2h agoTue 6 Jan 2026 at 8:26pmMarket snapshotASX 200 futures: +0.6% to 8,708 pointsAustralian dollar: +0.3% to 67.32 US centsWall Street: S&P500 +0.6%, Dow +1.0%, Nasdaq +0.9%Europe: Dax +0.1%, FTSE +1.2%, Eurostoxx 600 +0.6%Spot gold: +1.0% to $US4,483/ounceBrent crude: -2.0% to $US 60.51/barrelIron ore: +0.7% to $US106.60/tonneBitcoin: -1.9% at $US92,277

Prices current at around 7:20am AEDT

10m agoTue 6 Jan 2026 at 10:57pmData breach hits insurance customers

Customers of a company that offers insurance to cover damage to rental cars have been hit by Australia’s latest data breach.

The cyber attack at Prosura, which also trades as Hiccup, is the latest in a series of incidents over the past few years where hackers have gained access to the personal information of millions of Australians.

If you’ve used comparison website VroomVroomVroom to rent a car in Australia or New Zealand and bought gap insurance, you might be a victim.

The self-described “threat actor” who claims to be behind the breach has been emailing previous Prosura customers — but the missives have been ending up in spam folders.

You can find further details and Prosura’s response here:

34m agoTue 6 Jan 2026 at 10:33pm

…meanwhile in Venezuela

The perpetually moribund Caracas Stock Exchange (BVC) is being swamped by a flood of speculative money in the wake of the US capture of Venezuelan President Nicolás Maduro.

After a relatively modest 16% jump on Monday in the immediate aftermath of the weekend’s extraordinary events, the BVC rocketed up another 50% overnight.

Unsurprisingly, the surge was driven by oil and financial stocks in anticipation that existing sanctions would soon be lifted, and global banking ties will be restored.

Caracas Stock Exchange over 5 years (LSEG, BVC)

Caracas Stock Exchange over 5 years (LSEG, BVC)

59m agoTue 6 Jan 2026 at 10:08pm

Vicinity Centres wants changes to iconic facade of Sydney’s QVB

Retail landlord Vicinity Centres, which manages Sydney’s Queen Victoria Building (QVB), has applied to change some of the building’s iconic coloured glass panels, citing backlash from global retailers.

As Millie Roberts reports, the application, on behalf of Vicinity, said the current glass “hindered” visibility from foot traffic looking into corner stores at the QVB.

The coloured glass, a reconstruction of original stained glass, is a distinctive feature of the building. (ABC News: Abubakr Sajid)

The coloured glass, a reconstruction of original stained glass, is a distinctive feature of the building. (ABC News: Abubakr Sajid)

In a statement, Vicinity Centres said it took “responsibility to preserve the heritage of the Queen Victoria Building very seriously”.

“The proposed changes relates only to reconstructed glass panels … not original stained-glass — and is intended to improve natural light and visibility while maintaining architectural consistency along this key CBD frontage,” a spokesperson said.

“At this stage, the proposal is with Council for consideration, so we’re unable to provide further comment beyond what is in the application.”

In the application, consultants said the QVB’s corner stores were victim to “poor visualisation on retail performance”, citing a global flagship lifestyle brand that ended talks to set up shop after being denied permission to change the glass, leading to more than $1 million in lost rent.

Members of the public are able to comment on the matter until February 6, with some writing in opposition describing it as “short-sighted”.

Continue reading here:

1h agoTue 6 Jan 2026 at 9:28pmHot inflation set to cool (a bit)

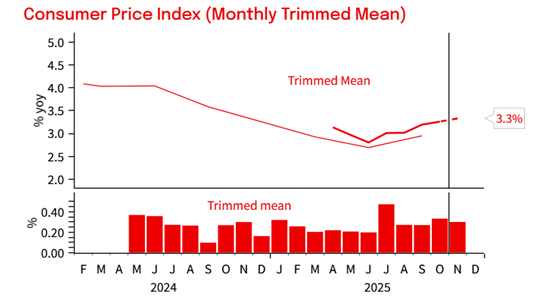

Here’s a bit of a primer from the NAB on the November CPI figures that are scheduled to drop at 11:30am AEDT today.

