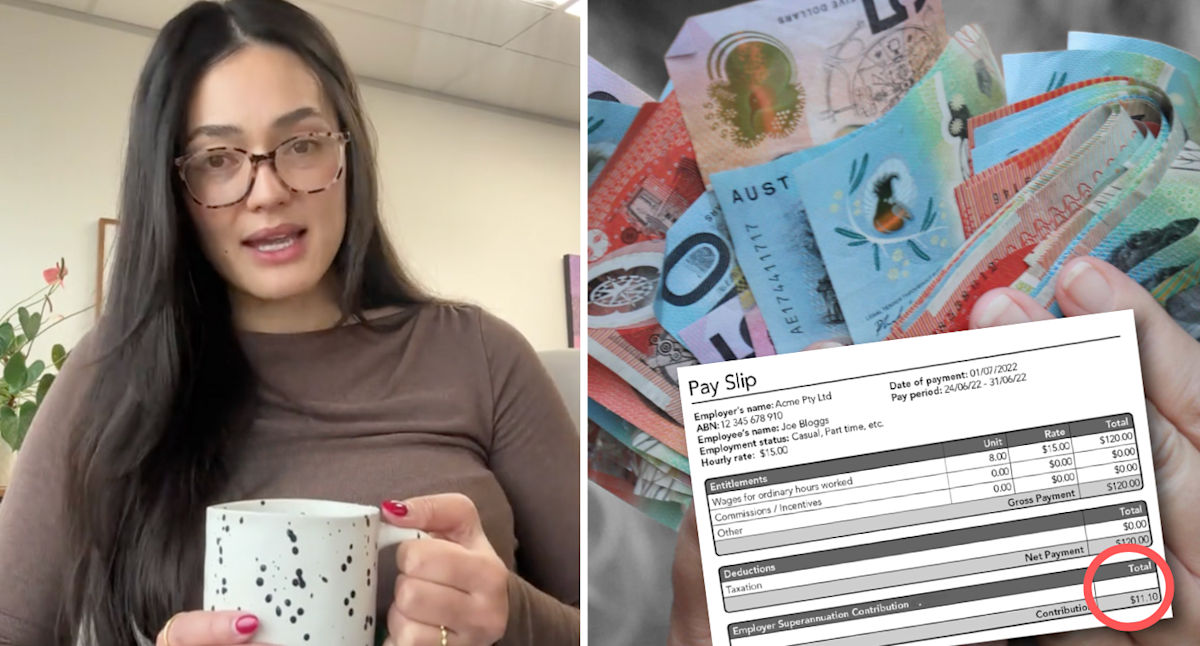

Financial advisor Patricia Ryan said even if your superannuation payments are included on your payslip, you need to check and make sure that money lands into your account. (Source: TikTok/Getty/Blue Penguin)

Australian workers have been urged to make sure their employers are keeping up with your mandatory superannuation contributions. These payments, which are called the super guarantee (SG), are typically made every quarter.

July 28 was the most recent deadline that bosses and companies had to ensure all SG payments had landed in workers’ accounts. But financial advisor Patricia Ryan told Yahoo Finance you need to make sure this was, in fact, completed.

“I’ve had clients find that they haven’t actually received the money, for whatever reason,” she said.

“They assumed that it was being received, but when they logged in and checked, it actually wasn’t in there.”

Even though SG payments are mandatory, some employers either forget or deliberately don’t pay up.

The ATO estimated that $5.2 billion failed to be transferred properly to workers in 2021-22. This issue went up to $5.7 billion in the 2022-23 year, with the average worker affected missing out on $1,730.

That could add up to more than $30,000 less at retirement.

Do you have a story? Email stew.perrie@yahooinc.com

Ryan said you might even see the superannuation contributions show up on your payslip, but you have to cross-check that with what your account says.

Some of her clients haven’t noticed the discrepancy for months or even years, and in some cases, they haven’t been able to get the money back.

As of July 1, employers have been required to send 12 per cent of your salary to your nominated super account.

That’s a boost of 0.5 per cent from the previous financial year, and the final legislated increase in SG contributions until at least 2027.

The Parker Financial advisor said many people, particularly younger workers, have a relaxed approach towards their retirement nest egg and believe it’s their boss’s responsibility.

“As they get older and closer to retirement, they realise, ‘Oh, wow, super is actually really important, I need to look at it,'” she said.

“I’ve seen many come to me in their 30s, and their investment option, for example, is in cash. Your super sitting in cash might not be the right move for someone who is younger and can’t access their super for 30 years.

“Or they’re in a super product that’s expensive, but they don’t care because it was an employer-default super. As they get closer to retirement, they realise that maybe it wasn’t the right option for them.”

Story Continues

She told Yahoo Finance Aussies need to be more active and involved with their super.

This includes checking your account at least every quarter to make sure your SG payments arrive on time.

“If you’re not aware of what that total contribution amount should be, or you’re not checking that it is being deposited, then it could be easily missed,” she said.

Ryan said it’s worth looking at other elements of your super account, like your investments and your insurance, to give yourself the best retirement possible.

You can chase it up with your employer and super fund to see if there are any issues with SG payments.

The Australian Taxation Office (ATO) said this should be your first port of call before escalating the problem.

“If they’ve made a simple mistake in calculating your entitlement or paying it into the right fund, an open discussion might be the most effective way to sort things out and get your super back on track,” it said.

But if your employer doesn’t want to play ball, you can lodge a complaint with the ATO.

The tax office has an online tool to report unpaid super contributions, and the ATO will be in contact with your company to find a solution.

Business owners can face significant penalties for missing the quarterly SG deadlines.

From July 1 next year, SG payments will need to come through when an employee gets paid, rather than every quarter.

Payday Super was first announced back in 2023, and it’s meant to crack down on unpaid super.

Ryan said this change will help many workers stay on top of their payments because it will be far more frequent.

Government modelling found a 25-year-old whose super was switched from quarterly to fortnightly payments could be $6,000 better off at retirement.

As part of the payday super alteration, employers will have a seven-day calendar deadline from the payment of wages to pay employees’ superannuation.

Get the latest Yahoo Finance news – follow us on Facebook, LinkedIn and Instagram.