NAB’s senior economist Taylor Nugent says headline CPI will slow from 3.8% to 3.6%, largely due to electricity base effects and cheaper travel.

Trimmed mean inflation, the RBA’s go-to figure, is forecast to come in at 0.3% over the month and 3.3% year-on-year, which is still a bit too hot for the RBA’s liking.

Mr Nugent notes there are still some teething issues with the new monthly CPI series.

“The properties of new monthly underlying inflation measures are not yet established, and a quarter of the monthly CPI exhibits seasonality but has too little back history to adjust with standard techniques,” he said.

“In November, seasonal discounting around Black Friday will be a particular challenge, meaning it will be difficult to extract signal from those price changes.

“The RBA has said they will focus on the quarterly trimmed mean, which only uses data from months with established historical seasonal patterns.”

CPI (monthly trimmed mean) (ABS, NAB, Macrobond)1h agoTue 6 Jan 2026 at 9:12pmASX set to rebound after strong sessions on Wall Street and in Europe, metals soar

CPI (monthly trimmed mean) (ABS, NAB, Macrobond)1h agoTue 6 Jan 2026 at 9:12pmASX set to rebound after strong sessions on Wall Street and in Europe, metals soar

The risk on vibe was back in play overnight with Dow and key European indices hitting record highs overnight.

At 7:45am (AEDT) the Dow was up 1.1%, while the broader S&P 500 had picked up a solid 0.6%.

The tech-centric Nasdaq was up 0.9% after a splurge of buying among data storage and memory stocks such as SanDisk (+23%), Western Digital (+16%) and Seagate Technology (+13%).

Oil stocks gave up their big gains from Monday with Exxon Mobil and Chevron down 2.3% and 4.5%, respectively as oil prices retreated.

In Europe, Germany’s Dax, Spain’s IBEX and the FTSE in the UK all closed at record highs.

The pan-European Eurostoxx 600 closed up 0.6%, also at a record, after an unexpectedly large slowdown in inflation across the region.

The US dollar rose against most currencies, but not the Aussie dollar, which is up another 0.4% in overnight trade to 67.37 US cents this morning.

Gold continued to benefit from global uncertainty, edging up another 1% to just below $US4,500/ounce.

Copper hit a new record high, up almost 2% on the London Metal Exchange to $US13,234/tonne and is up almost 7% since New Year’s Day.

Supply fears also saw nickel jump more than 10% on the LME on news Indonesia planned to cut production on the key industrial metal.

2h agoTue 6 Jan 2026 at 8:27pm

Good morning

Good morning and welcome to another day on the ABC markets and finance blog.

Stephen Letts from ABC business team limbering up for blow-by-blow coverage of the day’s events, where every post is hopefully a winner, but none should be construed as financial advice.

In short, it looks like the local market may regain most of the ground it lost yesterday after a solid session on Wall Street overnight where the blue-chip Dow Jones index hit another record high.

At 7:00am AEDT, ASX 200 futures pointed to a rise of around 0.6% on opening.

The ABS is back in business today with the release of the November CPI data at 11:30am AEDT, as well as November building approvals.

NAB is forecasting that the annualised inflation rate will slow from 3.8% to 3.6%.

As always, the game’s afoot, so let’s get blogging.

Loading

ASX 200 futures: +0.6% to 8,708 pointsAustralian dollar: +0.3% to 67.32 US centsWall Street: S&P500 +0.6%, Dow +1.0%, Nasdaq +0.9%Europe: Dax +0.1%, FTSE +1.2%, Eurostoxx 600 +0.6%Spot gold: +1.0% to $US4,483/ounceBrent crude: -2.0% to $US 60.51/barrelIron ore: +0.7% to $US106.60/tonneBitcoin: -1.9% at $US92,277

ASX 200 futures: +0.6% to 8,708 pointsAustralian dollar: +0.3% to 67.32 US centsWall Street: S&P500 +0.6%, Dow +1.0%, Nasdaq +0.9%Europe: Dax +0.1%, FTSE +1.2%, Eurostoxx 600 +0.6%Spot gold: +1.0% to $US4,483/ounceBrent crude: -2.0% to $US 60.51/barrelIron ore: +0.7% to $US106.60/tonneBitcoin: -1.9% at $US92,277